The Value-Based Payment Modifi er (VBPM) Program adjusts payment rates under the Medicare Physician Fee Schedule based on an eligible professional’s performance on quality and cost categories. The Centers for Medicare & Medicaid Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…Medicaid

Centers for Medicare and Medicaid Services

The Centers for Medicare & Medicaid Services, previously known as the Health Care Financing Administration, is a federal agency within the United States Department of Health and Human Services that administers the Medicare program and works in partnership with state government…

How do you calculate Medicare payment?

- Go to the CMS website.

- Scroll down to No. 3 of "Tables."

- Download Table 5 (final rule and correction notice; this is for Fiscal Year 2020).

- Open the file that displays the information as an Excel spreadsheet (the file that ends with “.xlsx”).

- The column labeled “weights” shows the relative weight for each DRG.

How does Medicare determine your payment?

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan.

What does Medicare adjustment mean?

The savings were acquired by doing the following:

- 7.9 percent cuts to defense spending; a $43 billion savings

- 5.3 percent reduction in domestic discretionary spending; a savings of $29 billion

- 2 percent cut in Medicare provide payments; a $10 billion savings

- 5.8 percent cut to defense and nondefense mandatory programs; a $4 billion savings

How do I Pay my Medicare payment?

- Social Security

- Railroad Retirement Board

- Office of Personnel Management

What is a payment adjustment?

Pay Adjustment Definition Term Definition. Pay adjustment is any change that the employer makes to an employee's pay rate. This change can be an increase or a decrease.

How does MIPS payment adjustment work?

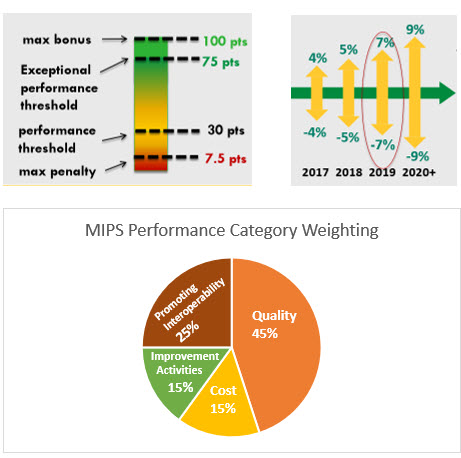

A MIPS eligible clinician with a Final Score of 85 points or higher will receive an additional payment adjustment factor for exceptional performance. The MIPS payment adjustment factor(s) are determined by the MIPS eligible clinician's Final Score.

What is Medicare Co 144 incentive adjustment?

CARC 144: "Incentive adjustment, e.g. preferred product/service" RARC N807: "Payment adjustment based on the Merit- based Incentive Payment System (MIPS)." Group Code: CO. This group code is used when a contractual agreement between the payer and payee, or a regulatory requirement, resulted in an adjustment.

How does Medicare calculate payment?

Medicare primary payment is $375 × 80% = $300.Primary allowed of $500 is the higher allowed amount.Primary allowed minus primary paid is $500 - $400 = $100.The lower of Step 1 or 3 is $100. ( Medicare will pay $100)

Will MIPS go away?

Clinicians will be able to report MVPs beginning with the 2023 performance year as a new reporting framework to eventually replace the traditional MIPS program. MVPs will be voluntary for the 2023 to 2027 performance years.

Do I need to participate in MIPS?

You must participate in MIPS (unless otherwise exempt) if, in both 12-month segments of the MIPS Determination Period, you: Bill more than $90,000 for Part B covered professional services, and. See more than 200 Part B patients, and; Provide more than 200 covered professional services to Part B patients.

What does Medicare denial code Co 151 mean?

Co 151 – Payment adjusted because the payer deems the information submitted does not support this many/frequency of services.

What is OA 23 Adjustment code mean?

What does code OA 23 followed by an adjustment amount mean? This code is used to standardize the way all payers report coordination of benefits (COB) information.

What does Medicare code Co 237 mean?

The PQRS, EHR Incentive Program, and Value Modifier currently use CARC 237 – Legislated/Regulatory. Penalty, to designate when a negative or downward payment adjustment will be applied. At least one Remark. Code must be provided (may be comprised of either the NCPDP Reject Reason Code, or Remittance Advice.

What income affects Medicare premiums?

How much will I pay for premiums in 2022?Yearly income in 2020: singleYearly income in 2020: married, joint filing2022 Medicare Part B monthly premium> $114,000–$142,000> $228,000–$284,000$340.20> $142,000–$170,000> $284,000–$340,000$442.30> $170,000– < $500,000> $340,000– < $750,000$544.30≥ $500,000≥ $750,000$578.302 more rows•Nov 16, 2021

Are Medicare premiums adjusted annually?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

What is the Medicare premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What is VBPM in Medicare?

The Value-Based Payment Modifi er (VBPM) Program adjusts payment rates under the Medicare Physician Fee Schedule based on an eligible professional’s performance on quality and cost categories. The Centers for Medicare & Medicaid Services (CMS) began phasing in application of the modifi er in 2015. Starting in 2017, payment rates for all group and solo practitioners will be subject to the VBPM. In 2018, all group and solo practitioners will receive an upward, neutral, or downward payment adjustment based on quality-tiering. Physicians who do not demonstrate higher quality or lower costs may receive lower payments. The VBPM is based on performance two years prior (e.g., application of the VBPM in 2017 will be based on performance in 2015). Eligible professionals may avoid automatic downward payment adjustments by successfully participating in the PQRS.

What is Medicare Access and CHIP Reauthorization Act?

The law repeals the sustainable growth rate (SGR) methodology and paves the way for physician payment reform. MACRA establishes two payment pathways for physicians: alternative payment models (APMs) and the Merit-Based Incentive Payment System (MIPS). Under MIPS, three existing Medicare quality programs will be consolidated into one program. The key Medicare initiatives described in this handout will remain in place through 2018 and will continue to present a unique opportunity for you to demonstrate the quality of care you provide. They potentially can increase your net revenue through payment adjustments that, in some cases, reward value in primary care rather than volume.

What is Medicare sequestration?

A: Sequestration is a mandatory payment reduction in the Medicare Fee-For-Service (FFS) program, set forth in the Budget Control Act of 2011 . This Act, among other things, requires mandatory across-the-board reductions in Federal spending, called “sequestration.”.

Do Medicare Part B payments apply to MIPS?

They do not apply to payments for Medicare Part B drugs or other items/services that are not covered professional services. When a 2019 MIPS payment adjustment is applied to a payment made to a MIPS EC, the following codes are displayed on your RA:

What is contractual adjustment in Michigan?

The Michigan Department of Community Health (MDCH) defines a contractual adjustment as the difference between the provider’s charges less any third party obligations (payment plus co-pays, deductible and co-insurance).

Can a Medicare provider bill a beneficiary?

A provider is prohibited from billing a Medicare beneficiary for any adjustment (Its a write off) amount identified with a CO group code, but may bill a beneficiary for an adjustment amount identified with a PR group code. Medicare contractors are permitted to use the following group codes: