What is a Qualified Medicare Beneficiary (QMB)?

- General Information. A Qualified Medicare Beneficiary (QMB) is a Medicare beneficiary who, because of low income and limited financial resources, qualifies to have certain medical expenses covered at no additional ...

- Eligibility. ...

- To Apply. ...

- For More Information. ...

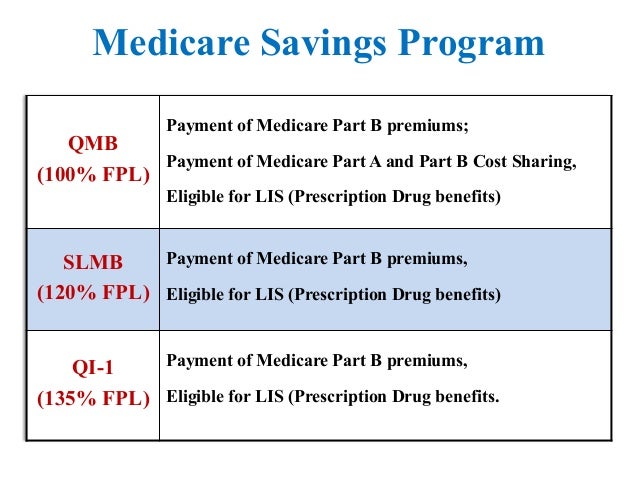

What is slmb or a specified low income Medicare beneficiary?

The Specified Low-income Medicare Beneficiary (SLMB) program is a type of Medicare Savings Program designed to help qualified beneficiaries – many of whom also have Medicaid – pay their Medicare Part B premiums.

Does QMB pay for medical?

The Qualified Medicare Beneficiary (QMB) program helps District residents who are eligible for Medicare pay for their Medicare costs. This means that Medicaid will pay for the Medicare premiums, co-insurance and deductibles for Medicare covered services. It also means that you will receive extra help with your costs under the Medicare prescription drug benefit (Part D), which will limit the amount you pay for your prescriptions to only a few dollars each.

Do QMB patients have copays?

The QMB program allows beneficiaries to receive financial help from their state of residence with the costs of Medicare premiums and more. A Qualified Medicare Beneficiary gets government help to cover health care costs like deductibles, premiums, and copays. Recipients must meet all criteria to qualify for the program assistance.

What is the income limit for QMB?

Someone can enroll in a QMB program providing they meet the monthly income limits. For an individual, the limit is $1,084 per month. For a married couple, the combined income must be less than $1,457 per month. The income limits are slightly higher in Alaska and Hawaii.

Is QMB the same as Medicare?

The Qualified Medicare Beneficiary (QMB) Program is one of the four Medicare Savings Programs that allows you to get help from your state to pay your Medicare premiums. This Program helps pay for Part A premiums, Part B premiums, and deductibles, coinsurance, and copayments.

What does Medicare beneficiary mean?

Beneficiary means a person who is entitled to Medicare benefits and/or has been determined to be eligible for Medicaid. CMP stands for competitive medical plan. Conditions of participation includes requirements for participation as the latter term is used in part 483 of this chapter.

How many Medicare beneficiaries are there?

Description: The number of people enrolled in Medicare varied by state. There were a total of 64.4 million Medicare beneficiaries in 2019.

What's the difference between dependent and beneficiary?

A dependent is a person who is eligible to be covered by you under these plans. A beneficiary can be a person or a legal entity that is designated by you to receive a benefit, such as life insurance.

What is a qualified Medicare beneficiary?

The Qualified Medicare Beneficiary program is a type of Medicare Savings Program (MSP). The QMB program allows beneficiaries to receive financial help from their state of residence with the costs of Medicare premiums and more. A Qualified Medicare Beneficiary gets government help to cover health care costs like deductibles, premiums, and copays.

What is QMB in Medicare?

Qualified Medicare Beneficiary (QMB) Program. If you’re a Medicare beneficiary, you know that health care costs can quickly add up. These costs are especially noticeable when you’re on a fixed income. If your monthly income and total assets are under the limit, you might be eligible for a Qualified Medicare Beneficiary program, or QMB.

What is QMB insurance?

The QMB program pays: The Part A monthly premium (if applicable) The Part B monthly premium and annual deductible. Coinsurance and deductibles for health care services through Parts A and B. If you’re in a QMB program, you’re also automatically eligible for the Extra Help program, which helps pay for prescription drugs.

How much money do you need to qualify for QMB?

To be eligible for a QMB program, you must qualify for Part A. Your monthly income must be at or below $1,084 as an individual and $1,457 as a married couple. Your resources (money in checking and/or savings accounts, stocks, and bonds) must not total more than $7,860 as an individual or $11,800 as a married couple.

Can QMB members pay for coinsurance?

Providers can’t bill QMB members for their deductibles , coinsurance, and copayments because the state Medicaid programs cover these costs. There are instances in which states may limit the amount they pay health care providers for Medicare cost-sharing. Even if a state limits the amount they’ll pay a provider, QMB members still don’t have to pay Medicare providers for their health care costs and it’s against the law for a provider to ask them to pay.

Does Medicare Advantage cover dual eligibility?

A Medicare Advantage Special Needs Plan for dual-eligible individuals could be a fantastic option. Generally, there is a premium for the plan, but the Medicaid program will pay that premium. Many people choose this extra coverage because it provides routine dental and vision care, and some come with a gym membership.

Is Medigap coverage necessary for QMB?

Medigap coverage isn’t necessary for anyone on the QMB program. This program helps you avoid the need for a Medigap plan by assisting in coverage for copays, premiums, and deductibles. Those that don’t qualify for the QMB program may find that a Medigap plan helps make their health care costs much more predictable.

What are the eligibility requirements for QMB?

Although the rules may vary from state to state, in general, you must meet the following requirements in order to be eligible for the QMB program: You must be entitled to Medicare Part A. Your income must be at or below the national poverty level (income limits generally change annually).

How to contact Medicare.org?

Call us at (888) 815-3313 — TTY 711 to speak with a licensed sales agent.

Does QMB cover Medicare?

It means that your state covers these Medicare costs for you, and you have to pay only for anything that Medicare normally does not cover. QMB does not supplement your Medicare coverage but instead ensures that you will not be precluded from coverage because you cannot afford to pay the costs associated with Medicare.

What is a QMB?

A Qualified Medicare Beneficiary (QMB) is a Medicare beneficiary who, because of low income and limited financial resources, qualifies to have certain medical expenses covered at no additional cost. If you are a Medicare beneficiary, you should know about programs that may help you pay part of your medical expenses.

Do you have to pay out of pocket for Medicare?

If you qualify, you may not have to pay Medicare premiums or certain out-of-pocket costs. In addition to the QMB program, there are other similar programs, including Specified Low-Income Medicare Beneficiary (SLMB) and Qualifying Individual (QI-1).