How is DSH calculated?

- Medicaid Managed Care

- Improvement Initiatives

- Performance Measurement

- Releases & Announcements

How does Medicaid reimburse hospitals?

Hospitals are reimbursed for the care they provide Medicare patients by the Centers for Medicare and Medicaid Services (CMS) using a system of payment known as the inpatient prospective payment system (IPPS). Under this system, hospitals are paid predetermined, fixed amounts by CMS based on a patient’s diagnosis and treatment.

Does Medicare under-pay hospitals?

Now, while Medicare holders are responsible for paying their premium payments and deductibles, Medicare must pay the hospitals and other healthcare facilities to reimburse them for the medical care they provide. You may think that the hospital simply sends Medicare a bill; however, the reimbursement process is actually much more intricate.

Does Medicare Part a pay 100 of hospitalization?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

What is DSH Medicare?

Medicare Disproportionate Share Payments (better known as DSH) are a critical component of overall Medicare inpatient payments and help offset the costs of care hospitals incur treating indigent patients.

How do you calculate DSH?

Medicare DSH Payment: Counting Hospital Beds & Patient Days Determine the number of beds in a hospital, according to 42 CFR Section 412.105(b), by dividing the number of available bed days during the cost reporting period by the number of days in the cost reporting period.

What is a DSH patient?

The Disproportionate Share Hospital (DSH) Program is a Medi-Cal supplemental payment program. It was established to reimburse hospitals for some of the uncompensated care costs associated with furnishing inpatient hospital services to Medi-Cal beneficiaries and uninsured individuals.

What does DSH stand for in government?

Federal law requires that state Medicaid programs make Disproportionate Share Hospital (DSH) payments to qualifying hospitals that serve a large number of Medicaid and uninsured individuals.

What is an outlier payment?

Medicare makes supplemental payments to hospitals, known as outlier payments, which are designed to protect hospitals from significant financial losses resulting from patient-care cases that are extraordinarily costly.

What makes a hospital critical access?

Have 25 or fewer acute care inpatient beds. Be located more than 35 miles from another hospital (exceptions may apply – see What are the location requirements for CAH status?) Maintain an annual average length of stay of 96 hours or less for acute care patients. Provide 24/7 emergency care services.

Is DSH the same as 340B?

Disproportionate share hospitals (DSH) are eligible to participate in 340B if their DSH adjustment–a measure that identifies hospitals that treat a disproportionate share of low income Medicare or Medicaid patients–is above 11.75%.

What is CSU in hospital?

Crisis Stabilization Units (CSU) offer 24/7/365 intensive, short-term stabilization for someone experiencing a mental health emergency and is willing to receive services.

What is OBRA limit?

Revenues. * Note: According to the Balanced Budget Act of 1997 and Balanced Budget Refinement Act of 1999, the OBRA. (Omnibus Budget Reconciliation Act) limit amounts that are determined by this formula will be applied: • at 175 % to public hospitals. • at 100 % to nonpublic hospitals.

What is DSH in California?

The Department of State Hospitals (DSH) manages the California state hospital system, which provides mental health services to patients admitted into DSH facilities.

What does DSH stand for cat?

domestic shorthairdomestic shorthair, also called British Shorthair, breed of domestic cat often referred to as a common, or alley, cat; a good show animal, however, is purebred and pedigreed and has been carefully bred to conform to a set standard of appearance.

What is a DSH payment?

Federal law requires that state Medicaid programs make Disproportionate Share Hospital (DSH) payments to qualifying hospitals that serve a large number of Medicaid and uninsured individuals. Federal law establishes an annual DSH allotment for each state that limits Federal Financial Participation ...

When was the DSH rule issued?

Reg. 16114 and codified at 42 C.F.R. § 447.299 (c) (10)) clarifies federal requirements regarding the treatment of third party payers in determining the hospital-specific Medicaid DSH payment limit, which is set by statute as a hospital’s “uncompensated costs” incurred in providing hospital services to Medicaid and uninsured patients .

What is required to receive FFP for DSH?

For states to receive FFP for DSH payments, federal law requires states to submit an independent certified audit and an annual report to the Secretary describing DSH payments made to each DSH hospital. The report must identify each disproportionate share hospital that got a DSH payment adjustment, and provide any other information ...

When was the DSH audit rule published?

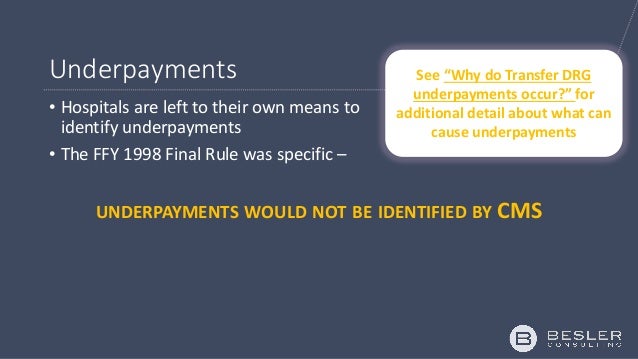

Final Rule on DSH Audit and Reporting Requirements. On December 19, 2008, the Centers for Medicare & Medicaid Services (CMS) published a final rule to implement federal law, specifying the elements for the required DSH report and the verifications required for the audit. CMS also developed additional guidance, including the.

Does uncompensated cost include Medicare?

The final rule makes clearer our existing policy that uncompensated costs include only those costs for Medicaid eligible individuals that remain after accounting for all payments received by or on behalf of Medicaid eligible individuals, including Medicare and other third party payments.

Is FFP available for DSH?

Federal law also limits FFP for DSH payments through the hospital-specific DSH limit. Under the hospital-specific D SH limit, FFP is not available for state DSH payments that are more than the hospital's eligible uncompensated care cost, which is the cost of providing inpatient hospital and outpatient hospital services to Medicaid patients and ...

What are DSH qualification methods?

According to the section of the Act mentioned above and the CMS website, “there are two methods for a hospital to qualify for the Medicare DSH adjustment.

How do you report Medicare DSH?

The Medicare DSH amount is typically reported annually on Worksheet E Part A of the Medicare cost report. Final eligibility is determined and could potentially be adjusted at cost report settlement by a provider’s Medicare administrative contractor, which is known as MAC.

What is DSH payment?

What are Medicaid DSH Payments? DSH payments are a way of providing extra funds to hospitals that treat a large number of low-income patients. That includes both patients on Medicaid and uninsured patients. Hospitals tend to charge private insurance companies much more than uninsured or Medicaid patients.

What is the benefit of Medicaid DSH?

The big benefit of Medicaid DSH is that it allows your hospital to treat low-income patients without having to worry about the financial challenges. In fact, under some systems, your hospital will have a financial incentive to treat low-income patients.

What qualifies as a DSH?

A hospital qualifies as DSH if it meets at least one of two criteria. Once again, they’re a bit complicated so bear with us. A hospital is a DSH hospital if it. has a Medicaid inpatient utilization rate that’s one standard deviation or greater above the average for Medicaid hospitals in the state.

How do states distribute funds?

States can distribute funds based on a formula known as the DSH adjustment. This is a formula that takes into account how many low-income patients the hospital serves and provides money accordingly. This is the most straightforward of the three guidelines.

When was DSH created?

A Brief History of DSH Payments. When Medicaid was created in 1965, it was closely linked with Medicare. States had to follow very specific rules so that Medicaid payments were in agreement with Medicare payments. However, in 1981, Congress loosened up the rules and decoupled Medicaid from Medicare. This gave state’s much more freedom in the way ...

When was the disproportionate share hospital payment codified?

Congress finally clarified and codified Disproportionate Share Hospital payments in 1992 , and state allotments today are still based on those numbers.

Is DSH money mandatory?

They can give them to any hospital that qualifies according to the above calculation. But those payments aren’t mandatory. However, it is mandatory that states give money to certified DSH hospitals.

What is the primary method of Medicare DSH adjustment?

The primary method to qualify is based on Disproportionate Patient Percentage (DPP).

What is Medicare Disproportionate Share Hospital?

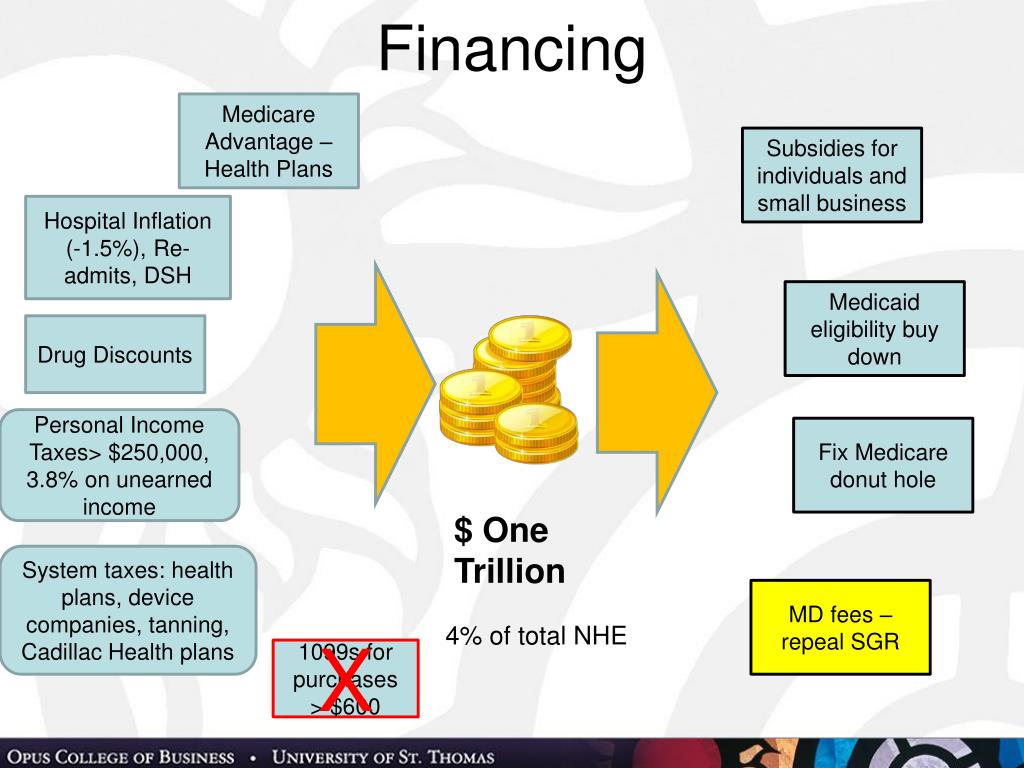

Medicare Disproportionate Share Hospital (DSH) payments are a critical and significant piece of total Medicare payments for qualifying hospitals. These payments are intended to offset costs incurred by hospitals treating a large or disproportionate number of indigent patients. Although the empirically justified DSH payment has been reduced substantially through the regulations implemented by the Affordable Care Act, it remains a very important component used to qualify hospitals for the uncompensated care payment as well as 340B. Furthermore, this continues to be a significant payment adjustment for qualifying hospitals, and utmost attention is needed to ensure hospitals are compliant and their reimbursement is maximized.

Is DSH a 340B?

Although the empirically justified DSH payment has been reduced substantially through the regulations implemented by the Affordable Care Act, it remains a very important component used to qualify hospitals for the uncompensated care payment as well as 340B.

Final Rule on DSH Audit and Reporting Requirements

Final Rule: State Disproportionate Share Hospital Allotment Reductions

- On September 23, 2019, CMS released a final rule(link is external)to implement statutorily required disproportionate share hospital (DSH) allotment reductions that are scheduled to begin in FY2020. The rule finalizes a methodology to calculate the annual reductions for FY2020 through FY2025. The methodology includes five factors outlined in 1923(f)...

State-Specific Annual DSH Reports and Independent Certified Audits

- State-specific annual DSH reports are posted as submitted by states based on their availability and are arranged alphabetically by state under the corresponding State Plan RateYear (SPRY) heading. Due to the size of the files and issues associated with electronic formatting, state-specific independent certified audits will be available only upon request. Interested parties shoul…