What does an Explanation of Benefits Include?

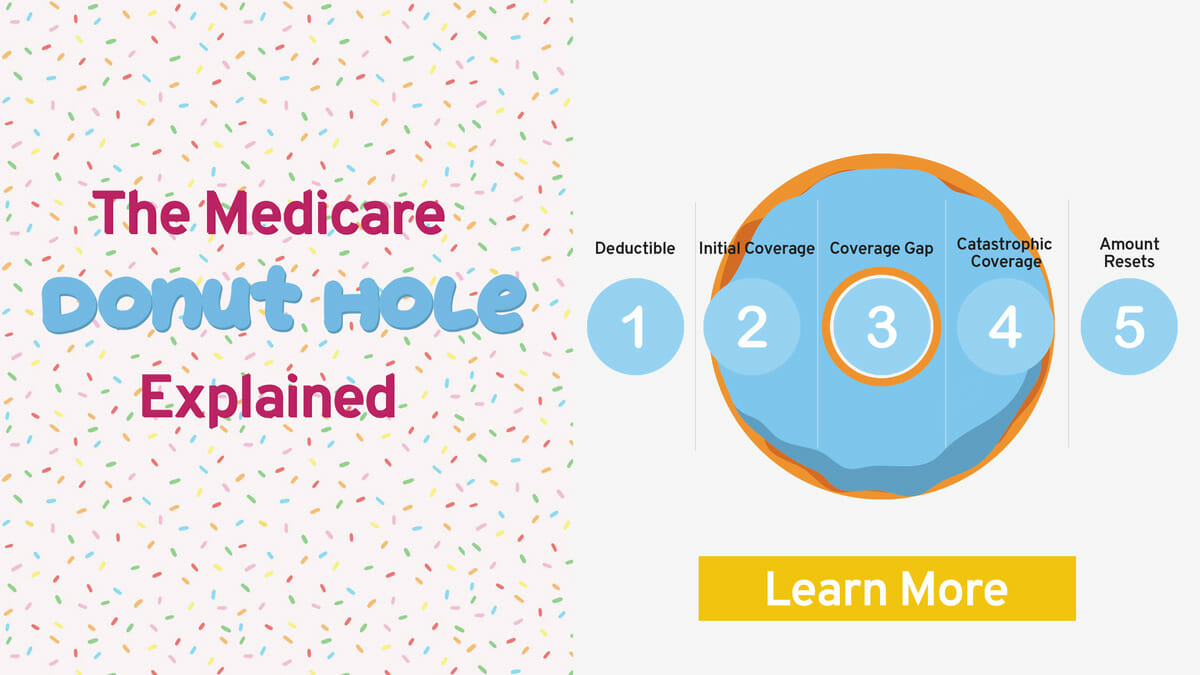

- Multiple charts. If Section 1 of your Explanation of Benefits statement features more than one chart, this means that some of your prescription drugs are provided under your Medicare Part ...

- If No Deductible Stage. ...

- A Detailed Description of Formulary Changes. ...

What are the advantages and disadvantages of Medicare?

What Are the Pros of a Medicare Advantage Plan?

- Additional Benefits. As mentioned above, Medicare Advantage plans can provide additional benefits that are not found in Original Medicare.

- Out-Of-Pocket Protection. ...

- Coordinated Care. ...

- Plan Selection. ...

- Customized Coverage. ...

What is Medicare statement of benefits?

- The Original Medicare Plan- Available almost everywhere in the U.S. This is the way most people get their Medicare Pat A and Part B benefits. ...

- Medicare Managed Care Plans- Like HMO’s, available in some areas of the country. You can go to doctors, specialists, or hospitals that are part of the plan. ...

- Private Fee-for-Service Plans- This is a new Medicare health care choice in some areas. You may go to any doctor, specialist, or hospital. ...

What benefits are covered by Medicare?

Medicare Part B provides coverage and benefits related to general medical care from doctors such as checkups, exams, and necessary durable medical equipment. In addition to the full coverage Medicare Part A and B provide, individuals can enroll in Medicare Part D and take advantage of the programs prescription drug benefits.

How to Check my Medicare benefits?

The easiest way to calculate your benefit is by taking your monthly payment and multiplying it by 5.9 percent. On a caluclator this would be the function (x * 1.059), if "x" equals your current benefits. That will give you the increase you will see reflected in your check.

What does medical explanation of benefits mean?

An EOB is a statement from your health insurance plan describing what costs it will cover for medical care or products you've received. The EOB is generated when your provider submits a claim for the services you received.

Who receives the explanation of benefits?

Your insurer determines how much of the bill they are prepared to pay. Regardless of whether or not you owe anything, you will still receive an explanation of benefits statement. 4. The health insurance provider will pay their portion of the bill directly to the healthcare provider.

How do I read my Medicare EOB?

How to Read Medicare EOBsHow much the provider charged. This is usually listed under a column titled "billed" or "charges."How much Medicare allowed. Medicare has a specific allowance amount for every service. ... How much Medicare paid. ... How much was put toward patient responsibility.

What is required on an explanation of benefits?

An explanation of benefits (EOB) may include, among other things, information about: The type of service provided and the date of service. The amount a plan provider billed for the service. Any discount the participant or beneficiary received for using an in-network provider.

Should I keep Explanation of Benefits?

When you or someone you are caring for is seriously ill, it is recommended that you keep EOBs for five years after the illness or condition is alleviated. If you or the patient is claiming or has claimed a medical deduction, keep the explanation of benefits for seven years.

How long does it take to get an explanation of benefits?

Almost 80 percent of claims are received within 30 days from the date of service. In some cases, it can take up to 60 days before your doctor or hospital submits a claim. How quickly we process the claim once it's received. More than 90 percent of claims are processed within 7 days of receiving them.

How do you read an EOB for dummies?

1:342:35How to Read Your Medical EOB - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe amount you pay for the service this is the amount that you will be billed. Remember the EOB isMoreThe amount you pay for the service this is the amount that you will be billed. Remember the EOB is not a bill it just shows you how the costs are distributed. If you have any questions by your EOB.

What is explanation of payment?

August 10, 2019. This Explanation of Payment (EOP) shows reimbursements and/or denials based on claims processed by your plan. You are responsible for paying the provider(s) listed if you haven't already done so.

How do I get a statement of benefit from Medicare?

You will need to link your Medicare through this service and follow the prompts to make an online claim. If the claim is approved, you will be notified with a statement of benefits via your myGov inbox within 7 to 10 days. If the claim is rejected, you will be notified by post.

Do prescriptions show up on EOB?

Your prescription drug Explanation of Benefits (EOB) statement shows a summary of your past medication orders. It is not a bill. Express Scripts records your prescription claim on an EOB statement each time you get a prescription filled at a retail network pharmacy or through home delivery.

What is allowed amount on EOB?

The maximum amount a plan will pay for a covered health care service. May also be called “eligible expense,” “payment allowance,” or “negotiated rate.” If your provider charges more than the plan's allowed amount, you may have to pay the difference. ( See. Balance Billing.

What's another term for Explanation of Benefits?

Explanation of benefits, also called an EOB.

What is EOB in Medicare?

An Explanation of Benefits (EOB) is the notice that your Medicare Advantage Plan or Part D prescription drug plan typically sends you after you receive medical services or items. You only receive an EOB if you have Medicare Advantage or Part D. An EOB is not the same as a Medicare Summary Notice.

Is EOB the same as Medicare?

An EOB is not the same as a Medicare Summary Notice. It is also important to remember that an EOB is not a bill. EOBs are usually mailed once per month. Some plans give you the option of accessing your EOB online. Your EOB is a summary of the services and items you have received and how much you may owe for them.

What is a Medicare Explanation of Benefits?

First, it is important to understand what a Medicare Explanation of Benefits is. Essentially, it summarizes what items or services you received that were paid for by your Medicare plan. Even if your plan only paid for a part of these items or services, it will show up on your Explanation of Benefits, also known as an EoB.

Why is Medicare EOB Important?

One of the reasons that an Explanation of Benefits is important for your Medicare plan is because it shows you what you are paying for treatment. If you find that you are paying more than you expected, you can find other plans that offer better savings.

How To Access Explanation of Benefits

As shown above, you generally get an Explanation of Benefits sent to you each month. However, there are other ways you can access this information.

What is in a Medicare Explanation of Benefits?

There are many different parts of your EOB. Regardless of where you get your plan, they will all include the same information.

How to Monitor Your EoB

Because it is easy to make mistakes when dealing with Medicare and insurance coverage, you must regularly monitor your Explanation of Benefits to check for mistakes.

Get Medicare Help Today

Understanding your Medicare benefits or your Medicare Explanation of Benefits can be difficult if you are not familiar with the Medicare system. However, you can find help! Whether you need help comparing the cost of Medicare plans, help with enrollment, or changing plans, NW Florida Medicare can help!

What is the Medicare Part A?

There are 2 main ways to get Medicare: Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance).

What is the difference between Medicare and Social Security?

While Social Security offers retirement, disability, and survivors benefits, Medicare provides health insurance. Medicare is our country’s health insurance program for people age 65 or older and younger people receiving Social ...

Does Medicare cover long term care?

The program helps with the cost of health care, but it doesn’t cover all medical expenses or the cost of most long-term care.

What is EOB in Medicare?

Explanation of Benefits (EOB) go to enrollees in Medicare Advantage. Medicare Advantage ( Medicare Part C) is health insurance for Americans aged 65 and older that blends Medicare benefits with private health insurance. This typically includes a bundle of Original Medicare (Parts A and B) and Medicare Prescription Drug Plan (Part D).

What is coinsurance for medical bills?

Coinsurance is the percentage of your medical costs that you pay after you meet your deductible. Your insurance company pays the remaining amount. For example: If you have a $1,000 medical bill and your coinsurance is 20%, you'll pay $200. Your insurance company will cover the final $800.

What is an EOB bill?

For example: If your deductible is $1,000, your insurance company will not cover any costs until you pay the first $1,000 yourself. An EOB is NOT a bill.

What does EOB mean in July?

The EOB you receive in July will reflect the claims and charges from those visits. Your EOB will show what your insurance company has agreed to pay for the services you received. With your EOB, you can check that you’re being charged correctly by your doctors and specialists when you get your bills.

What is copayment in insurance?

Copayment: the fixed amount you pay directly to your provider for medical services or prescription drugs covered in your plan. Coinsurance: the percentage of your medical costs that you pay after you meet your deductible; your insurance company pays the remaining amount. Deductible: the amount you pay out of pocket before your insurance company ...

Do you get an explanation of Medicare benefits each month?

If you have a Medicare Advantage or Medicare Prescription Drug Plan (Part D), you probably receive an explanation of benefits each month. Unfortunately, many people don’t understand how to use this info. With the right knowledge, however, your Explanation of Benefits can be a handy tool.

Does Medicare Advantage have an EOB?

Each plan has its own EOB form; private insurance companies provide Medicare Advantage and Part D, and your EOB will come directly from them. If your MA plan and Part D plan are from different companies, you’ll receive an EOB for each.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

Introduction

If you are enrolled in Medicare, you should be receiving Medicare plan documents like the Medicare Explanation of Benefits (EOB) or Medicare Summary Notices (MSN) when you receive care or use your plan’s benefits.

What information is included in the Medicare EOB?

The Explanation of Benefits contains your plan’s description and claim-related details like:

What is the purpose of the Medicare EOB?

These Medicare plan documents help you save money and track fraud. Here’s how:

What should you expect to see in the MSN?

If you’re enrolled in Original Medicare, you will receive an MSN instead of an EOB. An MSN shows similar information to an EOB.

Conclusion

In summary, Medicare EOBs and MSNs are important notices to help you keep track of your healthcare expenses and what your insurance covers, amongst other things. They’re also important documents if you want to make a claim or contest a charge. Remember to keep these Medicare plan documents for at least one calendar year.

What is paid by insurance?

Paid by Insurance: Paid by insurance is the amount of the total charges that insurance is paying towards the claim. Patient responsibility: You may be responsible to pay an amount of the charges/service. This amount is based on your insurance benefits and what the facility and provider charge. The actual billing statement ...

What is deductible insurance?

Deductible: A deductible is the amount you pay for health care services before your insurance starts to pay anything. Copay: A copay is a fixed amount you pay for a health care service covered by your insurance. It is typically due before we provide service. Copays are different for different services in the same plan.

What is EOB in billing?

Around the time you receive your patient billing statement, you will also receive an explanation of benefits (EOB) from your insurance provider. An explanation of benefits is a document that explains how your insurance processed the claim for the services you received.

What is an adjusted amount?

The amounts: charged by the facility or provider; the amount your insurance has agreed to pay per their contract with the provider/facility; and. the difference or discount between what the facility or provider charged and what your insurance paid. (This may also be referred to as an “Adjustment”, “Contracted Agreement”, or “Allowed Amount.”)

Is a service covered by health insurance?

The service you had is not covered by the health insurance plan benefits (also called a non-covered benefit). Your insurance coverage was ended (terminated) before you received this service. You received the service before you were eligible for insurance coverage (not eligible for coverage). There may be instances when an insurance carrier denies ...

Do you pay a copay for emergency care?

You may pay a different copay for your primary care than for a specialty service. Emergency care copays are also higher than other copays amounts. Coinsurance: Based on your insurance benefit, coinsurance is the amount you may be required to pay towards the claim, apart from any copayments or deductible.

What Does An Explanation of Benefits include?

- An Explanation of Benefits includes a summary of the health care services and products received by the policyholder. It will list the dates of service, the provider’s name, and the amount charged for each service. In addition, Explanations of Benefits may also include information such as: 1. The insurance company’s payment to the provider 2. Explanations of how the policyholder’s insu…

How Do I Get An Explanation of Benefits?

- You should receive an Explanation of Benefits for every month. It’ll include every service or product billed to your insurance plan.

What Does Medicare Advantage and Medigap Explanation of Benefits include?

- A Medicare Advantage and Medicare Supplement’s Explanation of Benefits is similar to a standard Explanation of Benefits. Still, it includes additional information specifically for those with Medicare Advantage or Medicare Supplement plans. This document will include: 1. A list of the health care services and products that your policyholder receives 2. The dates of service 3. The …

FAQs

- What is an Explanation of Benefits?

The Explanation of Benefits outlines the health care services and products received by the policyholder and the insurance company’s payment to the provider. This also includes any other medical services. - How does an Explanation of Benefits work?

You can use an Explanation of Benefits to your advantage by reviewing it for accuracy keeping track of your deductible and out-of-pocket expenses such as your copayment and coinsurance.