What does EOB mean in medical billing?

Each month you fill a prescription, your Medicare Prescription Drug Plan mails you an "Explanation of Benefits" (EOB). This notice gives you a …

What does EOB mean medical?

Explanation of Benefits (EOB) go to enrollees in Medicare Advantage and Medicare Prescription Drug Plan (Part D) EOBs show the claims and charges applied to your policy the previous month. EOBs offer detailed breakdowns of the costs, including the full price of services, amounts covered by your policy, and what you owe.

What is the best choice for Medicare?

An Explanation of Benefits (EOB) is the notice that your Medicare Advantage Plan or Part D prescription drug plan typically sends you after you receive medical services or items. You only receive an EOB if you have Medicare Advantage or Part D. An EOB is not the same as a Medicare Summary Notice. It is also important to remember that an EOB is not a bill.

Can I View my Medicare EOB online?

Explanation of Benefits (EOB) EOBs are for both Medicare Advantage and stand-alone drug plans. What is it? Each month when a beneficiary fills a prescription or gets health care, their Medicare Prescription Drug Plan (PDP) or Medicare Advantage (MA) plan mails them an Explanation of Benefits (EOB). This notice gives them a

How do I get a Medicare EOB?

- Check your Explanation of Benefits (EOB). Your Medicare drug plan will mail you an EOB each month you fill a prescription. ...

- Use Medicare's Blue Button by logging into your secure Medicare account to download and save your Part D claims information. ...

- For more up-to-date Part D claims information, contact your plan.

What is the purpose of an EOB?

What is a EOB form?

What is the difference between a claim and an EOB?

Who receives an EOB?

How often are EOBs sent?

What is required on an EOB?

What is another name for EOB?

What info is included in an EOB?

What is an Explanation of Benefits?

The first thing to know about an Explanation of Benefits is that it’s not a bill. Instead, it’s a summary of the claims and charges applied to your...

Who Receives an EOB?

Anyone enrolled in Medicare Advantage and Medicare Prescription Drug Plan (Part D) will receive an EOB when they use their policy. You don’t need t...

How Do I Read My EOB?

You can expect to see a few standard terms, no matter who sends your Explanation of Benefits. They are:

Can I Get Another Copy of my EOB?

If you misplaced your most recent EOB or didn’t receive it in the mail, contact your insurance company. A representative should be able to provide...

I’m on Original Medicare (Parts A and B) -- Do I get an EOB?

No, but you’ll receive a Medicare Summary Notice (MSN), the Medicare explanation of benefits. Like the EOB, the MSN is not a bill — it’s a monthly...

Does my EOB show specific prescription info?

If you have a Medicare Prescription Drug EOB, it can show which medicines you’re taking, how much they cost, and how much your insurance covers. [i]

Will I get an EOB each month if I don't see a doctor?

Your insurance company is only required to send you an EOB when you make a claim. This happens any time you see a healthcare provider through your...

What is EOB in Medicare?

An Explanation of Benefits (EOB) is the notice that your Medicare Advantage Plan or Part D prescription drug plan typically sends you after you receive medical services or items. You only receive an EOB if you have Medicare Advantage or Part D. An EOB is not the same as a Medicare Summary Notice.

Is an EOB a bill?

It is also important to remember that an EOB is not a bill. EOBs are usually mailed once per month. Some plans give you the option of accessing your EOB online. Your EOB is a summary of the services and items you have received and how much you may owe for them.

What is EOB in billing?

Around the time you receive your patient billing statement, you will also receive an explanation of benefits (EOB) from your insurance provider. An explanation of benefits is a document that explains how your insurance processed the claim for the services you received.

What is an EOB?

Below are some of the most common that you will see on an EOB: The service you had is not covered by the health insurance plan benefits (also called a non-covered benefit). Your insurance coverage was ended (terminated) before you received this service. You received the service before you were eligible for insurance coverage ...

How to contact University of Utah Health?

If you would like to schedule an online, face-to-face visit, please make an appointment or call us at 801-587-6303.

What is an explanation of benefits?

An explanation of benefits is a document that explains how your insurance processed the claim for the services you received. It breaks down the information like this: What your insurance covered and did not cover. The amount you must pay (amount you are responsible for) While this document is not a bill, it is an important tool ...

What is an adjusted amount?

The amounts: charged by the facility or provider; the amount your insurance has agreed to pay per their contract with the provider/facility; and. the difference or discount between what the facility or provider charged and what your insurance paid. (This may also be referred to as an “Adjustment”, “Contracted Agreement”, or “Allowed Amount.”)

What is deductible insurance?

Deductible: A deductible is the amount you pay for health care services before your insurance starts to pay anything. Copay: A copay is a fixed amount you pay for a health care service covered by your insurance. It is typically due before we provide service. Copays are different for different services in the same plan.

What is a copay?

Copay: A copay is a fixed amount you pay for a health care service covered by your insurance. It is typically due before we provide service. Copays are different for different services in the same plan. You may pay a different copay for your primary care than for a specialty service.

Who is Shereen Lehman?

Shereen Lehman, MS, is a healthcare journalist and fact checker. She has co-authored two books for the popular Dummies Series (as Shereen Jegtvig). An explanation of benefits (EOB) is a form or document provided to you by your insurance company after you had a healthcare service for which a claim was submitted to your insurance plan. ...

What is EOB in healthcare?

Updated on July 19, 2020. An explanation of benefits (EOB) is a form or document provided to you by your insurance company after you had a healthcare service for which a claim was submitted to your insurance plan. Your EOB gives you information about how an insurance claim from a health provider (such as a doctor or hospital) ...

What is EOB in insurance?

An explanation of benefits (EOB) is a form or document provided to you by your insurance company after you had a healthcare service for which a claim was submitted to your insurance plan. Your EOB gives you information about how an insurance claim from a health provider (such as a doctor or hospital) was paid on your behalf—if applicable—and how ...

What is a claim number?

Claim Number: The number that identifies, or refers to the claim that either you or your health provider submitted to the insurance company. Along with your insurance ID number, you will need this claim number if you have any questions about your health plan. Provider: The name of the provider who performed the services for you or your dependent. ...

What is a provider?

Provider: The name of the provider who performed the services for you or your dependent. This may be the name of a doctor, a laboratory, a hospital, or other healthcare providers. Type of Service: A code and a brief description of the health-related service you received from the provider.

What is billed charge?

Charge (Also Known as Billed Charges): The amount your provider billed your insurance company for the service. Not Covered Amount: The amount of money that your insurance company did not pay your provider. Next to this amount you may see a code that gives the reason the doctor was not paid a certain amount.

How old is Frank F.?

Frank F. is a 67-year-old man with type 2 diabetes and high blood pressure. He is enrolled in a Medicare Advantage Plan and sees his doctor every three months for a follow-up of his diabetes. Six weeks after his last visit, Frank received an EOB with the following information: 1 . Patient: Frank F.

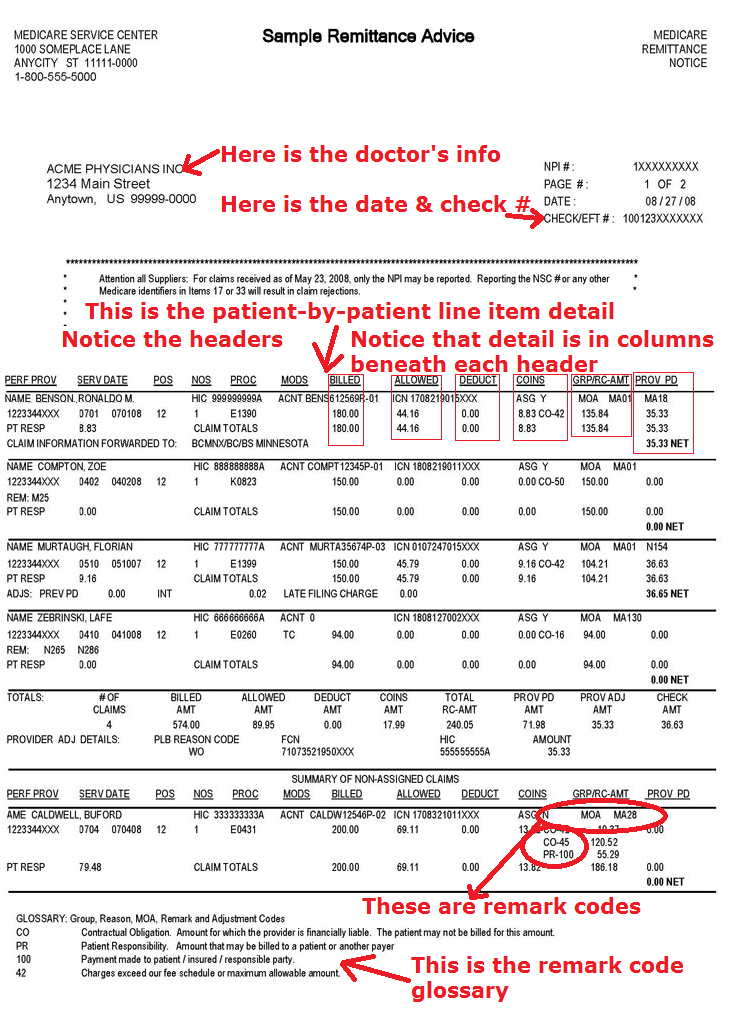

MSP Calculation Examples on EOBs

View examples of different primary Explanation of Benefits (EOBs) and how to calculate the specific fields that determine the allowed amount, patient responsibility, and Obligated to Accept Payment in Full (OTAF) amount for Medicare Secondary Payer (MSP) claims.

Example One

Field 1 BILLED AMT ($103.67) - Field 2 TOTAL CARC-AMT ($72.01) = Field 3 ALLOWED AMT ($31.66)

Example Three

Field 1 Amount Billed ($86367.36) - Field 2 Premera Network Discount ($64508.76) = Primary Allowed Amount ($21858.60)