Conditional payment

- Conditional situations. Auto/no-fault or workers’ compensation (WC) — 120 days after receipt of the claim, or when there is no evidence to the contrary, the date of service (discharge date).

- Coding a conditional claim. ...

- Reimbursing Medicare. ...

- Situations where conditional payment is denied. ...

How does Medicare affect medical billing?

Obamacare’s Affect on Medical Billing and Coding

- Increased Demand for Work. One of the undeniable facts about Obamacare is that more Americans will have health insurance, which means that demand for coding and billing professionals is bound ...

- Cumbersome Government-Related Processing Issues. ...

- Increased Medicare Efficiency. ...

- Job Outlook. ...

Can I refund the billing?

Billing administrators can take ownership of a reservation by selecting it and then selecting Grant access in the window that appears. ... You can cancel, exchange, or refund reservations with certain limitations. For more information, see Self-service exchanges and refunds for Azure Reservations.

Does medical billing pay well?

Top examples of these roles include: Head Of Medical Biller, Medical Billing Consultant, and Remote Biller. Importantly, all of these jobs are paid between $10,309 (20.6%) and $30,019 (59.8%) more than the average Independent Contractor Medical Biller salary of $50,164.

When can conditional primary Medicare benefits be paid?

Conditional Primary Medicare Payments for Group Health Plans (GHPs) Conditional primary Medicare benefits may be paid if the provider, the physician or other supplier, or the beneficiary failed to file proper claim with the GHP (or Large Group Health Plan [LGHP] due to beneficiary physical or mental incapacity.

When would Medicare make a conditional payment to a beneficiary?

MSP provisions allow conditional payments in certain situations when the primary payer has not paid or is not expected to pay within 120 days after receipt of the claim for specific items and/or services. Medicare makes these payments “on condition” that it will be reimbursed if it is shown another payer is primary.

Do I have to pay back conditional payments?

If you continue to certify for benefits while we review, you may have to pay back any conditional payments you received if we later find you ineligible.

How do I apply for Medicare conditional payment?

You can obtain the current conditional payment amount and copies of CPLs from the BCRC or from the Medicare Secondary Payer Recovery Portal (MSPRP). To obtain conditional payment information from the BCRC, call 1-855-798-2627.

How does Medicare calculate secondary payment?

As secondary payer, Medicare pays the lowest of the following amounts: (1) Excess of actual charge minus the primary payment: $175−120 = $55. (2) Amount Medicare would pay if the services were not covered by a primary payer: . 80 × $125 = $100.

How does Medicare calculate final demand?

Step number two: take the gross settlement amount and subtract the total procurement cost to determine Medicare's final lien demand.

Why did I receive a letter from CMS?

In general, CMS issues the demand letter directly to: The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment.

Do Medicare benefits have to be repaid?

The payment is "conditional" because it must be repaid to Medicare if you get a settlement, judgment, award, or other payment later. You're responsible for making sure Medicare gets repaid from the settlement, judgment, award, or other payment.

How does Medicare reimbursement work?

Medicare pays for 80 percent of your covered expenses. If you have original Medicare you are responsible for the remaining 20 percent by paying deductibles, copayments, and coinsurance. Some people buy supplementary insurance or Medigap through private insurance to help pay for some of the 20 percent.

What is Medicare recovery?

When an accident/illness/injury occurs, you must notify the Benefits Coordination & Recovery Center (BCRC). The BCRC is responsible for ensuring that Medicare gets repaid for any conditional payments it makes. A conditional payment is a payment Medicare makes for services another payer may be responsible for.

Does Medicare automatically send claims to secondary insurance?

Medicare will send the secondary claims automatically if the secondary insurance information is on the claim. As of now, we have to submit to primary and once the payments are received than we submit the secondary.

Does Medicare pay first or second?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

Will secondary pay if primary denies?

If your primary insurance denies coverage, secondary insurance may or may not pay some part of the cost, depending on the insurance. If you do not have primary insurance, your secondary insurance may make little or no payment for your health care costs.

When will Medicare determine if a conditional payment is being claimed?

Once Medicare has information concerning a potential recovery situation, it will identify the conditional payments paid by Medicare that are being claimed and/or released with respect to the accident, illness, or other incident from the date of incident through the date of settlement, judgment, award, or other payment.

Why are conditional payments called conditional payments?

These payments are referred to as conditional payments because the money must be repaid to Medicare when a settlement, judgment, award, or other payment is secured.

What is the sum of the amounts included in the conditional payment amount column?

The sum of the amounts included in the conditional payment amount column is the Total Conditional Payments Amount.

What is a payment summary form?

The Payment Summary form lists all of the claims that are included in the Current Conditional Payment Amount.

How long does it take to get a conditional payment letter?

Sixty-five days after the Rights and Responsibilities letter is sent, the Conditional Payment letter will be sent to all authorized parties on the case.

Can authorized users request an update to the conditional payment amount?

For CRC cases, authorized users may request an update to the conditional payment amount.

Does CRC have no claims paid?

Additionally, if requested, users will also receive an electronic or mailed version of the “no claims paid” letter for CRC cases where the overpayment amount equals zero.

What is conditional payment?

Conditional payment. A provider may submit a claim to Medicare for conditional payment for services for which another payer is responsible. If payment has not been made or cannot be expected to be made promptly from the other payer, Medicare may make a conditional payment, under some circumstances, subject to Medicare payment rules.

How long does it take to reopen Medicare?

Reimburse Medicare by submitting a claim adjustment or reopening within 60 days of receiving payment from the primary payer. Do not cancel the claim.

What does it mean when a provider fails to file a claim with a large group health plan?

The provider, the physician, or other supplier, or the beneficiary failed to file a proper claim with the group health plan (GHP) (or large group health plan) due to physical or mental incapacity of the beneficiary.

Does Medicare pay workers compensation?

The primary insurer denied the claims in full or when the claim was fully applied to deductible or coinsurance. Medicare will not make conditional payments associated with Workers' Compensation Medicare Set Aside or for an Ongoing Responsibilities for Medicals under auto/no-fault, liability, or workers' compensation.

Does Medicare deny claims?

There is an employer GHP that is primary to Medicare; and. You did not send the claim to the employer GHP first. Medicare will also deny claims when the provider submitted the claim to the liability insurer (including the self-insurer), no-fault, insurer or WC entity, but the insurer entity did not pay the claim if:

How to get conditional payment information?

You can obtain the current conditional payment amount and copies of CPLs from the BCRC or from the Medicare Secondary Payer Recovery Portal (MSPRP). To obtain conditional payment information from the BCRC, call 1-855-798-2627. To obtain conditional payment information from the MSPRP, see the “Medicare Secondary Payer Recovery Portal (MSPRP)” section below. If a settlement, judgment, award, or other payment occurs, it should be reported to the BCRC as soon as possible so the BCRC can identify any new, related claims that have been paid since the last time the CPL was issued.

What is a CPL for Medicare?

A CPL provides information on items or services that Medicare paid conditionally and the BCRC has identified as being related to the pending claim. For cases where Medicare is pursuing recovery from the beneficiary, a CPL is automatically sent to the beneficiary within 65 days of issuance of the Rights and Responsibilities letter (a copy of the Rights and Responsibilities letter can be obtained by clicking the Medicare's Recovery Process link). All entities that have a verified Proof of Representation or Consent to Release authorization on file with the BCRC for the case will receive a copy of the CPL. Please refer to the Proof of Representation and Consent to Release page for more information on these topics. The CPL includes a Payment Summary Form that lists all items or services the BCRC has identified as being related to the pending claim. The letter includes the interim total conditional payment amount and explains how to dispute any unrelated claims. The total conditional payment amount is considered interim as Medicare might make additional payments while the beneficiary’s claim is pending.

How to remove CPL from Medicare?

If the beneficiary or his or her attorney or other representative believes any claims included on the CPL or CPN should be removed from Medicare's conditional payment amount , documentation supporting that position must be sent to the BCRC. The documentation provided should establish that the claims are not related to what was claimed or were released by the beneficiary. This process can be handled via mail, fax, or the MSPRP. See the “Medicare Secondary Payer Recovery Portal (MSPRP)” section below for additional details. The BCRC will adjust the conditional payment amount to account for any claims it agrees are not related to what has been claimed or released. Upon completion of its dispute review process, the BCRC will notify all authorized parties of the resolution of the dispute.

Does Medicare pay for a secondary plan?

Under Medicare Secondary Payer law (42 U.S.C. § 1395y(b)), Medicare does not pay for items or services to the extent that payment has been, or may reasonably be expected to be, made through a no -fault or liability insurer or through a workers' compensation entity. Medicare may make a conditional payment when there is evidence that the primary plan does not pay promptly conditioned upon reimbursement when the primary plan does pay. The Benefits Coordination & Recovery Center (BCRC) is responsible for recovering conditional payments when there is a settlement, judgment, award, or other payment made to the Medicare beneficiary. When the BCRC has information concerning a potential recovery situation, it will identify the affected claims and begin recovery activities. Beneficiaries and their attorney(s) should recognize the obligation to reimburse Medicare during any settlement negotiations.

Can you get Medicare demand amount prior to settlement?

If the beneficiary is settling a liability case, he or she may be eligible to obtain Medicare's demand amount prior to settlement or to pay Medicare a flat percentage of the total settlement. Click the Demand Calculation Options link to determine if the beneficiary's case meets the required guidelines.

Does Medicare send recovery letters to beneficiaries?

The beneficiary does not need to take any action on this correspondence. However, if Medicare is pursuing recovery from the beneficiary, the BCRC will send recovery correspondence to the beneficiary.

Who is responsible for paying medical bills in West Virginia?

In West Virginia, the insurance company of the party at fault for an accident, injury or medical malpractice case is responsible for paying the victim’s medical bills. The insurance company is the primary payer, meaning that it has a duty to cover costs up to the policy coverage limit. If and when that coverage limit is reached, a secondary payer may cover the remaining costs.

Is Medicare a secondary payer?

If a victim is eligible for Medicare, the government healthcare program for those 65 and above, Medicare becomes the secondary payer. In certain circumstances, Medicare can temporarily take over the role of primary payer, offering conditional payments to cover a victim’s bills until the primary payer fulfills its duties. This payment is basically a loan. Medicare will expect to be reimbursed for these conditional payments.

What is the statute of limitations for Medicare to institute an action for repayment of conditional payments?

In the past the Centers for Medicare and Medicaid Services (“CMS”) had argued that the six (6) year limitation period contained in the Federal Debt Collection Act for claims arising out of contract was the correct standard for the plaintiff attorney. That statute provides:

How long is the statute of limitations for Medicare?

The new three (3) year statute of limitations under the “SMART” Act addresses that need and the complaint of so many Medicare beneficiaries who wonder if there is ever an end to CMS’s demand for repayment. It is now incumbent on the plaintiff’s attorney to report settlements to CMS (via their contractor MSPRC) so that the three (3) year timer starts running as soon as possible.

Does Synergy get paid for conditional payment?

There is a small administrative fee at the outset and then Synergy only gets paid if there is a refund on a percentage of savings basis. To learn more about Synergy’s lien resolution services, visit www.synergylienres.com

What is conditional payment in Medicare?

A conditional payment is a payment Medicare makes for services another payer may be responsible for.

Why is Medicare conditional?

Medicare makes this conditional payment so you will not have to use your own money to pay the bill. The payment is "conditional" because it must be repaid to Medicare when a settlement, judgment, award, or other payment is made.

How to remove CPL from Medicare?

If you or your attorney or other representative believe that any claims included on CPL/PSF or CPN should be removed from Medicare's interim conditional payment amount, documentation supporting that position must be sent to the BCRC. This process can be handled via mail, fax, or the MSPRP. Click the MSPRP link for details on how to access the MSPRP. The BCRC will adjust the conditional payment amount to account for any claims it agrees are not related to the case.

How to get conditional payment information?

You can also obtain the current conditional payment amount from the BCRC or the Medicare Secondary Payer Recovery Portal (MSPRP). To obtain conditional payment information from the BCRC, call 1-855-798-2627. Click the MSPRP link for details on how to access the MSPRP.

What happens if a BCRC determines that another insurance is primary to Medicare?

If the BCRC determines that the other insurance is primary to Medicare, they will create an MSP occurrence and post it to Medicare’s records. If the MSP occurrence is related to an NGHP, the BCRC uses that information as well as information from CMS’ systems to identify and recover Medicare payments that should have been paid by another entity as primary payer.

How to release information from Medicare?

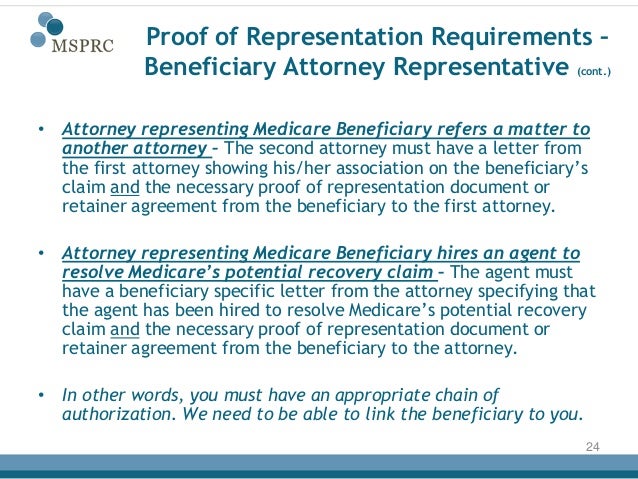

Medicare does not release information from a beneficiary’s records without appropriate authorization. If you have an attorney or other representative , he or she must send the BCRC documentation that authorizes them to release information. Your attorney or other representative will receive a copy of the RAR letter and other letters from the BCRC as long as he or she has submitted a Consent to Release form. A Consent to Release (CTR) authorizes an individual or entity to receive certain information from the BCRC for a limited period of time. With that form on file, your attorney or other representative will also be sent a copy of the Conditional Payment Letter (CPL) and demand letter. If your attorney or other representative wants to enter into additional discussions with any of Medicare’s entities, you will need to submit a Proof of Representation document. A Proof of Representation (POR) authorizes an individual or entity (including an attorney) to act on your behalf. Note: In some special circumstances, the potential third-party payer can submit Proof of Representation giving the third-party payer permission to enter into discussions with Medicare’s entities. If potential third-party payers submit a Consent to Release form, executed by the beneficiary, they too will receive CPLs and the demand letter. It is in the best interest of both sides to have the most accurate information available regarding the amount owed to the BCRC. Please see the following documents in the Downloads section at the bottom of this page for additional information: POR vs. CTR, Proof of Representation Model Language and Consent to Release Model Language.

What is a POR in Medicare?

A Proof of Representation (POR) authorizes an individual or entity (including an attorney) to act on your behalf. Note: In some special circumstances, the potential third-party payer can submit Proof of Representation giving the third-party payer permission to enter into discussions with Medicare’s entities.