Does Medicare really contribute to a MSA?

Sep 15, 2018 · Medicare Advantage MSA plans are a high-deductible plan combined with a special medical savings account set up in your name that you can use to pay qualifying health care expenses, including those that contribute to your plan’s deductible.

What are the advantages of Medicare Advantage?

Nov 18, 2021 · Medicare Advantage MSA plan coverage. Medicare Medical Savings Accounts include all the same benefits covered by Original Medicare (Medicare Part A and B). Medicare Advantage MSA plans may also provide coverage for benefits not offered by Original Medicare. These additional benefits can include: Dental; Vision; Hearing; Long-term care not covered by …

Is Medicare Advantage really an advantage?

Jan 25, 2022 · What Is a Medicare Advantage MSA? A Medicare Medical Savings Account (MSA) Plan is a plan available to most people eligible for Medicare who live where these plans are offered. An MSA has two separate components: a medical savings account and a high-deductible Medicare Advantage plan (“Part C”). This type of plan usually doesn’t have a network of …

What is the problem with Medicare Advantage?

These companies can choose to offer a consumer-directed Medicare Advantage Plan, called a Medicare MSA Plan. These plans are similar to Health Savings Account Plans available outside of Medicare. You can choose your health care services and providers (MSA plans usually don’t have a network of doctors, other health care providers, or hospitals). Medicare MSA Plans have 2 parts

How is an MSA different than other plans?

Some MSAs offer additional benefits, such as vision and hearing care. Unlike other Medicare Advantage Plans, MSA plans include both a high deductible health plan (HDHP) and a bank account to help pay your medical costs. HDHPs have large deductibles that you must meet before receiving coverage.

What are the two types of Medicare Advantage plans?

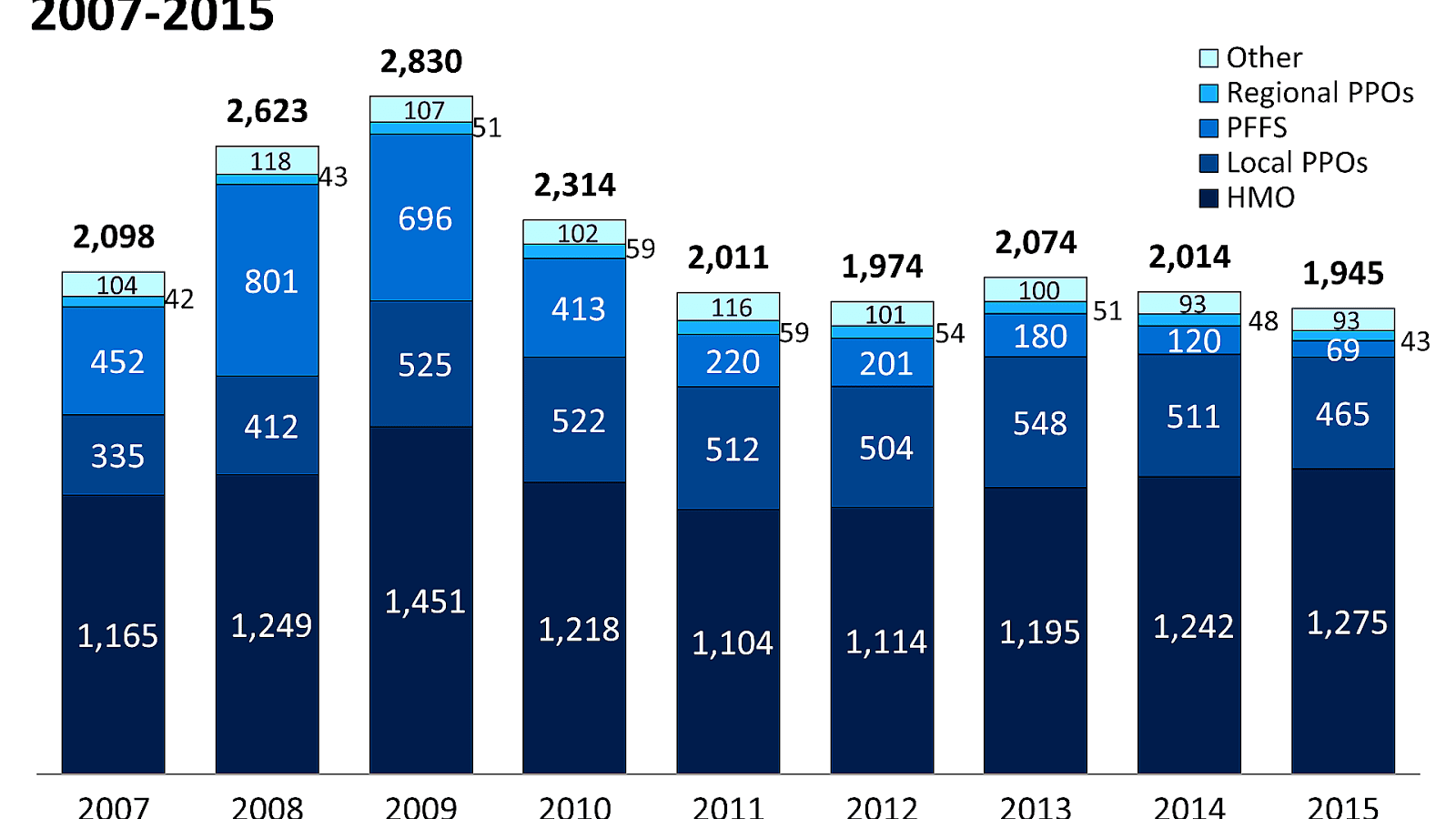

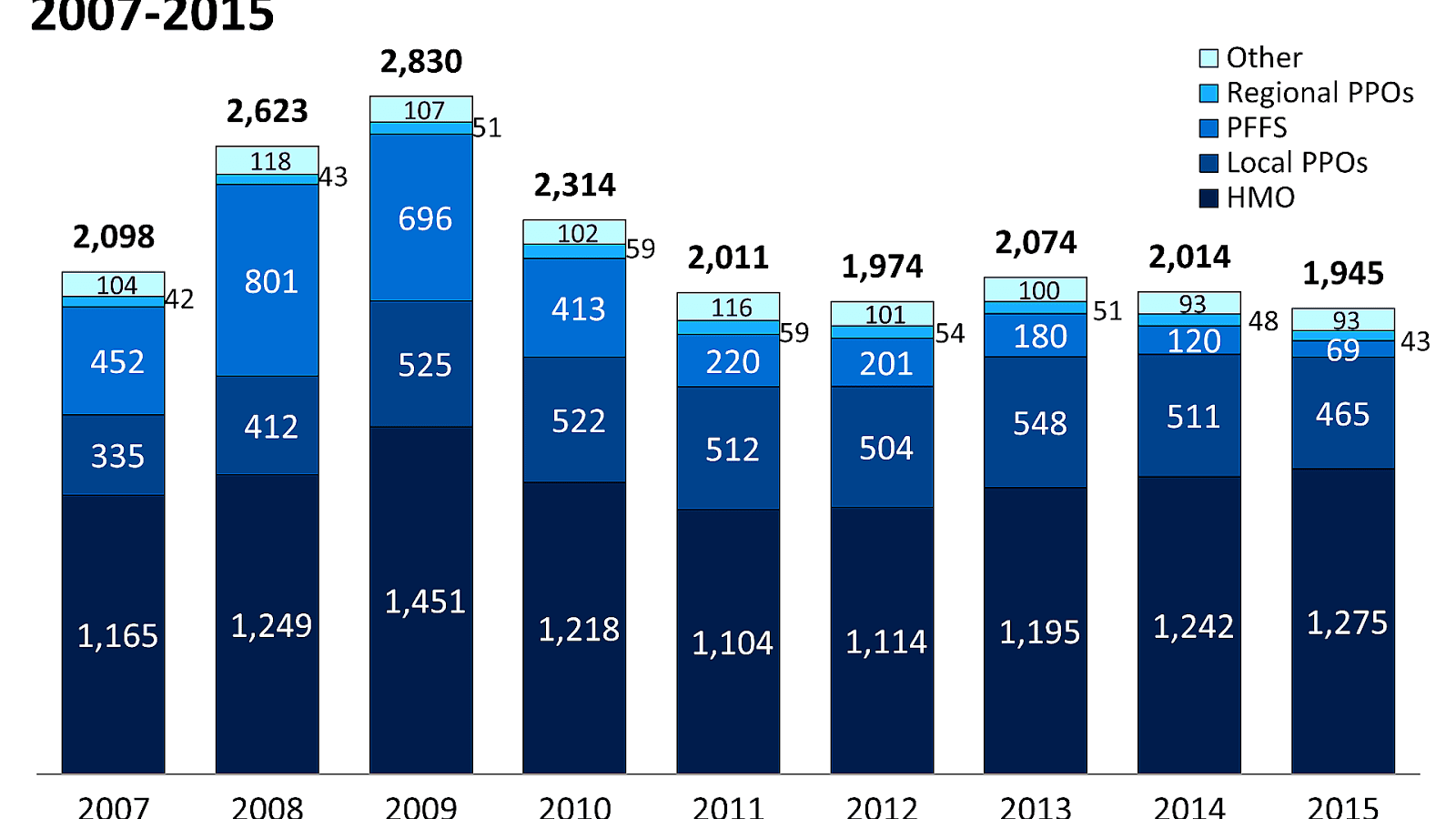

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

What is an MSA vs HSA?

Medicare savings accounts (MSAs) and health savings accounts (HSAs) both give consumers tax-advantaged ways to fund the costs of healthcare. MSAs are only for people enrolled in high-deductible Medicare plans. HSAs are restricted to people in high-deductible private insurance plans.Nov 10, 2021

What is the deductible for an MSA?

If you join an MSA plan after January 1, your yearly deductible will be pro-rated to the number of months left in the year. For example, if your plan's yearly deductible is $6,000 and your coverage starts September 1, your deductible for that year will be $2,000 (one-quarter of the yearly deductible).

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What does MSA stand for in insurance?

A Medicare Medical Savings Account (MSA) plan is a type of Medicare Advantage plan that combines a high-deductible health plan with a medical savings account.Dec 1, 2021

Can you have both an HSA and an MSA?

Consumers have the ability to have both an MSA and HSA or more than one HSA, but it comes with some minor adjustments on how they can contribute. The total annual limit does not change, but the allocation on where they can put their funds is important.

Can I have an MSA and HSA at the same time?

The Main Types of HSAs and MSAs These plans can be paired with employer-provided or individual health plans. Archer MSA plans were an older version of the current HSAs. This type of plan is no longer common, but some people do still have these accounts.

Are Medicare MSA contributions tax deductible?

Your MSA money isn't taxable as long as it's used for your qualified medical expenses. Interest earned on MSA money isn't taxable if it's used for your qualified medical expenses. If you have any questions about Medicare you can learn more at CMS.gov.

Can you have a health savings account if you are on Medicare?

Can You Have a Health Savings Account (HSA) and Medicare? Once you enroll in Medicare, you're no longer eligible to contribute funds to an HSA. However, you can use existing money in an HSA to pay for some Medicare costs. You'll receive a tax penalty on any money you contribute to an HSA once you enroll in Medicare.

Does MSA cover Part D?

Medicare MSA Plans don't cover Medicare Part D prescription drugs. However, if you join a Medicare MSA Plan, you can also join a Medicare Prescription Drug Plan to add this coverage.

How to contact Medicare Advantage MSA?

Special Needs Plan (SNP) To learn more about Medicare Advantage MSA plans, including which Medicare Advantage MSA plans may be available for sale near you and how you can enroll, speak with a licensed insurance agent by calling. 1-800-557-6059. 1-800-557-6059 TTY Users: 711 24 hours a day, 7 days a week.

How does a Medicare MSA work?

How Medicare Medical Savings Accounts (MSA) work. When you enroll in a Medicare Medical Savings Account, the Medicare MSA plan will designate an amount of money to be deposited into a savings account each year. You will then be able to use the money in this account to pay for covered health care services and products.

What is MSA plan?

MSA Plans combine a high deductible Medicare Advantage Plan and a trust or custodial savings account (as defined and/or approved by the IRS). The plan deposits money from Medicare into the account. You can use this money to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

Does Medicare MSA have a deductible?

Medicare MSA plans include a deductible that is greater than the amount of money that the Medicare MSA plan deposits into the account. The money deposited into your account can be used toward the plan deductible before the plan’s additional coverage kicks in.

Does Medicare Advantage cover prescription drugs?

Medicare Advantage MSA plans may also provide coverage for benefits not offered by Original Medicare. These additional benefits can include: MSA plans do not provide coverage for prescription drugs.

Does Medicare cover hearing?

Hearing. Long-term care not covered by Original Medicare 1. MSA plans do not provide coverage for prescription drugs. If you wish to enroll in Medicare prescription drug coverage, you may enroll in a Medicare Part D plan in addition to your Medicare Advantage MSA plan.

Does MSA account grow over time?

Any unused money in your account at the end of the year will remain in your account and will be combined with the deposited money of the upcoming year, so the account has the ability to grow over time. Money that is deposited into your Medicare Advantage MSA plan account that is used for qualified medical expenses through ...

What Is a Medicare Advantage MSA?

A Medicare Medical Savings Account (MSA) Plan is a plan available to most people eligible for Medicare who live where these plans are offered. An MSA has two separate components: a medical savings account and a high-deductible Medicare Advantage plan (“Part C”).

How a Medicare Advantage MSA Plan Works

The first step to getting an MSA plan is to select a high-deductible MSA plan. You can do this when you first sign up for Medicare or during the annual open enrollment period between October 15 and December 7. You won't pay a monthly premium for your Medicare Advantage MSA, however, you must continue to pay your monthly Medicare Part B premium. 1

The Bottom Line

A Medicare Medical Savings Account (MSA) plan isn’t right for everyone. But it might be a good fit if you appreciate the flexibility of choosing any Medicare-approved provider, and if you can afford to pay a high deductible before your coverage kicks in.

What is Medicare MSA?

What's a Medicare MSA Plan? Medicare works with private insurance companies to offer you ways to get your health care coverage. These companies can choose to offer a consumer-directed Medicare Advantage Plan, called a Medicare MSA Plan. These plans are similar to Health Savings Account Plans available outside of Medicare.

What is MSA plan?

Medicare MSA Plans combine a high-deductible insurance plan with a medical savings account that you can use to pay for your health care costs. A type of Medicare health plan offered by a private company that contracts with Medicare.

What is a medical savings account?

Medical Savings Account (MSA): The second part is a special type of savings account. The Medicare MSA Plan deposits money into your account. You can use money from this savings account to pay your health care costs before you meet the deductible.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

Does MSA cover extra?

In addition, some Medicare MSA plans may cover extra. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. Contact plans in your area for more information on what extra benefits they cover, if any.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . The plan will only begin to cover your costs once you meet a high yearly. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , which varies by plan.

Does Medicare cover MSA?

Medicare MSA Plans don't cover Medicare Part D prescription drugs. If you join a Medicare MSA Plan and need drug coverage, you'll have to join a Medicare Prescription Drug Plan. To find available plans in your area, you can: Visit the Medicare Plan Finder. Call us at 1-800-MEDICARE (1-800-633-4227).

What is a medical savings account?

Medical Savings Account (MSA) A Medicare Medical Savings Account (MSA) plan is a type of Medicare Advantage plan that combines a high-deductible health plan with a medical savings account. Enrollees of Medicare MSA plans can initially use their savings account to help pay for health care, and then will have coverage through a high-deductible ...

Is https:// secure?

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. Header.

What is MSA insurance?

An MSA plan is a type of Medicare Advantage plan. Medicare Advantage plans give you health coverage through a private insurance company that has contracted with Medicare. MSA plans have two parts: A high-deductible health plan (HDHP). With this type of plan, you are responsible for paying your health costs up to a certain dollar amount, ...

What is MSA plan?

An MSA plan is a type of Medicare Advantage plan. However, MSA plans are different from most other Medicare Advantage plans. MSA plans don’t typically include dental, vision, or prescription drug coverage, as some Medicare Advantage plans do. MSAs have more restrictions than Medicare Advantage plans when it comes to who can join in the first place.

How to choose MSA?

Why choose an MSA plan? 1 They have a $0 premium. You pay no premium with an MSA plan. You do still have to pay your Part B premium (typically it’s withheld from your Social Security check) and the premiums for any Part D prescription drug plan you choose. 2 They are simple. If you enroll in an MSA, you can have $0 premiums, and no required copays or coinsurance. 3 They have tax benefits. Money deposited in the MSA account is not taxed as income, and any interest it earns is tax-free too. 4 Your out-of-pocket costs are predictable. Worst-case scenario: the most you’d have to spend is the difference between the annual deposit and your deductible. 5 Your savings can build if you stay healthy. If you spend less money on health care than the yearly deposit, the difference will roll over. If the balance grows high enough to cover your full deductible, you might not need to pay anything out of pocket in some years. 6 You can move the funds to any financial institution you choose. The plan will open your account at a bank they choose, but you can move the money if you like. Keep in mind that you will be responsible for tracking your spending if you move the funds.

How much is MSA premium?

The premium for an MSA is $0, but that doesn’t mean your total costs are always zero. It’s best to set some money aside in case you have health care costs above what is in the savings account. Until you meet your deductible, you’re responsible for paying 100% of the Medicare-approved amount for your care. You can use the money from your medical ...

How many people have MSA plans in 2019?

You’re not alone. Only about 5,600 Medicare enrollees have MSA plans in 2019. 1 That’s miniscule compared to the 64 million total people on Medicare. 2. However, things may be changing, as MSA plans are about to become available to more people in more states. That’s a good thing, because this type of plan offers substantial benefits for some people.

What is Medicare deductible?

With this type of plan, you are responsible for paying your health costs up to a certain dollar amount, called your deductible. Once you reach the deductible, the plan pays all your medical costs. A medical savings account. Medicare puts money into this account for you each year, and you can use it to pay for your health care costs ...

When is Medicare enrollment period?

Specifically, the initial enrollment period occurs during a seven-month window around your 65th birthday. It includes the month you turn 65, plus the three months before and after. The Annual Election Period, when anyone can change Medicare plans, runs from October 15 to December 7.