Plan N covers basic Medicare benefits including:

- Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end

- Medical Expenses: pays Part B coinsurance excluding $20 copay for office visits and $50 copay for ER—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services

- Blood: pays for the first 3 pints of blood each year

Is Medicare plan N a cost-effective choice?

"If you are pretty healthy and don't go to the doctor often, Plan N may be a more cost-effective option than Plan G," says Medicare expert Danielle Roberts. "If you go to the doctor once a month, Plan G would likely be more cost-effective than Plan N."

What does plan N cover in Medicare?

Plan N covers basic Medicare benefits including:

- Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end

- Medical Expenses: pays Part B coinsurance excluding $20 copay for office visits and $50 copay for ER—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services

- Blood: pays for the first 3 pints of blood each year

Which Medicare plan is best for You?

Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. Plans may have lower out-of-pocket costs than Original Medicare. In many cases, you’ll need to use doctors and other providers who are in the plan’s network and service area for the lowest costs.

How does Medicare supplement plan N work?

Other examples of how Medicare supplement plans work with Medicare include:

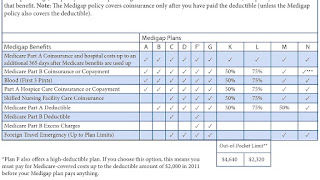

- All plans include coverage for blood work at varying levels; Plan K covers it 50 percent and Plan L covers it at 75 percent. ...

- If you have to endure a lengthy hospital stay, a Medicare supplement plan can save you money. ...

- Medicare supplement plans don’t cover routine dental or vision care, hearing aids, glasses, private nursing or long-term care. ...

What is the difference between plan G and plan N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

What is the difference between Medigap plan D and plan N?

The benefits of Medigap Plan N are similar to Plan D's policy, the sole exception being how it covers Medicare Part B coinsurance costs. Under Medigap Plan N, 100% of the Part B coinsurance costs are covered, except up to a $20 copayment for office visits and up to $50 for emergency room visits.

What is the N policy?

Medicare Supplement Plan N is one type of insurance policy that you can purchase to help lower your out-of-pocket costs from Medicare. These plans can cover costs like premiums, copays, and deductibles.

What is the difference between plan F and N?

Plan N premiums are typically lower than Plan F premiums, meaning, you spend less out of pocket monthly with Plan N than you will with Plan F. However, Plan F covers more out-of-pocket expenses. If you know that you will have many medical expenses throughout the year, Plan F may be a better choice.

Does plan N have copays?

With Plan N, you are responsible for copayments up to $20 when you visit the doctor's office (or up to $50 for emergency room visits). You are also responsible for any excess charges, the additional amount a doctor may charge for services above what Medicare covers.

What is the deductible for Medicare Plan N?

What does Plan N cover? Plan N covers the Medicare Part A deductible of $1,556, coinsurance for Parts A and B, three pints of blood and 80% of medical costs incurred during foreign travel. Plan N does not provide coverage for the Medicare Part B deductible ($233 in 2022).

Does plan N cover prescriptions?

Like all Medigap plans, Medicare Supplement Plan N coverage does not include prescription drugs. If you want prescription coverage you can purchase Medicare Part D. Medicare Plan N also does not cover dental, vision, or hearing. If you want coverage for these services, consider a Medicare Advantage plan.

Is plan N guaranteed issue?

While Plan N does have a potential of fees that the patient is responsible for, its rate increase history has and will remain low as it is not a guaranteed issue plan. This secures your client in a stable plan for a longer amount of time.

Can you switch from plan N to plan G?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to answer health questions to switch. Your approval is not guaranteed.

Can I switch from plan N to plan G without underwriting?

You can change Medigap carriers, while keeping the same level of coverage, during the months surrounding your Medigap anniversary. For example, you can switch from a Plan G to a Plan G without underwriting, but not from a Plan G to a Plan N.

Is there a Medicare plan that covers everything?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

Is plan G as good as plan F?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

How much does Plan N cost monthly?

Plan N does not have a set premium but ranges from $85 to $200. The premium will depend on several factors such as zip code, gender, age, tobacco u...

What is the deductible for Plan N?

In 2022, the deductible is $233 which is the Part B annual deductible that you are responsible for with Plan N. The Part B deductible is one gap th...

What is the difference between Plan G and Plan N?

Plan N has more out-of-pocket than Plan G, but the premium for Plan N is typically lower. You must pay up to $20 copays for office visits and up to...

Can I switch from Plan N to Plan G?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to ans...

Do people prefer Plan N over Plan G?

Plan N is very appealing as it tends to have lower premiums than Plan G. For those who don’t visit the doctor often, this plan may be a great fit!...

What is Medicare Plan N?

Medicare Plan N is a supplemental policy that typically has lower premiums while you pay your Part B deductible, excess charges and some copays for doctor and emergency visits. It has been popular since it was first introduced in 2010. Also called Medigap Plan N, this option was created for consumers who like the idea ...

What is Medicare Supplement Plan N?

Also called Medigap Plan N, this option was created for consumers who like the idea of paying a lower premium in exchange for taking on a small annual deductible and some copays. All Medicare Supplement Plan N policies are the same, no matter which insurance company you choose.

How much is the Part B deductible for 2021?

First, you agree to pay the small annual Part B deductible ($203 in 2021). You will also pay co-payments up to $20 for doctor appointments. Emergency room visits have a $50 copay. Finally, people with Medigap N also pay excess charges to some medical providers. Providers can charge 15% more than what Medicare allows.

What is the difference between Medicare Plan N and Plan G?

People who enroll in Plan N also often look at Plan G as an alternative because Plan G is only slightly more expensive. The primary difference is that Plan G covers the little copays and excess charges so there are less bills showing up in your mailbox.

How much does Medicare pay for a medical bill?

Medicare pays 80% and then sends the bill to your Medigap plan. If your doctor does not accept Medicare assignment, you will pay a 15% excess charge. Read more about how this would work in our Medigap Plan N Example below.

When is the best time to enroll in Medicare Plan N?

You must also live in the plan’s service area. The best time to enroll in Medicare Plan N is during your Medigap Open Enrollment Period. This six-month window starts with your Part B effective date. It’s your one chance to enroll in any Medigap plan without health underwriting.

Does Plan N cover hospital deductible?

For inpatient care, Medicare Supplement Plan N fully covers her hospital deductible.

What is Medicare Plan N?

Medicare Plan N is a type of Medigap insurance that supplements the expenses of Original Medicare. Learn more about the benefits of Plan N and what’s covered. Everyday Health may earn a portion of revenue from purchases of featured products. To enroll in a Medigap Plan N policy, you need to apply with the insurance company directly. Shutterstock.

When to enroll in Medigap Plan N?

The ideal time to enroll in a Medigap Plan N policy is during your Initial Enrollment Period, which extends from the three months before your 65th birthday through your birthday month, and ends three months later.

How much does Medicare pay for a doctor's office visit?

Excess charges incurred by Medicare Part B-approved services. Medicare Part B copay of up to $20 for doctor’s office visits, or up to $50 for non-inpatient emergency room visits. Prescription drug costs. Vision, dental, and hearing services.

How much is Medicare Part A deductible?

The Medicare Part A deductible, which is $1,408 in 2020. Part A hospital coinsurance and other costs incurred up to a year after the cap is reached. One hundred percent of Medicare Part B coinsurance (You might have to pay a small copay for some services.) Medicare Part A–approved hospice care coinsurance or copayments.

Which states have Medigap plans?

Most states require insurance providers to offer Medigap plans that are standardized, including Plan N. The only exceptions are Massachusetts, Minnesota, and Wisconsin. If you live in one of these three states, you can click the corresponding link above to see what your options are.

Does Medigap cover vision?

Otherwise, you’ll have to pay out of pocket. Medigap policies don’t offer extra services beyond the realms of the basic hospital and medical insurance coverage from Original Medicare. This means they don’t offer perks like vision, dental, and hearing coverage.

Does Medicare cover prescription drugs?

One important thing to know about all Medigap plans (not just Plan N) is that they don’t cover prescription drugs. For this reason, if your doctor prescribes you a medication to take regularly, you might want to look into adding a stand-alone Medicare Part D prescription drug plan to cover the cost of your medication.

What is Medicare Supplement Plan N?

Medicare Supplement Plan N: Understanding the Costs. Plan N is a Medicare supplement (Medigap) plan that helps cover the costs of medical care. Federal law ensures that no matter where you purchase your Medigap Plan N, it will include the same coverage. The cost for Medigap Plan N may vary based on where you live, when you enroll, and your health.

How long does Medicare plan N last?

Plan N coverage includes: Part A coinsurance and hospital costs for up to an additional 365 days after you use your Medicare benefits.

How long does it take to get Medicare Part B?

This is a 6-month period that begins the month you are both age 65 or older and enrolled in Medicare Part B. A company can not use medical underwriting during this initial enrollment period to sell you a policy. This means they cannot consider your overall health and medical conditions when they sell you a policy.

When to enroll in Medigap Plan N?

The cost for Medigap Plan N may vary based on where you live, when you enroll, and your health. Enrolling in Medigap when you’re first eligible, around your 65th birthday, is the easiest way to get the lowest cost. Medicare Supplement Plan N, also called Medigap Plan N, is a type of supplemental insurance to help cover some ...

Can you still buy a medicaid policy after open enrollment?

This means they cannot consider your overall health and medical conditions when they sell you a policy. The insurance company must sell you the policy for the same price they sell it to people who are in general good health. You can still purchase a Medigap policy after your Medicare open enrollment period.

Is Medigap Plan N a supplement plan?

The takeaway. Medigap Plan N is one example of a standardized Medicare supplement plan. The plan may help you avoid out-of-pocket costs associated with Medicare. You can compare plans through sites such as Medicare.gov and by contacting private insurance companies.

How it works

Once Medicare pays its approved amount for health care costs and services, Medigap Plan N will supplement “gaps” left in your coverage. For example, Plan N can cover your Medicare Part A deductible or assist with your Medicare Part B copay.

How much does Medigap Plan N cost?

Medigap plans are regulated by the government but sold by private companies. The cost of a Medigap Plan N policy varies based on factors including age, location and tobacco use. In a representative California ZIP code (92589) in 2022, monthly Plan N premiums for a 65-year-old nonsmoker range from $95 to $189.

Compare alternative plans

About the authors: Jason Jenkins is a freelance writer specializing in consumer credit and debt. Read more