What companies offer Medicare Advantage plans?

Oct 25, 2021 · A Medicare Advantage HMO plan with a POS option is known as an HMO-POS. This is a type of plan beneficiaries may choose for Medicare coverage. HMO-POS plans allow members to receive care outside of the plan’s network, but the cost of care will be more expensive. An HMO-POS policy has the flexibility of a PPO with restrictions like an HMO.

How to pick the best Medicare Advantage plan?

Point-of-service (POS) plans are Medicare Advantage plans that combine features of health maintenance organization (HMO) and preferred provider organization (PPO) plans. They typically cost less in exchange for more limited choices, but POS plans let you seek out-of-network health care services. Connect With a Medicare Expert

What are the best Medicare Advantage plans?

Advantage Plan. In all types of Medicare Advantage Plans, you’re always covered for emergency and urgent care. Medicare Advantage Plans must offer emergency coverage outside of the plan’s service area (but not outside the U.S.). Many Medicare Advantage Plans also offer extra benefits such as dental care, eyeglasses, or wellness programs ...

Should you choose a Medicare Advantage plan?

Jan 06, 2022 · With Aetna Medicare Advantage HMO-POS plans, you have a network of providers to use for medical care. Most of our HMO-POS plans require you to use a network provider for medical care. But there are options to go out of network for dental care. That gives you more choice and flexibility. ZIP CODE Continue to 2022 plans

What is the difference between a PPO and a POS?

In general the biggest difference between PPO vs. POS plans is flexibility. A PPO, or Preferred Provider Organization, offers a lot of flexibility to see the doctors you want, at a higher cost. POS, or Point of Service plans, have lower costs, but with fewer choices.

Is POS better than HMO?

POS: An affordable plan with out-of-network coverage But for slightly higher premiums than an HMO, this plan covers out-of-network doctors, though you'll pay more than for in-network doctors. This is an important difference if you are managing a condition and one or more of your doctors are not in network.

What is the difference between HMO and POS plans?

What is the difference between an HMO and POS? Members have to receive in-network care for both POS and HMO plans and both types of plans have restricted networks. They're different in one key way: POS plans don't require referrals to see specialists, but HMO plans demand a referral to see a specialist.Nov 10, 2021

What POS insurance means?

Point of ServiceA type of plan in which you pay less if you use doctors, hospitals, and other health care providers that belong to the plan's network. POS plans also require you to get a referral from your primary care doctor in order to see a specialist.

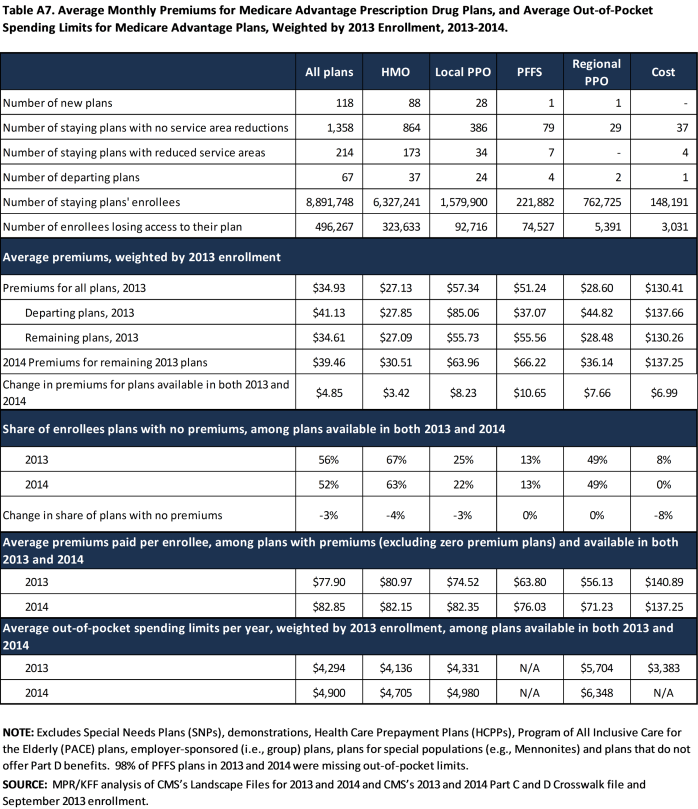

What is the maximum out-of-pocket for Medicare Advantage?

The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year. In 2019, this amount is $6,700, which is a common MOOP limit. However, you should note that some insurance companies use lower MOOP limits, while some plans may have higher limits.Oct 1, 2021

What counts toward the out-of-pocket maximum on the Medicare Advantage plan?

Medicare rules allow Medicare Advantage plans to credit the following costs toward your out-of-pocket maximum: Copayments or coinsurance amounts for doctor visits, emergency room visits, hospital stays, and covered outpatient services. Copayments or coinsurance for durable medical equipment and prosthetics.

What are the pros and cons of an EPO?

What Are the Advantages and Disadvantages of EPO Insurance?It does not require you to use a primary care physician.You don't need to get referrals to see specialists.EPOs also generally have lower premiums than HMOs due to their higher deductibles.More items...

What type of insurance is Aetna Choice POS II?

About the Aetna Network and Preferred Benefits Choice POS II is a network plan, which means you get the highest level of benefits when you choose doctors, hospitals and other health care providers who belong to the Aetna network .

What is a disadvantage of a POS plan?

Disadvantages of POS Plans This freedom of choice encourages you to use network providers but does not require it, as with HMO coverage. Higher Out-of-Network Co-PaymentsAs in a PPO, there is generally strong financial incentive to use POS network physicians.

How does a POS health plan work?

A point-of-service plan (POS) is a type of managed care plan that is a hybrid of HMO and PPO plans. Like an HMO, participants designate an in-network physician to be their primary care provider. But like a PPO, patients may go outside of the provider network for health care services.

What are the benefits for providers who use POS?

POS plans often offer a better combination of in-network and out-of-network benefits than other options like HMO. While you can expect to pay higher out-of-network fees compared to in-network fees, members have wider access to health providers and specialists.Feb 19, 2018

What is the difference between HMO and POS?

However, there is one big difference. An HMO-POS plan allows members to use healthcare providers that are outside the plan’s network for some or all services.

What is Medicare Advantage HMO?

What is a Medicare Advantage HMO-POS plan? | 65 Incorporated. What does HMO-POS mean? HMO-POS stands for Health Maintenance Organization with a point-of-service option. This is one type of Medicare Advantage plan. An HMO-POS plan has features of an HMO plan. One is a defined list of providers, often referred to as a network, ...

What Is a Medicare Advantage POS Plan?

Some Medicare health maintenance organization (HMO) plans offer a point-of-service (POS) option. These plans are sometimes called HMO-POS plans. They combine lower costs associated with HMO plans along with some out-of-network flexibility associated with preferred provider organization (PPO) plans.

How Do Point-of-Service Plans Work?

Point-of-service plans work like HMO plans to keep premiums low by having a typically small network of doctors, hospitals and other health care providers to choose from. They work like a PPO by allowing you to see out-of-network doctors or other providers.

Costs of Point-of-Service Insurance

Costs for a Medicare POS plan usually fall somewhere between that for an HMO plan and a PPO plan. But it’s important to look at your particular situation to see if it is right for you.

What is POS plan?

Point-of-service (POS) plans generally offer you more choice than traditional health maintenance organization (HMO) plans. While you choose an in-network primary care physician, you can also see providers for certain types of services out of network. However, you may pay more for out-of-network care you receive.

What is a D-SNP?

Our dual-eligible Special Needs Plan (D-SNP) is a type of Medicare Advantage plan, available to people who have both Medicare and Medicaid. We can help you find out if you qualify.

Does Aetna offer Medicare Advantage?

Medicare Advantage plans for every need. In addition to HMO-POS plans, Aetna offers you other Medicare Advantage plan options — some with a $0 monthly plan premium. We can help you find a plan that’s right for you.

Does Aetna have a PCP?

Yes, in many plans. Yes, in many plans. Yes, in many plans. Aetna Medicare Advantage plans at a glance. Our HMO-POS plans. Requires you to use a provider network. Varies by plan. Seeing out-of-network providers generally costs more. Requires you to have a primary care physician (PCP)

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

What is the difference between a PPO and an HMO?

POS stands for point of service. PPO stands for preferred provider organization. All these plans use a network of doctors and hospitals. The difference is how big those networks are and how you use them.

Does HMO cover urgent care?

They coordinate all your care and can refer you to trusted doctors and specialists in your network. Another thing to know about HMO plans is that most health care isn't covered outside your network. That means if you're traveling outside your coverage area, we'll only cover emergency or urgent care in most cases.

What is POS plan?

POS plans require you to choose a PCP and to get referrals if you need to see other providers, except for OB-GYNS. In fact, "point of service" means that your PCP is your number one go-to for care—they are your initial point of service. If you need to see specialists or get any other care, your PCP will coordinate it.

What is the difference between a PPO and a POS plan?

In general the biggest difference between PPO vs. POS plans is flexibility. A PPO, or Preferred Provider Organization, offers a lot of flexibility to see the doctors you want, at a higher cost. POS, or Point of Service plans, have lower costs, but with fewer choices.

Is a PPO a PCP?

If you're looking for a lot of choice and flexibility, you might consider a PPO. No PCP required, no referrals, and coverage for both in- and out-of-network providers. This choice and flexibility comes with higher plan costs, though. POS plans cost less, but offer fewer choices than PPOs.

What is a network provider?

A network is made up of doctors and facilities that contract with an insurance provider. Network providers typically agree to offer discounted rates to customers, which is the advantage to staying in-network. Some plans require you to see providers in a network. PPO plans do not require you to see in-network doctors and you don't need referrals, ...

Do POS plans have deductibles?

POS plans typically do not have a deductible as long as you choose a Primary Care Provider, or PCP, within your plan's network and get referrals to other providers, if needed. Copays: Both PPO and POS plans may require copays. This is a fee you pay to a doctor at the time of a visit or for a prescription medication.