Medicare Supplement Plan G covers:

- Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits run out

- Part A deductible ($1,484 in 2021)

- Part A hospice care coinsurance or copayment

- Part B coinsurance or copayment

- Part B excess charges

- Blood (the first three pints needed for a transfusion)

- Skilled nursing facility coinsurance

Which Medicare supplement plan should I Choose?

Dec 03, 2021 · Medicare Plan G is the second most popular Medicare Supplement after Plan F, partly because it covers the most gaps in coverage of any Medigap plan available to new Medicare beneficiaries who first became eligible for Medicare after January 1, 2020.

Is a Medicare supplement insurance plan worth it?

Medicare Supplement Plan G covers your percentage of any medical benefit that Original Medicare covers, except for the outpatient deductible. So, it helps to pay for inpatient hospital costs, such as the first three pints of blood, skilled nursing facility care, and hospice care.

How much does a Medicare supplement insurance plan cost?

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203. In their initial research phase, many people compare Plan G to Plan F, which covers the Part B deductible.

Which Medicare supplement plan is the most popular?

Medicare Part G – Known as Medicare Plan G – is now the most popular Medigap Plan Available. Medicare Supplement Plan G covers 100% of the gaps in Medicare Part A & B with only one small deductible to pay. More people will enroll in Medicare Plan G …

Is Plan G Good for Medicare?

Medicare Plan G is the most popular Medicare Supplement plan among those newly eligible for Medicare. That's not surprising since Plan G has the most comprehensive coverage (except for Plan F, which isn't available to new beneficiaries).Sep 22, 2021

Is Plan G as good as Plan F?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.Feb 18, 2021

What is the monthly premium for Plan G?

The cost of Medicare Supplement Plan G varies depending on multiple factors, including where you live. However, the average cost of Medigap Plan G can range from $100-$300 per month. Medicare Supplement premium prices depend on ZIP Code, age, gender, and more.Feb 4, 2022

What is the average cost of Plan G?

In most areas of the country, Plan G prices start at around $90-110/month. However, some states that are lower than that and some that are much, much higher.Oct 26, 2021

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Is Plan G guaranteed issue in 2021?

Plan G rates are among the most stable of any of the plans. There are several significant reasons for this. First of all, Plan G is not offered as a “guaranteed issue” (no health questions) option in situations where someone is losing group coverage or Medicare Advantage plan coverage.Nov 8, 2021

Does Plan G have a deductible?

Plan G also covers some of the expenses related to your Medicare policy. For example, Medicare Part A has a deductible of $1,408. If you don't have Plan G, then you'll pay that deductible out of pocket. But with Plan G coverage, your health insurer would pay for the entire deductible.Jan 24, 2022

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the deductible for Plan G?

Plan G has nearly the same level of coverage as Plan F. With Plan G, you are responsible for the Part B deductible of $233. Otherwise, coverage is exactly the same as Plan F.

Does Medicare G cover prescriptions?

Are prescription drugs covered under Medicare Supplement Plan G? Medicare Plan G does not cover outpatient retail prescriptions that are typically covered by Medicare Part D. It does, however, cover the coinsurance on all Part B medications.May 27, 2020

How much does AARP plan G cost?

In states with this pricing structure, the average monthly cost for the AARP Medigap Plan G is $124 per month for someone who is 65 years old. At age 75, the average monthly premium is $199, and it's $209 for those aged 85.Jan 24, 2022

What is the difference between Plan G and high deductible plan G?

What is the difference between Plan G and High Deductible Plan G? High Deductible Plan G offers the same benefits as Plan G. Yet, while High Deductible Plan G comes with a lower monthly premium, beneficiaries also must pay the higher deductible before receiving full coverage.Mar 1, 2022

What is the average cost of Plan G?

There is no set premium for Plan G as plans can range from $100 to $200. Your monthly premium will depend on your location and zip code, your gende...

What is the Plan G deductible in 2022?

$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separ...

What is the difference between Plan N and Plan G?

The biggest difference between these two is your out-of-pocket costs. With Plan N you will be responsible for the Part B deductible, $20 copay for...

What Does Medicare Plan G pay for?

Plan G pays for your hospital deductible and all copayments and coinsurance under Medicare. For example, this would include the hospice care coinsu...

Does Medicare Plan G cover dental?

No, since Medicare does not cover routine dental care, a Medigap policy will not either. However, medically necessary dental services can be covere...

Does Plan G cover prescriptions?

Plan G will cover the coinsurance on any Part B medications. These are typically drugs that are administered in a clinical setting, such as chemoth...

Which is better, Medicare Plan F vs G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more th...

What is Medicare Plan G?

Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $203 in 2021. In fact, if you have a Plan F that has been in place for years, we can probably help you on premiums by looking ...

What is Plan G?

After that, Plan G provides full coverage for all of the gaps in Medicare. It pays for your hospital deductible, copays and coinsurance. It also covers the 20% that Part B doesn’t cover.

Why is Medicare Plan G so popular?

It is because Medigap Plan G is also a long-term rate saver. Medicare Supplemental Plan G has a lower rate increase trend from year to year than Plan F.

Does Frank have a medicare plan?

Frank is a diabetic who has Medicare Supplement Plan G. He sees his primary care doctor once per year, but visits his endocrinologist several times a year to renew his prescriptions. In January, he goes to his first doctor visit for the year. The specialist bills Medicare, which pays 80% share of the bill except for the $203 outpatient deductible, which is billed to Frank.

What is the difference between Medigap Plan G and Plan N?

With Plan N you will be responsible for the Part B deductible as well as excess charges. With Medigap Plan G, you will be responsible for the Part B deductible but you will have no excess charges.

Which is better, Plan F or Plan G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more than Plan G since it picks up the annual Part B deductible. COMPARE PLANS AND PRICING.

Does Medicare pay for inpatient hospital?

So, it helps to pay for inpatient hospital costs, such as blood transfusions, skilled nursing, and hospice care. It also covers outpatient medical services such as doctor visits, lab work, diabetes supplies, durable medical equipment, x-rays, ambulance, surgeries and much more. Medicare pays first, then Plan G pays all the rest after you pay ...

What is a G plan?

This means that Plan G will be the plan with the most comprehensive coverage available to you. Additionally, you will have the option to sign up for a High Deductible Plan G. If you currently have a Plan F and are considering switching, we can help you evaluate your options.

What is the Medicare Supplement Plan G deductible for 2021?

With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203.

Medicare Plan G Coverage

Probably the easiest way to explain what Medicare Plan G covers, is to simply explain what it doesn’t cover. Medigap Plan G pays 100% of the gaps in Medicare (All costs) except for the annual Medicare Part B deductible.

Medicare Supplement Plan G – What it Pays

The following is a list of the rest of the items that Medicare Plan G pays. These are the most common things you might run into when using your coverage.

Medicare Plan G vs Plan F

Medicare plan F used to be the plan with the highest coverage. It paid 100% of all your medical bills for you, including the Medicare Part B deductible.

Medicare Part G Cost

Medicare Plan G varies in cost based on where you live, your age, gender, tobacco use, and if you qualify for a household discount or not. The cost for Plan G Medicare ranges from $85 – $120 per month.

What is Medicare Plan G?

December 12, 2019. Plan G is a type of supplemental insurance for Medicare. Supplemental insurance plans help cover certain health care costs, such as deductibles, coinsurance, and copayments. Without a supplement plan, you’d have to pay those expenses yourself. Some people call Medicare supplement plans “Medigap” because they “fill in ...

How much does Plan G cover?

Plan G also covers 80% of emergency health care costs while in another country. However, you must pay a $250 deductible first, and the care has to occur during the first 60 days of a trip. Also, the plan sets a lifetime limit of $50,000 on this type of coverage. 5.

When is the best time to enroll in Medigap?

That’s the six months immediately after you turn 65 and sign up for Part B, when you’re guaranteed by federal law to be accepted by any plan, regardless of health.

Who is Kathryn Stewart?

Kathryn Anne Stewart. Kathryn Anne Stewart is a freelance writer who covers the intersection of health and money. She has written for Johns Hopkins Medicine, Weight Watchers, Newsmax Magazine, Franklin Prosperity Report, and the National Hemophilia Foundation, often crafting clear explanations of complex topics.

What is the difference between Plan G and Plan F?

Plan G is most similar in coverage to Plan F. The only difference is that Plan F covers your Part B deductible, while Plan G does not. Plan F will have limited enrollment for some beneficiaries beginning in 2020.

Does Medigap Plan G cover Part B?

After doing some research, Debra decided to purchase Medigap Plan G, as it will cover any Part B excess charges from her dermatologist and pay for emergency services abroad.

Can I switch Medicare Supplement Plans?

You can enroll in or switch Medicare Supplement plans at other times, but the insurance companies can deny you or charge you more based on your health. Most Medigap plans are standardized across the nation. However, if you live in Massachusetts, Minnesota, or Wisconsin, different types of plans are available.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G – What does it cover? Plan G is a great option if you’re looking for a plan that has comprehensive benefits and low out of pocket costs.#N#All Medicare Supplement Insurance Plans are Standardized by the government. This means that the plan benefits are exactly the same from company to company.

What does Plan G cover?

Plan G covers Skilled Nursing and rehab facility stays and also Hospice care.

What is Medicare Supplement Plan G?

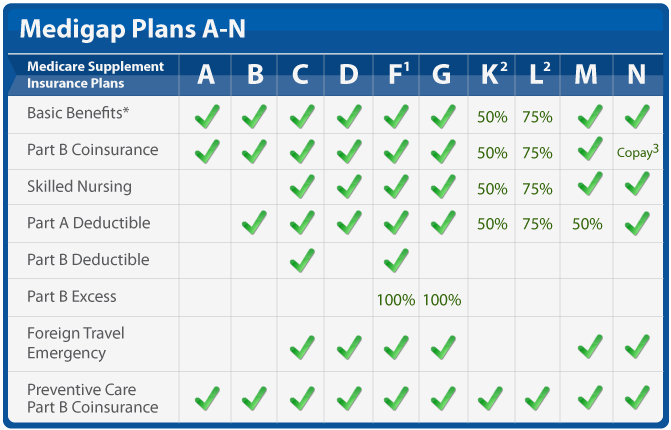

Medigap is supplemental insurance plan sold by private companies to help cover original Medicare costs, such as deductibles, copayments, and coinsurance . Medigap Plan G is a Medicare supplement plan that offers eight of the nine benefits available. This makes it one the most comprehensive Medigap plan offered.

Does Medicare Part A cover Part B?

Medicare Part A coinsurance and hospital costs up to 365 days after your Medicare benefits are used up. The only cost that Medigap Plan G doesn’t cover is the Part B deductible. On January 1, 2020, changes to Medicare meant that Plan F and Plan C were phased out for people new to Medicare.