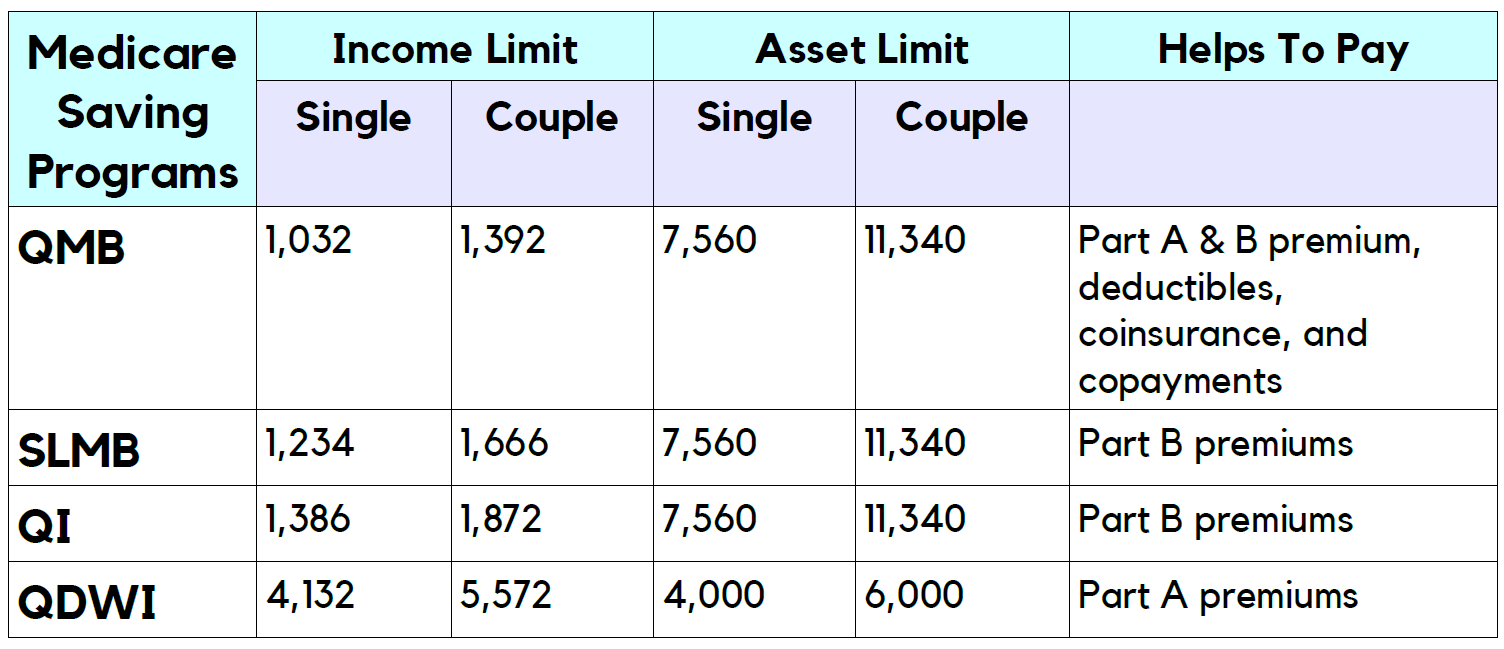

| MSP | Income Limits * | Benefit |

| Qualified Medicare Beneficiary (QMB) Pro ... | 100% of FPL | QMB helps pay Medicare Part A premiums, ... |

| Specified Low-Income Medicare Beneficiar ... | 100-120% of FPL | SLMB helps pay Medicare Part B premiums |

| Qualifying Individual (QI) Program | 120-135% of FPL | QI helps pay Medicare Part B premiums |

| Qualified Disabled and Working Individua ... | under 200% of FPL | QDWI helps pay Medicare Part A premiums |

Full Answer

What is the Medicare qualifying individual program?

The Qualifying Individual (QI) Program is one of the four Medicare Savings Programs that allows you to get help from your state to pay your Medicare premiums. This Program helps pay for Part B premiums only.

What is the qualifying individuals (QI) program?

Aug 31, 2020 · The Qualifying Individual or QI program is a Medicare savings program (MSP). Medicare provides four savings programs with different income and resource limits. To receive the program benefits, a...

Who qualifies for Medicare qdwi?

The Qualified Individuals (QI) program is a Medicare Savings Program (MSP) that pays for an enrollee’s Medicare Part B premiums. MSPs are federal programs that are administered by Medicaid in each state.

Are you eligible for the Qi Medicare savings program?

5 rows · The Qualifying Individual (QI) program is one of four Medicare Savings Programs (QMB, SLMB, QI, ...

Who is a qualifying individuals?

A qualified individual is a person who meets legitimate skill, experience, education, or other requirements of an employment position that s/he holds or seeks, and who can perform the essential functions of the position with or without reasonable accommodation.

What is a Qi recipient?

The QI program is for people who have Medicare Part A (hospital insurance) and Part B (medical insurance). Together, these two parts make up original Medicare. The program covers the cost of the Part B premium for people who qualify.

What's the difference between Qi and SLMB?

Specified Low-income Medicare Beneficiary (SLMB): Pays for Medicare Part B premium. Qualifying Individual (QI) Program: Pays for Medicare Part B premium.

What does QMB mean in Medicare?

Qualified Medicare BeneficiaryIf you're among the 7.5 million people in the Qualified Medicare Beneficiary (QMB) Program, Medicare providers aren't allowed to bill you for services and items Medicare covers, including deductibles, coinsurance, and copayments.May 15, 2020

Does Social Security count as income for extra help?

We do not count: You should contact Social Security at 1-800-772-1213 (TTY 1-800-325-0778) for other income exclusions.

Does Social Security count as income for QMB?

An individual making $1,800 from Social Security cannot qualify for QMB because they are over the $1,133 income limit.

Will Medicaid pay for my Medicare Part B premium?

Medicaid can provide premium assistance: In many cases, if you have Medicare and Medicaid, you will automatically be enrolled in a Medicare Savings Program (MSP). MSPs pay your Medicare Part B premium, and may offer additional assistance.

What is the income limit for the Medicare Savings Program?

This means that you could be eligible for an MSP with assets totaling $8,400 for individuals and $12,600 for couples.

Who qualifies for Medicare Savings Program?

Below are general requirements for the MSP: Reside in a state or the District of Columbia. Are age 65 or older. Receive Social Security Disability benefits.

What does Part A of Medicare pay for?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

What is QNB insurance?

The Qualified Medicare Beneficiary (QMB) Program is one of the four Medicare Savings Programs that allows you to get help from your state to pay your Medicare premiums. This Program helps pay for Part A premiums, Part B premiums, and deductibles, coinsurance, and copayments.

What part of Medicare pays for physician services and outpatient hospital care?

Part BPart B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

What is automatic extra help?

Automatic Extra Help. When someone qualifies for the QI Medicare savings program, they can receive the Medicare Part D low-income subsidy. Also known as Extra Help, the program provides financial assistance for prescription drugs.

What is QI Medicare?

The QI Medicare savings program helps those on a low income to pay for their Medicare Part B monthly premiums. The Qualifying Individual or QI program is a Medicare savings program (MSP). Medicare provides four savings programs with different income and resource limits. To receive the program benefits, a person must meet financial criteria ...

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What is the maximum income for Medicaid?

For a person to be eligible for Medicaid, the total monthly income limit is $895.

What is the eligibility for QI?

To receive QI benefits, people must have Part A or be eligible and have income and resources below a specified limit. The eligibility requirements can differ between states and from year to year. When the Medicaid agency looks at someone’s application for a QI program, they consider the following resources:

How much income do you need to qualify for QI?

In most states, this includes a $20 general income disregard. For a single person, the limit is $1,456 per month. For a married couple, the combined income must be less than $1,960 per month.

Does QI cover Part B?

The QI program covers Part B premiums only. However, most people do not pay a premium for Part A. A person must reapply each year to continue receiving MSP benefits. The programs do not have unlimited funding, and priority goes to the people who received QI benefits the previous year.

What is a qualified individual?

The Qualified Individuals (QI) program is a Medicare Savings Program (MSP) that pays for an enrollee’s Medicare Part B premiums.

How much does Medicare pay in 2020?

As of 2020, most Medicare beneficiaries pay $144.90 a month for Part B. QI enrollees no longer have this amount deducted from their Social Security benefit – amounting to an annual increase of over $1,738.

Does QI pay for Part A and B?

Unlike the Qualified Medicare Beneficiary (QMB) program, QI does not pay for Parts A and B cost sharing (e.g. deductibles, co-pays and coinsurance) or for Part A premiums (if an enrollee owes them).

What is a QI program?

Qualifying Individual Program (QI) The Qualifying Individual program offers financial help to lower payments for Medicare Part B premiums. Medicare Part B helps pay for doctor visits, lab tests, and medical supplies, among other services generally delivered to you as an outpatient. To qualify, you must not earn more than a specific amount each year.

Can I qualify for medicaid if I have QI?

You cannot qualify if you qualify for Medicaid. You must reapply every year for QI benefits. Even if you are receiving QI coverage now, you have to apply for it again next year. Benefits are granted on a first-come, first-serve basis with priority given to people who got benefits through the program the previous year.

How much do Americans spend on prescription drugs?

Americans of all ages spend over $1,200.00 on average for prescription drugs every year. But the elderly, and people with chronic conditions, spend even more than the national average for their medications.

How many prescriptions do people take in a year?

For people over 80 the numbers go up to 91 percent taking 22 prescriptions every year.

What are the resources not included in the set resource limit?

Resources that are not included in the set resource limit include: • Vehicles registered to your or your spouse. • Jewelry, home furnishings, and other items that cannot be converted to cash easily. • Property used for self-support such as rental properties or farmland used to produce food for your consumption.

When does Medicare review your eligibility?

The Social Security Administration reviews your eligibility status every year, generally at the end of August.

What is Medicare QI?

The Medicare QI program is one of four Medicare savings programs. It helps Medicare beneficiaries with limited incomes pay their Part B premiums. You’ll need to apply through your state and meet the income requirements to qualify.

What is the QI program for Medicare?

As of 2021, there are four Medicare savings programs: The QI program is for people who have Medicare Part A (hospital insurance) and Part B (medical insurance). Together, these two parts make up original Medicare. The program covers the cost of the Part B premium for people who qualify.

What is QI premium?

Your premium is the monthly fee you pay for your Part B medical coverage . The QI program is one of four Medicare savings programs. These programs help individuals with limited incomes cover their healthcare costs.

What is QI insurance?

The QI program is for people who have Medicare Part A (hospital insurance) and Part B (medical insurance). Together, these two parts make up original Medicare. The program covers the cost of the Part B premium for people who qualify.

What is the income limit for Medicare QI 2021?

In 2021, the income limits for the QI program are $1,469 per month for individuals or $1,980 for married couples. The income limits are slightly higher in Alaska and Hawaii.

Can I apply for FPL for medicaid?

Various programs use the FPL as a benchmark to qualify for programs like Medicare QI. You aren’t eligible for QI benefits if you also qualify for Medicaid. But you can still apply for the program through your state Medicaid office. The office will determine which programs, if any, you qualify for.

Does Medicare consider high value items?

Medicare doesn’t consider high-value items like your car or home to be resources. The income limits can change each year and are based on the federal poverty level (FPL). The FPL is calculated using data like the cost of living and the average salary in each state.

What is a SLMB?

The Specified Low-Income Medicare Beneficiary Program. If your income is too high to qualify for QMB but is not more than 20 percent above the federal income poverty level, you may receive Specified Low-Income Medicare Beneficiary (SLMB) coverage, which pays for your Medicare Part B monthly premium only. You will, however, pay for Medicare ...

What are the eligibility requirements for QMB?

Although the rules may vary from state to state, in general, you must meet the following requirements in order to be eligible for the QMB program: You must be entitled to Medicare Part A. Your income must be at or below the national poverty level (income limits generally change annually).

What if my income is too high for SLMB?

If your income is too high for help under SLMB, you may qualify under the Qualifying Individual (QI) program. If your income is more than 20 percent but no more than 35 percent above the national poverty level, your state may pay your Medicare Part B premium .

How to contact Medicare.org?

Call us at (888) 815-3313 — TTY 711 to speak with a licensed sales agent.

Does QMB cover Medicare?

It means that your state covers these Medicare costs for you, and you have to pay only for anything that Medicare normally does not cover. QMB does not supplement your Medicare coverage but instead ensures that you will not be precluded from coverage because you cannot afford to pay the costs associated with Medicare.

4 kinds of Medicare Savings Programs

Select a program name below for details about each Medicare Savings Program. If you have income from working, you still may qualify for these 4 programs even if your income is higher than the income limits listed for each program.

How do I apply for Medicare Savings Programs?

If you answer yes to these 3 questions, call your State Medicaid Program to see if you qualify for a Medicare Savings Program in your state:.

What is Medicare Supplement?

Medicare Supplement (Medigap) Medigap is supplemental Medicare insurance. It is an original Medicare add-on that helps cover some of the out-of-pocket costs associated with your plans. The Medicare QDWI program does not help cover any of your Medigap plan premiums.

What is Medicare QDWI?

The Medicare Qualified Disabled and Working Individuals ( QDWI) program helps cover the Medicare Part A premium. Individuals who qualify for this program include low-income, working, disabled beneficiaries who are under the age of 65. Qualifying individuals can apply for the Medicare QDWI program through their state’s local health insurance office.

How to enroll in QDWI?

To enroll in the Medicare QDWI program, you must fill out an application through the Medicare program in your state. In some states, you may be allowed to fill out an application online through your state’s Department of Insurance website.

What are the requirements for Medicare?

You must also meet the income requirements to enroll in your state’s Medicare QDWI program, which include: 1 an individual monthly income of $4,339 or less in 2020 2 an individual resources limit of $4,000 3 a married couple monthly income of $5,833 or less in 2020 4 a married couple resources limit of $6,000

What does QDWI cover?

It covers inpatient hospital stays, home health care services, short-term skilled nursing facility services, and end of life hospice care. When you are enrolled in Medicare Part A, you pay a monthly premium for your coverage. The Medicare QDWI program helps pay for this monthly Part A premium cost.

What is the income limit for QDWI 2020?

You must also meet the income requirements to enroll in your state’s Medicare QDWI program, which include: an individual monthly income of $4,339 or less in 2020. an individual resources limit of $4,000. a married couple monthly income of $5,833 or less in 2020. a married couple resources limit of $6,000.

Does Medicare Part D cover prescription drugs?

Medicare Part D is prescription drug coverage. It is an original Medicare add-on that helps cover the cost of the prescription drugs you take. Although there is a monthly premium associated with most Medicare prescription drug plans, the Medicare QDWI program does not cover it.