What is Plan E?

- Plan E is a Medicare supplement (Medigap) plan that has not been available to new Medicare subscribers since 2009.

- Unless you had Plan E before January 1, 2010, you may not purchase it, but if you have Plan E, you can keep it.

- Since so few people have Plan E, it may be more expensive than other similar Medigap plans. ...

Full Answer

What are the best Medicare plans?

... Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers. Sign up today for a FREE virtual event and let Silver Supplements Solutions help you understand your best option for your own peace of mind!

Which Medicare plan is best for You?

Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. Plans may have lower out-of-pocket costs than Original Medicare. In many cases, you’ll need to use doctors and other providers who are in the plan’s network and service area for the lowest costs.

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

Which Medicare Prescription Plan is best?

- Medicare Advantage, also known as Part C is an alternative to Original Medicare.

- Medicare Advantage is run by private Medicare-approved insurance companies.

- Medicare Advantage is a bundle of Original Medicare, but provides more benefits than just Part A, Part B, and Part D (most plans), such as dental, hearing and vision, which ...

What is Medicare Part E for?

Medigap Plan E helps cover your basic Medicare expenses, including some Part A and Part B costs, blood transfusions, and foreign travel medical costs. Medigap Plan E is no longer available to new Medicare beneficiaries but if you already have the plan, you can continue to use the benefits available to you.

What are 4 types of Medicare plans?

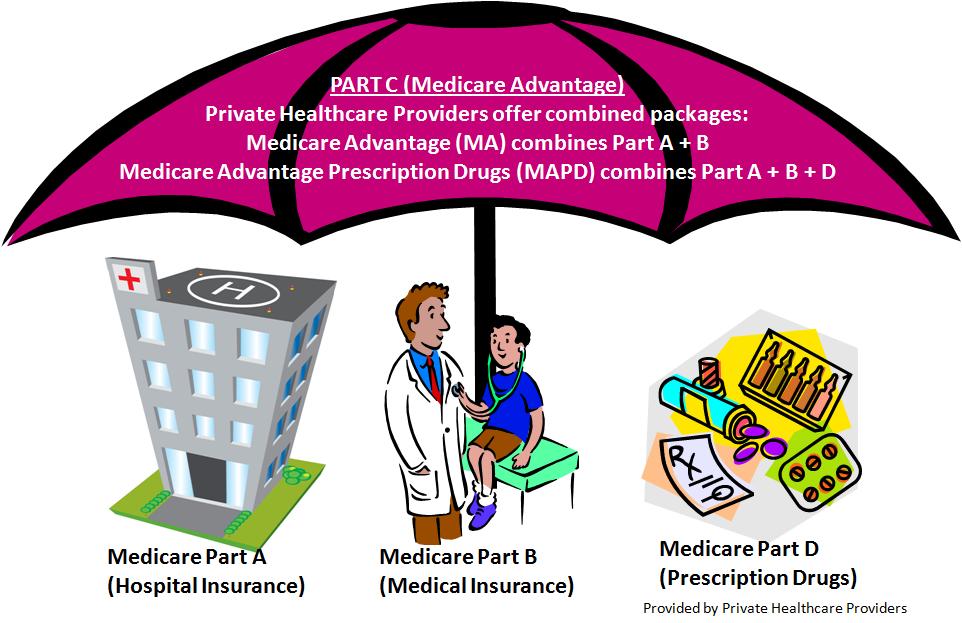

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Does Medicare Part E cover prescriptions?

Medigap Plan E does not cover prescription drugs. Medigap plans can only help cover certain out-of-pocket Medicare costs, such as deductibles and copayments. If you want to get Medicare prescription drug coverage, you have two options: You can enroll in a Medicare Advantage Prescription Drug plan (MAPD).

What are the 2 types of Medicare plans?

Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). You can join a separate Medicare drug plan to get Medicare drug coverage (Part D). You can use any doctor or hospital that takes Medicare, anywhere in the U.S.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is Medicare Plan F?

Medigap Plan F is a Medicare Supplement Insurance plan that's offered by private companies. It covers "gaps" in Original Medicare coverage, such as copayments, coinsurance and deductibles. Plan F offers the most coverage of any Medigap plan, but unless you were eligible for Medicare by Dec.

Is it worth getting Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What will Medicare not pay for?

Generally, Original Medicare does not cover dental work and routine vision or hearing care. Original Medicare won't pay for routine dental care, visits, cleanings, fillings dentures or most tooth extractions. The same holds true for routine vision checks. Eyeglasses and contact lenses aren't generally covered.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Who has the best Medicare plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Jun 22, 2022

What is Medicare Part C called?

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

What happened to Medicare Supplement Insurance Plan E?

In 2003, Congress passed the Medicare Prescription Drug, Improvement and Modernization Act, which expanded certain Original Medicare benefits. This...

What does Medicare Supplement Plan E cost?

Medigap plan costs may vary based on factors such as age, gender, health, how your insurance company rates (prices) its plans, and where you live.

Does Medicare Supplement Plan E cover prescriptions?

Medigap Plan E does not cover prescription drugs. Medigap plans can only help cover certain out-of-pocket Medicare costs, such as deductibles and c...

Should I switch from my Medigap Plan E to another Medigap plan?

The first thing to consider is the plan cost. Because no new members are being accepted into Plan E, the overall plan risk pool can only increase i...

What is Medicare Plan E?

Medicare Plan E is a Medicare supplement (Medigap) plan that is no longer available to new enrollees in Medicare. However, some of the people who purchased this plan before its discontinuation still have it.

What is Medicare Supplement Plan E?

Summary. Medicare Supplement Plan E is a former Medicare supplement insurance (Medigap) plan that has not been available to new enrollees since 2010. However, if a person already has Plan E, they may keep it. Original Medicare pays for most, but not all, healthcare costs. Medigap plans help cover some of the remaining costs ...

Why do people choose Medigap?

A person may choose a Medigap plan to help with costs that original Medicare does not cover. Medicare-approved private health insurance companies administer Medigap plans, which help fill any gaps that original Medicare has in its coverage. These coverage gaps include: Medigap plans do not help with Medicare premium costs.

What are the benefits of Plan E?

The benefits of Plan E include coverage of: Part A copayment. Part B coinsurance. the first 3 pints of blood that a person may need. Part A deductible. SNF daily copayment. 80% of emergency care costs outside the U.S. up to $120 per year for extra preventive care that original Medicare does not cover.

What is a copayment for Medicare?

Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

Does Medigap cover premiums?

Medigap plans do not help with Medicare premium costs. Different Medigap plans have various benefits and levels of coverage. Covered expenses may include: deductibles for a hospital stay. coinsurance for a skilled nursing facility (SNF) emergency healthcare that a person receives outside the United States.

Does Medicare cover DME?

Before 2003, original Medicare did not cover certain types of durable medical equipment (DME) or some home healthcare, and Medigap Plan E helped cover some of these costs. In 2003, Congress passed the Medicare Prescription Drug, Improvement, and Modernization Act, which saw an increase in original Medicare coverage.

What does Medicare Supplement Plan E cost?

Medigap plan costs may vary based on factors such as age, gender, health, how your insurance company rates (prices) its plans, and where you live.

What happened to Medicare Supplement Insurance Plan E?

At the time, certain Medigap plans – such as Medigap Plan E – covered some of these services and devices for people who joined those plans.

What happened to Plan C and Plan F in 2020?

Medicare Supplement Insurance Plan F offers more standardized benefits than the other current Medicare Supplement plans.

What is the most popular Medicare plan?

Plan F and Plan G are the two most popular Medigap plans. Plan F is the most popular Medigap plan currently available. 53 percent of all Medicare Supplement Insurance beneficiaries are enrolled in Plan F. 1. Plan G is the second-most popular Medigap plan currently available. 17 percent of all Medigap beneficiaries are enrolled in Plan G.

What is Medicare Part D?

The 2003 law also introduced Medicare Part D plans, which are standalone Medicare prescription drug plans (PDP) sold by private insurance companies. Due to this law, Medicare Advantage plans (Medicare Part C) can also offer prescription drug coverage.

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

What is a PDP plan?

These plans cover all of the same hospital and medical insurance benefits that are covered by Original Medicare, as well as prescription drug costs. Many plans also offer benefits such as routine hearing, vision and dental. You can enroll in a standalone Medicare Part D Prescription Drug plan (PDP).

When did Medicare Supplement Plan E end?

Overview of Medicare Supplement Plan E. Medicare Supplement Plan E is one of the four Medicare Supplement Plans that was eliminated on June 1st, 2010 due to the Medicare Modernization Act.

Is it ok to have an old Medicare supplement?

With an increase in these types of standard Medicare coverage, it does not make sense to have one of the "old" Medicare supplement plans, because you will simply be paying for additional benefits on your Medicare Supplement Policy that you get for free by just having Medicare.

Is Medicare Supplement Plan J a duplication?

With this upgrade in Medicare coverage, some of the "old" Medicare Supplement Plans were eliminated due to the duplication of benefits.

Is it a good idea to purchase a Medicare Supplement Plan?

It is a good idea to consider purchasing a more current "Modernized" Medicare Supplement Plan that will cover the gaps left by Medicare, but one that will not duplicate benefits already provided as standard coverage.

How long do you have to be in a hospital to be eligible for Medicare?

You must meet Medicare's requirements, including having been in a hospital for at least 3 days and entered a Medicare-approved facility within 30 days after leaving the hospital: First 20 days. All approved amounts. $0. $0. 21st through 100th day. All but $137.50 a day. Up to $137.50 a day. $0.

How much is the Part A deductible for nursing?

The Basic Benefits, the Part A deductible of 1100.00 is paid by the plan and Skilled Nursing Coinsurance is included in this plan. The plan pays the Part A Deductible of $ 1100.00 per benefit period. The Plan pays up to $ 120.00 for preventative not paid by Medicare per year. Click here to start your free quote.

Is Plan E still available?

Plan E is no longer available for sale. If you currently have a plan E you will be grandfathered in and can keep the plan. If you would like to look at the 2019 Modernized plans click here. You pay the Part B excess when you see a provider that does not accept Medicare Assignment.

Is a dipstick urinalysis covered by Medicare?

BENEFIT- NOT COVERED BY MEDICARE. Some annual physical and preventative tests and services such as: digital rectal exam, hearing screening, dipstick urinalysis, diabetes screening, thyroid function test, tetanus and diphtheria booster and education, administered or ordered by your doctor when not covered by Medicare: