A Medicare review nurse performs claim reviews to assess eligibility for Medicare coverage. You look at patient records and medical documents while evaluating claims. In some cases, your duties include investigating to see if a patient’s Medicare plan covers a medically-complex procedure or treatment.

What is Medicare?

Sep 10, 2018 · According to the U.S. Library of Medicine, an advice nurse is described as a registered nurse who is qualified and able to do phone triage and offer health advice over the phone. Triage in a health care setting means that a nurse or other health professional will assess your signs and symptoms and determine how urgently you need to be seen by a doctor or other …

What do you need to know about Medicare and advice nurse services?

The different parts of Medicare help cover specific services: Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive ...

Does Medicare pay for nursing home care?

A Medicare review nurse performs claim reviews to assess eligibility for Medicare coverage. You look at patient records and medical documents while evaluating claims. In some cases, your duties include investigating to see if a patient’s Medicare plan covers a medically-complex procedure or treatment.

Does Medicare Part a cover skilled nursing?

Medicare Coverage for Your Home Health Services. Visiting Nurse Association is a Medicare certified home health agency. Medicare is a national health insurance program provided by the federal government. It covers people age 65 or older and people of all ages with certain disabilities or end-stage renal disease. To receive Medicare coverage for ...

What is Medicare responsibility?

What type of care does Medicare provide?

What is the responsibility of a Medicare patient who is in a nursing facility for the first 20 days?

What is Medicare in simple terms?

What are the 4 types of Medicare?

- Part A provides inpatient/hospital coverage.

- Part B provides outpatient/medical coverage.

- Part C offers an alternate way to receive your Medicare benefits (see below for more information).

- Part D provides prescription drug coverage.

What is not covered by Medicare Part A?

How Long Does Medicare pay for hospital stay?

What happens when Medicare hospital days run out?

How Long Will Medicare pay for home health care?

How is Medicare paid?

Does the government pay for Medicare?

What triggers Medicare Part A?

What is nursing home care?

Most nursing home care is. custodial care . Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom. It may also include the kind of health-related care that most people do themselves, like using eye drops.

What is part A in nursing?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. may cover care in a certified skilled nursing facility (SNF). It must be. medically necessary. Health care services or supplies needed to diagnose or treat an illness, injury, condition, disease, ...

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

How much of Medicare coinsurance do you pay?

at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance. If you want drug coverage, you can add a separate drug plan (Part D).

What is a medicaid supplement?

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S.

How much will Medicare cost in 2021?

If you aren't eligible for premium-free Part A, you may be able to buy Part A. You'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $458. If you paid Medicare taxes for 30–39 quarters, the standard Part A premium is $259.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

What Does a Medicare Review Nurse Do?

A Medicare review nurse performs claim reviews to assess eligibility for Medicare coverage. You look at patient records and medical documents while evaluating claims. In some cases, your duties include investigating to see if a patient’s Medicare plan covers a medically-complex procedure or treatment.

How to Become a Medicare Review Nurse

The qualifications you need to become a Medicare review nurse include a nursing degree and state nursing license. You can start this career by either becoming a registered nurse (RN) or licensed practical nurse (LPN). You achieve this by first earning a postsecondary certificate (LPN) or degree (RN).

What is a Medicare certified agency?

Approved agencies like Visiting Nurse Association are typically referred to as “Medicare certified agencies.”. If you or your loved one receive Medicare benefits and meet all four criteria, Medicare will cover:

What is Medicare billing number?

Please call 816-627-6210.

How to contact Medicare by phone?

Please call 816-627-6210. To learn more about Medicare in general, call 1-800-MEDICARE or visit medicare.gov. Eligibility criteria for many private insurance plans are similar to Medicare guidelines. Our billing specialists will be happy to contact your private insurance carrier for individual eligibility requirements.

What are the requirements for home health care?

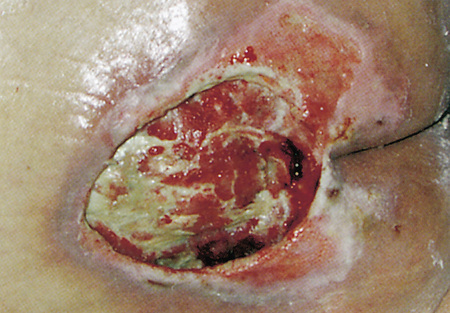

If you or your loved one receive Medicare benefits and meet all four criteria, Medicare will cover: 1 Skilled nursing on a part-time basis, as long as your home health care provider is a registered or licensed practical nurse. 2 Rehabilitation therapy, if ordered by your doctor. 3 Home health aide services on a part-time basis. Medicare will only cover home health aide services if you are also getting skilled care like nursing or other therapy. 4 Medical social work services to assist with social and emotional concerns related to your illness, injury or condition. 5 Certain medical supplies, such as wound dressings.

What services do you need to be a home health care provider?

You must also need at least one of the following services: Intermittent (part-time) skilled nursing care. Physical or speech therapy.

Is a skilled nursing part time?

Skilled nursing on a part-time basis, as long as your home health care provider is a registered or licensed practical nurse.

Does Medicare cover home health aides?

Medicare will only cover home health aide services if you are also getting skilled care like nursing or other therapy. Medical social work services to assist with social and emotional concerns related to your illness, injury or condition. Certain medical supplies, such as wound dressings. Medicare does not pay for:

How long does it take to become a Medicare provider?

You’ve 90 days after your initial enrollment approval letter is sent to decide if you want to be a participating provider or supplier.

What are Medicare providers and suppliers?

Medicare provider and supplier organizations have business structures, such as corporations, partnerships, Professional Associations (PAs), or Limited Liability Companies (LLCs) that meet the “provider” and “supplier” definitions. Provider and supplier organizations don’t include organizations the IRS defines as sole proprietorships.

How to change Medicare enrollment after getting an NPI?

Before applying, be sure you have the necessary enrollment information. Complete the actions using PECOS or the paper enrollment form.

What is Medicare 855I?

Medicare Enrollment Application: Physicians and Non-Physician Practitioners (Form CMS-855I): Individual physicians or NPPs, as well as individual physicians and NPPs that are sole proprietors or sole owners of a corporation that provides services, use this form to begin the Medicare enrollment/revalidation process or change Medicare enrollment information.

How much is the Medicare application fee for 2021?

Application Fee Amount. The enrollment application fee sent January 1, 2021, through December 31, 2021, is $599. For more information, refer to the Medicare Application Fee webpage. How to Pay the Application Fee ⤵. Whether you apply for Medicare enrollment online or use the paper application, you must pay the application fee online:

Do I need an NPI before enrolling in Medicare?

You must get an NPI before enrolling in the Medicare Program. Apply for an NPI in 1 of 3 ways:

Do health care providers have to enroll in Medicare?

Health care providers must enroll in the Medicare Program to get paid for providing covered services to Medicare patients. Learn how to determine if you’re eligible to enroll and how to do it.

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is a type of health plan offered by private insurance companies that provides the benefits of Parts A and Part B and often Part D (prescription drug coverage) as well. These bundled plans may have additional coverage, such as vision, hearing and dental care.

What is not covered by Medicare?

The biggest potential expense that’s not covered is long-term care, also known as custodial care. Medicaid, the federal health program for the poor, pays custodial costs but typically only for low-income people with little savings. Other common expenses that Medicare doesn’t cover include:

How long does it take to get Medicare Supplemental Insurance?

If you want Medicare Supplemental Insurance (Medigap), you would sign up during the six-month Medigap enrollment period, which starts the month you turn 65 and are enrolled in Medicare Part B. The private insurers who provide Medigap plans are required to take you if you sign up during that period. Otherwise, there is no guarantee they will sell you a Medigap plan.

What happens if you don't sign up for Medicare Part B?

If you don’t sign up for Medicare Part B at 65 and later decide you need it, you’ll likely pay a penalty of 10% of the premium for each 12-month period that you delayed. You will pay this penalty for life, basically, since few people drop Medicare Part B once they have it.

What are the most common medical expenses that are not covered by Medicaid?

The biggest potential expense that’s not covered is long-term care, also known as custodial care . Medicaid, the federal health program for the poor, pays custodial costs but typically only for low-income people with little savings. Hearing aids and exams for fitting them. Eye exams and eyeglasses.

Does Medicare Part A cover hospice?

Part A also helps pay for hospice care and some home health care. Medicare Part A has a deductible ($1,484 in 2021) and coinsurance, which means patients pay a portion of the bill. There is no coinsurance for the first 60 days of inpatient hospital care, for example, but patients typically pay $371 per day for the 61st through 90th day ...

Is Medicare the same as Medicaid?

No. Medicare is an insurance program, primarily serving people over 65 no matter their income level. Medicare is a federal program, and it’s the same everywhere in the United States. Medicaid is an assistance program, serving low-income people of all ages, and patient financial responsibility is typically small or nonexistent.

How many days does Medicare pay for a hospital stay?

In Original Medicare, a total of 60 extra days that Medicare will pay for when you are in a hospital more than 90 days during a benefit period. Once these 60 reserve days are used, you do not get any more extra days during your lifetime. For each lifetime reserve day, Medicare pays all covered costs except for a daily coinsurance.

What is a medicaid person?

A person who has health care insurance through the Medicare or Medicaid program.

What is the gap in Medicare coverage?

Also known as the “donut hole,” this is a gap in coverage that occurs when someone with Medicare goes beyond the initial prescription drug coverage limit. When this happens, the person is responsible for more of the cost of prescription drugs until their expenses reach the catastrophic coverage threshold.

How much do you have to pay for Medicare after you pay deductible?

The amount you may be required to pay for services after you pay any plan deductibles. In Original Medicare, this is a percentage (like 20%) of the Medicare approved amount. You have to pay this amount after you pay the deductible for Part A and/or Part B. In a Medicare Prescription Drug Plan, the coinsurance will vary depending on how much you have spent.

What is copayment in Medicare?

A copayment is usually a set amount you pay. For example, this could be $10 or $20 for a doctor’s visit or prescription.

What is deductible in Medicare?

DEDUCTIBLE (MEDICARE) The amount you must pay for health care or prescriptions, before Original Medicare, your prescription drug plan, or other insurance begins to pay. For example, in Original Medicare, you pay a new deductible for each benefit period for Part A, and each year for Part B.

How long does it take for Medicare to make a decision?

A fast decision from the Medicare+Choice organization about whether it will provide a health service. A beneficiary may receive a fast decision within 72 hours when life, health or ability to regain function may be jeopardized.

What does Medicare Part A cover?

Medicare Part A (Hospital Insurance) - Part A helps cover inpatient care in hospitals, including critical access hospitals, and skilled nursing facilities (not custodial or long-term care). It also helps cover hospice care and some home health care. Beneficiaries must meet certain conditions to get these benefits. Most people don't pay a premium for Part A because they or a spouse already paid for it through their payroll taxes while working.

What age does Medicare cover?

Medicare is a health insurance program for: People age 65 or older . People under age 65 with certain disabilities. People of all ages with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a kidney transplant).