Preferred provider organization

In health insurance in the United States, a preferred provider organization, sometimes referred to as a participating provider organization or preferred provider option, is a managed care organization of medical doctors, hospitals, and other health care providers who have agreed with an insurer or a third-party administrator to provide health care at reduced rates to the top insur…

Full Answer

What is the best Medicare plan?

A Medicare PPO Plan is a type of Medicare Advantage Plan (Part C) offered by a private insurance company. PPO Plans have network doctors, other health care providers, and hospitals. You pay less if you use doctors, hospitals, and other health care providers that belong to the plan's network . You can also use out‑of‑network providers for

Which Medicare plan is best for me?

A Preferred Provider Organization (PPO) Medicare Advantage plan gives you access to a network of doctors, hospitals, and healthcare providers, but how does staying in the network save you money?...

What is offered under the Original Medicare plan?

A Medicare PPO plan is a plan that takes into account your Medicare qualification (65 or older) while also allowing you to take advantage of the choices embodied in the PPO business model. PPOs are for private insurance, not government-based insurance.

What is the cheapest Medicare Part D plan?

Feb 10, 2022 · What is Medicare? | Tufts Health Plan Medicare Preferred What is Medicare? More In This Section Medicare is basic health insurance provided by the Federal government for …

What does Medicare Preferred mean?

A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, with a few exclusions, for example, certain aspects of clinical trials which are covered by Original Medicare even though you're still in the plan.

What are the 2 types of Medicare plans?

What's a Medicare health plan? Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

Is Medicare preferred the same as Medicare Advantage?

A Preferred Provider Organization (PPO) plan is a Medicare Advantage Plan that has a network of doctors, specialists, hospitals, and other health care providers you can use, but you can also use out-of-network providers for covered services, usually for a higher cost.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

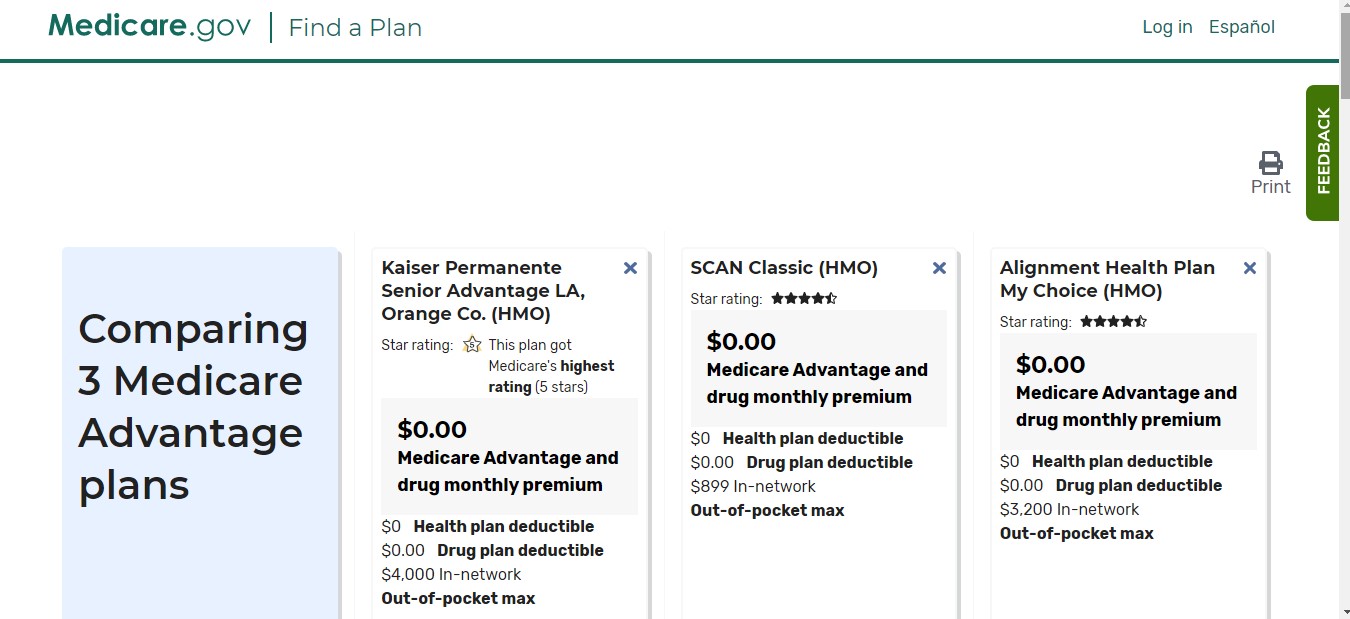

Which is better PPO or HMO?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.Sep 19, 2017

What is the most popular Medicare Advantage plan?

Best for size of network: UnitedHealthcare Standout feature: UnitedHealthcare offers the largest Medicare Advantage network of all companies, with more than 1 million network care providers. UnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Is Medicare Advantage cheaper than original Medicare?

The costs of providing benefits to enrollees in private Medicare Advantage (MA) plans are slightly less, on average, than what traditional Medicare spends per beneficiary in the same county. However, MA plans that are able to keep their costs comparatively low are concentrated in a fairly small number of U.S. counties.Jan 28, 2016

Whats the difference between Medicare Part A and B?

Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care.

What is the difference between Medicare Part C and Part D?

Medicare part C is called "Medicare Advantage" and gives you additional coverage. Part D gives you prescription drug coverage.

Is Medicare Part A free at age 65?

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

What is Medicare Advantage Plan?

A Preferred Provider Organization (PPO) Medicare Advantage plan gives you access to a network of doctors, hospitals, and healthcare providers, but how does staying in the network save you money?

Do PPOs require a primary care physician?

Offer lower costs for in-network services. Do not route care through a primary care physician. Unlike many HMOs, PPOs do not require you to choose a primary care physician, and you won’t need a referral to receive care from a specialist or a provider out of your plan’s network.

Can I see outside of my network for PPO?

With a PPO plan, you can see healthcare providers outside of your network for services PPOs cover. However, going out of your plan's preferred network of hospitals, doctors, and specialists will usually cost more. Additionally, emergency and urgent care are always covered under Medicare Advantage plans. Drug coverage, or Medicare Part D, is often ...

Does Medicare cover urgent care?

Additionally, emergency and urgent care are always covered under Medicare Advantage plans. Drug coverage, or Medicare Part D, is often included in Medicare Advantage plans like PPOs. You won’t need to sign up for a separate Medicare plan for your prescriptions as long as your PPO plan offers drug coverage. However, if you sign up ...

Why do private insurance companies have PPO plans?

A PPO plan allows the patient to choose which doctors, specialists, and drug plans that they need to suit their individual medical conditions.

What is PPO system?

If you are someone who wants greater flexibility in your health care options, you would probably like PPO systems. The idea of PPS is to give people a greater flexibility in their health plan by allowing them to choose between In-network and out-of-network providers.

Do you have to meet the deductible for PPO?

This means that you must meet the deductible before you are allowed to reap the benefits of the insurance plan

Is Obama's plan for medical services true?

There have been many efforts by politicians and President Obama to integrate a plan for medical services that would work with all people. The problem is that it’s not true.

Is a PPO plan good for you?

If you don’t mind paying higher premiums to keep your doctor that you are used to, then a PPO plan might be right for you. You will still get to take advantage of many of the benefits of a PPO plan, but you will have the added flexibility of using your doctors.

What is Medicare meeting?

Medicare is basic health insurance provided by the Federal government for people 65 and older, and people under 65 who meet certain criteria.

Do you need to add Part C and Part D to Medicare?

Add Part C and Part D for complete coverage. Once you sign up for Medicare (Part A and Part B) you will want to consider adding Part C and Part D to have complete coverage. Many people find that Original Medicare (Part A and Part B) does not provide enough coverage on its own.

Why do people choose PPO over Medicare?

A few reasons why some people might prefer a PPO plan over other types of Medicare Advantage plans include: Medicare PPOs typically offer the freedom and flexibility to seek health care services from providers outside of their plan network, though it will typically be at a higher out-of-pocket cost.

What is Medicare PPO?

by Christian Worstell. February 25, 2021. A Medicare PPO, or Preferred Provider Organization, is just one type of Medicare Advantage plan. What is a Medicare PPO plan, and could a PPO plan be a good fit for your health coverage needs? Learn more about Medicare Advantage PPO insurance plans ...

How to get information on Medicare PPO?

Get in touch with a licensed insurance agent who can provide information on Medicare PPO plans that may be available in your area . A licensed agent can also help you review the costs and benefits of each available plan where you live and help guide you through the enrollment process. Call. 1-800-557-6059.

What is a PPO plan?

What is a Medicare PPO? A Medicare PPO plan consists of a network of preferred health care providers. These are doctors, facilities, pharmacists and other sources of health care services who have agreed to participate in the PPO plan network.

How many people are in a PPO plan in 2017?

In 2017, more than 6.2 million people were enrolled in a local or regional Medicare PPO plan, which represented more than a third of all Medicare Advantage plan holders. 2.

Is out of network care covered by Medicare?

However, out-of-network care may still be covered to some extent.

Is hospice covered by Medicare?

Hospice care is still covered by Medicare Part A even if you are enrolled in a Medicare Advantage PPO plan. Where Medicare Advantage plans distinguish themselves is with the extra benefits they each may offer in addition to the required minimum coverage. Prescription drugs, dental, vision and hearing coverage are among the popular extra benefits ...

What is preferred pharmacy?

A “preferred” pharmacy refers to a subset of retail pharmacies within a plan’s network that agree to charge plan members covered prescription drugs at a reduced copay or coinsurance. If you select a Medicare Part D Prescription Drug Plan or Medicare Advantage Prescription Drug plan that has preferred pharmacies, ...

What is Medicare Advantage?

A Medicare Advantage Prescription Drug plan that combines benefits for the medical and hospital services covered by Medicare Part A and Part B with Medicare’s Part D prescription drug coverage.

How does a preferred pharmacy save money?

By using a preferred pharmacy, you may be able to save money. Your added savings comes from the lower copayment or coinsurance you pay (the preferred cost-share) at preferred pharmacies. Using preferred pharmacies can work in your favor two ways: First, using preferred pharmacies may lower your prescription drug costs.

Does Medicare pay for prescription drugs?

Usually Medicare plan’s prescription drug benefits are designed so that the plan pays the cost of your covered medication at any network pharmacy. You may have to pay a copayment or coinsurance, after you have met the annual deductible (if the plan has one). By using a preferred pharmacy, you may be able to save money.

How to decide if you need Medicare Part D?

How To Decide If You Need Part D. Medicare Part D is insurance. If you need prescription drug coverage, selecting a Part D plan when you’re eligible to enroll is probably a good idea—especially if you don’t currently have what Medicare considers “creditable prescription drug coverage.”. If you don’t elect Part D coverage during your initial ...

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What is Medicare Part D 2021?

Luke Brown. Updated July 15, 2021. Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost. But deciding whether to enroll in Medicare Part D can have permanent consequences—good or bad. Learn how Medicare Part D works, when and under what circumstances you can enroll, ...

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

How long do you have to be in Medicare to get Part D?

You must have either Part A or Part B to get it. When you become eligible for Medicare (usually, when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2. If you don’t elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty ...

What is Tier 3 drug?

Tier 3: Non-preferred brand name drugs with higher copayments. Specialty: Drugs that cost more than $670 per month, the highest copayments 4. A formulary generally includes at least two drugs per category; one or both may be brand-name or one may be a brand name and the other generic.

What drugs are covered by Part D?

Drugs covered by each Part D plan are listed in their “formulary,” and each formulary is generally required to include drugs in six categories or protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretrovirals, and antineoplastics.