What is medical GAP insurance and is it worth it?

Jan 17, 2022 · Most Medicare plans have a coverage gap, but sometimes in select areas, there are plans available that cover more than the standard amount. If you find a plan that includes gap coverage, it’s likely to have a higher monthly premium. What is Gap Coverage? Gap coverage is insurance that covers more than the standard amount of your medications.

Why is there a coverage gap in Medicare?

Briefly, Medicare gap insurance is health insurance that fills in the ‘gaps’ between what Medicare pays for and what you are billed when health issues arise. Medicare does not pay everything required. When necessary both Medicare and Medicare gap insurance pays a share of the costs leaving your medical bill either zero or very little.

What does no gap coverage mean Medicare?

A Medigap policy (Medicare Supplement Health Insurance) is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover.

What are gaps in coverage with Medicare?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,430 on covered drugs in 2022, you're in …

What are My Costs in the Coverage Gap?

Once you reach $4,430 in total spending on your covered drugs, you’re responsible for a certain percentage of the costs. When you enter the coverage gap, you’ll pay no more than 25% of the actual drug cost.

What Plans Provide Gap Coverage?

A Part D drug plan or Part C Medicare Advantage plan may include gap coverage, though these plans aren’t available everywhere and may have a higher premium. Plans are available by location, if you don’t live in the service area, you’re not eligible for that policy.

Is the Medicare Coverage Gap Going Away?

While the coverage gap has closed, it doesn’t mean that it goes away. After the Initial Coverage Period, people with Medicare will pay a higher portion of their drug costs.

Which Plan Covers My Medications at the Lowest Cost?

There is not one specific plan that suits everyone’s needs. Most of the time spouses will find they have different plan needs. Perhaps you have a brand-name medication that fewer plans cover, or maybe there is a plan option that allows you to avoid the donut hole.

What is Medicare Supplemental?

What is Medigap (Medicare Supplemental) insurance? En español | Medigap is also sometimes referred to as a Medicare supplemental insurance. A Medigap policy, sold by private insurance companies, can help pay some of the health care costs (“gaps”) Original Medicare doesn’t cover, such as Medicare deductibles, coinsurance ...

Does Medigap cover Medicare Supplemental?

Then your Medigap policy pays its share of covered benefits. Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as Medicare supplemental insurance. Insurance companies that sell Medigap can only sell you “standardized” Medigap policies, identified in most states by letters.

Does Medigap cover the same benefits?

Plans identified by the same letter cover the same benefits regardless of what company sells it. Note: In Massachusetts, Minnesota and Wisconsin, Medigap policies may be standardized in a different way. Note: Types of coverage that are NOT Medigap plans are Medicare Advantage plans, Medicare prescription drug plans, employer or union plans, ...

What is the coverage gap for Medicare?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,130 on ...

How much will Medicare cover in 2021?

Once you and your plan have spent $4,130 on covered drugs in 2021, you're in the coverage gap. This amount may change each year. Also, people with Medicare who get Extra Help paying Part D costs won’t enter the coverage gap.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , coinsurance, and copayments. The discount you get on brand-name drugs in the coverage gap. What you pay in the coverage gap.

How much does Medicare pay for generic drugs?

Generic drugs. Medicare will pay 75% of the price for generic drugs during the coverage gap. You'll pay the remaining 25% of the price. The coverage for generic drugs works differently from the discount for brand-name drugs. For generic drugs, only the amount you pay will count toward getting you out of the coverage gap.

Does Medicare cover gap?

If you have a Medicare drug plan that already includes coverage in the gap, you may get a discount after your plan's coverage has been applied to the drug's price. The discount for brand-name drugs will apply to the remaining amount that you owe.

What is gap insurance?

Gap insurance can be used to supplement an individual ACA-qualifying health plan or an employer’s group plan by providing additional benefits if you experience a covered injury or illness.

How much is the gap insurance?

You have a gap policy with a $7,500 maximum benefit limit for qualifying accidents and critical illnesses, as well as an ACA silver-level health plan with a $4,500 annual deductible.

Why are metal gap plans called metal gap insurance?

These plans are also sometimes called “metal gap insurance” because they can “fill the gaps” in individual healthcare spending that may be left by bronze and silver ACA plans, which often come with lower premiums but higher costs when you need care. [8]

What is gap benefit?

Stroke. Medical gap benefits can typically be used to cover a range of expenses, including: Major medical deductible until you can access your policy’s benefits. Major medical coinsurance and copayments until you reach your annual out-of-pocket maximum. Major medical monthly premiums.

What is the phone number for gap insurance?

To learn more, determine which plans are available in your state, and get a quick and easy quote, call 888-855-6837 to speak with a licensed agent or get a gap quote online (it just takes a minute).

How much does a gap insurance policy pay?

You have a gap policy with a $7,500 maximum benefit limit for accidents and critical illnesses. You fracture a finger, a qualifying injury on your policy, and it costs $2,000 to treat it. Your gap policy will pay up to $2,000 and you’ll have $5,500 in gap benefits remaining for the policy year. These benefits can still be used if you experience another covered accident or illness.

What is hospital indemnity insurance?

A hospital indemnity policy pays a fixed benefit at set intervals, such as per day, week, month, visit or event, rather than a percentage of the bill, for covered hospital stays and services. Like a gap plan, it is typically purchased to supplement an ACA-qualifying health plan.

What is Medicare Select?

Medicare Select. A type of Medigap policy that may require you to use hospitals and, in some cases, doctors within its network to be eligible for full benefits. policies that may require you to use certain providers. If you buy this type of Medigap policy, your premium may be less.

What does each insurance company decide?

Each insurance company decides how it will set the price, or. premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. , for its Medigap policies. It’s important to ask how an insurance company prices its policies. The way they set the price affects how much you pay now ...

Why do premiums go up?

They may be the least expensive at first, but they can eventually become the most expensive. Premiums may also go up because of inflation and other factors.

What is medical underwriting?

medical underwriting. The process that an insurance company uses to decide, based on your medical history, whether to take your application for insurance, whether to add a waiting period for pre-existing conditions (if your state law allows it), and how much to charge you for that insurance.

Can you compare a Medigap policy?

As you shop for a Medigap policy, be sure to compare the same type of Medigap policy, and consider the type of pricing used .

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What states have Medigap policies?

In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

Where do you live in Medigap?

You live in Massachusetts, Minnesota, or Wisconsin. If you live in one of these 3 states, Medigap policies are standardized in a different way. You live in Massachusetts. You live in Minnesota. You live in Wisconsin.

Do insurance companies have to offer every Medigap plan?

Insurance companies that sell Medigap policies: Don't have to offer every Medigap plan. Must offer Medigap Plan A if they offer any Medigap policy. Must also offer Plan C or Plan F if they offer any plan.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

What is the coverage gap in the ACA?

The “coverage gap” exists because the ACA’s premium tax credits (premium subsidies) are only available for people with a household income of at least 100% of FPL, up to 400% of FPL (note that for 2021, people receiving unemployment compensation are eligible for full premium subsidies even if their household income is under the poverty level, and for 2021 and 2022, there is no upper income limit for premium subsidy eligibility ).

What happens if you are in the coverage gap?

If you’re in the coverage gap, Medicaid isn’t available, and ACA-compliant coverage can only be purchased at full price – generally an unrealistic option, given that everyone in the coverage gap has an income below the poverty level. There are a few possible solutions, ...

Why are premium subsidies not available?

Premium subsidies are not available below 100% of FPL, because when the ACA was written, Medicaid expansion was an integral part of the law: It was assumed that subsidies would not be needed below 100% of FPL, since Medicaid would be available instead.

What was the Affordable Care Act?

When the Affordable Care Act was written, a cornerstone of the legislation was the expansion of Medicaid to everyone with household incomes up to 138% of federal poverty level, (FPL).

How many people are in the coverage gap?

According to Kaiser Family Foundation data, there are about 2.2 million people in the coverage gap across the 11 states that have not expanded Medicaid and do not currently have a plan in place to expand Medicaid. About 208,000 people in Missouri and Oklahoma are caught in the coverage gap until those states officially expand their Medicaid ...

How many states have not expanded Medicaid?

There are still 14 states where Medicaid eligibility has not been expanded under the ACA, although Wisconsin has a unique situation and does not have a coverage gap (Wisconsin essentially implemented a partial Medicaid expansion — without the enhanced federal funding they’d receive if they fully expanded Medicaid ).

Why are people of color uninsured?

In most cases, they will remain uninsured, simply because they have no other alternatives. Unfortunately, this disproportionately impacts people of color, particularly in the southern United States where almost all of the states have maintained their pre-ACA Medicaid eligibility guidelines.

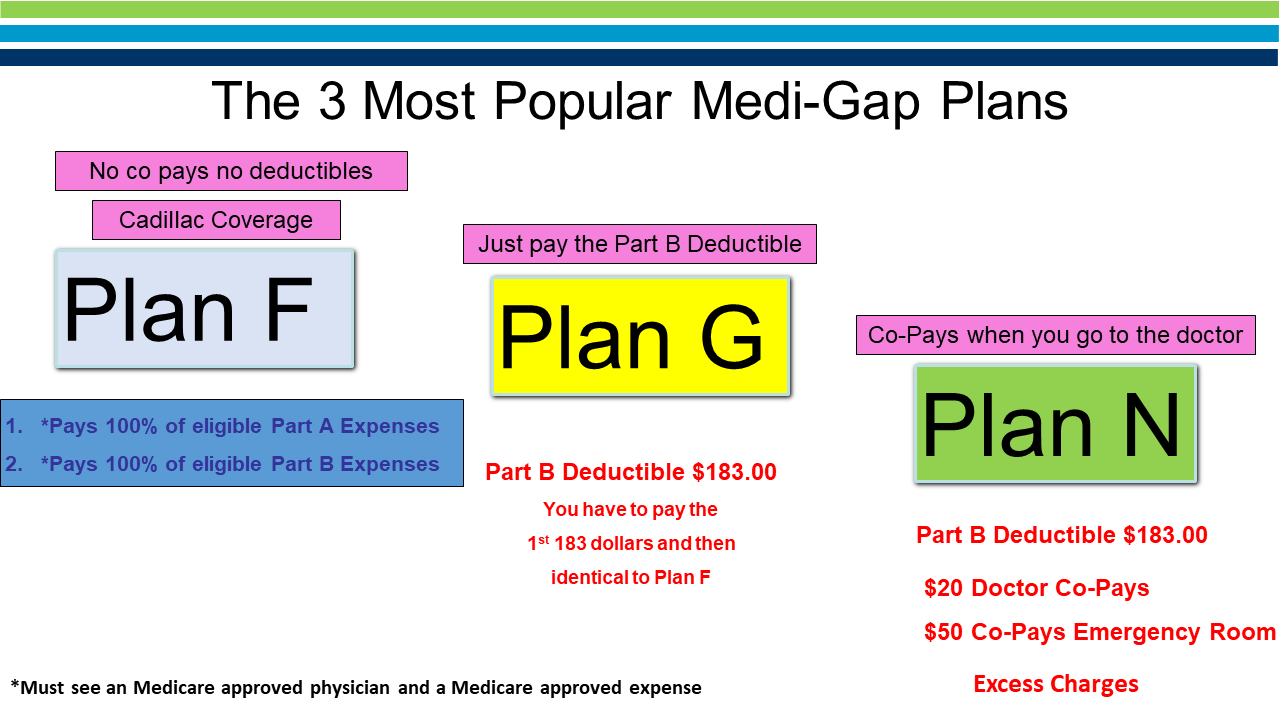

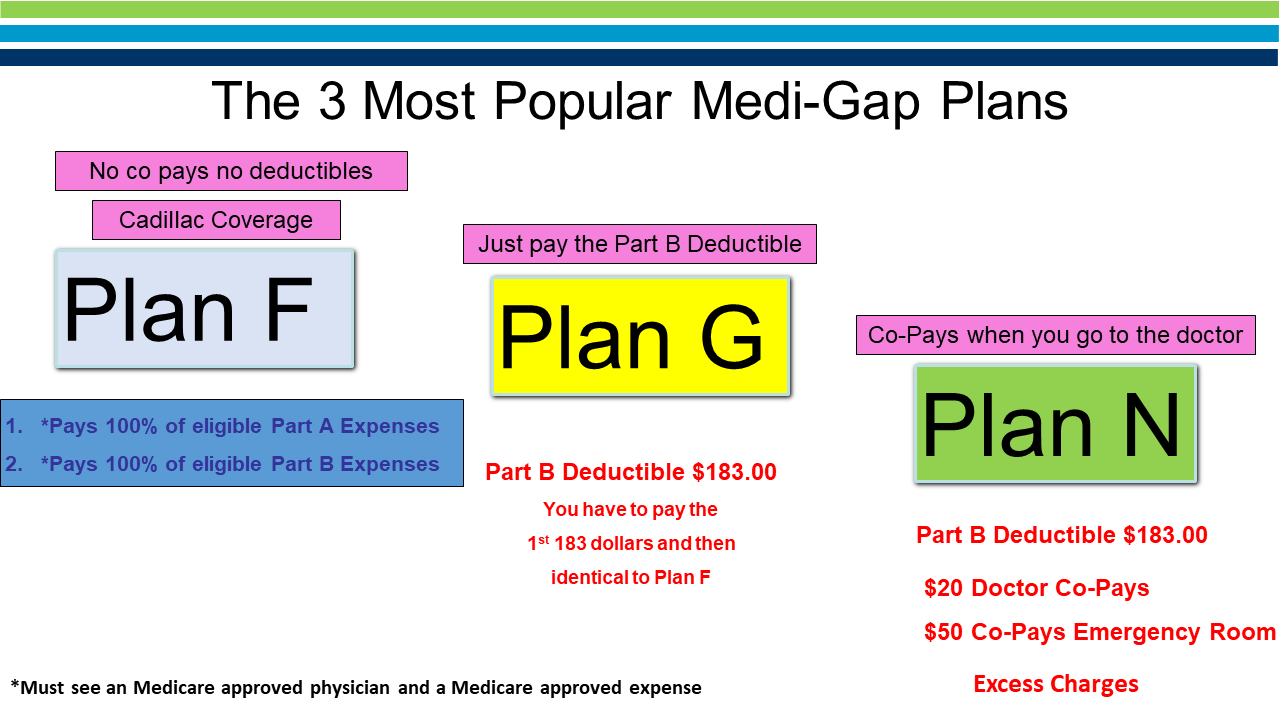

Basic benefits

Inpatient hospital care: covers the Part A coinsurance plus coverage for 365 additional days after Medicare coverage ends.

Compare these plans side-by-side

If a "yes" appears, the plan covers the described benefit 100%. If "no" appears, the policy doesn't cover that benefit.