What Is MedicareComplete?

- Medicare Advantage Plans. Medicare Advantage Plans are substitutes for Original Medicare coverage and were authorized by Congress to shift some of Medicare's cost burden to private insurance companies.

- MedicareComplete. UnitedHealthcare markets three types of MedicareComplete plans. ...

- Benefits. ...

- Features. ...

- Enrollment and Cost. ...

Full Answer

Which Medicare plan should I Choose?

Your 2020 Buyer's Guide for Choosing the Best Medicare Advantage Plan

- Key Takeaways. Medicare annual open enrollment is October 15 to December 7, 2020. ...

- UnitedHealthcare. You want lots of plans to choose from (both HMOs and PPOs ). ...

- Humana. You want extra benefits. ...

- Blue Cross Blue Shield. You want excellent coverage at competitive rates. ...

- CVS Health–Aetna. Other plans aren’t available in your area. ...

- Kaiser Permanente. ...

- Final Word. ...

What are the best Medicare plans?

... Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers. Sign up today for a FREE virtual event and let Silver Supplements Solutions help you understand your best option for your own peace of mind!

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

Which Medicare supplement plan should I Choose?

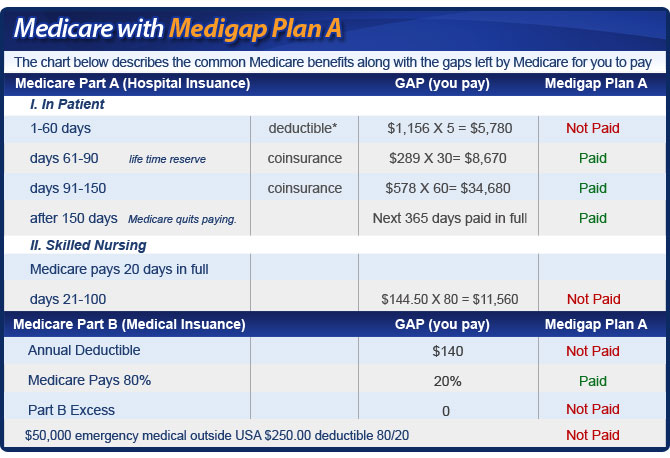

Some people also refer to these plans as Medigap. As with traditional Medicare, the CMS divides Medicare supplement plans by letter. People new to Medicare in 2021 can choose from plans A, B, D, G, K, L, M, and N. Not all insurers offer the same plans in all areas of the country, however.

What is the difference between Medicare Advantage and Medicare Complete?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

What are 4 types of Medicare plans?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is the most complete Medicare plan?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

What are 3 plans for Medicare?

Medicare health plans include:Medicare Advantage Plans.Other Medicare health plans. Medicare Cost Plans. Demonstrations/Pilot Programs. Programs of All-inclusive Care for the Elderly (PACE)

What are the two types of Medicare plans?

There are 2 main ways to get Medicare: Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). If you want drug coverage, you can join a separate Medicare drug plan (Part D).

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

Is plan F better than plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

What is the most widely accepted Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Does Medicare come out of your Social Security check?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

What will Medicare not pay for?

In general, Original Medicare does not cover: Long-term care (such as extended nursing home stays or custodial care) Hearing aids. Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

Sign up When you are 64

Eligibility for Medicare coverage begins when you turn 65, but there’s no reason to wait until then to sign up. The initial enrollment period begins 3 months before your 65th birthday. The 7-month window lasts until 3 months after, but if you miss your initial enrollment period you may face financial penalties and decreased coverage.

Who is Eligible for Medicare?

If you’re 65, or just about to turn 65, and you’re an American citizen or permanent resident, you’re eligible for Medicare. You qualify for Parts A and B. Part A is free if you’ve been working and paying your taxes or you and your spouse combined have been working and paying your taxes for 10 years or more.

How Many Parts Does Medicare Have?

Medicare plans cover everything from hospitalization to medical services, prescription drug medication to hospice and home care. Medicare has 4 basic parts: A, B, C and D. A supplemental insurance plan, Medicare Part G, also is available.

Is Medicare a Generous Insurance Program?

Few people would describe Medicare as generous. The program provides fewer benefits than most private insurance and covers only half the healthcare costs. Still, it gives people health insurance who otherwise might not qualify. Spending per beneficiary grows at a slower rate than with private insurance.

What is Medigap?

Medigap, or Medicare Part G, is a supplemental plan that fills in the gaps where regular Medicare parts A and B leave off. Medicare isn’t free. You need supplemental health coverage like Medigap to pay for many of the services regular Medicare does not. You must first qualify for Medicare parts A and B to be eligible for Part G.

When Should I Sign Up for Medicare?

Medicare is insurance for seniors 65 and older, people who otherwise wouldn’t qualify or can’t afford private health insurance. It’s sponsored by the federal government and partially paid for by the payroll taxes that come out of your paycheck. People who qualify for Medicare include:

What are the different types of Medicare?

UnitedHealthcare offers four types of MedicareComplete plans. One type is HMO plans, which are health maintenance organizations that require participants to pursue care within a network of providers. Another type is point-of-service plans, which maintains a network of providers but allows participants to seek coverage for certain services outside of the network for a higher price. The third type is the preferred provider organization, which allows participants to seek a provider for any covered service outside of the network; this comes with higher costs for participants. The fourth type is private fee-for-service, which provides the most flexibility in choosing your desired doctor who takes Medicare and accepts the plan's payment terms.

What is Medicare Advantage?

Medicare Advantage plans are offered through private companies, which develop agreements with Medicare to provide some Medicare benefits to those who sign up with them. The AARP MedicareComplete plans are available through the insurance provider UnitedHealthcare. Some medical care services continue to be covered through Medicare instead ...

Do you have to pay deductible for a health insurance plan?

Plan participants pay no deductible for eligible health care costs, and an annual maximum is set for out-of-pocket costs, limiting the medical expenses participants pay in a year. They receive routine eye exams, access to a nurse by phone around the clock and coverage for emergency care anywhere in the world.

Does AARP MedicareComplete have a deductible?

Plan participants pay no deductible for eligible health care costs, and an annual maximum is set for out-of-pocket costs, ...

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

What is Medicare replacement plan?

What is a Medicare Replacement Plan. If you’ve heard of a Medicare replacement plan, it’s the same as an Advantage plan. Advantage plans are also known as replacement plans because, in a way, they replace Original Medicare. If you’re thinking about signing up for an Advantage plan, we’re here to tell you everything you need to know.

Why are Advantage Plans also known as Replacement Plans?

Advantage plans are also known as replacement plans because, in a way, they replace Original Medicare. If you’re thinking about signing up for an Advantage plan, we’re here to tell you everything you need to know.

How does an Advantage plan work?

The way these plans work is by providing benefits through a private insurance company rather than through Medicare. When enrolled in an Advantage plan, you must use the plan’s network of providers to be covered. When signing up for an Advantage plan, you must have enrolled in both Parts A and B.

What to do if you enroll in Advantage Plan?

If you enroll in an Advantage plan, check your Summary of Benefits. This document will let you know what’s not covered, as well as list copay amounts for which you’ll be responsible. Additionally, your benefits are subject to change each year.

Can you return to Medicare Advantage during Open Enrollment Period?

Replacement plans, Advantage, or Part C, plans stand-in for your Medicare for each year you’ve enrolled. They don’t act as a permanent replacement, and you can always return to Medicare during the Medicare Advantage Open Enrollment Period or Annual Enrollment Period. The way these plans work is by providing benefits through a private insurance ...

Can an Advantage Plan replace Medicare?

Again, an Advantage plan doesn’t permanently replace Medicare. However, it acts as your primary coverage. Medicare pays private insurance companies offering Advantage plans to handle beneficiary claims and benefits. The Advantage plan must offer the same benefits as Parts A and B.

Do you need to visit many doctors for Medigap?

On the other hand, others who don’t need to visit many doctors enjoy having one plan for all their needs and spending less than they would for a Medigap plan. If you’re considering enrolling in an Advantage plan, be sure to go with a top-rated carrier.