How much does a Medicare Advantage plan really cost?

Medicare Advantage Plans, a type of Medicare health plan offered by contracting private companies, give all Part A and Part B benefits. Medicare Advantage Plans: HMO, PPO, Private Fee-for-Service, Special Needs Plans, HMO Point of …

What companies offer Medicare Advantage plans?

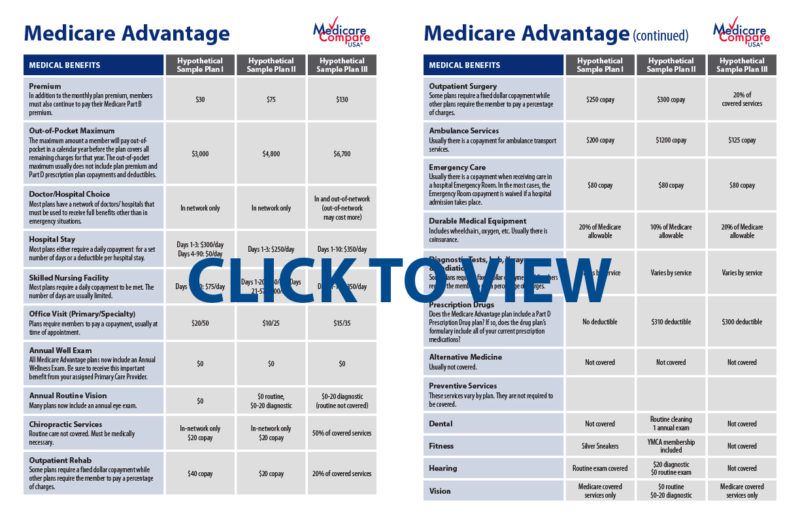

Medicare Advantage Plans have a yearly limit on your out-of-pocket costs for medical services. Once you reach this limit, you’ll pay nothing for covered services. Each plan can have a different limit, and the limit can change each year. You should consider this when choosing a plan.

What are the weaknesses of Medicare Advantage plans?

Medicare Advantage Plans, sometimes called “Part C” are offered by Medicare-approved private companies that must follow rules set by Medicare. Most Medicare Advantage Plans include drug coverage (Part D).

What are the most popular Medicare Advantage plans?

What is Medicare Advantage? En español | The Medicare Advantage program (Part C) gives people an alternative way of receiving their Medicare benefits. The program consists of many different health plans (typically HMOs and PPOs) that are regulated by Medicare but run by private insurance companies.

What is the difference between Medicare and Medicare Advantage plans?

What are the negatives to a Medicare Advantage plan?

What is the purpose of a Medicare Advantage plan?

What are 4 types of Medicare Advantage plans?

- Health Maintenance Organization (HMO) Plans.

- Preferred Provider Organization (PPO) Plans.

- Private Fee-for-Service (PFFS) Plans.

- Special Needs Plans (SNPs)

Who is the largest Medicare Advantage provider?

Can I drop my Medicare Advantage plan and go back to original Medicare?

What is the most popular Medicare Advantage plan?

Do you need Medicare Part A and B if you have Medicare Advantage?

Can you have Medicare and Medicare Advantage at the same time?

Are you automatically enrolled in Medicare if you are on Social Security?

Does Medicare cover dental?

What Does Medicare Advantage Cost?

What are the different types of Medicare Advantage Plans?

Other less common types of Medicare Advantage Plans that may be available include. Hmo Point Of Service (Hmopos) Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost. and a. Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account.

Does Medicare Advantage include drug coverage?

Most Medicare Advantage Plans include drug coverage (Part D). In many cases , you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs.

What is MSA plan?

Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account. The plan deposits money from Medicare into the account. You can use the money in this account to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

Does Medicare cover vision?

You still get complete Part A and Part B coverage through the plan. Some plans offer extra benefits that Original Medicare doesn’t cover – like vision, hearing, or dental. Your out-of-pocket costs may be lower in a Medicare Advantage Plan.

Does Medicare have a yearly limit?

Medicare Advantage Plans have a yearly limit on your out-of-pocket costs for medical services. Once you reach this limit, you’ll pay nothing for covered services. Each plan can have a different limit, and the limit can change each year. You should consider this when choosing a plan.

What is Medicare Advantage?

En español | The Medicare Advantage program (Part C) gives people an alternative way of receiving their Medicare benefits. The program consists of many different health plans (typically HMOs and PPOs) that are regulated by Medicare but run by private insurance companies. Plans usually charge monthly premiums (in addition to the Part B premium), ...

Does Medicare have a monthly premium?

Plans usually charge monthly premiums ( in addition to the Part B premium), although some plans in some areas are available with zero premiums. These plans must offer the same Part A and Part B benefits that Original Medicare provides, and most plans include Part D prescription drug coverage in their benefit packages.

What is Medicare Advantage?

Most Medicare Advantage Plans offer coverage for things that aren't covered by Original Medicare, like vision, hearing, dental, and wellness programs (like gym memberships). Plans can also cover more extra benefits than they have in the past, including services like transportation to doctor visits, over-the-counter drugs, adult day-care services, ...

What happens if you have a Medicare Advantage Plan?

If you have a Medicare Advantage Plan, you have the right to an organization determination to see if a service, drug, or supply is covered. Contact your plan to get one and follow the instructions to file a timely appeal. You also may get plan directed care.

Does Medicare Advantage cover hospice?

Medicare Advantage Plans must cover all of the services that Original Medicare covers. However, if you’re in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research studies.

What is Medicare health care?

Health care services or supplies needed to diagnose or treat an illness, injury, condition, disease, or its symptoms and that meet accepted standards of medicine. under Medicare. If you're not sure whether a service is covered, check with your provider before you get the service.

How much is Medicare Advantage 2021?

In addition to your Part B premium, you usually pay a monthly premium for the Medicare Advantage Plan. In 2021, the standard Part B premium amount is $148.50 (or higher depending on your income). If you need a service that the plan says isn't medically necessary, you may have to pay all the costs of the service.

Can you get care outside of Medicare?

Care that you get outside of your Medicare health plan's service area for a sudden illness or injury that needs medical care right away but isn’t life threatening. If it’s not safe to wait until you get home to get care from a plan doctor, the health plan must pay for the care. . The plan can choose not to cover the costs of services that aren't.

Does Medicare Advantage have a monthly premium?

For starters, Medicare Advantage plans are offered by private insurance companies but are regulated by Medicare. Regardless if the Medicare Advantage plan you choose has a monthly premium or not, you must continue to pay your Medicare Part B premium. Some Medicare Advantage plans have premiums as low as $0.

Can you use any provider under Medicare Advantage?

Many Medicare Advantage plans have networks, such as HMOs (health maintenance organizations) or PPOs* (preferred provider organization). Many Medicare Advantage plans may have provider networks that limit the doctors and other providers you can use. Under Original Medicare, you can use any provider that accepts Medicare assignment.

What are the benefits of a syringe?

Other extra benefits may include: 1 Meal delivery for beneficiaries with chronic illnesses 2 Transportation for non-medical needs like grocery shopping 3 Carpet shampooing to reduce asthma attacks 4 Transport to a doctor appointment or to see a nutritionist 5 Alternative medicine such as acupuncture

What are the disadvantages of Medicare Advantage?

A possible disadvantage of a Medicare Advantage plan is you can’t have a Medicare Supplement plan with it. You may be limited to provider networks. Find affordable Medicare plans in your area. Find Plans. Find Medicare plans in your area. Find Plans.

Is Medicare Advantage a private insurance?

For starters, Medicare Advantage plans are offered by private insurance companies but are regulated by Medicare. Regardless if the Medicare Advantage plan you choose has a monthly premium or not, you must continue to pay your Medicare Part B premium.

Does Medicare have an out-of-pocket maximum?

You may not know that Original Medicare (Part A and Part B) has no out-of- pocket maximum. That means that if you face a catastrophic health concern, you may be responsible to pay tens of thousands of dollars out of pocket.

What is the out of pocket limit for Medicare Advantage?

Once you meet this limit, your plan covers the costs for all Medicare-covered services for the rest of the year. In 2021 the out of pocket limit is $7,550, according to the Kaiser Family Foundation.

What are the different types of Medicare Advantage plans?

Understanding the Types of Medicare Advantage Plans 1 HMO plans only cover you when you go to doctors, providers, or hospitals in your plan’s network except in urgent or emergencies. Referrals from primary care doctors to see other doctors or specialists may be required. 2 PPO plans will generally cover you outside the network with a higher out of pocket cost to you. 3 PFFS plans are most like Medicare; you can go to any doctor, provider, or hospital if they accept the plan’s payment terms. 4 Special Needs Plans provide specialized health care for specific groups of people, like those with Medicare and Medicaid, people living in a nursing home, or those with certain chronic medical conditions. 5 HMO-POS plans may allow you to get some services out-of-network for a higher cost.

Do you need prior authorization for Medicare Advantage?

Check with the plan before you get a service to find out if the service is covered and what your costs might be. Many times, Medicare Advantage plans require prior authorization. Following plan guidelines, like getting a referral when needed, can keep your costs lower. Check with your plan.

Is Medicare Advantage free?

But, since Medicare isn’t free, it’s a good idea to have other options for coverage. One option is a Medicare Advantage plan. These plans will take the place of Medicare. When you go to the doctor, your Medicare Advantage Plan ID card is your main card for Medicare. These plans have Part D, which can make keeping track of your healthcare easier.

Does Medicare Advantage have a special enrollment period?

Also, two Medicare Advantage contracts in Florida and Tennessee have a 5-star rating on CMS. 5-star plans have a Special Enrollment Period option; so, if you don’t have a 5-star plan, you can enroll in the high-quality plan anytime during the year.

Is Aetna a PPO?

Aetna is one of the largest health insurance carriers in the world . They have earned the title of an AM Best A Rated Company. These plans have options- HMO or PPO, zero or low premiums, and added benefits. You can choose the plan that is right for you and your needs.

Does HMO cover PPO?

HMO plans only cover you when you go to doctors, providers, or hospitals in your plan’s network except in urgent or emergencies. Referrals from primary care doctors to see other doctors or specialists may be required. PPO plans will generally cover you outside the network with a higher out of pocket cost to you.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare. You can also find her over on our Medicare Channel on YouTube as well as contributing to our Medicare Community on Facebook.