Point-of Service (POS) Plans Point-of-service (POS) plans are Medicare Advantage plans that combine features of health maintenance organization (HMO) and preferred provider organization (PPO) plans. They typically cost less in exchange for more limited choices, but POS plans let you seek out-of-network health care services.

What is a point of service (POS) health insurance plan?

What is POS Health Insurance? In general, a Point of Service (POS) health insurance plan provides access to health care services at a lower overall cost, but with fewer choices. Plans may vary, but in general, POS plans are considered a combination of HMO and PPO plans.

How do point of service health care plans operate?

What are the pros of POS insurance?

- Your health care costs are typically lower when you get care from in-network providers.

- You can see a specialist outside of your approved network – and be covered, but you may pay more out-of-pocket.

- When you receive in-network treatment and services, the paperwork is usually done for you.

What is the Medicare PPO plan?

When you enroll in a Medicare Advantage PPO plan, you’ll be covered for:

- Medicare Part A, which includes hospital services, limited skilled nursing facility care, limited home healthcare, and hospice care

- Medicare Part B, which includes medical insurance for the diagnosis, prevention, and treatment of health conditions

- prescription drug coverage (offered by most Medicare Advantage PPO plans)

What is the definition of point of service plan?

A point-of-service plan is a health insurance plan for which policyholders pay less when they seek medical attention from health care providers who belong to the plan’s network.

What is the difference between point of service and PPO?

In general the biggest difference between PPO vs. POS plans is flexibility. A PPO, or Preferred Provider Organization, offers a lot of flexibility to see the doctors you want, at a higher cost. POS, or Point of Service plans, have lower costs, but with fewer choices.

How does a point of service plan work?

A type of plan in which you pay less if you use doctors, hospitals, and other health care providers that belong to the plan's network. POS plans also require you to get a referral from your primary care doctor in order to see a specialist.

What are the benefits of a point of service plan?

POS plans often offer a better combination of in-network and out-of-network benefits than other options like HMO. While you can expect to pay higher out-of-network fees compared to in-network fees, members have wider access to health providers and specialists.

What is the difference between HMO and point of service?

As with an HMO, a Point of Service (POS) plan requires that you get a referral from your primary care physician (PCP) before seeing a specialist. But for slightly higher premiums than an HMO, this plan covers out-of-network doctors, though you'll pay more than for in-network doctors.

What is a disadvantage of a POS plan?

Although POS plan premiums tend to be around 50% cheaper than PPO plans, they can also cost as much as 50% more than HMO premiums. If you don't understand the tradeoffs of those costs, you won't be able to take advantage of POS insurance benefits.

What does POS mean in nursing?

POS stands for point of service. PPO stands for preferred provider organization.

What are the pros and cons of POS?

Pros and Cons of Having a POS System for RestaurantsPro: User-friendly & Simple. Little IT knowledge and minimal training is required. ... Con: Limited Support Options. ... Pro: Easy to grow & expand. ... Con: Connectivity. ... Pro: Automation. ... Con: Subscription Fees. ... Pro: Hardware.

What are the advantages and disadvantages of the new POS system?

The advantages of POS systems include better customer service, easier team management, increases sales and much more. On the flip side, there can be some disadvantages such as security risks, costly pricing and malware infections.

What two plans are in a POS plan?

A POS plan combines features of the two most common health insurance plans: the health maintenance organization (HMO) and the preferred provider organization (PPO).

Do doctors prefer HMO or PPO?

PPOs Usually Win on Choice and Flexibility If flexibility and choice are important to you, a PPO plan could be the better choice. Unlike most HMO health plans, you won't likely need to select a primary care physician, and you won't usually need a referral from that physician to see a specialist.

Why would a person choose a PPO over an HMO?

A PPO plan can be a better choice compared with an HMO if you need flexibility in which health care providers you see. More flexibility to use providers both in-network and out-of-network. You can usually visit specialists without a referral, including out-of-network specialists.

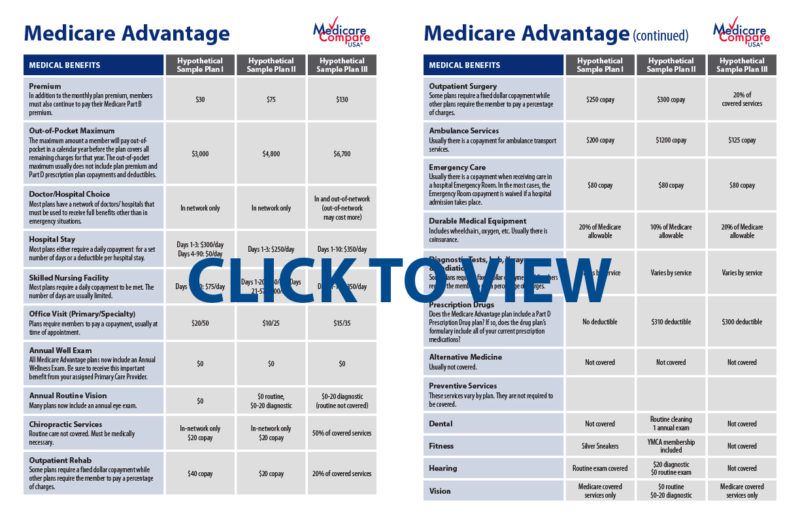

What is the maximum out-of-pocket for Medicare Advantage plans?

The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year. In 2019, this amount is $6,700, which is a common MOOP limit. However, you should note that some insurance companies use lower MOOP limits, while some plans may have higher limits.

How Does a Point-of-Service Plan Work?

Health insurance companies create networks of healthcare providers who agree to accept set fees for services. 5 People who pay the lowest monthly premiums 6 typically have HMO plans, which don’t allow them to see providers outside the network except for emergency and urgent care visits. 7

What Are Benefits of a Point-of-Service Plan?

If your doctors happen to be members of your health insurance plan’s network, POS coverage may help you save money , because fees will be lower than for out-of-network doctors.

How Does a POS Plan Differ from an HMO Plan?

A POS plan is similar to an HMO plan, up to a point: Both have networks of providers that offer services at rates that the insurance company has negotiated. Both plans usually require you to choose a PCP and get referrals in order to see other providers.

What is Medicare Advantage HMO?

What is a Medicare Advantage HMO-POS plan? | 65 Incorporated. What does HMO-POS mean? HMO-POS stands for Health Maintenance Organization with a point-of-service option. This is one type of Medicare Advantage plan. An HMO-POS plan has features of an HMO plan. One is a defined list of providers, often referred to as a network, ...

What is the difference between HMO and POS?

However, there is one big difference. An HMO-POS plan allows members to use healthcare providers that are outside the plan’s network for some or all services.

Is Medicare i65 software?

Instead of trying to wade through the mess of Medicare regulations by yourself, why not try the revolutionary, unbiased i65 Medicare decision-making software. i65 is created by the experts at 65 Incorporated and is NOT affiliated with the sale of insurance . So, the Medicare timing and coverage type guidance you receive is always in your best ...

Does an HMO plan limit out of network services?

The member will pay more for out-of-network services and the plan may limit use. However, this option provides an element of flexibility not available with an HMO plan.

Does HMO cover out of network hospitalization?

For example, one HMO-POS plan will cover out-of-network hospitalization but not mental health care. In most cases, a referral from the primary physician is required and authorization may be necessary. The plan has separate deductibles and out-of-pocket limits for in- and out-of-network services. The member will pay more for out-of-network services ...

How does a HMO-POS plan work?

HMO-POS plans work a lot like HMO plans. The main difference is that you can see doctors outside your network in some cases. That's where the "POS," or "point of service" part comes in. Each insurance company implements this a little differently.

What is the difference between a PPO and an HMO?

POS stands for point of service. PPO stands for preferred provider organization. All these plans use a network of doctors and hospitals. The difference is how big those networks are and how you use them.

Does Medicare cover emergency care?

All our Medicare Advantage plans help cover emergency care outside the U.S.

Is an HMO plan right for me?

If you want low monthly premiums and copays and you don’t travel much, an HMO plan might be right for you.

What Is A Point-of-Service (POS) Plan?

How A Point-of-Service (POS) Works

- A POS plan is similar to an HMO. It requires the policyholder to choose an in-network primary care doctor and obtain referrals from that doctor if they want the policy to cover a specialist’s services. And a POS plan is like a PPO in that it still provides coverage for out-of-network services, but the policyholder will have to pay more than if they used in-network services.2 However, the POS pla…

Disadvantages of Pos Plans

- Though POS plans combine the best features of HMOs and PPOs, they hold a relatively small market share. One reason may be that POS plans are marketed less aggressively than other plans. Pricing also might be an issue. Though POS plans can be up to 50% cheaper than PPO plans, premiums can cost as much as 50% more than for HMO premiums. While POS plans are c…

Special Considerations

- A point-of-service (POS) plan is a type of health insurance plan that provides different benefits depending on whether the policyholder visits in-network or out-of-network healthcare providers. POS plans generally offer lower costs than other types of plans, but they may also have a much more limited set of providers. It is possible to see out-of-network providers with a POS plan, but …