Simplified (opt in) Enrollment Mechanism •Expanding to dually eligible beneficiaries currently enrolled in a non-renewing integrated D-SNP into another integrated

Full Answer

What is Medicare simplified?

Medicare Simplified. What is Medicare? Medicare is a nationwide federal health insurance program for people who are 65 or older. It also covers younger individuals with disabilities and those meeting certain criteria. You become eligible for Medicare coverage when you turn 65 years old. So, if you are approaching age 65, congratulations!

What are the new special enrollment periods (SEPs)?

The establishment of two new Special Enrollment Periods (SEPs) for exceptional circumstances and the codification of previously adopted SEPs for exceptional conditions implemented through sub-regulatory guidance; in addition, to, The new Model Individual Enrollment Request Form to enroll in an MA plan, OMB No. 0938-1378; and

What is a Medicare scope of Appointment form?

Collection of a Scope of Appointment form is required in all personal or individual face-to-face marketing appointments where MA, MA-PD, PDP and Cost Plan products are to be discussed with Medicare beneficiaries. This includes walk-ins and for unexpected beneficiaries who wish to attend a pre-scheduled, one-on-one meeting with another beneficiary.

What kind of information does this page contain about Medicare Advantage?

This page contains information for current and future contracting Medicare Advantage (MA) organizations, other health plans, and other parties interested in the operational and regulatory aspects of Medicare health plan enrollment and disenrollment. New!

What is opt in simplified enrollment Medicare?

Seamless Continuation of Coverage – (Opt-in) – This change provides a simplified election process for non-Medicare members (commercial, Medicaid, other) into MA offered by same plan sponsor.

Do I have to opt out of Medicare every year?

While you can decline Medicare altogether, Part A at the very least is premium-free for most people, and won't cost you anything if you elect not to use it. Declining your Medicare Part A and Part B benefits completely is possible, but you are required to withdraw from all of your monthly benefits to do so.

What is the difference between Medicare open enrollment and general enrollment?

“Medicare Open Enrollment” doesn't generally refer to Original Medicare. You generally can sign up for Medicare Part A and/or Part B: During your Medicare Initial Enrollment Period, when you're first eligible for Medicare. During the Medicare General Enrollment Period, which runs from January 1 – March 31 every year.

When can you opt into Medicare?

65Generally, you're first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. (You may be eligible for Medicare earlier, if you get disability benefits from Social Security or the Railroad Retirement Board.)

Do I automatically get Medicare when I turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

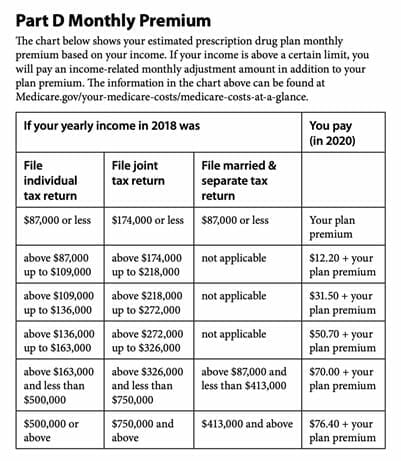

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Do you have to enroll in Medicare Part B every year?

Do You Need to Renew Medicare Part B every year? As long as you pay the Medicare Part B medical insurance premiums, you'll continue to have the coverage. The premium is subtracted monthly from most people's Social Security payments. If you don't get Social Security, you'll get a bill.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What happens if you don't enroll in Medicare Part A at 65?

If you don't have to pay a Part A premium, you generally don't have to pay a Part A late enrollment penalty. The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled.

What happens if I opt out of Medicare Part B?

But beware: if you opt out of Part B without having creditable coverage—that is, employer-sponsored health insurance from your current job that's as good or better than Medicare—you could face late-enrollment penalties (LEPs) down the line.

Can I opt out of Medicare tax?

The problem is that you can't opt out of Medicare Part A and continue to receive Social Security retirement benefits. In fact, if you are already receiving Social Security retirement benefits, you'll have to pay back all the benefits you've received so far in order to opt out of Medicare Part A coverage.

When do you get Medicare Part A?

You are eligible to receive Medicare Part A on the first day of the month that you turn 65. Happy Birthday! In most cases, Part A is premium-free.

Why is Medicare Supplement Plan important?

That’s why having a Medicare Supplement Plan can be so important! It will protect you and your family from the high costs of healthcare. Remember to sign up for Part A as soon as you become eligible to avoid potential late penalties.

What is Medicare for 65?

What is Medicare? Medicare is a nationwide federal health insurance program for people who are 65 or older. It also covers younger individuals with disabilities and those meeting certain criteria. You become eligible for Medicare coverage when you turn 65 years old.

What is a Part C plan?

Part C plans include HMOs, PPOs, and Private Fee for Service Plans, among others. Individuals under a Part C plan usually have a schedule of co-payment and co-insurance costs (called cost-sharing) for covered services with physicians and hospitals within the plan’s network.

Does Medicare Part A cover everything?

You will not have to pay a premium for Medicare Part A if you or your spouse paid Medicare taxes for over 10 years. But Part A doesn’t cover everything.

When does MA default enrollment start?

As outlined in the 2019 guidance, only MA organizations who meet the criteria outlined and are approved by CMS to conduct default enrollment for coverage effective dates of January 1, 2019 , or later.

When is the MA model enrollment period?

All enrollments with an effective date on or after January 1, 2021, must be processed in accordance with the revised guidance requirements, including the new model MA enrollment form. MA plans are expected to use the new model form for the 2021 plan year Annual Enrollment Period (AEP) which begins on October 15, 2020.