Is Medicare better than HMO?

Health Maintenance Organization (HMO) In HMO Plans, you generally must get your care and services from providers in the plan's network, except: Emergency care. Out-of-area urgent care. Out-of-area dialysis. In some plans, you may be able to go out-of-network for certain services.

What is the difference between HMO and EPO health insurance?

Aug 31, 2020 · Medicare health maintenance organization (HMO) plans are a type of Medicare Advantage plan. The plans are offered by private insurance …

What is the best health plan for Medicare?

Apr 26, 2022 · A Medicare HHMO plan is a type of Medicare Advantage Plan, an alternative to Original Medicare. An HMO provides you with access to your Medicare-covered services plus additional benefits through a specific network of physicians and facilities.

Which Medicare plan should I Choose?

HMO stands for health maintenance organization. HMOs have their own network of doctors, hospitals and other healthcare providers who have agreed to accept payment at a certain level for any services they provide. This allows the HMO to keep costs in check for its members.

What does HMO mean in Medicare?

What is the difference between a PPO and an HMO Medicare plan?

Is Medicare HMO the same as Medicare?

What are the disadvantages of an HMO?

- HMO plans require you to stay within their network for care, unless it's a medical emergency.

- If your current doctor isn't part of the HMO's network, you'll need to choose a new primary care doctor.

What are the advantages of an HMO or PPO for a Medicare recipient?

Why do doctors not like Medicare Advantage plans?

What are the disadvantages of a Medicare Advantage plan?

- Restrictive plans can limit covered services and medical providers.

- May have higher copays, deductibles and other out-of-pocket costs.

- Beneficiaries required to pay the Part B deductible.

- Costs of health care are not always apparent up front.

- Type of plan availability varies by region.

What is the relationship between Medicare and HMOs?

What is an example of an HMO?

Why do doctors not like HMO?

What are some pros and cons of an HMO plan?

- PPOs typically have a higher deductible than an HMO.

- Co-pays and co-insurance are common with PPOs.

- Out-of-network treatment is typically more expensive than in-network care.

- The cost of out-of-network treatment might not count towards your deductible.

Is a PPO better than an HMO?

If flexibility and choice are important to you, a PPO plan could be the better choice. Unlike most HMO health plans, you won't likely need to select a primary care physician, and you won't usually need a referral from that physician to see a specialist.

What is an HMO plan?

HMO plans provide a more consistent quality of care by relying on in-network providers for services. There are many options for Medicare Advantage HMO plans in each state, including plans with $0 premiums, no deductibles, and low copayments.

What is Medicare Advantage HMO?

What are they? Medicare Advantage HMOs are popular options for additional coverage not offered by original Medicare. In a Medicare Advantage HMO plan, services are limited to to in-network providers. There are many different Medicare Advantage HMO plans to choose from in each state.

What are the disadvantages of Medicare Advantage?

Disadvantages of Medicare Advantage HMOs. There is less provider flexibility with HMOs compared with other Medicare Advantage plans. You will be required to choose a primary care physician (PCP) when you enroll in the plan, which may mean switching from your current doctor.

Does Medicare Advantage HMO cover Part B?

Medicare Advantage HMO plans may have their own monthly premium, unless they are premium-free plans. Your Medicare Advantage HMO plan doesn’t cover the Part B premium , so you’ll pay this amount in addition to any premium that comes with your HMO plan.

How much is Medicare Advantage deductible?

Medicare Advantage HMO plans generally have their own in-network deductible amounts, which can start as low as $0. If your plan covers prescription drugs, you can expect to see a drug deductible amount, as well.

What is Medicare Part D?

prescription drug coverage ( Medicare Part D) dental, vision, and hearing coverage. additional health coverage, such as home meal delivery or fitness memberships. To enroll in a Medicare Advantage HMO plan, you must already be enrolled in Medicare parts A and B.

What is an HMO plan?

Summary. Medicare health maintenance organization (HMO) plans are a type of Medicare Advantage plan. The plans are offered by private insurance companies, with varied coverage and costs. In this article, we discuss Medicare Advantage, look at the HMO plans, and examine how they compare with original Medicare.

Does HMO have a deductible?

An HMO-POS does not usually have a deductible for in-network providers and the copays may be low. When a person takes the HMO-POS option, they may have higher out-of-pocket costs. They may also have to pay most of the cost unless they have a referral from a doctor to the out-of-network provider.

What is Medicare Advantage?

Medicare Advantage plans combine the benefits of parts A and B and may offer prescription drug coverage. The Balanced Budget Act of 1997 added a new Part C to Medicare called the Medicare+choice program. It included various coordinated healthcare plans, including health maintenance organizations (HMOs). The Medicare+choice program is now known as ...

When is the open enrollment period for Medicare?

During the Medicare Advantage open enrollment period (OEP) from October 15 to December 7, a person can join, switch, or drop an Advantage plan.

What is Advantage Healthcare?

Advantage healthcare plans are offered by private companies that must follow Medicare rules and offer the same benefits as original Medicare (Part A and Part B). Many also offer prescription drug coverage.

Does HMO cover out of network care?

HMO plans have certain limitations and conditions: Most HMOs do not cover out-of-network care except in an emergency. If a person uses the services of a provider who is not in the network, they are responsible for the out-of-pocket costs.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What is Medicare HMO?

A Medicare HMO is one of several types of Medicare Advantage Plans available to Medicare beneficiaries. In order to sign up for a Medicare HMO plan an individual must first have signed up for Medicare Part A and Part B coverage.

Why do people choose HMO plans?

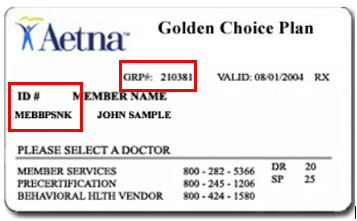

Health Maintenance Organization plans were created to offer cost savings to their beneficiaries, and the reduced expense is one of the primary advantages of selecting a Medicare HMO plan. Choosing an HMO reduces the need to fill out time-consuming paperwork or claim forms, as once the beneficiary provides their proof of insurance card at the point of service, there is no need to complete or submit any further claims. The beneficiary also has the security of knowing that their healthcare expenses will be limited to a fixed monthly premium; copayments and coinsurance charges vary depending upon the services received.

Which is the least expensive Medicare plan?

Medicare HMO plans are generally among the least costly of the Medicare Advantage Plans. Continue reading to learn more about what these plans offer and whether one is right for you.

How old do you have to be to get Medicare?

To be eligible for Medicare you must either have turned 65 years old and either a U.S. citizen or a legal resident for at least five years.

Who is Caren Lampitoc?

Caren Lampitoc is an educator and Medicare consultant for Medicare Risk Adjustments and has over 25 years of experience working in the field of Medicine as a surgical coder, educator and consultant.

How long is the initial enrollment period?

The Initial Enrollment Period refers to a 7-month period that begins three months before the month you turn 65, the month in which you turn 65, and the three months after the month in which you turn 65. Initial Coverage Enrollment Period (ICEP). This enrollment period is for those enrolling in a Medicare Advantage plan.

Who is Ron Elledge?

Ron Elledge. Medicare Consultant and Author. Ron Elledge is a seasoned Medicare consultant and author of “Medicare Made Easy.”. As a Medicare expert, he regularly consults beneficiaries on Medicare rules, regulations, and strategies.

What is HMO in Medicare?

December 10, 2019. A Health Maintenance Organization (HMO) plan from Medicare Advantage varies from Original Medicare and PPO plans—learn the differences and which might be best for you.

What is an HMO?

An HMO provides members access to a more restricted network of healthcare providers, and members must stay within that network in order for claims to be covered. Generally, you are required to choose a primary care physician (PCP), and then that doctor will provide referrals if you need to see a specialist.

Is Medicare Advantage the same as Medicare Part C?

Understanding Medicare HMO plans. When it comes to Medicare Advantage, also known as Medicare Part C, the rules of a Medicare HMO are surprisingly similar to traditional insurance: Lower costs. If you’re budget-conscious, Medicare HMO plans tend to be less expensive than PPO plans.

When is the open enrollment period for Medicare?

The new Medicare Advantage Open Enrollment Period, which runs from January 1 through March 31. If you have already enrolled in a Medicare Advantage plan and want to switch Medicare Advantage plans, you may do so during this period.

What happens if you see a specialist without a referral?

Choosing to see a specialist without a referral may result in your claim being denied or you having to pay out-of-pocket costs. Prescription drugs.

HMO Basics

With an HMO, which is a type of managed care organization, you use a network of doctors, hospitals, and other health care providers that your insurance company has pre-approved for services and payment. They’re called in-network providers.

How Much You Pay

As a member of an HMO, you pay a monthly premium. If you get your insurance through your employer, this usually comes directly out of your paycheck.

Why HMOs are Less Expensive

HMOs keep their costs down by making agreements with in-network providers to charge a certain amount.

Pros and Cons of HMOs

These are some advantages of HMOs, compared to other health insurance plans.

Other Plans You May Consider

Insurance plans vary, so one HMO may be different from another. States may also have different standards, so individual insurers may offer different types of plans with different names.

What is an HMO plan?

HMO stands for “ Health Maintenance Organization .”. This type of plan typically utilizes a primary care physician. A primary care physician is a general practice doctor whom you will almost always see first. This doctor can perform a wide range of treatments and may be able to treat the majority of your ailments.

What is the difference between a PPO and an HMO?

What are the differences between HMO and PPO plans? 1 Primary care physicians#N#HMO plans generally require members to utilize a primary care physician (PCP), while PPO plans typically do not. 2 Cost#N#On average, HMO members can generally expect to pay lower premiums than members of PPO plans. 3 Referrals#N#HMO members typically must obtain a referral from their primary care physician prior to visiting with a specialist. PPO plan members are typically free to seek out specialist care as they wish, without being required to get a referral. 4 Out-of-network coverage#N#HMO plans do not offer members any coverage for care received outside of the plan’s network of participating providers, except for in limited circumstances and in emergencies.#N#Members of PPO plans can typically receive at least partial coverage for care obtained outside of their network, though they typically pay more out-of-pocket for care outside of their network than they would for an in-network provider.

What are the benefits of a PPO?

The benefits of a PPO plan may include: 1 At least partial coverage for care received outside of the plan’s network 2 No need to use a primary care physician or seek out referrals for specialist care

What are the different types of Medicare Advantage plans?

There are several different types of Medicare Advantage plans from which to choose, and two of the most popular kinds are Medicare HMO’s and Medicare PPO’s. Let’s compare these two types of plans to better understand how they are different and help you determine which one might be best for you.

What is primary care physician?

A primary care physician is a general practice doctor whom you will almost always see first. This doctor can perform a wide range of treatments and may be able to treat the majority of your ailments. An HMO plan is typically made up of an approved network of health care providers.

How much does a PPO cost in 2020?

Members of regional PPO plans with drug coverage paid an average premium of $44 per month in 2020, while members of local PPO plans with drug coverage paid an average premium of $39 per month. Two things that are worth noting about these costs:

Do you need a referral for a PPO or HMO?

HMO members typically must obtain a referral from their primary care physician prior to visiting with a specialist. PPO plan members are typically free to seek out specialist care as they wish, without being required to get a referral. Out-of-network coverage. HMO plans do not offer members any coverage for care received outside ...

What are the different types of Medicare Advantage Plans?

Other less common types of Medicare Advantage Plans that may be available include. Hmo Point Of Service (Hmopos) Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost. and a. Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account.

Does Medicare Advantage include drug coverage?

Most Medicare Advantage Plans include drug coverage (Part D). In many cases , you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs.

What is MSA plan?

Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account. The plan deposits money from Medicare into the account. You can use the money in this account to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.