Full Answer

How to choose the best Medicare Part D plan?

Apr 12, 2022 · Medicare Part D prescription drug plans are also known as PDPs. These are standalone plans that can be purchased through private insurance companies. PDPs provide coverage for prescription drugs and medications and may also cover some vaccines too. Original Medicare (Parts A & B) doesn't provide prescription drug coverage.

What are the best Medicare Part D drug plans?

Part D (Medicare drug coverage) helps cover cost of prescription drugs, may lower your costs and protect against higher costs.

Who has the best Medicare Part D plan?

Mar 12, 2022 · A Medicare Part D plan will generally cover at least two drugs from every drug category. Plans are also required to cover almost every drug from the following classes: Both generic and brand-name drugs are covered by Medicare Part D, but brand-name medications may cost more for beneficiaries.

What is the best Medicare Part D plan?

Medicare Part D prescription drug plans (PDPs) provide coverage for prescription drugs not covered by Original Medicare. Anthem offers Part D prescription drug plans with copays as low as $1 at preferred pharmacies in our network.

What does PDP mean in Medicare Part D?

Medicare Prescription Drug PlanMedicare Cost Plan Join a Medicare Prescription Drug Plan (PDP). These plans add coverage to Original Medicare, and can be added to one of these: • A Medicare Savings Account (MSA) Plan.

Is PDP the same as Part D?

A Medicare Prescription Drug plan (PDP) is an insurance policy that covers take-home drugs prescribed by a doctor. Out-of-pocket costs usually apply. PDPs are also known as Medicare Part D. Private insurance companies sell these plans, following approval by Medicare.

What are the two types of Medicare Part D plan?

Are you thinking about Medicare Part D coverage for your prescription drugs? As you may know, there are two main ways to get this coverage: Stand-alone Medicare Part D Prescription Drug Plan. Medicare Advantage Prescription Drug plan.

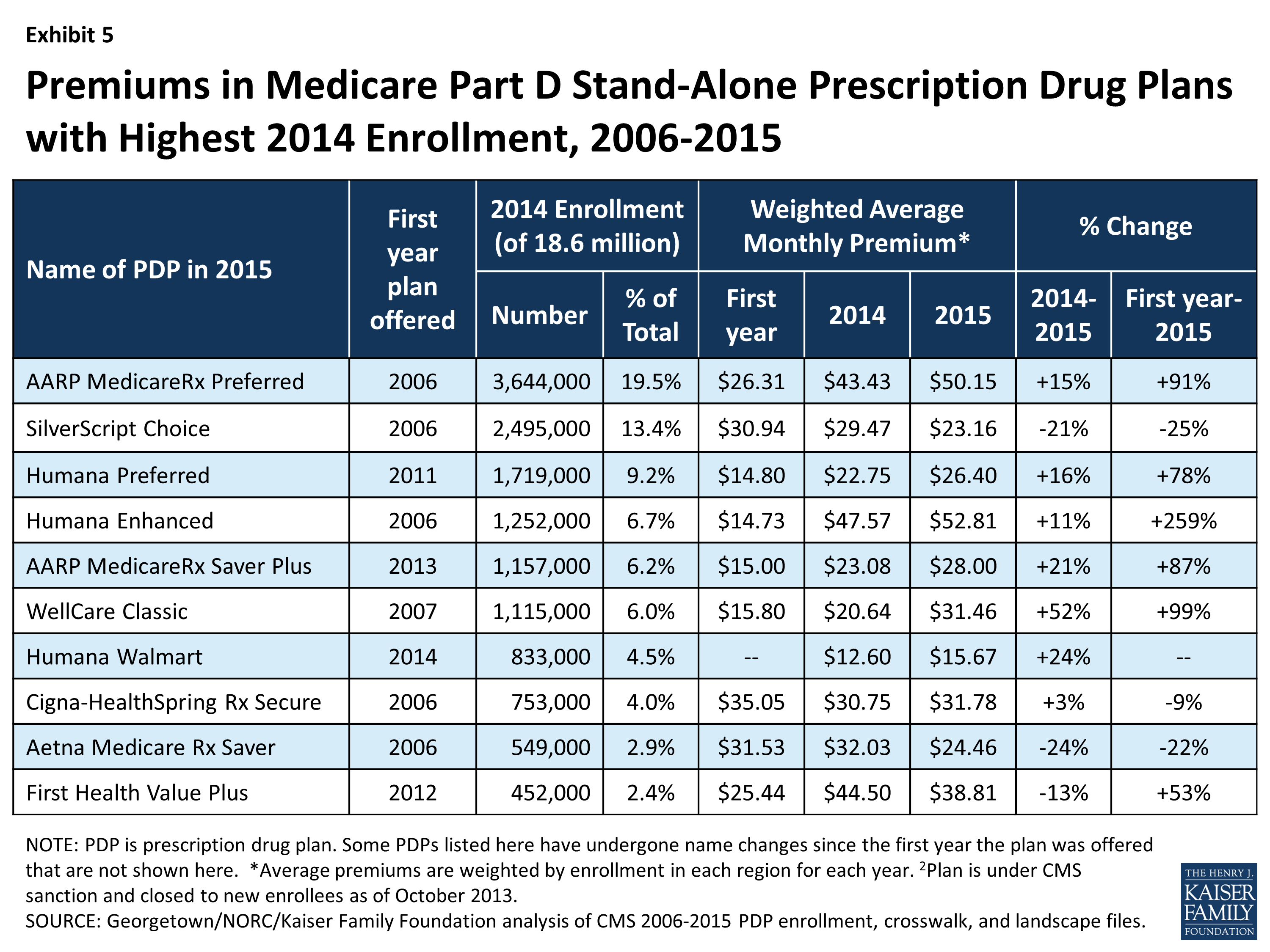

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Is Medicare Part D the same as Medicare Advantage?

How is Medicare Advantage different from Part D? Medicare Part D is a supplement to Original Medicare and covers prescription drugs only. Medicare Advantage, on the other hand, replaces Original Medicare and becomes your hospital and medical insurance plan.Jul 23, 2021

What is the difference between Medicare Advantage and PDP?

Once you enroll in an Advantage plan, a private insurance company handles your claims instead of Medicare. In other words, it pays instead of Original Medicare. In contrast, Prescription Drug Plans (PDP) are stand-alone plans that only provide prescription drug coverage through Part D of Medicare.Feb 18, 2022

Can you add Medicare Part D at any time?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

Does Medicare Part D have a maximum out of pocket?

Medicare Part D, the outpatient prescription drug benefit for Medicare beneficiaries, provides catastrophic coverage for high out-of-pocket drug costs, but there is no limit on the total amount that beneficiaries have to pay out of pocket each year.Jul 23, 2021

What is the max out of pocket for Medicare Part D?

A Medicare Part D deductible is the amount you must pay every year before your plan begins to pay. Medicare requires that Medicare Part D deductibles cannot exceed $445 in 2021, but Medicare Part D plans may have deductibles lower than this. Some Medicare Part D plans don't have deductibles.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.Sep 27, 2021

Can you use GoodRx If you have Medicare Part D?

So let's get right to it. While you can't use GoodRx in conjunction with any federal or state-funded programs like Medicare or Medicaid, you can use GoodRx as an alternative to your insurance, especially in situations when our prices are better than what Medicare may charge.Aug 31, 2021

Is Medicare Part D deducted from Social Security?

You can have your Part C or Part D plan premiums deducted from Social Security. You'll need to contact the company that sells your plan to set it up. It might take several months to set up and for automatic payments to begin.Dec 1, 2021

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What is the late enrollment penalty for Medicare?

Part D late enrollment penalty. The late enrollment penalty is an amount that's permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there's a period of 63 or more days in a row when you don't have Medicare drug coverage or other.

How long does it take for Medicare to reconsider?

In general, Medicare’s contractor makes reconsideration decisions within 90 days. The contractor will try to make a decision as quickly as possible. However, you may request an extension. Or, for good cause, Medicare’s contractor may take an additional 14 days to resolve your case.

What is creditable prescription drug coverage?

creditable prescription drug coverage. Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage. People who have this kind of coverage when they become eligible for Medicare can generally keep that coverage without paying a penalty, ...

What is extra help?

Extra Help. A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance. , you don't pay the late enrollment penalty.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Does Medicare cover emergency services?

In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for under Original Medicare (your Cost Plan pays for emergency services or urgently needed services ). with drug coverage, the monthly premium may include an amount for drug coverage.

What is a Part D plan?

The best Medicare Part D plans not only help you manage the cost of prescription drugs, they also play a role in ensuring medicines stay affordable and they can protect against future price hikes. Roughly 70% of Americans signed up for Medicare supplement with a Part D plan, ...

What is the best Medicare Part D provider?

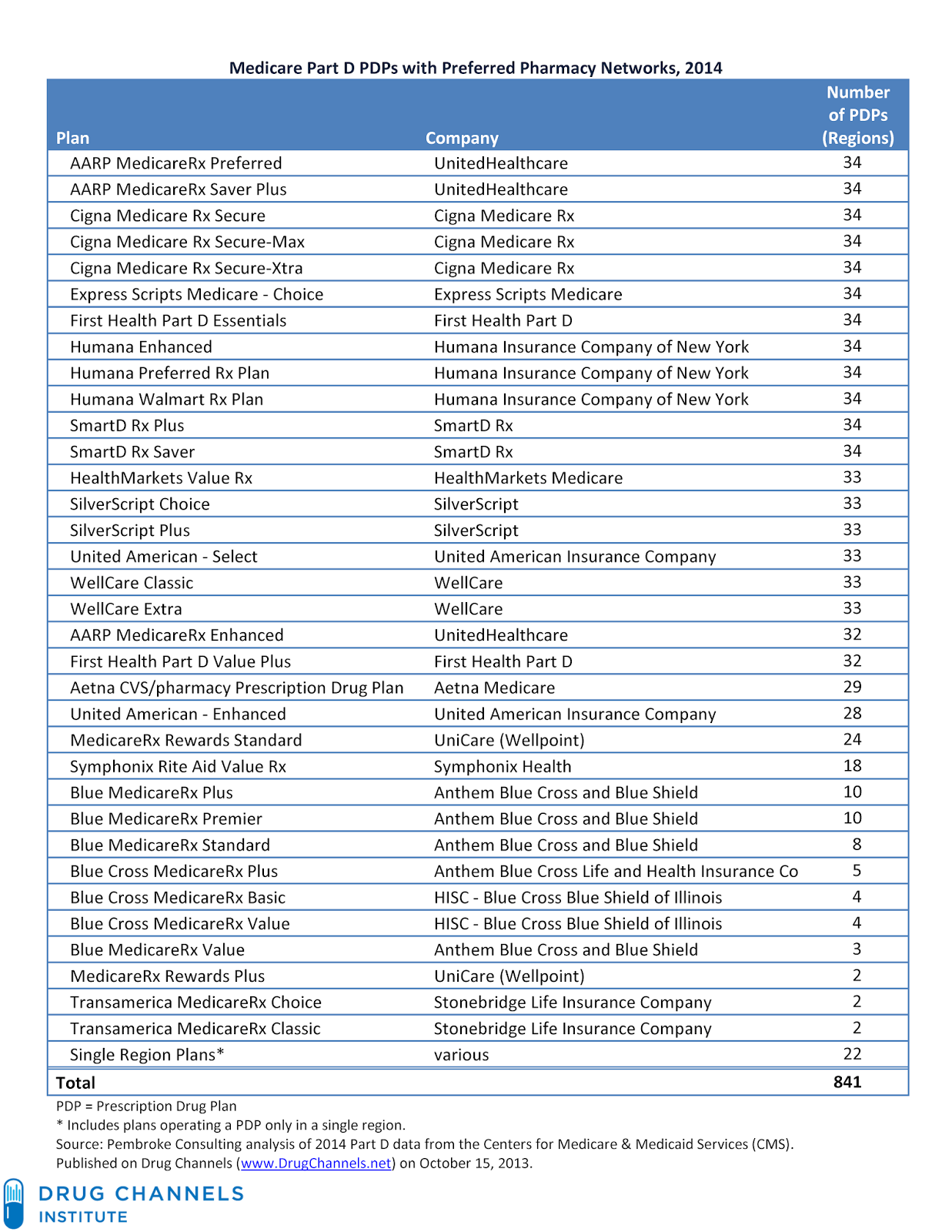

The best Medicare Part D providers include AARP, Humana Medicare Rx, WellCare, and Cigna-HealthSpring. If you’re eligible for Part D coverage, the three main considerations you’re likely to make are your current health, budget, and any medicine you take.

How long does Medicare Part D last?

There are three different enrollment periods for Medicare Part D, as follows: Initial enrollment period: This covers a total of seven months - three months before you turn 65, your birthday month itself, and then the three months directly after your 65th birthday. So seven months in total.

Does Medicare Part D cover all medications?

Most companies offering Medicare Part D Prescription Drug Plans cover medications based on a tier program, and not all medications may be covered.

What is the Medicare Part D deductible for 2020?

In 2020, the allowable Medicare Part D deductible is $435. Depending on the provider you choose, plans may either charge the full deductible, a partial, or waive the deductible (zero deductible). You pay the network discounted price for prescription drugs until your plan equals the deductible.

Is AARP a good Medicare plan?

AARP Medicare Rx, with services provided by United Healthcare, is an excellent all-round provider of Medicare Part D plans and is the only range of plans backed by AARP. This is the best Medicare Part D plan option for seniors as it mixes low co-pays with competitive premiums and has a network of preferred providers.

Is Medicare Part D low cost?

While prescription drugs costs under the majority of Medicare Part D plans are low, the amount you’ll pay will vary by the Part D provider. These are the most common expenses you’ll need to familiarize yourself with...

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is the difference between generic and brand name drugs?

Generic drugs are typically on lower tiers and cost less, while brand name drugs and specialty drugs are typically on higher tiers and cost more. Medicare Part D plans are sold by private insurance companies. These insurance companies are generally free to set their own premiums for the plans they sell.

Does Medicare Part D have coinsurance?

Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing. Some Medicare Part D plans have deductibles and copayments or coinsurance. The cost of your Part D premium may depend on the amounts of coinsurance or copayments you pay with your plan, ...

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

Does Medicare Advantage cover Part A?

Medicare Advantage plans (also called Medicare Part C) provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesn’t cover. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

What is coinsurance and copayment?

Copayments and coinsurance are the amounts that you must pay once your plan’s coverage does begin. A copayment is usually a fixed dollar amount (such as $5) while coinsurance is most often a percentage of the cost (such as 20 percent). Plans might have different copayment or coinsurance amounts for each tier of drugs.

When does Medicare Part D start?

The coverage you choose during the Medicare Part D Enrollment will be effective the first day of the following year. For example, if you enrolled in a Part D drug plan by December 7, 2020, your coverage would start January 1, 2021.

How to opt out of Medicare Part D?

The Medicare Part D Enrollment Period also allows you to opt out of Part D drug benefits. You can: 1 Drop your PDP or MAPD coverage completely. 2 Switch from a PDP or MAPD to a Medicare Advantage plan without drug coverage.

What happens if you don't get Medicare Part D?

If you didn’t get Part D during your IEP, you get another chance to do so during the Medicare Part D Open Enrollment. However, you might pay the Part D late enrollment penalty (an extra amount added to your Part D premium) if:². You went more than 63 days past your IEP without having other credible drug coverage.

When is it important to review Medicare Part D?

It’s important to review your Part D options annually during Medicare Open Enrollment. The cost, pharmacy network, and drug formulary for Medicare Part D plans can vary from plan to plan year to year.

How long does an IEP last?

Your IEP lasts for seven months and:¹. Begins three months before, and ends three months after, your 25th month of getting Social Security or Railroad Retirement Board (RRB) disability benefits. If you didn’t get Part D during your IEP, you get another chance to do so during the Medicare Part D Open Enrollment.