A Medicare Complementary Plan is coverage which supplements Medicare approved benefits and also provides limited Major Medical benefits. Part A of Medicare helps pay for inpatient hospital or skilled nursing facility care and related inpatient expenses, home health care and hospice care

Hospice

Hospice care is a type of care and philosophy of care that focuses on the palliation of a chronically ill, terminally ill or seriously ill patient's pain and symptoms, and attending to their emotional and spiritual needs. In Western society, the concept of hospice has been evolving in Europe since the 11…

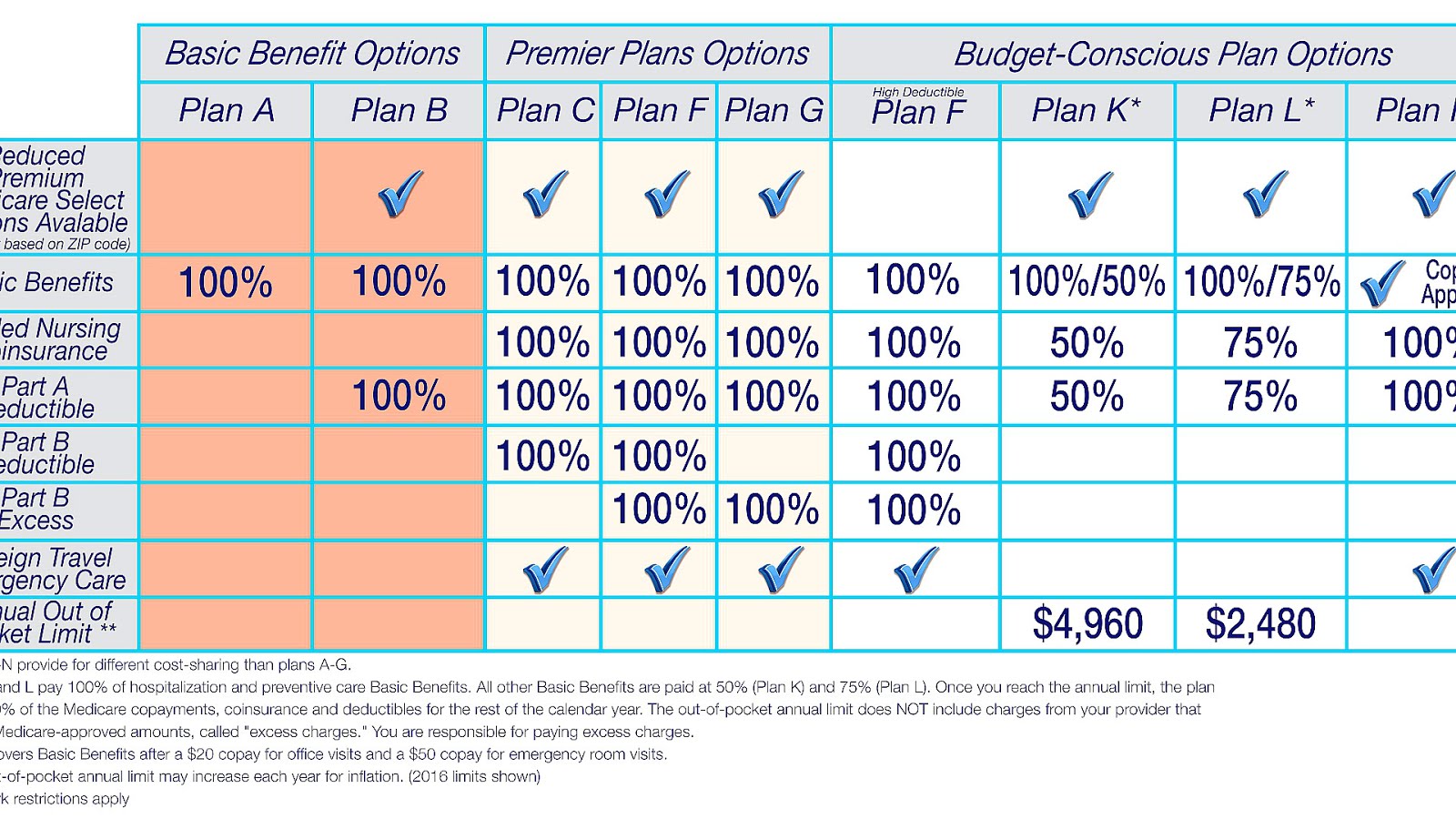

What are the benefits of Medicare plans?

Who Plan A is Ideal For

- Those looking for a lower monthly premium

- People who aren’t concerned about out of pocket hospital costs

- Those who do not travel outside the United States

How do you compare Medicare Advantage plans?

What you should know

- Medicare plans can offer different benefits and cost structures.

- You can compare Medicare drug or Medicare Advantage plans using Medicare.gov’s Plan Finder tool.

- When comparing Medicare plans, consider elements such as cost, provider choice and benefits.

- Costs vary greatly among Medicare plans, both in how much you pay and when you pay.

What is Medicare Advantage PPO?

What You Should Know

- A Medicare Preferred Provider Organization, or PPO, plan is a form of Medicare Advantage Plan (Part C) that relies on a specified provider network.

- Of the Medicare Part C options, Medicare PPO plans are the most flexible.

- Cost is the primary disadvantage of Medicare PPO plans. ...

What is Medicare plan part N?

Medicare Plan N is a supplemental policy that typically has lower premiums while you pay your Part B deductible, excess charges and some copays for doctor and emergency visits. It has been popular since it was first introduced in 2010. Also called Medigap Plan N, this option was created for consumers who like the idea of paying a lower premium ...

What are the 2 types of Medicare plans?

There are 2 main ways to get Medicare: Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). If you want drug coverage, you can join a separate Medicare drug plan (Part D).

What are 4 types of Medicare plans?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is the difference between Medicare and a supplemental plan?

When you buy a Medicare Supplement insurance plan, you are still enrolled in Original Medicare, Part A and Part B. Medicare pays for your health-care bills primarily, while the Medigap plan simply covers certain cost-sharing expenses required by Medicare, such as copayments or deductibles.

What's the difference between Medigap and Medicare Advantage?

Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the advantages and disadvantages of Medicare Supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Can I switch from Medicare Advantage to Medicare Supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

What is the downside to Medigap plans?

Because Medigap plans are sold by private insurance companies, they can charge different monthly premiums. While plans are standardized in regard to coverage and benefits, they are not standardized in regards to cost. Cost can even increase over time based on inflation, your age and other factors.

Who pays for Medigap?

You pay the private insurance company a monthly premium for your Medigap plan in addition to the monthly Part B premium you pay to Medicare. A Medigap plan only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Is a Medigap plan better than an Advantage plan?

A Medicare Advantage plan may be a better choice if it has an out-of-pocket maximum that protects you from huge bills. Regular Medicare plus a Medigap insurance plan generally allows you more choice in where you receive your care.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

What is hospice care?

Hospice care provides medical and social support services to terminally ill individuals, both in the home or in an approved facility. Hospice care includes some services not usually covered by Medicare, such as custodial services, homemaker services, and counseling. Medicare Part A pays for tw o ninety (90) day periods, follow ed by a thirty (30) day period and, w hen necessary, an extension period. Except for small copayments for outpatient drugs and inpatient respite care (five

Does Medicare cover skilled nursing?

Medicare covers medically necessary skilled nursing and other therapeutic services provided by an approved home health care agency in your home. In order to qualify for benefits, you must be confined to your home and under the care of a physician w ho provides a home health care plan for you. The care must include intermittent skilled nursing care (up to tw enty-one (21) consecutive days at eight (8) hours per day), physical, or speech therapy, and occupational therapy after it is determined you no longer need the required care. In addition to these services, home health aides, medical social services, and medical supplies may be covered. Medicare w ill pay 80% of expenses for durable medical equipment and your Medicare Complementary Plan w ill pay the 20% balance, providing 100% coverage for home health care services.

How Medicare works with other insurance

Learn how benefits are coordinated when you have Medicare and other health insurance.

Retiree insurance

Read 5 things you need to know about how retiree insurance works with Medicare. If you're retired, have Medicare and have group health plan coverage from a former employer, generally Medicare pays first. Your retiree coverage pays second.

What's Medicare Supplement Insurance (Medigap)?

Read about Medigap (Medicare Supplement Insurance), which helps pay some of the health care costs that Original Medicare doesn't cover.

When can I buy Medigap?

Get the facts about the specific times when you can sign up for a Medigap policy.

How to compare Medigap policies

Read about different types of Medigap policies, what they cover, and which insurance companies sell Medigap policies in your area.

Medigap & travel

Read about which Medigap policies offer coverage when you travel outside the United States (U.S.).

Examples of Complementary Plan in a sentence

Only those who selected the Medicare Complementary Plan at that time are eligible for the plan at retirement.

Related to Complementary Plan

Primary Plan means a plan whose benefits for a person’s healthcare coverage must be determined without taking the existence of any other plan into consideration.