Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

How does the Medicare crossover claim system work?

Jan 18, 2021 · A crossover claim is a claim for a recipient who is eligible for both Medicare and Medicaid, where Medicare pays a portion of the claim, and Medicaid is billed for any remaining deductible and/or coinsurance. A Coordination of Benefits Contractor (COBC) is used to electronically, automatically cross over claims billed to Medicaid for eligible recipients.

How to set up Medicare crossover?

Part 1 – Medicare/Medi-Cal Crossover Claims Overview Page updated: August 2020 Automatic Crossover Claims Medicare uses a consolidated Coordination of Benefits Contractor (COBC) to automatically cross over to Medi-Cal claims billed to any Medicare contractor for Medicare/Medi-Cal eligible recipients.

How do I make a Medicare claim?

Apr 08, 2016 · CROSSOVER CLAIMS The crossover process allows providers to submit a single claim for individuals dually eligible for Medicare and Medicaid, or qualified Medicare beneficiaries eligible for Medicaid payment of coinsurance and deductible to a Medicare fiscal intermediary, and also have it processed for Medicaid reimbursement.

What is a crossover professional claim?

Feb 06, 2020 · A crossover claim is a claim for a recipient who is eligible for both Medicare and Medi-Cal, where Medicare pays a portion of the claim and Medi-Cal is billed for any remaining deductible and/or coinsurance.

When would you do a crossover claim?

In health insurance, a "crossover claim" occurs when a person eligible for Medicare and Medicaid receives health care services covered by both programs. The crossover claims process is designed to ensure the bill gets paid properly, and doesn't get paid twice.

What is the Medicare crossover code?

CODE INDICATING THAT THE ELIGIBLE IS COVERED BY MEDICARE (KNOWN AS DUAL OR MEDICARE ELIGIBILITY), ACCORDING TO MEDICAID (MSIS), MEDICARE (EDB) OR BOTH IN THE CALENDAR YEAR.

Does Medicare automatically forward claims to secondary insurance?

Medicare will send the secondary claims automatically if the secondary insurance information is on the claim. As of now, we have to submit to primary and once the payments are received than we submit the secondary.Aug 19, 2013

How do I find a Medicare crossover claim?

Your Medicare remittance will have an indicator that will show the claim was an automatic cross over to Medicaid. When the indicator appears on the Medicare remittance you will not bill Medicaid for those clients.Feb 1, 2010

What is a crossover only application?

Crossover Only providers are those providers who are enrolled in Medicare, not enrolled in Medi-Cal, and provide services to dual-eligible beneficiaries. Dual-eligible beneficiaries are those beneficiaries who are eligible for coverage by Medicare (either Medicare Part A, Part B or both) and Medi-Cal.

What is it commonly called when Medicare electronically forwards secondary claim information?

A. The Electronic Remittance Advice (ERA), or 835, is the electronic transaction which provides claims payment information in the HIPAA mandated ACSX12 005010X221A1 format.

How does Medicare process secondary claims?

The primary insurer must process the claim in accordance with the coverage provisions of its contract. If, after processing the claim, the primary insurer does not pay in full for the services, submit a claim via paper or electronically, to Medicare for consideration of secondary benefits.Feb 10, 2021

How do I submit a Medicare claim as a secondary?

Medicare Secondary Payer (MSP) claims can be submitted electronically to Novitas Solutions via your billing service/clearinghouse, directly through a Secure File Transfer Protocol (SFTP) connection, or via Novitasphere portal's batch claim submission.Sep 9, 2021

Does Medicare crossover to AARP?

Things to remember: When Medicare does not crossover your claims to the AARP Medicare Supplement Plans, you will need to make sure this CO253 adjustment is applied before you electronically submit to AARP as a secondary payer.Mar 2, 2022

What is the purpose of the AOB form?

An AOB is an agreement that, once signed, transfers the insurance claims rights or benefits of your insurance policy to a third party. An AOB gives the third party authority to file a claim, make repair decisions and collect insurance payments without your involvement.

What is sent as additional data to support a claim?

A claim attachment is additional data in printed or electronic format sent to support a claim. Examples include lab results, specialty consultation notes, and discharge notes.

What is the most common method of claim transmission?

Paper claims (manual) are the most common types of claims submission. The HIPAA regulations require electronic transmission claims. The electronic transmission claim number is 12 837.Nov 24, 2021

What is Medicare Part A?

Medicare divides its services into Part A and Part B. Part A covers institutional services and Part B covers non-institutional services. Recipients may be covered for Part A only, Part B only or both.

When will Medicare replace HIC?

Beginning April 1, 2018 , the Health Insurance Claim (HIC) number traditionally appearing on Medicare cards is being replaced by a non-Social Security Number based Medicare Beneficiary Identifier (MBI) number. Updated Medicare cards with MBIs will be phased into use through December 31, 2019. Therefore, the term HIC will be phased out of the Medi-Cal provider manuals, as appropriate. Removal of references to HIC does not preclude providers from processing transactions using HIC numbers. Providers can continue to process both HIC and MBI numbers, as appropriate, from April 1, 2018 through December 31, 2019. Providers should refer to the CMS website for detailed information.

What is Medi-Cal eligibility verification?

The Medi-Cal eligibility verification system indicates a recipient’s Medicare coverage when a provider submits a Medi-Cal eligibility inquiry. One of the following messages will be returned if a recipient is eligible for Medicare:

What is OHC in Village Health?

Medicare providers of services to dual-eligible VillageHealth Medicare Part C recipients should refer to the Other Health Coverage (OHC) section for instructions for requirements for billing coinsurance and/or deductible claims.

Is Medicare covered by Medicare?

Most medical supplies are not covered by Medicare and can be billed directly to Medi-Cal. However, the medical supplies listed in the Medical Supplies: Medicare-Covered Services section of the appropriate Part 2 manual are covered by Medicare and must be billed to Medicare prior to billing Medi-Cal.

Do you have to bill Medicare before you use Medi-Cal?

If a recipient has Medicare Part A coverage only, and a provider is billing for Part A covered services, the provider must bill Medicare prior to billing Medi- Cal. However, if billing for Part

Can you bill Medicare for coinsurance?

Providers who accept persons eligible for both Medicare and Medi-Cal as recipients cannot bill them for the Medicare deductible and coinsurance amounts. These amounts can be billed only to Medi-Cal. (Refer to Welfare and Institutions Code [W&I Code], Section 14019.4.) However, providers should bill recipients for any Medi-Cal Share of Cost (SOC). Note: Providers are strongly advised to wait until they receive the Medicare payment before collecting SOC to avoid collecting amounts greater than the Medicare deductible and/or coinsurance.

How to find if a Medicare claim is crossed over?

If a claim is crossed over, you will receive a message beneath the patient’s claim information on the Payment Register/Remittance Advice that indicates the claim was forwarded to the carrier.

How long does it take for Medicare to cross over to Blue Cross?

When a Medicare claim has crossed over, providers are to wait 30 calendar days from the Medicare remittance date before submitting a claim to Blue Cross and Blue Shield of Louisiana. Claims you submit to the Medicare intermediary will be crossed over to Blue Cross only after they have been processed by Medicare.

What is crossover process?

The crossover process allows providers to submit a single claim for individuals dually eligible for Medicare and Medicaid, or qualified Medicare beneficiaries eligible for Medicaid payment of coinsurance and deductible to a Medicare fiscal intermediary, and also have it processed for Medicaid reimbursement.

How long to wait to resubmit a Medicare claim in Louisiana?

What to do when the claim WAS NOT crossed over from Medicare For Louisiana claims that did not crossover automatically (except for Statutory Exclusions), the provider should wait 31 days from the date shown on the Medicare remittance to resubmit the claim.

What is a CIF for a crossover claim?

A CIF is used to initiate an adjustment or correction on a claim. The four ways to use a. CIF for a crossover claim are: • Reconsideration of a denied claim. • Trace a claim (direct billed claims only) • Adjustment for an overpayment or underpayment. • Adjustment related to a Medicare adjustment.

Is Michigan a secondary carrier for Medicare?

For example, if the member has a Medicare Supplement with Blue Cross and Blue Shield (BCBS) of Michigan, then BC BS of Michigan should be indicated as the secondary carrier, not Blue Cross and Blue Shield of Florida ( BCBSF).

Does MDHHS accept Medicare Part A?

MDHHS accepts Medicare Part A institutional claims (inpatient and outpatient) and Medicare Part B professional claims processed through the CMS Coordinator of Benefits Contractor, Group Health, Inc. (GHI). Claim adjudication will be based on the provider NPI number reported on the claim submitted to Medicare.

What is a Medicare crossover claim?

Medicare crossover claims are claims that have been approved for payment by Medicare and sent to Medicaid for payment towards the Medicare deductible and coinsurance within Medicaid program limits.

How does Medicaid receive crossover claims?

How Medicaid Receives Crossover Claims. After providing a service to a dually-eligible recipient, the provider sends a claim to its Medicare carrier or intermediary. After Medicare processes the claim, it sends the provider an explanation of Medicare benefits. If Medicare has approved the claim, Medicaid can pay towards ...

Does Medicare pay for crossover?

Medicaid will not pay a crossover claim when it has been paid by Medicare in an amount that is the same or more than Medicaid’s rate for the specified service. Medicaid will not pay a crossover claim when it is for a service that is not covered by the Medicaid program.

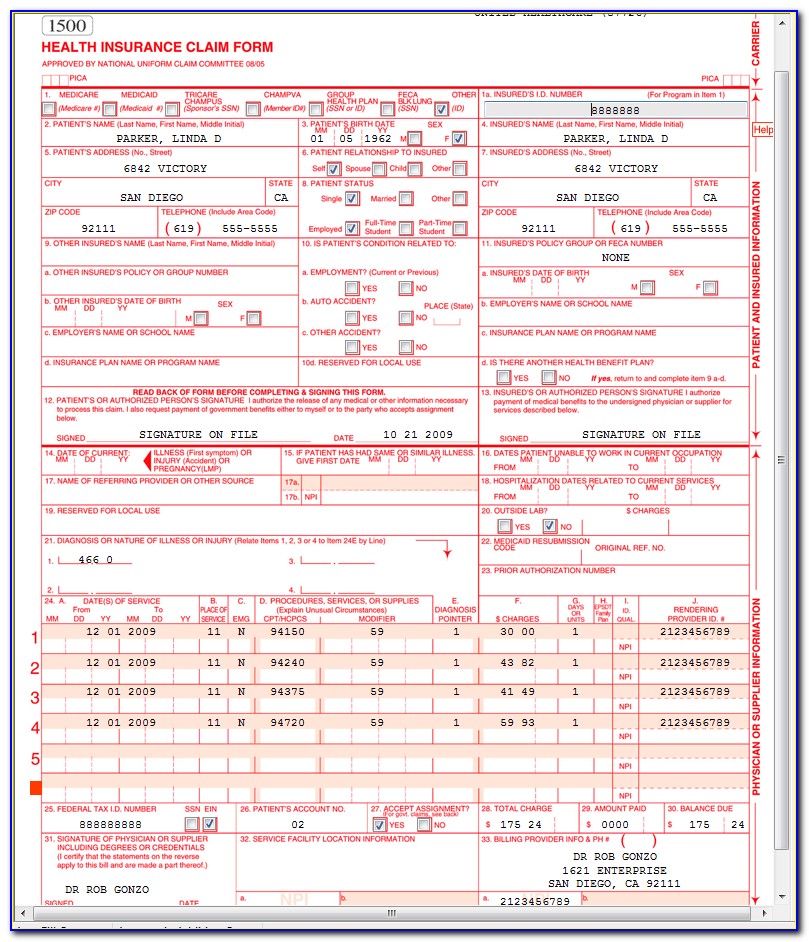

Can Medicare pay for coinsurance?

If Medicare has approved the claim , Medicaid can pay towards the deductible and coinsurance according to Medicaid policy. Medicare crossover claims are submitted to the Medicaid fiscal agent by one of the following methods:

What is a crossover claim?

In health insurance, a "crossover claim" occurs when a person eligible for Medicare and Medicaid receives health care services covered by both programs. The crossover claims process is designed to ensure the bill gets paid properly, and doesn't get paid twice. Advertisement.

Who sets rules for crossover claims?

Rules for crossover claims are set by the federal Centers for Medicare & Medicaid Services. Health-care providers submit all crossover claims to Medicare. Medicare assesses the claim, pays its portion of the bill, and then submits the remaining claim to Medicaid.

Is Medicare a federal program?

Medicare is a federal program that provides health care coverage to people age 65 and older, as well as disabled adults. Medicaid is a combined federal-state program that covers low-income people regardless of age. Because of overlaps in eligibility, some people may be covered by both programs.