What is the difference between a Medicare PDP and MAPD?

Apr 12, 2022 · Medicare Part D prescription drug plans are also known as PDPs. These are standalone plans that can be purchased through private insurance companies. PDPs provide coverage for prescription drugs and medications and may also cover some vaccines too. Original Medicare (Parts A & B) doesn't provide prescription drug coverage.

What is the best secondary insurance with Medicare?

A Part D prescription drug plan (PDP) – or “stand-alone prescription drug plan” – is one of two main ways Medicare beneficiaries can enroll in Medicare coverage for prescription drugs. The Medicare Part D benefit is offered through private insurers, either as a stand-alone Part D plan (PDP) or a Medicare Advantage plan that has prescription drug benefits (MAPD).

What does PDP stand for?

The Medicare Prescription Drug Plan, or Medicare Part D, offers prescription drug coverage to all beneficiaries who elect to enroll in a prescription drug plan. Plans are available through private companies that contract with Medicare to offer prescription drug coverage. Anyone who has Part A and/or Part B and lives in a plan’s service area is eligible to join the plan.

What is dual insurance plan?

Medicare Part D prescription drug plans (PDPs) provide coverage for prescription drugs not covered by Original Medicare. Anthem offers Part D prescription drug plans with copays as low as $1 at preferred pharmacies in our network.

What does PDP mean in Medicare Part D?

Medicare Prescription Drug PlanMedicare Cost Plan Join a Medicare Prescription Drug Plan (PDP). These plans add coverage to Original Medicare, and can be added to one of these: • A Medicare Savings Account (MSA) Plan.

How does a PDP plan work?

A Medicare Prescription Drug plan (PDP) is an insurance policy that covers take-home drugs prescribed by a doctor. Out-of-pocket costs usually apply. PDPs are also known as Medicare Part D. Private insurance companies sell these plans, following approval by Medicare.

What is the difference between Mapd and PDP plans?

A "PDP" is the abbreviation used for a stand-alone Medicare Part D "prescription drug plan". A PDP provides coverage of your out-patient prescription drugs that are found on the plan's formulary. An "MAPD" is the abbreviation for a "Medicare Advantage plan that offers prescription drug coverage".

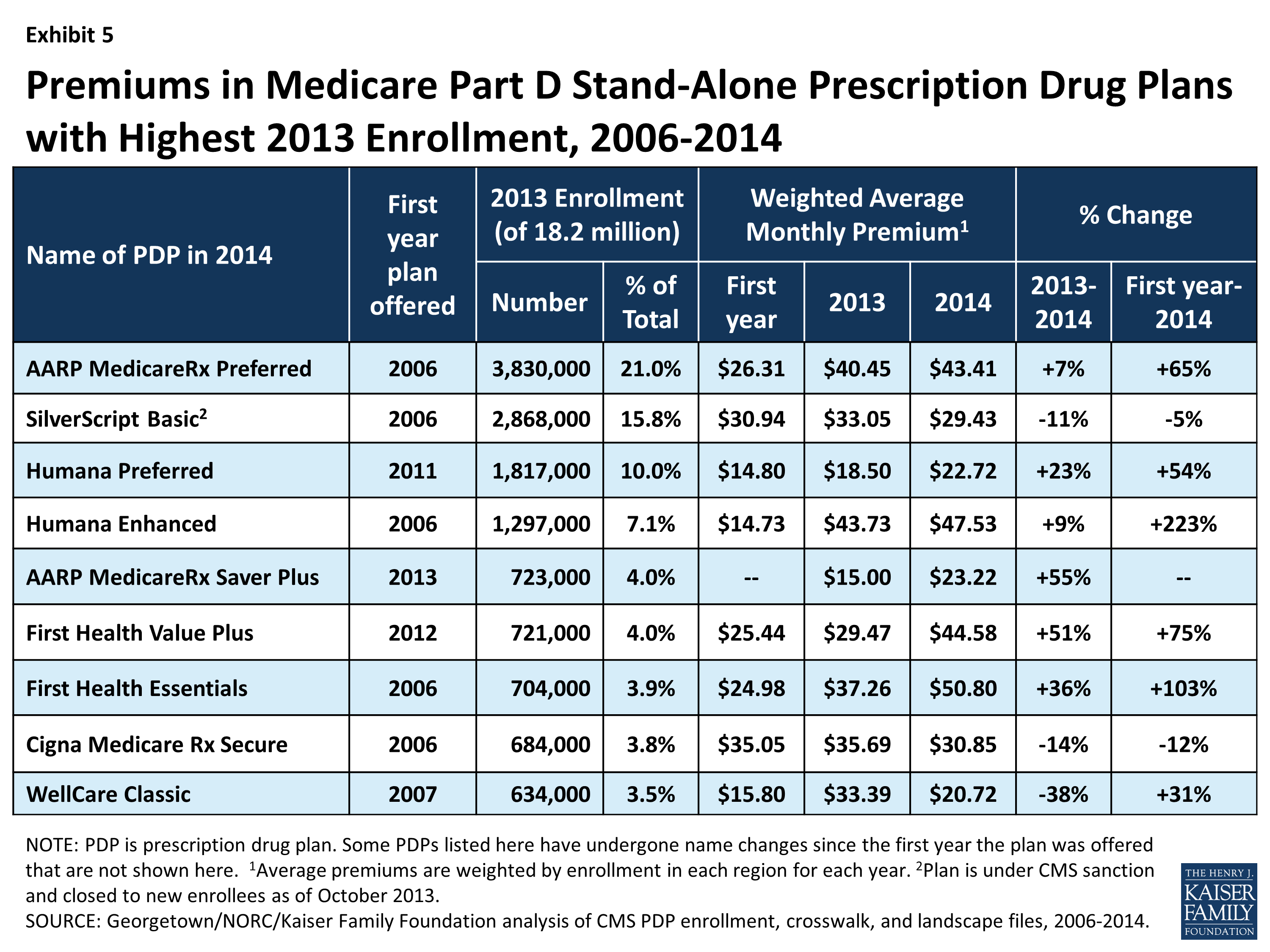

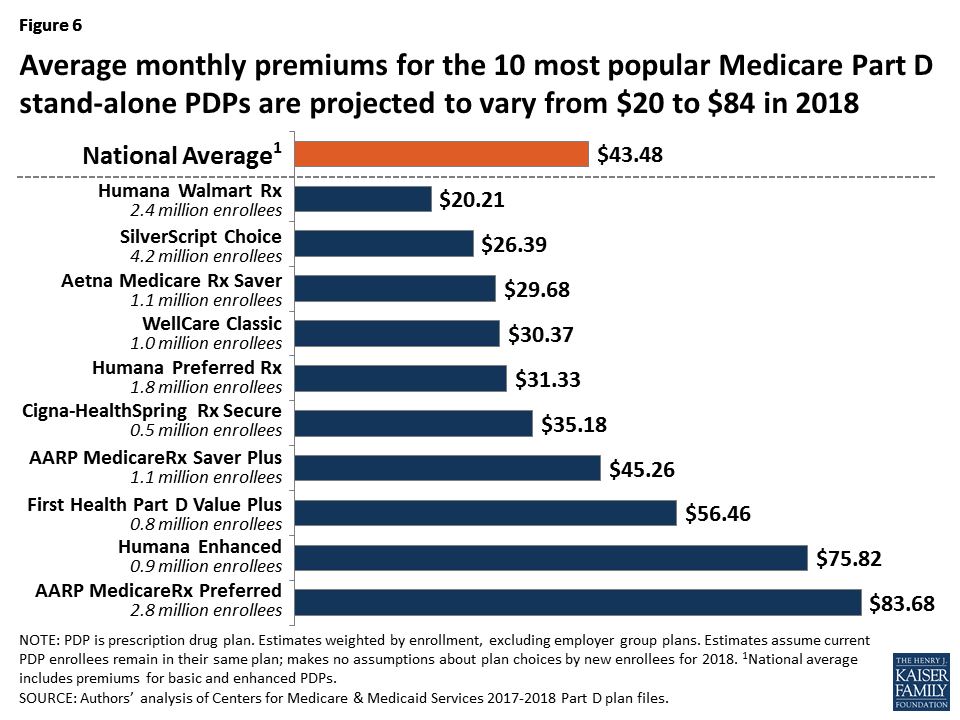

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the deductible of a PDP plan?

Your ZIP Code allows us to filter for Medicare plans in your area. Summary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2021, the Medicare Part D deductible can't be greater than $445 a year.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the difference between Medicare Advantage and PDP?

Once you enroll in an Advantage plan, a private insurance company handles your claims instead of Medicare. In other words, it pays instead of Original Medicare. In contrast, Prescription Drug Plans (PDP) are stand-alone plans that only provide prescription drug coverage through Part D of Medicare.Feb 18, 2022

Can you have a Mapd and PDP at the same time?

Remember that prescription drug coverage is offered only by private insurance companies, either as a standalone Part D plan or combined with Medicare Advantage in an MAPD plan. You cannot be enrolled in both at the same time.Oct 9, 2020

What are the 4 phases of Medicare Part D coverage?

If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage. Select a stage to learn more about the differences between them.Oct 1, 2021

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.Sep 27, 2021

Can you use GoodRx If you have Medicare Part D?

So let's get right to it. While you can't use GoodRx in conjunction with any federal or state-funded programs like Medicare or Medicaid, you can use GoodRx as an alternative to your insurance, especially in situations when our prices are better than what Medicare may charge.Aug 31, 2021

What is the best Medicare Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

What is a PDP plan?

A Part D prescription drug plan (PDP) – or “stand-alone prescription drug plan” – is one of two main ways Medicare beneficiaries can enroll in Medicare coverage for prescription drugs. The Medicare Part D benefit is offered through private insurers, either as a stand-alone Part D plan (PDP) or a Medicare Advantage plan that has prescription drug ...

Can you get PDP with Medicare?

A PDP can be purchased by beneficiaries with Original Medicare coverage (with or without a Medigap plan) and – in some cases –by Medicare Advantage (MA) beneficiaries who don’t have a prescription drug benefit included in their MA plan.

What is a PDP plan?

Prescription Drug Plans (PDPs) are also known as Medicare Part D. Private insurance companies sell these plans, following approval by Medicare. Most PDPs include coverage for commonly prescribed medications. This article takes an in-depth look at PDPs, or Medicare Part D.

What does PDP cover?

What does a PDP cover? Share on Pinterest. PDPs can help cover the cost of take-home drugs. Part D plans provide outpatient prescription drug coverage. They are available through private health insurance companies — as part of Medicare Advantage plans or as stand-alone policies.

How much is the deductible for Medicare 2021?

In 2021, no Medicare drug plans are allowed to charge a deductible of more than $445. Some plans have no deductibles, but their monthly premiums may be higher. After a person pays their annual deductible, a copayment or coinsurance charge may apply.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What is the Medicare Part B copayment?

For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How much can I spend on PDP in 2021?

In 2021, the maximum a person and their drug plan can spend is $4,130 before reaching the coverage gap. This maximum amount can change from year to year, however. Medicare recipients who get additional support in paying their PDP costs do not enter coverage gaps.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What happens if Medicare decides the penalty is wrong?

What happens if Medicare's contractor decides the penalty is wrong? If Medicare’s contractor decides that all or part of your late enrollment penalty is wrong, the Medicare contractor will send you and your drug plan a letter explaining its decision. Your Medicare drug plan will remove or reduce your late enrollment penalty. ...

How long does it take for Medicare to reconsider?

In general, Medicare’s contractor makes reconsideration decisions within 90 days. The contractor will try to make a decision as quickly as possible. However, you may request an extension. Or, for good cause, Medicare’s contractor may take an additional 14 days to resolve your case.

What happens if Medicare pays late enrollment?

If Medicare’s contractor decides that your late enrollment penalty is correct, the Medicare contractor will send you a letter explaining the decision, and you must pay the penalty.

What is the late enrollment penalty for Medicare?

Part D late enrollment penalty. The late enrollment penalty is an amount that's permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there's a period of 63 or more days in a row when you don't have Medicare drug coverage or other.

What is creditable prescription drug coverage?

creditable prescription drug coverage. Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage. People who have this kind of coverage when they become eligible for Medicare can generally keep that coverage without paying a penalty, ...

How long do you have to pay late enrollment penalty?

You must do this within 60 days from the date on the letter telling you that you owe a late enrollment penalty. Also send any proof that supports your case, like a copy of your notice of creditable prescription drug coverage from an employer or union plan.

Do you have to pay a penalty on Medicare?

After you join a Medicare drug plan, the plan will tell you if you owe a penalty and what your premium will be. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.