A “Medicare Set Aside” or “MSA” is essentially a trust fund created as part of a workers’ compensation settlement that allows money for future medical treatment to be set aside for reimbursing Medicare. In this situation, Medicare will only begin paying medical expenses resulting from the workplace injury after the MSA has been fully depleted.

How long does it take to get Medicare set aside?

The process typically begins with a referral to a Medicare set-aside vendor or consultant. Most vendors and consultants can complete the Medicare set-aside allocation within a week or two of receiving a copy of the medical records and prescription history.*

Do we have to pay workers comp?

Your insurance company will still charge you. The reason they will charge you is because the subcontractor, if injured on a job working for you, can file a claim under your Workers Comp policy, and the carrier will likely be required to pay it.

Can I see my own doctor for workers comp?

You have the right to seek medical treatment. This may be your own doctor or a doctor of a managed care organization (MCO), depending on your employer’s workers’ compensation insurance policy. You have the right to return to work if you are released for work by your doctor.

Can I get the money from a Medicare set aside?

Using a Medicare set-aside arrangement, you can set aside the money you’ll need for treatment. The money in your Medicare set-aside arrangement will then be used to pay for the care you need as a result of your injury or illness. Common expenses include:

How does a Medicare set aside work?

Settlement funds are 'set aside' in a special account to pay claimants' future medical treatment and service costs. Once the funds are exhausted, Medicare will begin paying for the injured person's qualified medical expenses.

What happens if you spend your MSA?

Simple answer: When MSA funds are exhausted, Medicare will begin to pay for all covered items related to your injury, only if you have properly managed your MSA funds and reported your spending to Medicare, and if you are enrolled as a beneficiary on Medicare.

What is an MSA payment?

An MSA is a financial arrangement that allocates a portion of a settlement, judgment, award, or other payment to pay for future medical services. The law mandates protection of the Medicare trust funds but does not mandate an MSA as the vehicle used for that purpose.

Can I manage my own Medicare set aside?

Medicare beneficiaries may choose to self-administer their CMS-approved WCMSA or have it professionally administered on their behalf.

What happens to unused Medicare set aside?

The Centers for Medicare & Medicaid Services Self Administration Toolkit indicates that: If you have funds left over at the end of a year, they remain in the account and are carried forward to the next year. The following year, you will be able to use the annual deposit money as well as whatever was carried forward.

How do I stop Medicare set aside?

The short answer is if your settlement includes future medical expenses and there's likelihood a cost-shift could occur to Medicare (i.e. Medicare could reasonably be expected to pay for injury-related medicals), then it is not advised to attempt to avoid a Medicare Set Aside.

Why is an MSA necessary?

An MSA is never required, but workers' compensation insurance companies usually want to have this process completed as a way to prove no one is trying to shift the burden of medical treatment from private insurance to the public medicare system without some payments to medicare.

What are MSA requirements?

To have an MSA reviewed by CMS, the minimum amount of the total settlement must be more than $25,000 for a Medicare beneficiary, or $250,000 for a claimant with reasonable expectation of Medicare enrollment within 30 months of the settlement date.

Is Medicare set aside taxable?

In most cases, the entire amount paid out in a personal physical injury settlement is non-taxable. So, your MSA funds, as part of that settlement are also not taxed upon receipt. The injured party is responsible for taxes on interest earned on their MSA funds.

What is MSA seed money?

An initial deposit of “seed money” is used to fund the MSA. The amount of the seed deposit totals the first surgical procedure or replacement and two years of annual payments. The structured settlement then funds the MSA with annual deposits.

How do I set up an MSA account?

You must open an MSA through your health plan provider. Your provider will then open your account with Optum Bank, Member FDIC. Your health plan provider will then deposit money into your account.

What is a non submit MSA?

A Non-Submit Medicare Set-Aside (MSA), sometimes called an Evidence-Based MSA, may be appropriate when the settlement does not meet the Centers for Medicare and Medicaid Services (CMS) Workers' Compensation Medicare Set-Aside Arrangement (WCMSA) review thresholds or in situations where the settling parties have decided ...

What is an MSA?

A Workers' Compensation Medicare Set-Aside Arrangement (WCMSA) is a financial agreement that sets aside a portion of a workers' compensation injury...

What is the purpose of an MSA?

The WCMSA was created under federal law because Medicare does not want to pay for medical care that should have been the responsibility of a worker...

When is an MSA used?

A WCMSA will be necessary any time an injured worker: is on Medicare or may be in the near future; and settles his or her future medical care with...

How is a WCMSA calculated?

When an injured worker's condition has stabilized at the permanent and stationary date, the treating doctor can determine the future medical care a...

What happens to the WCMSA report?

Medicare will review the WCMSA if the: amount of the settlement money is over $25,000; and injured worker is a Medicare beneficiary. Medicare will...

How Long does Medicare take to review an MSA report?

The timeline for review of an MSA report by Medicare can vary significantly from weeks to many months. The delays can be frustrating to the injured...

What does it mean if Medicare approves the set-aside?

If Medicare agrees to the set-aside amount, it will pay benefits once the money in the set-aside is used up. Depending on the type of occupational...

How does an MSA work after a settlement?

When there is a Compromise and Release settlement, the amount going to the MSA can be put in a special bank account. The special account should onl...

What happens if an injured worker spends the money in an MSA?

There is nothing to prevent an injured worker from spending the MSA money on something else. However, if the injured worker then needs treatment fo...

What is the effect of an MSA in workers' compensation settlement?

An MSA can protect an injured worker from having to pay for medical costs on his or her own. Because an MSA is a detailed analysis of future medica...

What is a workers compensation set aside?

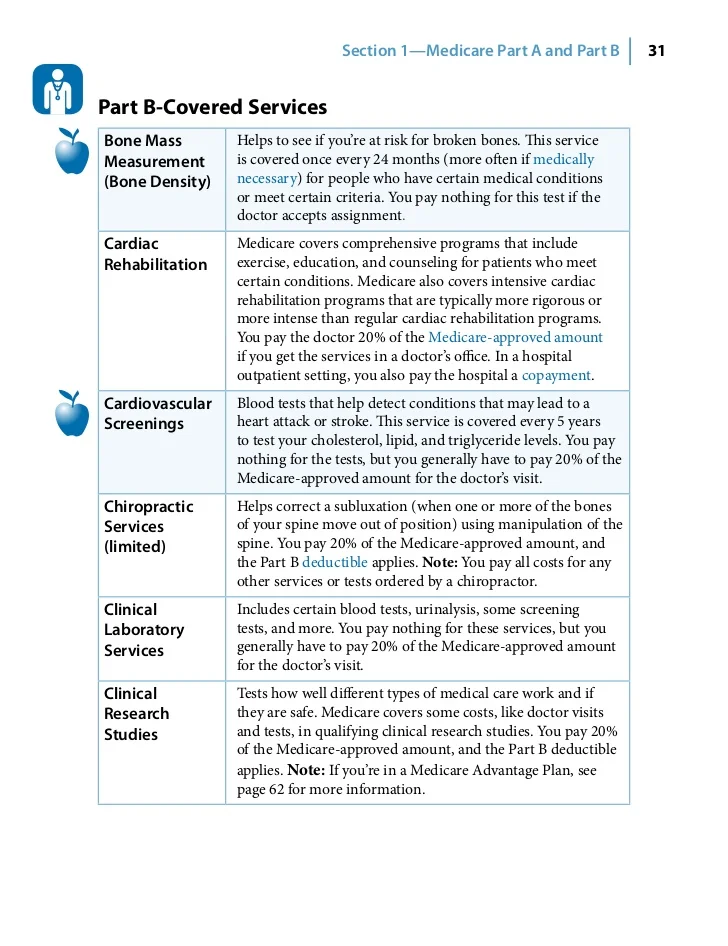

A Workers’ Compensation Medicare Set-aside Arrangement (WCMSA), often called “Medicare set-aside,” involves some of the money from a workers’ compensation settlement being allocated for future costs that Medicare would typically cover. Medicare has strict guidelines about how a person can use the funds in their set-aside account.

When do you have to use set aside funds for Medicare?

Settlement recipients must use the set-aside account funds in their entirety before Medicare starts to cover the costs of care related to the illness, injury, or disease reported in the claim for compensation.

What does WCMSA go toward?

Money in a WCMSA account must go toward future medical expenses related to the work-related injury or illness. The costs must be among those that Medicare typically covers, including prescription drug expenses. Individuals may not use the funds for any services that Medicare does not cover.

What should be included in a workers compensation record?

Records should include evidence of the services and items covered by the account . A person should save their receipts, medical reports, appointment letters, and prescriptions. The paperwork should prove that the money from the set-aside account went toward medical costs related to their workers’ compensation claim.

What is MSA in WCMSA?

When a person has an WCMSA, some money awarded in a workers’ compensation settlement is placed in a separate account, called an MSA, to cover future medical needs related to the illness or injury in the claim. A person needs to use this money for Medicare-approved services.

Does Medicare approve set aside accounts?

In some cases, the workers’ compensation insurance company asks Medicare to approve a certain amount for the set-aside account. Medicare then reviews medical documentation and estimates future medical expenses related to the injury or illness in the compensation claim. Medical costs covered may include:

Does Medicare cover MSA?

Medicare helps cover a range of healthcare costs for adults ages 65 and older, as well as for some younger adults with specific health conditions. If a person receives a settlement for a workers’ compensation claim, a portion of the money is put into a WCMSA account — called an MSA — for future medical care.

What is WCMSA in workers compensation?

A WCMSA is used when an injured worker: is eligible for Medicare. settles his or her future medical care with a lump sum payment. A lump-sum settlement of future medical care in workers’ compensation cases is done through a form called a Compromise and Release. A WCMSA is calculated by:

What is it called when an injured worker settles his or her future medical care with the insurance company?

When an injured worker settles his or her future medical care with the insurance company, the settlement is called a Compromise and Release.

What is MSA medical?

medical treatment for the work injury. treatment that is with a Medicare provider. The money is for treatment that would have been paid by the workers’ compensation insurance company if not for the settlement. In an MSA, the workers’ compensation insurance company is estimating and paying for the medical care upfront.

What is a WCMSA 2021?

Updated May 18, 2021 A Workers’ Compensation Medicare Set-Aside (WCMSA or MSA) is money set aside from a workers’ compensation settlement to pay future medical benefits. The money goes toward any treatment for the work-related injury that would have been paid by Medicare.

What is a WCMSA?

A Workers’ Compensation Medicare Set-Aside (WCMSA or MSA) is money set aside from a workers’ compensation settlement to pay future medical benefits. The money goes toward any treatment for the work-related injury that would have been paid by Medicare. A WCMSA is used when an injured worker:

What is a WCMSA in Nevada?

Updated May 18, 2021 A Workers’ Compensation Medicare Set-Aside (WCMSA or MSA) is money set aside from a workers’ compensation settlement to pay future medical benefits. The money goes toward any treatment for the work-related injury that would have been paid by Medicare.

What is the purpose of WCMSA?

The account is used to pay for medical treatment whenever the injured worker gets treatment for the work injury through Medicare. There is nothing to stop an injured worker from using the set-aside funds on something else.

How much is set aside for Medicare?

Worker’s compensation Medicare set-aside arrangements (WCMSAs) are required if you receive $25,000 or more and are already enrolled in Medicare or plan to enroll within the next 30 months.

How often do you get Medicare set aside payments?

Depending on your settlement, payments might be made to you monthly, quarterly, or yearly. You’ll add money to your Medicare set-aside arrangement from a lump sum right away.

What happens if you get injured on Medicare?

If you’re enrolled in Medicare, the money from your settlement will pay for care related to that injury before Medicare does.

Where does Medicare set aside money come from?

The money in your Medicare set-aside arrangement comes from one of three sources: settlement of a worker’s compensation claim. settlement of a liability lawsuit. settlement of a no-fault car accident claim.

Do you have to keep Medicare set aside funds?

Your Medicare set-aside arrangement funds are required to be kept in a separate account from all your other assets. Your Medicare set-aside arrangement account must earn interest, and the earned interest must also be used to pay medical expenses related to your settlement. The way you add money to your Medicare set-aside arrangement will depend on ...

Is Medicare a secondary payer?

Medicare is always the secondary payer when another option, like a worker’s compensation or liability settlement, is available. This is because Medicare is taxpayer funded. Medicare doesn’t want to spend taxpayer money on your treatment if you’re already receiving money from a settlement to treat it.

Does Medicare pick up the cost of Medicare set aside?

Medicare will pick up the costs once you’ve used all the funds in your Medicare set-aside arrangement, but only if your arrangement has been set up and managed correctly. In this article, we’ll go into the details of what Medicare set-aside arrangements are, how they work, and how you can get help setting one up.

Medicare Set Aside: The Short Version

A “Medicare Set Aside” or “MSA” is essentially a trust fund created as part of a workers’ compensation settlement that allows money for future medical treatment to be set aside for reimbursing Medicare. In this situation, Medicare will only begin paying medical expenses resulting from the workplace injury after the MSA has been fully depleted.

Medicare Set Aside: The Long Version

An MSA is basically an account where some money is set aside to be used for future medical care. There are many varieties of MSA’s. Some Medicare Set Asides are professionally managed and the injured worker is given a card to use like a health insurance card.

What is Medicare set aside account?

A Medicare Set Aside account, also known as an MSA, is an important component of the workers’ compensation payment landscape. Here’s the essential information you need to know about who qualifies for them, how they work, approved expenses, etc.:

What happens when Medicare sets aside funds are exhausted?

Once all Medicare Set Aside account funds have been exhausted, a final audit is performed on expenditures. If the funds were used appropriately, then the injured person should receive Medicare benefits for medical expenses related to the claim.

How does MSA fund work?

How Does the Injured Person Access MSA Funds? MSA funds are placed into an interest-bearing account. The account may have a linked debit card , or the account holder may withdraw funds for reimbursement for expenses related to the settlement. For any expense, the account holder must keep detailed records and receipts.

What is MSA in medical?

An MSA is a settlement resulting from a workers’ compensation or personal injury claim. The settlement funds are ‘set aside’ in a special account to pay the claimants’ future costs for medical treatments and services. Once the funds are exhausted, only then will Medicare begin paying for the injured person’s qualified medical expenses ...

What is MSA settlement money?

MSA settlement money is only for approved medical services and other costs directly related to the specific injury. MSA accounts must be interest-bearing and the interest must stay in the account to be used for medical expenses. Recipients should keep ALL records and receipts for every expense paid for from the account.

Who must report Medicare set aside expenses?

Rules and Regulations. Medicare Set Aside account holders are required to report their expenditures on annual basis to the Centers for Medicare and Medicaid Services (CMS). They must hold on to all receipts in order to validate the expenses.

Who administers MSA?

MSA account administration may be performed by the injured person (self-administered) or by a professional administrator. The party who administers the MSA (individual or administrator) must keep accurate records of all disbursements from the account for CMS reporting.