How much does a Medicare Advantage plan really cost?

The average Medicare Advantage premium in 2019 was $8, according to eHealth research. This was a result of the popularity of $0 premium plans. Medicare Advantage cost sharing Aside from your monthly premium, Medicare Advantage plans typically have cost sharing.

What companies offer Medicare Advantage plans?

What Companies Offer Medicare Advantage Plans Currently

- Aetna Medicare Advantage Plans. ...

- Benefits of Aetna Medicare Advantage Plans. ...

- Blue Cross and Blue Shield Medicare Advantage Plans. ...

- Benefits of Blue Medicare Advantage Plans. ...

- Cigna Medicare Advantage Plans. ...

- Benefits of Cigna Medicare Advantage Plans. ...

- Humana Medicare Advantage Plans. ...

- Benefits of Humana Medicare Advantage Plans. ...

What are the weaknesses of Medicare Advantage plans?

The Surprising Pros and Cons of Medicare

- Pros of Medicare. In many senses, Medicare works. Thanks to the program, millions of aging adults have been able to receive coverage.

- Cons of Medicare. In 2020, Medicare spending was projected to be $858.5 billion. ...

- Review Medicare Plans With HealthMarkets. When applying for a Medicare plan, your best bet is to do plenty of research. ...

What are the most popular Medicare Advantage plans?

- KelseyCare Advantage. ...

- Kaiser Permanente. ...

- Tufts Health Plan, Tufts Associated HMO. ...

- Blue Cross Blue Shield of Minnesota. ...

- Capital District Physicians’ Health Plan Medicare Choices PPO (CDPHP) CDPHP’s MA plan secured an overall five-star rating while performing particularly well in the customer service categories.

What is the difference between Medicare and Medicare Advantage plans?

Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. Plans may have lower out-of- pocket costs than Original Medicare. In many cases, you'll need to use doctors who are in the plan's network.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the point of a Medicare Advantage plan?

A Medigap policy is private insurance that helps supplement Original Medicare. This means it helps pay some of the health care costs that Original Medicare doesn't cover (like copayments, coinsurance, and deductibles).

What is Medicare Advantage in simple terms?

Medicare Advantage is a type of Medicare health plan offered by private companies that are Medicare-approved. They are considered an alternative to Original Medicare and cover all the expenses incurred under Medicare. They include the same Part A hospital and Part B medical coverage, but not hospice care.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

What is the biggest difference between Medicare and Medicare Advantage?

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you'll pay more for care you get outside your network.

What are 4 types of Medicare Advantage plans?

Below are the most common types of Medicare Advantage Plans.Health Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Why should I get an Advantage plan?

Advantage plans provide the benefits of Part A and B, and most also include Part D, or prescription drug coverage. Some offer extra benefits not available through Original Medicare, such as fitness classes or vision and dental care.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

What are the advantages and disadvantages of Medicare Advantage plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

What is a TAB plan?

#TAB#Medical Savings Account (MSA) plans—These plans combine a high-deductible health plan with a bank account. Medicare deposits money into the account (usually less than the deductible). You can use the money to pay for your health care services during the year. MSA plans don’t offer Medicare drug coverage. If you want drug coverage, you have to join a Medicare Prescription Drug Plan. For more information about MSAs, visit Medicare.gov/publications to view the booklet “Your Guide to Medicare Medical Savings Account Plans.”

Can you sell a Medigap policy if you already have a Medicare Advantage Plan?

If you already have a Medicare Advantage Plan, it’s illegal for anyone to sell you a Medigap policy unless you’re disenrolling from your Medicare Advantage Plan to go back to Original Medicare.

What Is Medicare Advantage?

Medicare Advantage is private health insurance for people eligible for Medicare. It offers similar benefits to Original Medicare (Part A and Part B) — including funding the cost of medical testing, hospital care, and doctor’s appointments.

How Can I Enroll in Medicare Advantage?

The specific Medicare Advantage plans available to you depend on where you live. You can enroll in Medicare Advantage when you initially become eligible for Medicare, or during each subsequent Medicare Advantage Open Enrollment Period after that. Open enrollment extends from January 1 through March 31 every year.

Get Started Now

Interested in learning more about Medicare, Medigap, and Medicare Advantage plans? WebMD Connect to Care Advisors may be able to help.

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is offered to people ages 65 and older and disabled adults who qualify. Plans are provided by Medicare-approved private insurance companies. Coverage is the same as Part A hospital, Part B medical coverage, and, usually, Part D prescription drug coverage, with the exception of hospice care.

When can I change my Medicare Advantage plan?

People can change their Medicare Advantage plans during a specified open enrollment period in the fall that typically spans from mid-October to early December. 8 9. Like other types of health insurance, each Medicare Advantage plan has different rules about coverage for treatment, patient responsibility, costs, and more.

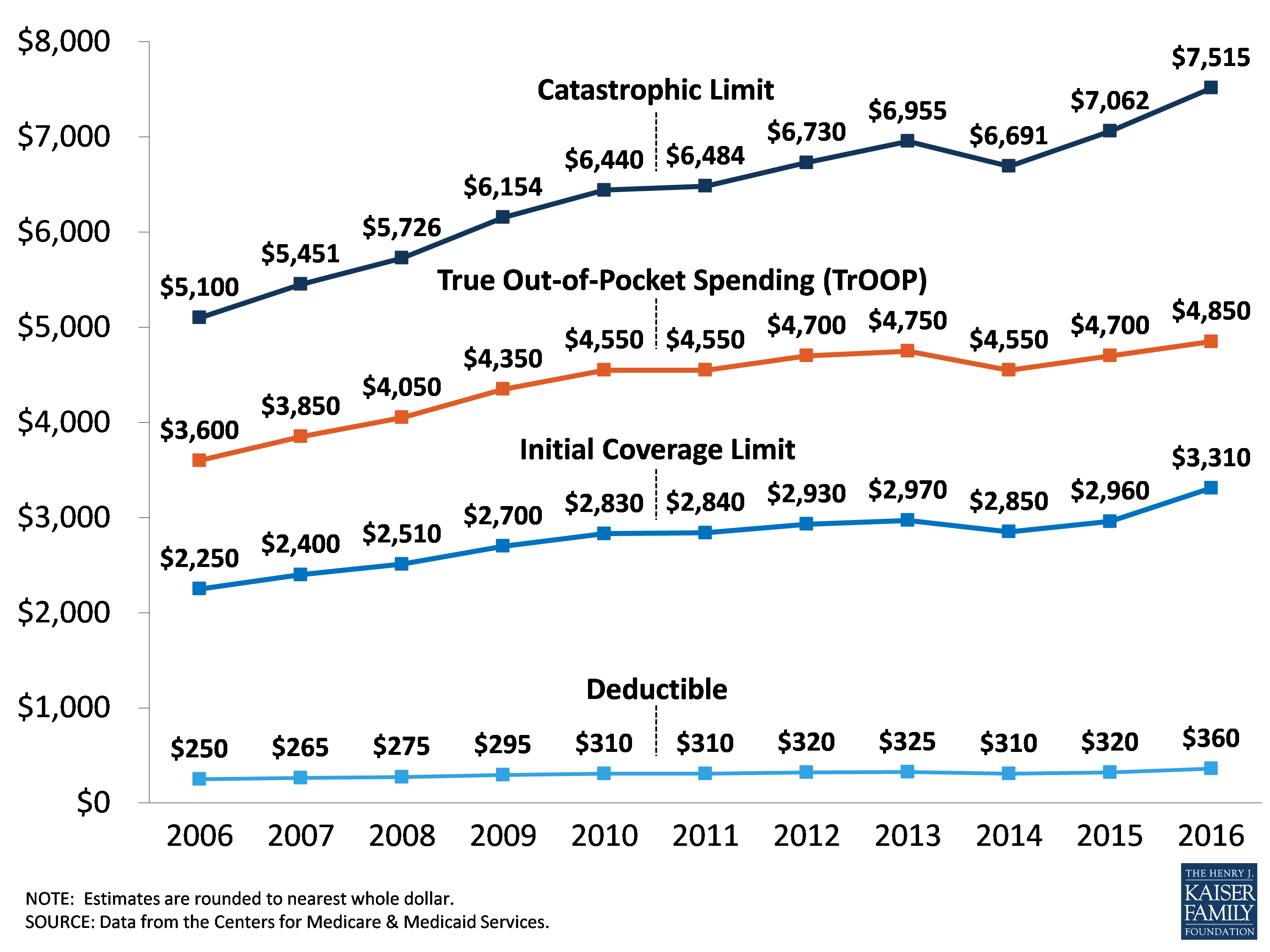

What is the maximum Medicare deductible for 2021?

In 2021, the annual maximum is rising to $7,550, up from $6,700, although many plans have lower out-of-pocket caps. 11 The 2021 monthly premium and annual deductible for Medicare Part B are $148.50 and $203, respectively. 12.

Is Medicare available for people over 65?

Medicare is generally available for people age 65 or older, younger people with disabilities, and people with end-stage renal disease—permanent kidney failure requiring dialysis or transplant—or amyotrophic lateral sclerosi (ALS). 3 4 Medicare Advantage is a type of Medicare health plan offered by private companies that are Medicare-approved.

Does Medicare Advantage work with Medigap?

Medicare Advantage plans don't work with Medigap, which is also called Medicare Supplement Insurance. 2. The average monthly premium for a Medicare Advantage plan in 2021 is expected to drop 11% to about $21 from an average of $23.63 in 2020. 5 Private companies receive a fixed amount each month for Medicare Advantage plan care.

What is Medicare Advantage?

Medicare Advantage is an all-in-one alternative to Original Medicare. Private insurers that offer Medicare Advantage Plans contract with the federal government to provide health insurance benefits to people who qualify for Medicare. In 2021, about four in 10 people eligible for Medicare are in Medicare Advantage Plans.

What are the drawbacks of Medicare?

Drawbacks include less freedom to choose your medical providers, requirements that you reside and get your non-emergency medical care in the plan’s geographic service area, and limits on your ability to switch back to Original Medicare.

How to enroll in Medicare online?

Click on “Enroll.”. — Go to the plan’s website to see if you can enroll online. — Contact the plan to get a paper enrollment form. Fill it out and return it to the plan provider. — Call the provider for the plan you wish to join. — Call Medicare at 1-800-MEDICARE (1-800-633-4227).

When do you need your Medicare number?

You will need your Medicare number and the date your Part A and/or Part B coverage started. Keep in mind that you can only enroll in a Medicare Advantage Plan during your Initial Enrollment Period (when you first become eligible for Medicare) or during the Open Enrollment Period from Oct. 15 to Dec. 7.

Does Medicare have an out-of-pocket limit?

That caps the amount you’ll be expected to pay in addition to your premiums. Original Medicare and most Medigap plans don’t have out-of-pocket maximums.

Can you use Medicare Advantage without a network?

Medicare Advantage Plans may have provider networks that limit your choices. If you go outside the network, your care may not be covered. With Original Medicare, you generally can use any doctor or medical facility that accepts Medicare assignment.

Is Medicare Advantage the same as Medicare Supplement?

Are Medicare Advantage Plans the same as Medicare Supplement Plans or Medigap? No, they’re not the same thing. Medicare Supplement Insurance or Medigap is coverage that fills gaps in Original Medicare, such as covering additional copays or coinsurance. Medicare Advantage completely replaces Original Medicare.

What is Medicare Advantage?

En español | The Medicare Advantage program (Part C) gives people an alternative way of receiving their Medicare benefits. The program consists of many different health plans (typically HMOs and PPOs) that are regulated by Medicare but run by private insurance companies. Plans usually charge monthly premiums (in addition to the Part B premium), ...

When can Medicare Advantage plans change?

Medicare Advantage plans can change their costs (premiums, deductibles, copays) every calendar year. To be sure of getting your best deal, you can compare plans in your area during the Open Enrollment period (Oct. 15 to Dec. 7) and, if you want, switch to another one for the following year.

Does Medicare have a monthly premium?

Plans usually charge monthly premiums ( in addition to the Part B premium), although some plans in some areas are available with zero premiums. These plans must offer the same Part A and Part B benefits that Original Medicare provides, and most plans include Part D prescription drug coverage in their benefit packages.