What are the top 5 Medicare supplement plans?

Sep 13, 2019 · Medicare Supplement (Medigap) plans are designed to help pay your share of health-care costs under Medicare Part A and Part B. For example, they may pay your Medicare Part B coinsurance for Medicare-approved doctor visits and lab tests. Medicare Supplement plans are sold by private insurance companies, but they have standard benefits designed by the …

Which is the best Medicare supplement?

A Medicare Supplement is a type of health insurance sold by private insurers to cover the gaps in Medicare. This is why we refer to the plans as “Medigap Plans.” Your Medicare Supplement insurance company will issue you an card with your plan and policy information

Why should I get a Medicare supplement?

Medicare Supplement insurance plans, also known as Medigap, help supplement Original Medicare. They may help pay some of the healthcare costs that Original Medicare does pay like copayments, coinsurance and deductibles. A Medigap plan may be purchased from a private insurance company. To be eligible, you must be enrolled in Medicare Parts A and B, you must …

Which Medicare supplement plan should I buy?

services and supplies. Medicare Supplement Insurance (Medigap) policies, sold by private companies, can help pay for some of the costs that Original Medicare doesn’t cover, like copayments, coinsurance, and deductibles. Some Medigap policies also offer coverage for services that Original Medicare doesn’t cover, like emergency medical

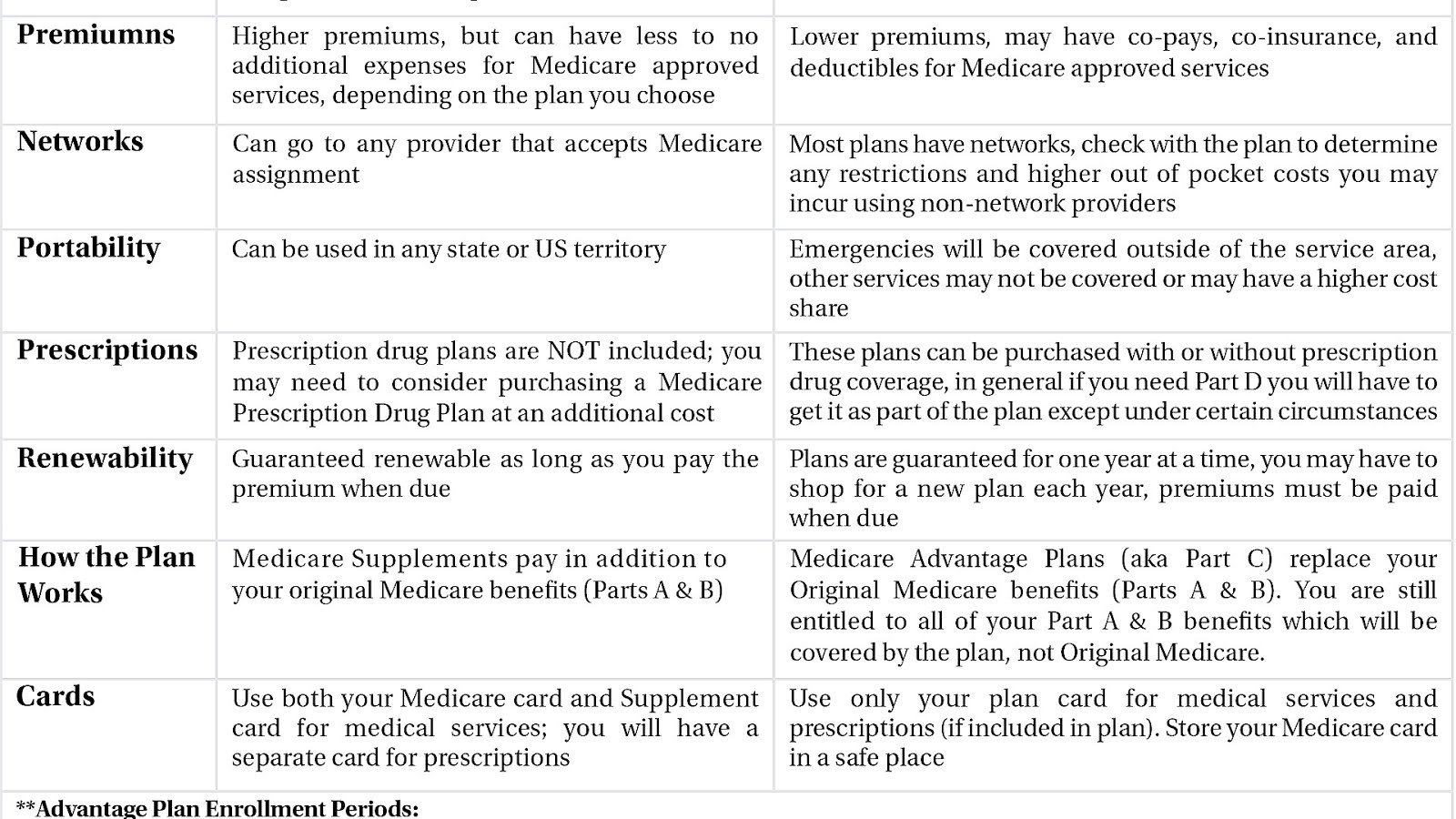

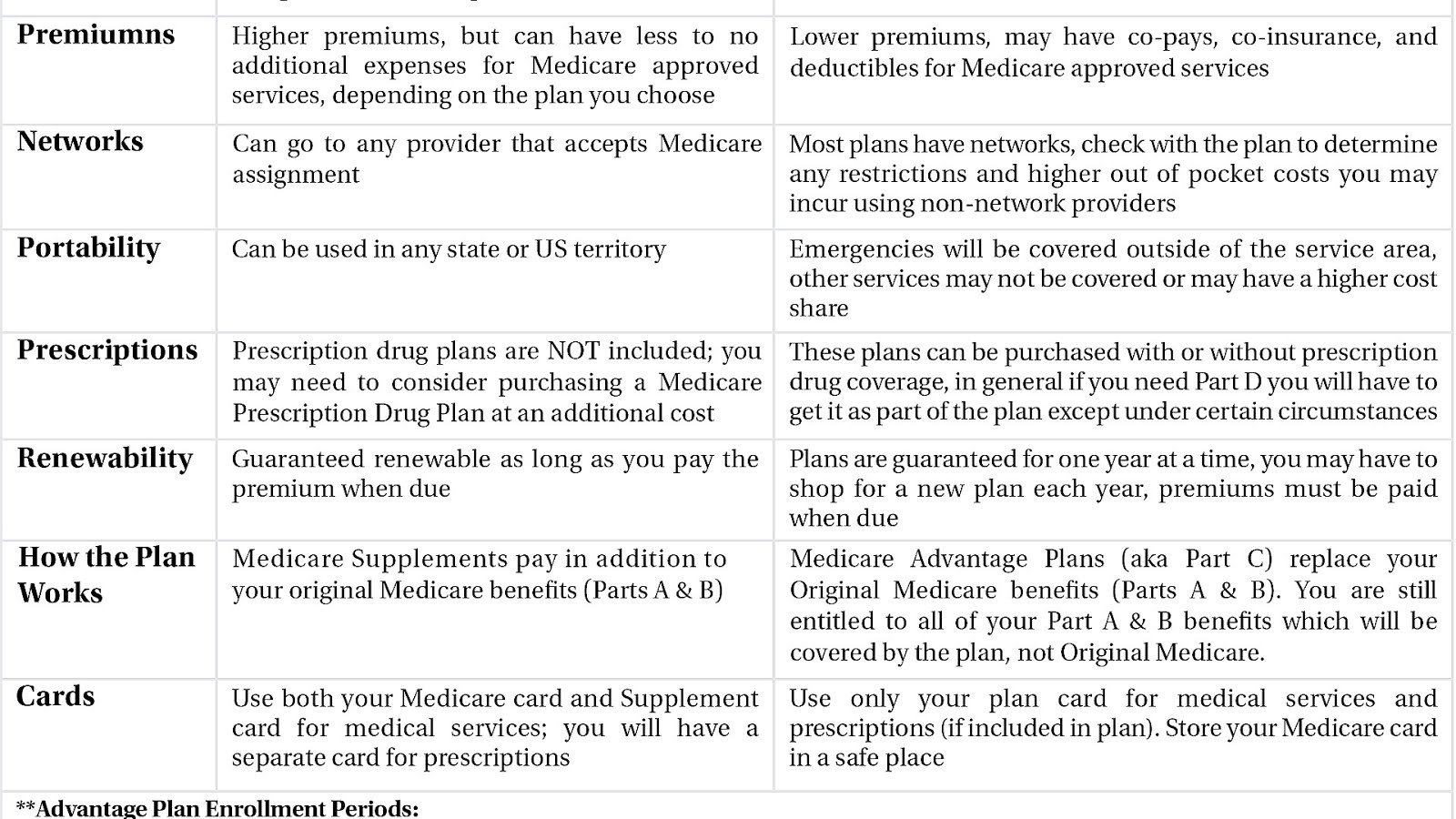

What is the difference between a Medicare Advantage plan and a Medicare Supplement?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

What is Medicare Supplement called?

Medigap is Medicare Supplement Insurance that helps fill "gaps" in. Original Medicare.

What does Medicare Supplement plan a cover?

Medicare Supplement insurance Plan A covers 100% of four things: Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days after Medicare benefits are used up. Medicare Part B copayment or coinsurance expenses. The first 3 pints of blood used in a medical procedure.

Is Medicare Supplement the same as Medigap?

Medicare Supplement and Medigap are different names for the same type of health insurance plan – you can use either name. To explain the terms themselves, you can think of “Medigap” as a plan that fills in some of the “gaps” for benefits that Original Medicare (Part A and Part B)

What is the most comprehensive Medicare Supplement plan?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

Do you have to pay for Medicare supplemental insurance?

Summary: If you have a Medicare Supplement insurance plan, you pay your premium separately from your monthly Medicare premiums, like Medicare Part B. You pay your Medicare Supplement Insurance (Medigap) premium as directed by the insurance company that sold you the plan.

Does Medicare Part G cover prescriptions?

Medicare Plan G does not cover outpatient retail prescriptions that are typically covered by Medicare Part D. It does, however, cover the coinsurance on all Part B medications. These prescriptions are typically for medications used for treatment within a clinical setting, such as for chemotherapy.May 27, 2020

What is the difference between Plan G and high deductible plan G?

What is the difference between Plan G and High Deductible Plan G? High Deductible Plan G offers the same benefits as Plan G. Yet, while High Deductible Plan G comes with a lower monthly premium, beneficiaries also must pay the higher deductible before receiving full coverage.Mar 1, 2022

What is not covered by Medigap?

Medigap is extra health insurance that you buy from a private company to pay health care costs not covered by Original Medicare, such as co-payments, deductibles, and health care if you travel outside the U.S. Medigap policies don't cover long-term care, dental care, vision care, hearing aids, eyeglasses, and private- ...Nov 18, 2020

How Do Medicare Supplement (Medigap) Plans Work With Medicare?

Medigap plans supplement your Original Medicare benefits, which is why these policies are also called Medicare Supplement plans. You’ll need to be...

What Types of Coverage Are Not Medicare Supplement Plans?

As a Medicare beneficiary, you may also be enrolled in other types of coverage, either through the Medicare program or other sources, such as an em...

What Benefits Do Medicare Supplement Plans Cover?

Currently, there are 10 standardized Medigap plans, each represented by a letter (A, B, C, D, F, G, K, L, M, N; there’s also a high-deductible vers...

What Benefits Are Not Covered by Medicare Supplement Plans?

Medigap policies generally do not cover the following health services and supplies: 1. Long-term care (care in a nursing home) 2. Routine vision or...

Additional Facts About Medicare Supplement Plans

1. You must have Medicare Part A and Part B to get a Medicare Supplement plan. 2. Every Medigap policy must be clearly identified as “Medicare Supp...

What are the benefits of Medicare Supplement?

All Medicare Supplement plans typically cover: 1 Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted 2 Some or all of your Medicare Part B coinsurance 3 Some or all of your Part A hospice coinsurance 4 Some or all of your first three pints of blood

How many Medicare Supplement Plans are there?

There are four “parts” of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

What is Medicare Part A coinsurance?

Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted. Some or all of your Medicare Part B coinsurance. Some or all of your Part A hospice coinsurance. Some or all of your first three pints of blood. Medicare Supplement Plan A is the most basic of the standardized, ...

What is community rated Medicare?

Medicare Supplement insurance companies can use one of three ways to rate, or price, their policies: Community-rated, which means everyone pays the same premium regardless of age. Issue-age rated, which means your premium is based on your age at the time you buy the policy.

How long does Medicare Supplement open enrollment last?

Your Medicare Supplement Open Enrollment Period (OEP) typically begins the month you are both age 65 or over and enrolled in Part B, and lasts for six months. If you think you will ever want coverage, it’s important to buy it during the OEP.

Is there an annual enrollment period for Medicare Supplement?

Unlike with Medicare Advantage and Medicare Part D prescription drug plans, there is no annual enrollment period for Medicare Supplement plans. You can apply for a plan anytime you want, as long as you’re enrolled in Medicare Part A and Part B.

Does Medicare Supplement cover out of pocket expenses?

Out-of-pocket costs with Part A and Part B can pile up, especially if you have a chronic health condition or a medical emergency. Medica re Supplement plans help cover those out-of-pocket Medicare costs so it’s easier to budget for your health care.

What is Medicare Supplement?

A Medicare Supplement is a type of health insurance sold by private insurers to cover the gaps in Medicare. This is why we refer to the plans as “Medigap Plans.”. Here’s an easy way to think of a Medicare Supplement. Picture it as a card that sort of bolts onto the back of your Original Medicare.

How long does Medicare cover skilled nursing?

Skilled Nursing Facility coinsurance – Medicare allows for 100 days of skilled nursing facility (SNF) care after you have been in a hospital and need nursing care while you recover. However, Medicare only pays for the first 20 days. A policy with SNF coverage will pay for the other 80 days.

What is Medicare Part B coinsurance?

Medicare Part B coinsurance or copayment – every Supplement also covers this benefit, which is one of the most important. Since Medicare only covers 80% of your Part B outpatient expenses, this benefit is what pays the other 20% for you. This can be crucial for high-ticket items like cancer treatments or dialysis.

How much is Medicare Part B deductible for 2021?

Medicare Part B deductible – in 2021, the Part B deductible is $203/year. You will pay the Part B deductible once per year for services such as doctor’s visits, lab-work, or physical therapy unless your Medicare Supplement provides this benefit.

Do you have to reapply for Medicare Supplement each year?

Also, all Medicare Supplement plans are guaranteed renewable. Therefore, you don’t have to reapply each year. There are several factors which you will want to know about each insurance carrier before you choose your Supplement though:

Does Medicare cover foreign travel?

You may wish to choose a Medicare Supplement that covers this expense. Foreign travel emergency – Since Medicare is a U.S. health insurance program, it does not offer you coverage outside our country. Some Medicare Supplements include a foreign travel benefit.

How does Medicare Supplement insurance work?

Medicare Supplement insurance plans, also known as Medigap, help supplement Original Medicare. They may help pay some of the healthcare costs that Original Medicare does pay like copayments, coinsurance and deductibles.

What do Medicare Supplement insurance plans cover? 1

All Medicare Supplement insurance plans offer the same basic benefits but some offer additional benefits. A list of basic benefits includes:

Important things to know about Medicare Supplement insurance plans 2

Medicare Supplement insurance plans are not the same as Medicare Advantage plans.

How to pick the best Medicare Supplement insurance plan for you

Everyone has unique healthcare needs. If you’re thinking about adding extra insurance to Original Medicare, check out how to pick the best Medicare Supplement insurance plan for you.

How can we help?

Licensed Humana sales agents are available Monday - Friday, 8 a.m. to 8 p.m., local time.

What is Medicare Supplement Insurance?

Medicare supplement insurance, also referred to as Medigap, are policies sold by private companies. The policies help with costs like copayments, coinsurance, and deductibles. Medigap plans are different from Medicare Advantage Plans, which serve as a method of receiving Medicare benefits. Medigap plans, on the other hand, serve as a way ...

What are the benefits of Medicare Supplement?

At the very least, all Medicare Supplement insurance plans cover at least 50 percent of the following benefits: 1 Medicare Part A coinsurance costs up to an additional 365 days after exhausting Medicare benefits. 2 Medicare Part A hospice care coinsurance or copayments. 3 Medicare Part B coinsurance or copayments. 4 The first 3 pints of blood used in a medical procedure.

How much does Medicare Supplement cover?

At the very least, all Medicare Supplement insurance plans cover at least 50 percent of the following benefits: Medicare Part A coinsurance costs up to an additional 365 days after exhausting Medicare benefits. Medicare Part A hospice care coinsurance or copayments. Medicare Part B coinsurance or copayments. The first 3 pints of blood used in ...

When is the best time to enroll in Medicare Supplement?

This is a six-month period that starts on the month of your 65th birthday and extends an additional five months.

What is Medicare Part A?

Medicare Part A hospice care coinsurance or copayments. Medicare Part B coinsurance or copayments. The first 3 pints of blood used in a medical procedure. In some cases, your supplement plan may cover up to 100 percent of these basic benefits. Different plans offer differing coverage amounts.

Does Medicare cover Part B?

Part B preventive care coinsurance. Skilled Nursing Facility care coinsurance. Foreign travel emergency care. It is important to note that Medicare does not cover any of your supplement insurance plan costs. You must purchase your Medicare Supplement from a private insurance provider.

What is the most popular Medicare supplement plan?

Understanding a Medicare Supplement plan’s additional benefits is crucial when it comes to deciding which plan is best for you. For example, Medigap Plan F , which is the most popular supplement plan, offers coverage of several additional benefits:

How Medicare works with other insurance

Learn how benefits are coordinated when you have Medicare and other health insurance.

Retiree insurance

Read 5 things you need to know about how retiree insurance works with Medicare. If you're retired, have Medicare and have group health plan coverage from a former employer, generally Medicare pays first. Your retiree coverage pays second.

What's Medicare Supplement Insurance (Medigap)?

Read about Medigap (Medicare Supplement Insurance), which helps pay some of the health care costs that Original Medicare doesn't cover.

When can I buy Medigap?

Get the facts about the specific times when you can sign up for a Medigap policy.

How to compare Medigap policies

Read about different types of Medigap policies, what they cover, and which insurance companies sell Medigap policies in your area.

Medigap & travel

Read about which Medigap policies offer coverage when you travel outside the United States (U.S.).

What is Medicare Supplement Insurance Plan?

What Is a Medicare Supplement Insurance Plan? A Medicare Supplement Insurance plan (also called Medigap) can help cover some of the out-of-pocket costs that Original Medicare doesn't, such as copays and deductibles. Each type of plan offers a different combination of basic health insurance benefits. Use the following guide to compare Medicare ...

Which Medicare Supplement Insurance Plan covers all of the basic Medicare benefits?

Medicare Supplement Insurance Plan F is the most popular Medigap plan, largely because it offers the most comprehensive range of basic benefits. Plan F is the only Medigap plan that covers all nine of the basic Medigap benefits, including the Medicare Part B deductible and Part B excess charges.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

When is the best time to buy Medicare Supplement?

The best time to buy a Medicare Supplement Insurance plan is during your Medigap open enrollment period. During your open enrollment period, insurance companies cannot consider any pre-existing conditions when deciding whether or not to offer you a policy. They also cannot charge you more for a Medigap plan based on pre-existing conditions.

Does Medicare Part A require coinsurance?

Medicare Part A and Part B both require deductibles and coinsurance or copays. Medigap plans help beneficiaries fill in these cost "gaps" that can add up to potentially large dollar amounts.

What is a medicaid supplement?

Medigap (Medicare Supplement Health Insurance) A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover.

What is the difference between Medigap and Medicare?

Generally, the only difference between Medigap policies sold by different insurance companies is the cost. You and your spouse must buy separate Medigap policies.Your Medigap policy won't cover any health care costs for your spouse. Some Medigap policies also cover other extra benefits that aren't covered by Medicare.

Can insurance companies sell standardized Medicare?

Insurance companies can only sell you a “standardized” Medigap policy. Medigap policies must follow Federal and state laws. These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.”. It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that ...

Do you have to pay for Medigap?

Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.