A high-deductible Medicare Supplement Plan F or Plan G may be a good fit for you if you:

- Prefer a low monthly premium

- Live in a state that allows Medicare Part B excess charges (the difference between the Medicare-approved amount and the amount the doctor is legally allowed to charge)

- Travel abroad frequently

- Are likely to get medical care frequently, such as doctor visits, hospital stays, or skilled nursing facility care during the year

Full Answer

Which is the best Medicare supplement?

But with a high-deductible plan, you have to meet the Medicare Supplement deductible for the year before the plan helps pay your Medicare out-of-pocket costs. As noted above, annual deductible for high-deductible plans is $2,370 in 2021. Each year Medicare might adjust the deductible amount. Compare Medicare Supplement insurance plans

Who is eligible for a high deductible health plan?

Medicare Supplement Insurance high-deductible Plan G is a newer Medigap plan that became available in most states in 2020. There is already a standard Medigap Plan G. The new high-deductible Plan G option offers the coverage benefits of Plan G with lower monthly premiums in exchange for the higher deductible.

What are the top 5 Medicare supplement plans?

Mar 11, 2020 · High deductible plans require the consumer pay a large deductible before the plan begins to pay. Once this deductible is met, the plan pays 100% of covered services for the rest of the calendar year. In 2020, the deductible for High Deductible Medicare supplements is $2,340.

Why is my health insurance deductible so high?

Oct 26, 2021 · High Deductible Plan G is a Medicare Supplement plan that offers the same coverage as the standard Medigap Plan G. The premiums for this plan are lower than the premiums for the standard Plan G . Yet, enrollees must pay a higher deductible for coverage to kick in at 100%.

What is a Medicare high-deductible?

High Deductible Plan F is an alternative version of the standard Plan F. The difference is the beneficiary agrees to pay the deductible before full coverage kicks in. Once you reach the deductible, the plan covers the left-over costs going forward, keeping the monthly premium low.Mar 17, 2022

How does Medicare work with a high deductible plan?

With high-deductible plans, Medicare pays 80% of covered costs, and you pay 20% up to the deductible amount, which is $2,370 in 2021 and rising to $2,490 in 2022. After that, the high-deductible plans pay just like full Medigap plans F and G.Nov 18, 2021

What is the Medicare Plan G deductible for 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the difference between high deductible Plan F and Plan G?

Fortunately, Plan G is nearly identical to Plan F. Plans F and G are the only two Medigap policies which cover your Part B excess charges. The only difference between Plans F and G is that Plan G does not cover your small Part B annual deductible ($198 as of 2020).

What is the deductible for Medicare Supplement plan g?

$233Plan G has nearly the same level of coverage as Plan F. With Plan G, you are responsible for the Part B deductible of $233. Otherwise, coverage is exactly the same as Plan F.

What is the most comprehensive Medicare Supplement plan?

Overview. Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

What is the out-of-pocket maximum for Medigap Plan G?

Similarly, Plan G has no out-of-pocket limit to protect you from spending too much on covered health care in a year.Dec 12, 2019

Are all Plan G Medicare supplements the same?

Because all Medicare Supplement Plan G policies provide the exact same coverage or benefits. This is what people mean when they say these plans are “standardized.” That said, not all Plan G policies cost the same. Insurance companies are free to charge what they want for them, and so they do.Nov 11, 2020

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Is Plan G the best?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

Is Plan G going away?

Plan F covers the Plan B deductible, and Plan G does not, but Plan F was phased out as of Jan. 1, 2020. Plan F is now available only to those who were eligible for Medicare before that date. Plan G is a popular replacement because both offer identical benefits aside from the Plan B deductible coverage.

When will Medicare start a new high deductible plan?

The new high-deductible Plan G will be available to both current and newly-eligible Medicare beneficiaries beginning in 2020. If you become eligible for Medicare before January 1, 2020, or after, you will be eligible to apply for for high-deductible Plan G. In order to apply for high-deductible Medicare Supplement Plan G, ...

How does a high deductible plan work?

How Does High-Deductible Plan G Work? High-deductible Medigap Plan G will offer the same benefits as standard Medigap Plan G, except the plan won’t pay its share of covered costs until you meet annual deductible amount. Once you spend a certain amount in qualified out-of-pocket Medicare expenses, you will meet your deductible ...

What is the difference between a plan G and a plan F?

The primary difference in the benefits of these two plans is that high-deductible Plan F covers the Medicare Part B deductible, while high-deductible Plan G will not. In 2019, the Medicare Part B deductible is $185 for the year.

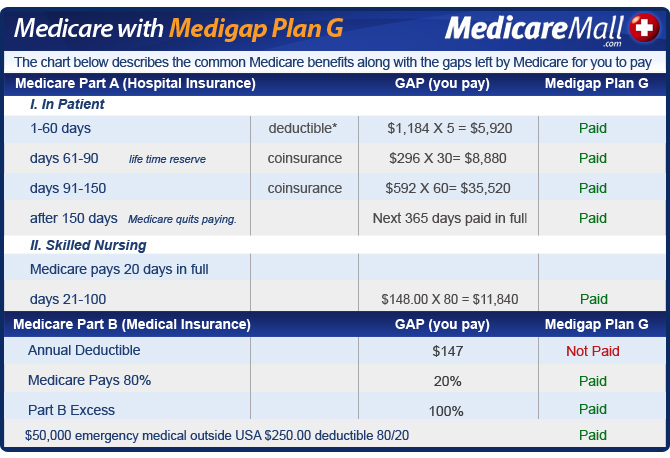

What is Medicare Part B coinsurance?

Medicare Part B Coinsurance and Copayment. Medicare Part B usually charges a coinsurance and copayments for doctor visits and other outpatient care . Medicare Part B typically pays for 80% of the Medicare-approved amount for covered services, leaving a 20% coinsurance in most cases.

How much is Medicare Part A deductible?

Medicare Part A comes with a deductible, which is $1,408 per benefit period in 2020. Medigap Plan G will cover your deductible in full for each benefit period you require.

What is the new Medicare Supplement Plan G?

New in 2020: High-Deductible Medicare Supplement Plan G. Medicare Supplement Insurance high-deductible Plan G is a new Medigap plan being offered in most states in 2020. There is already a standard Medigap Plan G. The new high-deductible Plan G option offers the coverage benefits of Plan G with lower monthly premiums in exchange for ...

What is the only Medicare plan that covers Part B?

Plan F and Plan C are the only Medigap plans that cover the Part B deductible. Anyone who is eligible for Medicare before January 1, 2020, may sign up for Plan F (including High-Deductible Plan F) or Plan C after that date, as long as one of these plan options is available where they live. If you are already enrolled in Plan F or Plan C ...

Changes to Medicare in 2020

With the passage of MACRA in 2015, the biggest change to new Medicare beneficiaries is the removal of the option to choose Medicare supplements that cover the Part B deductible. The three plans that cover this are the Plan F, the High Deductible Plan F, and the Plan C.

How do High Deductible Medicare Supplement Plans work?

High deductible plans require the consumer pay a large deductible before the plan begins to pay. Once this deductible is met, the plan pays 100% of covered services for the rest of the calendar year.

High Deductible Plan G Coverage

With the removal of the High Deductible Plan F for new Medicare beneficiaries in 2020 and beyond, the High Deductible Plan G was added as a new option.

Who are high-deductible Medicare plans good for?

High deductible Medicare plans can work great for people who can easily afford the $2,340 annual deductible if they have a bad year and wish to substantially save on their Medicare supplement premiums. If you are paying over $250 a month, you could actually save money by going the high deductible route.

What is Medicare Supplement High Deductible Plan G?

Updated on May 13, 2021. Medicare Supplement High Deductible Plan G is one of the newest standardized Medigap plans. High Deductible Plan G is an option for beneficiaries who want the benefits of standard Plan G but would prefer lower monthly premiums. We’re here to answer your questions about this plan and inform you to make ...

What is high deductible plan G?

High Deductible Plan G is a Medicare Supplement plan that offers the same coverage as standard Plan G. The premiums for this plan are lower than the premiums for the standard Plan G. Yet, enrollees must pay a higher deductible for coverage to kick in at 100%. Cost-sharing you pay out-of-pocket as well as the Part B deductible applies toward ...

Can you use guaranteed issue rights to enroll in Plan G?

Conversely, those who can use guaranteed issue rights to enroll in Plan F aren’t eligible to use them to enroll in either version of Plan G.

What is a high deductible plan?

High deductible Plan F provides the same level of coverage as the standard Plan F with potentially lower monthly premiums. The tradeoff for these lower monthly premiums is a high deductible.

How much is the average premium for a high deductible plan?

In 2019, the average premium for high-deductible Plan F was $57.16 per month. In 2019, the average premium for standard Plan F was $169.14 per month. 1. If you are interested in enrolling in a high-deductible Medigap Plan F, you should consider a few things. You must pay for Medicare-covered costs up to $2,370 in 2021 before your plan coverage will ...

What happens if you meet your deductible on Medigap?

Once you meet your deductible, your Medigap insurance company will begin paying the benefits offered in the plan. Before you choose the high-deductible Plan F, you should consider how likely you are to use enough medical services to meet the yearly deductible. Then evaluate how much coverage you would need after the deductible is met.

How much will Medicare cover in 2021?

You must pay for Medicare-covered costs up to $2,370 in 2021 before your plan coverage will kick in. For example, if you need a blood transfusion, a traditional Medigap plan will cover the cost of the first three pints, and Medicare will cover the cost of pints four and beyond.

What is Medicare Supplement Plan G?

In this case, Medicare Supplement Plan G is the parent plan if you will. To sum it up, Plan G covers your whole portion of medical benefits that are left over after Original Medicare has paid its portion except for the Part B deductible. Similarly, a High Deductible Plan G provides coverage the same way but only after you reach your annual ...

What is the deductible for Plan G?

Here’s what you need to know about the High Deductible Plan G: You will pay the other 20% until you satisfy the $2,370 deductible. After the out-of-pocket deductible is met, the plan will pay the same benefits as regular Plan G. The plan does not cover the Part B deductible (just like Plan G) The annual Part B deductible ...

Does Medicare have a high deductible plan?

For beneficiaries who became eligible for Medicare on or after January 1, 2020, a High Deductible Plan G option will be available. This plan will be like the High Deductible Plan F; however, it will not cover your Part B deductible. As with any new plan, there are looming of questions of how a High Deductible Plan G will stack up against ...

Is Medicare Plan F a semi-exit?

As you may know, Medicare Plan F made a semi-exit in 2020, as did Plan C and High-Deductible Plan F. Many people who have considered getting a high deductible Medicare Supplement are left wondering what their options are now that Plan F and its accompanying high deductible Plan F plan are no longer viable options.

Is Plan F going away?

The part you need to know is that for those who are newly eligible for Medicare on or after January 1, 2020, Plans C and F (including the high deductible option) will no longer be available. BUT don’t get this semi-exit confused with the incessant sound bites that say Plan F is going away for good.

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $170.10 per month. The maximum cost of Medicare Part B premiums is $578.30 per month in 2022, and that's for individuals reporting half a million dollars or more in income in 2020.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

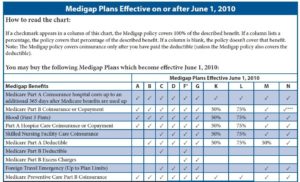

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022.

What is the difference between a regular plan and a high deductible plan?

The only difference between regular Plan F and High Deductible Plan F is just that – the deductible. With this plan, you must pay Medicare-covered costs such as copayments and coinsurance up to the deductible amount before your plan will pay anything. In 2021, the deductible for High-Deductible Plan F is $2,370.

What is the deductible for a high deductible plan F in 2021?

In 2021, the deductible for High-Deductible Plan F is $2,370. Once you meet the deductible for this plan, you’ll have the exact Plan F coverage as a standard Plan F plan. Because the deductible is so high, you can expect to pay a much lower premium for a High Deductible Plan F plan.

What is a Medigap Plan G?

Medigap Plan G High Deductible Coverage . The most crucial aspects of the HD Plan G plan are the benefits you will receive and the deductible amount. Your benefits will cover: Part B excess charges. Foreign travel emergency (up to plan limits) Skilled nursing facility care coinsurance.

What is the difference between Plan F and Plan G?

The only difference between Plan F and Plan G is the fact that Plan G does not pay the Part B deductible ($203 in 2021), while Plan F does. Overall, this won’t hurt your pocket. Many seniors find they still find a substantial amount of savings with Plan G, even though they have to pay the Part B deductible. Because Plan F is going away, it’s ...

What are the changes to Medicare in 2020?

What are the Medicare Changes in 2020? To provide a quick recap of the events happening in 2020, Medicare Supplement Plan F and Plan C are going away for those who are not eligible for Medicare before January 1, 2020.

What is a skilled nursing facility coinsurance?

Skilled nursing facility care coinsurance. Part A hospice care coinsurance or copayment. The first 3 pints of blood. Part B coinsurance or copayment. Part A coinsurance and hospital costs (up to an additional 365 days after Medicare benefits are used)

How much is HD Plan G 2021?

In 2021, deductible for HD Plan G will be $2,370.

What is a high deductible plan?

You can also choose a high-deductible Plan F offered by select insurance companies in some states. The high-deductible Plan F offers the same benefits as the standard plan; the only difference is you’d need to pay all costs for Medicare-covered services until a deductible amount is reached.

Which Medicare plan gives the most help?

But if you see your doctor frequently, need many health-care services, or face high out-of-pocket costs, Plan F generally gives you the most help with Original Medicare costs.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F (also called Medigap Plan F) is a popular choice because it generally features the most benefits. Some insurance companies may also offer a high-deductible version of Plan F. As the name implies, Medicare Supplement insurance like Plan F “supplements” your Original Medicare coverage by paying for some ...

When is the best time to enroll in Medicare Supplement?

A good time to enroll is during the Medicare Supplement Open Enrollment Period, which is a six-month period that starts automatically when you are 65 or older and have Part B. During this period, Medigap insurance companies can’t turn you down for coverage – even if you have pre-existing conditions or health problems.

Does Medicare leave out of pocket?

As you may know , Original Medicare (Part A and Part B) may leave you with out-of-pocket hospital and medical costs, like copayments, coinsurance, and deductibles. To help cover these “gaps,” you can consider purchasing one of the 10 standardized Medicare Supplement (Medigap) plan options available in 47 states (Massachusetts, Minnesota, ...

Is Medicare Supplement F deductible?

Here is an overview of the differences between Medicare Supplement F and the high-deductible Plan F, including covered benefits and costs. But there have been changes effective 2020 for Medicare Supplement. As of January 1, 2020, Medicare Supplement Plans F and C won’t be sold to anyone who’s not already eligible for Medicare before that date.

How old do you have to be to get Medicare?

You must be enrolled in Original Medicare Part A and Part B, and most plans require you to be 65 years of age or older. If you are under 65 years old and receive Medicare benefits, you can check the Medigap plans sold in your state to see if any are available for you.

Does Medicare have a monthly premium?

While Original Medicare does offer coverage for an array of different medical services and supplies, the costs associated with them often include a monthly or annual premium and an annual deductible.

Does Medicare help offset coinsurance?

Medigap plans can help offset these costs, making your healthcare more affordable and giving you more access to services you might otherwise be unable to afford. Medicare Supplement plans can help pay for deductibles, coinsurance, and copayments.

Can you cancel Medicare Supplement?

Medicare Supplement policies cannot be canceled by the providing company. This means that as long as you continue to pay your premiums, the insurance company is not able to cancel your insurance plan regardless of your current state of health or the usage of your plan. Related articles: What is Medicare Parts A & B.

Does Medicare cover travel abroad?

Some Medigap plans can also help cover the cost of medical care you receive while traveling abroad, so many Medicare recipients who spend time traveling outside of the United States find Medigap coverage appealing. Medicare Supplement plans are sold by private insurance carriers.