What is the difference between a preferred and non preferred provider?

These physicians, specialists are known as preferred providers, and PPO members are free to see any of them, without any reference from their primary physicians. PPO members may also see non-contracted providers, these are known as non preferred providers.

What does it mean to be a non-participating Medicare provider?

As a Non-Participating Medicare Provider, you can bill the patient up to 115% of the Medicare Fee Schedule. So what kinds of questions does this status bring up? …

What is the non-par status for Medicare?

A little more detail on the Non-Par Status: You can accept self-payment from the beneficiary at the time of service, but you still must send in the claim to Medicare. Medicare will then send any reimbursement directly to the patient. As a Non-Participating Medicare Provider, you can bill the patient up to 115% of the Medicare Fee Schedule.

What does it mean when a provider accepts Medicare?

Participating providers accept Medicare and always . Taking means that the provider accepts Medicare’s for health care services as full payment. These providers are required to submit a bill (file a ) to Medicare for care you receive. Medicare will process the bill and pay your provider directly for your care.

What does non-preferred provider mean?

A provider who doesn't have a contract with your health insurer or plan to provide services to you.

What is non-preferred?

What are non-preferred brand-name drugs? These are brand-name drugs that are not included on the plan's formulary (list of preferred prescription drugs). Non-preferred brand-name drugs have higher coinsurance than preferred brand-name drugs.

What is the difference between a preferred provider and a participating provider?

Differences Between Participating and Preferred Providers Preferred providers are in a network that receives higher reimbursement rates than participating providers. This is because preferred providers are required to meet quality standards while participating providers are not.

What is the difference between participating and non-participating providers?

Non-participating providers accept Medicare but do not agree to take assignment in all cases (they may on a case-by-case basis). This means that while non-participating providers have signed up to accept Medicare insurance, they do not accept Medicare's approved amount for health care services as full payment.

What is an example of a non-preferred pharmacy?

"Standard" (non-preferred) retail pharmacies, "Preferred" mail-order pharmacies, and. "Standard" (non-preferred) mail-order pharmacies.

What is the difference between preferred and standard?

That means the younger and healthier you are, the cheaper your rates will be. Preferred rates are the lowest available and bestowed upon people in the optimum health. Everyone else falls into the “standard' rate category.

When a provider is non-participating they will expect?

When a provider is non-participating, they will expect: 1) To be listed in the provider directory. 2) Non-payment of services rendered. 3) Full reimbursement for charges submitted.

Can a provider refuse to bill Medicare?

In summary, a provider, whether participating or nonparticipating in Medicare, is required to bill Medicare for all covered services provided. If the provider has reason to believe that a covered service may be excluded because it may be found not to be reasonable and necessary the patient should be provided an ABN.

Can a Medicare patient pay out-of-pocket?

Keep in mind, though, that regardless of your relationship with Medicare, Medicare patients can always pay out-of-pocket for services that Medicare never covers, including wellness services.

What are the advantages of a non-participating provider?

Non-Par Providers can also take payment in full at the time of service directly from the beneficiary, so they are not waiting for a 3rd Party Payor to reimburse them. Furthermore, the billing can be up to 115% of the Medicare Fee Schedule, so you can get a little more money for your time as a Non-Par Provider.

What is the difference between a network provider and a non network provider?

A network provider accepts the negotiated rate as payment in full for services rendered. A non-network provider is a civilian provider who is authorized to provide care to TRICARE beneficiaries, but has not signed a network agreement.

When a Medicare patient seeks care from a non-par provider?

Non-participating providers are then required to submit a claim to Medicare, so that Medicare can process the claim and reimburse the patient for Medicare's share of the charge. Two Medigap insurance policies, which beneficiaries may purchase to supplement their Medicare coverage, include coverage for balance billing.

How much can a non-participating provider bill Medicare?

Medicare will then send any reimbursement directly to the patient. As a Non-Participating Medicare Provider, you can bill the patient up to 115% of the Medicare Fee Schedule.

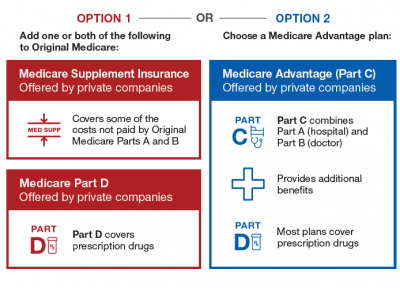

What is the most common Medicare Advantage plan?

There are coordinated care options such as HMOs or PPOs, private fee-for-service (PFFS) plans, and medical savings account (MSA) plans. The most common form of Medicare Advantage plan is the HMO. Apparently, there are a number of Medicare Advantage plans in which coverage is limited to only in-network providers.

What is the maximum amount of Medicare Physician Fee Schedule?

If you are a Non-Participating provider, providing covered services and collecting payment from beneficiaries at the time of service, the maximum amount you may charge is 115% of the approved fee schedule amount for Non-Participating providers; which is 95% of the normal Medicare Physician Fee Schedule (MPFS).

What is the relationship status of a physical therapist with Medicare?

There are three possibilities for a Physical Therapist’s relationship-status with Medicare: 1) No relationship at all (notthe same as a “Non-Participating Provider” and also notthe same as “opting out”) 2) Participating Provider. 3) Non-Participating Provider.

Can a Medicare beneficiary see you out of network?

If a beneficiary with a Medicare Advantage plan wants to see you on a cash-pay basis, and you are out-of-network with that plan , you need to call the plan and ask them if it is okay for you to provide them with covered services and that the beneficiary pay you directly out-of-pocket.

Can non-par providers take payment in full?

This is hugely important for some practices in certain areas with certain demographics. Non-Par Providers can also take payment in full at the time of service directly from the beneficiary, so they are not waiting for a 3rd Party Payor to reimburse them.

Can you be a non-par provider for Medicare?

If you feel that you need to be able to treat Medicare beneficiaries, either financially or personally, but don’t want to wait for Medicare reimbursement (or denials), then being a Non-Par Provider might be a an option to consider regardless of the extra 15% you can bill.

What does it mean to take assignment with Medicare?

Taking assignment means that the provider accepts Medicare’s approved amount for health care services as full payment. These providers are required to submit a bill (file a claim) to Medicare for care you receive.

How long does it take for a provider to bill Medicare?

Providers who take assignment should submit a bill to a Medicare Administrative Contractor (MAC) within one calendar year of the date you received care. If your provider misses the filing deadline, they cannot bill Medicare for the care they provided to you.

Does Medicare charge 20% coinsurance?

However, they can still charge you a 20% coinsurance and any applicable deductible amount. Be sure to ask your provider if they are participating, non-participating, or opt-out. You can also check by using Medicare’s Physician Compare tool .

Can non-participating providers accept Medicare?

Non-participating providers accept Medicare but do not agree to take assignment in all cases (they may on a case-by-case basis). This means that while non-participating providers have signed up to accept Medicare insurance, they do not accept Medicare’s approved amount for health care services as full payment.

Do opt out providers accept Medicare?

Opt-out providers do not accept Medicare at all and have signed an agreement to be excluded from the Medicare program. This means they can charge whatever they want for services but must follow certain rules to do so. Medicare will not pay for care you receive from an opt-out provider (except in emergencies).

Can you have Part B if you have original Medicare?

Register. If you have Original Medicare, your Part B costs once you have met your deductible can vary depending on the type of provider you see. For cost purposes, there are three types of provider, meaning three different relationships a provider can have with Medicare.

Do psychiatrists have to bill Medicare?

The provider must give you a private contract describing their charges and confirming that you understand you are responsible for the full cost of your care and that Medicare will not reimburse you. Opt-out providers do not bill Medicare for services you receive. Many psychiatrists opt out of Medicare.

What is a Medicare participating provider?

Medicare participating providers must adhere to the following: A participating provider is one who voluntarily and in advance enters into an agreement in writing to provide all covered services for all Medicare Part B beneficiaries on an assigned basis. Agrees to accept Medicare approved amount as payment in full.

How much is the Medicare limit for non-participating providers?

As a non-participating provider and not willing to accept assignment, the patient is responsible to pay you the Limiting Charge of $34.00. You cannot accept your regular fee of $35.00 even though you are non-participating. You bill Medicare the Limiting Charge of $34.00.

How much does Medicare reimburse you?

Medicare will reimburse you $24.00, which is 80% of the Non-Par Fee Allowance (assuming the deductible has been met). Just a side note, at the present time DCs cannot “opt-out” of the Medicare program – so if you choose to treat Medicare patients, then you must follow the above rules.

Can a non-participating provider accept assignment?

Medicare non-participating providers must adhere to the following: A non-participating provider has not entered into an agreement to accept assignment on all Medicare claims. Can elect to accept assignment or not accept assignment on a claim-by-claim basis. Cannot bill the patient more than the limiting charge on non-assigned claims.

Can Medicare collect more than deductible?

May not collect more than applicable deductible and coinsurance for covered services from patient. Payment for non-covered services may also be collected. Charges are not subject to the limiting charge. Medicare payment paid directly to the provider. Mandatory claims submission applies. Reimbursement is 5 percent higher than ...

What is a non contract provider?

Non-contract providers are required to accept as payment, in full, the amounts that the provider could collect if the beneficiary were enrolled in original Medicare. Plans should refer to the MA Payment Guide for Out of Network Payments in situations where they are required to pay at least the Medicare rate to out of network providers.

What is Medicare Advantage reimbursement?

Medicare Advantage organizations, Cost plans, and PACE organizations are required to reimburse non-contract providers for Part A and Part B services provided to Medicare beneficiaries with an amount that is no less than the amount that would be paid under original Medicare.