How often do I need to have a CDR?

The law requires us to perform a medical CDR at least once every 3 years, unless we determine you have a medical condition that we expect will improve sooner. However, if you have a medical condition that is not expected to improve, we will still review your case, once every 7 years.

What iqies data is included in the CDR?

IQIES data in the CDR includes assessment data for HHA, MDS, LTCH, IRF, and Hospice schemas. This data is extracted from iQIES system and the "Most Recent Refresh" column reflects the date at which the data was extracted. The data is generally made available in the CDR within 2 business days of extraction.

What if a beneficiary qualifies for protection from a medical CDR?

If a beneficiary qualifies for protection from a medical CDR based on work activity, he or she will still undergo a regularly scheduled medical CDR. If you have questions, please call 1-800-772-1213.

What happens during a CDR?

During the CDR, we will also review your income, resources, and living arrangements to ensure that you continue to meet the non-medical program requirements. We call this periodic review a redetermination.

Should I worry about a CDR?

As long as you are continuing to see your doctors and receive treatments, your condition has not improved and you are not working, there is virtually nothing to worry about. These reviews are typically only conducted every three or every seven years, depending on the severity of your condition.

What is CDR determination?

WHAT IS A CONTINUING DISABILITY REVIEW? Social Security periodically reviews your medical impairment(s) to determine if you continue to have a disabling condition. If we determine that you are no longer disabled or blind, your benefits will stop. We call this review a continuing disability review (CDR).

What triggers a CDR?

CDR will occur if your vocational services have been completed and Vocational Rehab reports you are working or able to work. Report from someone who is in a position know the claimant. If SSA receives a report from an individual who knows you and the agency believe the reports to be true, it may trigger a CDR.

How often does Social Security re evaluate disability?

Expected, we'll normally review your medical condition within six to 18 months after our decision. Possible, we'll normally review your medical condition about every three years. Not expected, we'll normally review your medical condition about every seven years.

What are the chances of losing disability?

There are exceptions to these rules – such as Social Security finding there was a clear error or fraud in the original decision – but in actuality, only about 5% of disability recipients lose benefits after a review.

What happens after a CDR?

Once you send in this report, the SSA will conduct a full medical review of your case. In some cases, beneficiaries who initially received the short-form mailer will be flagged for a CDR. They will then receive the longer Continuing Disability Review Report, and have to undergo a full medical review.

At what age does Social Security disability stop reviewing?

age 65What Age Are You When Social Security Disability Stops? Social Security Disability can stay active for as long as you're disabled. If you receive benefits until age 65, your SSDI benefits will stop, and your retirement benefits will begin.

Will work trigger a CDR?

Will they do a CDR when I am in my Trial Work Period? If you have received SSD benefits for at least 24 months or you are using the Ticket to Work Program, your work activity should not automatically trigger a CDR. However, you may still get regularly scheduled medical reviews.

Can my disability be taken away?

Recipients of SSDI and SSI can have their disability benefits taken away for many reasons. The most common reasons relate to an increase in income or payment-in-kind. Individuals can also have their benefits terminated if they are suspected of fraud or convicted of a serious crime.

What should you not say in a disability interview?

Making Statements That Can Hurt Your Claim – Unless you are specifically asked pertinent questions, do not talk about alcohol or drug use, criminal history, family members getting disability or unemployment, or similar topics. However, if you are asked directly about any of those topics, answer them truthfully.

What is the most approved disability?

1. Arthritis. Arthritis and other musculoskeletal disabilities are the most commonly approved conditions for disability benefits. If you are unable to walk due to arthritis, or unable to perform dexterous movements like typing or writing, you will qualify.

What should you not tell a disability doctor?

For example, if you are being examined for a medical condition, you should not tell a doctor you have pain everywhere, or your level of pain is 10 out of 10 for everything if your daily activities are not consistent with this level of pain.

What is the best Medicare plan for 2021?

SilverScript. Humana. Cigna. Mutual of Omaha. UnitedHealthcare. The highest rating a plan can have is 5-star. Just because a policy is 5-star in your area doesn’t mean it’s the top-rated plan in the country. There is no nationwide plan that has a 5-star rating.

When will Medicare Part D be updated?

Home / FAQs / Medicare Part D / Top 5 Part D Plans. Updated on June 3, 2021. Medicare prescription drug plan changes in 2021 are noteworthy. Also, by knowing what to expect, you can stay ahead of the game. Drugs can be costly, and new brand-name drugs can be the most expensive. With age, you’re more likely to require medications.

Which pharmacy is the most cost efficient?

The Walgreens policy is the pharmacy that is the most cost-efficient. But, mail-order is generally the best pharmacy to use if you’re trying to save the most money.

Which insurance company monitors drug plans?

Plans that have accurate price information are more likely to have higher ratings. Further, Medicare monitors plans for drug safety.

How much is Value Plan deductible?

The Value policy has no deductible on the first two tiers at preferred pharmacies. But, the Value plan has a $445 deductible on all other tiers. The Plus Plan has a deductible of $445 that applies to all tiers. However, the Plus plan has a broader range of drugs that have coverage.

What does a medical review determine?

A medical review determines if an individual is meeting the medical requirements to collect disability. If the person does not meet the medical requirements, SSA may stop the disability benefits.

What is a work review for disability?

Social Security Administration (SSA) reviews disability cases periodically to see if the person with a disability still meets SSA disability rules. SSA performs two types of reviews, a medical continuing disability review and a work continuing disability review. Under a work review, SSA looks at earnings to determine if an individual is eligible for monthly benefits. A medical review determines if an individual is meeting the medical requirements to collect disability. If the person does not meet the medical requirements, SSA may stop the disability benefits.

What happens if you don't sign up for Medicare?

If you don’t sign up within seven months of turning 65 (three months before your 65 th birthday, your birthday month, and three months after), you will pay a 10% penalty for every year you delay. Enroll in a Medicare Advantage plan, which is a privately-run health plan approved by the government to provide Medicare benefits.

What is a Medigap plan?

If you have Original Medicare, you might also consider a Medigap plan, which will fill in other the gaps in Medicare coverage, reducing how much you spend each time you go for medical care.

Does Part D cover prescriptions?

It will help cover the cost of your prescription medications. Similar to Part B, there is a financial penalty if you do not sign up for a Part D plan when you are first eligible, unless you have other prescription drug coverage.

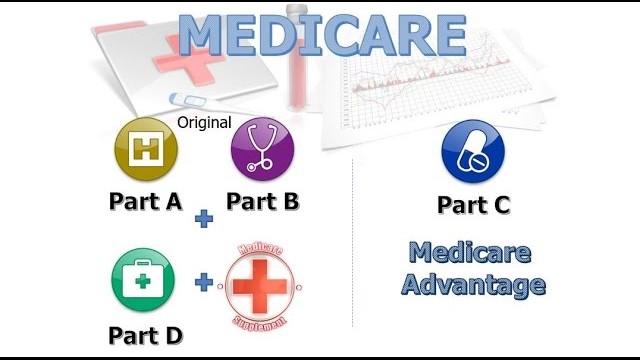

What is Medicare Advantage?

Medicare Advantage is an all-in-one plan choice alternative for receiving Medicare benefits. You may also hear it referred to as Medicare Part C. This plan is bundled with Medicare Part A and Part B and usually includes Part D, which provides prescription drug coverage. Medicare pays private insurance companies to administer the benefits of Medicare Advantage plans they sell.

What is the donut hole in Medicare?

Most Medicare drug plans have a coverage gap called the “donut hole,” which means there’s a temporary limit on what the drug plan will cover. “A person gets limited coverage while in the ‘donut hole.’ whether on a Medicare Advantage plan or a separate Part D plan,” says Antinea Martin-Alexander, founder of Advocate Insurance Group in South Carolina. “The individual will pay no more than 25% of the cost of the medication in the donut hole until a total out of $6,550 in out of pocket expenses is reached. There are different items that contribute to the out-of-pocket expenses while in the donut hole: any yearly drug deductible you may have, copays for any and all your medications, what the manufacturer’s discount is on that medication and what the insurance company pays for that medication,” she says.

How many Medicare Advantage plans are there in 2021?

adults age 65 and older. But picking the right plan can be complicated—nationwide, insurance providers offered a total of 3,550 different Medicare Advantage plans in 2021 alone [1]. What’s more, finding the right insurance plan is highly personalized to the individual. Only by providing your ZIP code and demographic information can you see a list of plans for which you’re eligible, and even then, you’re likely comparing the details of approximately 30 plans.

Does Cigna have dental coverage?

Cigna doesn’t cast as wide of a net with its nationwide coverage, but people who live in areas it does serve can certainly benefit from its robust coverage options and trusted reputation—it earned an A rating from A.M. Best and J.D. Power ranking of 822. Some of its plans come with dental and vision coverage, and in many areas, additional benefits for hearing coverage, lifestyle coverage, holistic coverage (for services like acupuncture) and transportation coverage are available as well.

Does Medicare Advantage have a monthly premium?

Some Medicare Advantage plans may have lower out-of-pocket costs than Original Medicare, and some have a $0 monthly premium. Here are a few questions to consider before purchasing a plan.