The Medicare Prescription Drug, Improvement and Modernization Act of 2003 created the Medicare Part D

Medicare Part D

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

Full Answer

What is part D of Medicare Part A?

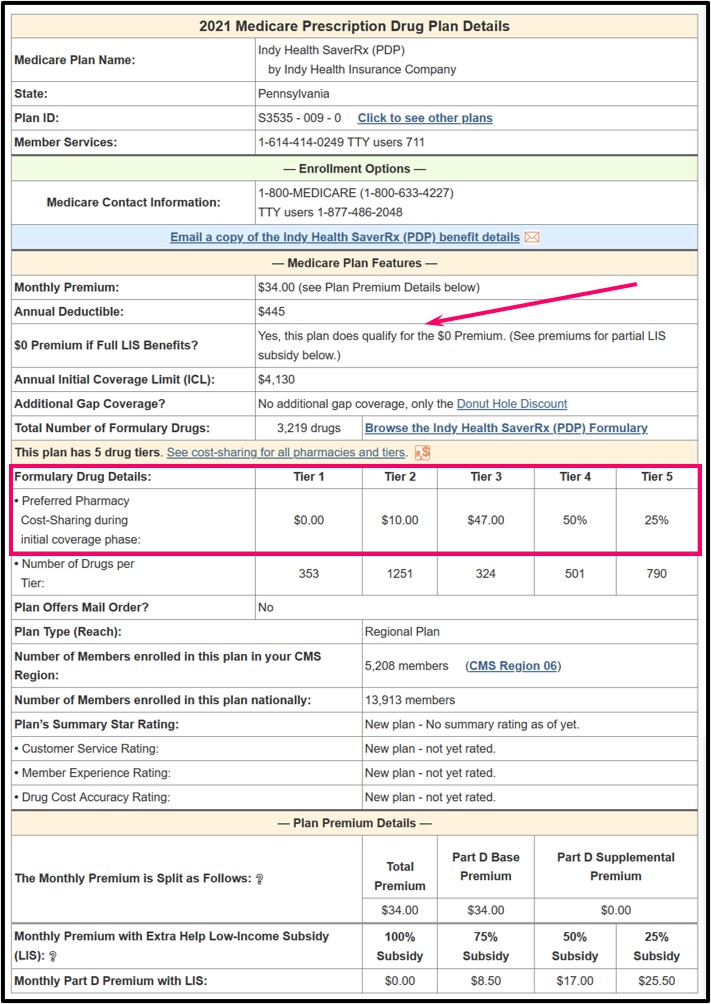

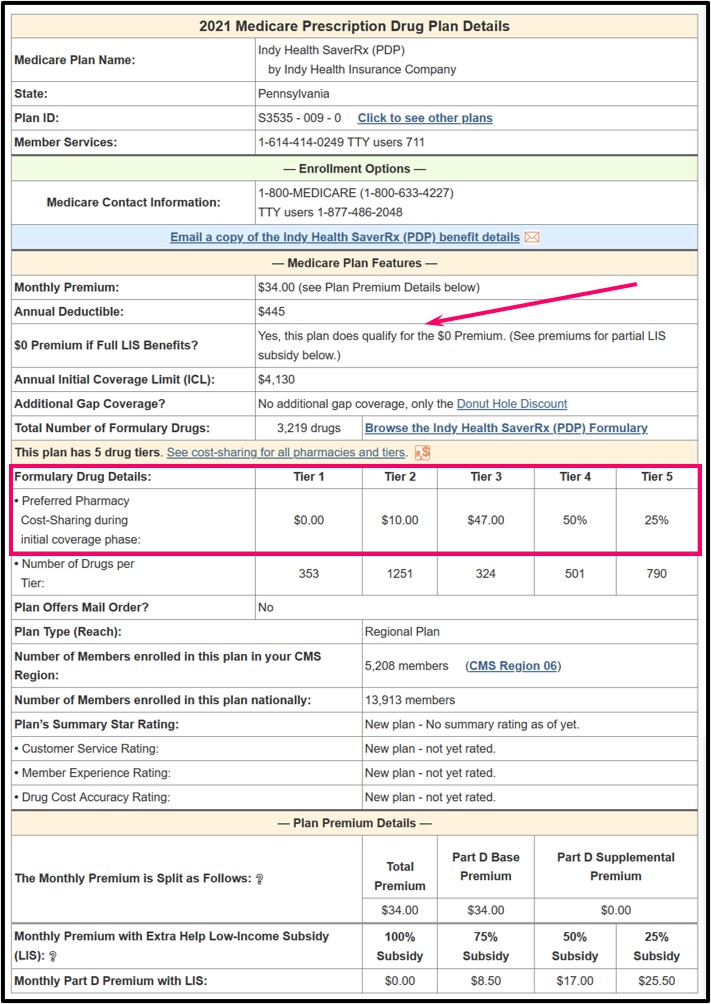

Medicare Part D. Part D is a standalone prescription drug coverage plan offered by the government that beneficiaries can purchase in addition to original Medicare (Parts A and B). A Part D plan includes a deductible, which varies by plan but does have a cap put in place by the government.

What is the Medicare Part D deductible for prescription drugs?

Medicare Part D Part D is a standalone prescription drug coverage plan offered by the government that beneficiaries can purchase in addition to original Medicare (Parts A and B). A Part D plan includes a deductible, which varies by plan but does have a cap put in place by the government. In 2017, the maximum Part D deductible is $400.

Should I enroll in Part D or Medicare Advantage for prescription drugs?

Two different options exist for prescription drug coverage in Medicare: enrolling in a Medicare Part D plan or choosing a Medicare Advantage plan that includes prescription drug coverage. Which one is better? The answer depends on your specific needs.

What is the Medicare Part D prescription drug gap?

When it begins: When you and your Medicare Part D plan have collectively spent $4,130 on your covered prescription drugs. Once in this stage of the plan, you will pay 25% of the retail cost of your prescription drugs. Gap spending will continue until your total out of pocket costs have reached $6,350 (2020’s figure).

What is a sanctioned Medicare plan?

If the health plan fails to comply with the MLR requirements for five consecutive years, the federal government can terminate the Medicare Advantage contract with the health insurer, preventing it from being offered, though this is the first time CMS has sanctioned a health plan for failing to comply with the ...

What does sanctioned by CMS mean?

SANCTIONS. Administrative remedies and actions (e.g., exclusion, Civil Monetary Penalties, etc.) available to the OIG to deal with questionable, improper, or abusive behaviors of providers under the Medicare, Medicaid, or any State health programs. SECOND OPINION.

What does precluded providers mean?

A provider will be precluded for the length of their re-enrollment bar if they are currently revoked or would have been revoked had they enrolled in the Medicare program.

Why would a doctor be put on preclusion list?

Why was the list created? To replace the Medicare Advantage (MA) and prescriber enrollment requirements. To ensure patient protections and safety and to protect the Trust Funds from prescribers and providers identified as bad actors.

What does it mean when a provider is sanctioned?

Sanctioned Provider means a provider, entity or individual, who has been suspended, terminated or excluded from furnishing, ordering, or prescribing items or services to Medicaid beneficiaries.

What is the difference between sanctions and exclusions?

Sanctions can be imposed for many reasons but are primarily the result of patient abuse, criminal convictions related to diversion of controlled substances, or healthcare fraud. An exclusion, however, is the result of an extreme sanction which is issued by the HHS OIG (Office of Inspector General).

What is the meaning of word precluded?

to make impossible bytransitive verb. 1 : to make impossible by necessary consequence : rule out in advance. 2 archaic : close.

What is a CMS exclusion list?

Overview. The OIG Exclusion List is a registry of individuals and entities that have been excluded from participation in Federal health care programs. Exclusion may be mandatory in nature or permissive, depending based on the underlying adverse action.

What is a Medicare revocation?

❖ Revocation: removal of billing privileges and termination of provider/supplier.

Who can access the preclusion list?

EIDM is the system that connects you to all the Centers for Medicare & Medicaid Services (CMS) applications with one central user ID. The EIDM user authentication process prevents others from using a user's identity fraudulently. You will need an EIDM user ID to access the Preclusion List.

Can Medicare be revoked?

Medicare billing privileges can be revoked for twenty-two enumerated reasons, including non-compliance with Medicare enrollment requirements, felony convictions, and failure to respond to requests for medical records.

How do I find CMS preclusion list?

You will need an EIDM user ID to access the CMS preclusion List. Go to the CMS Enterprise Portal at https://portal.cms.gov and choose “New User Registration.” > Use the drop-down menu to choose “CMS Preclusion List” as your application.

Does UHC follow CMS guidelines?

UnitedHealthcare follows CMS guidelines and considers interprofessional telephone/Internet assessment and management services reported by consultative physicians with CPT codes 99446-99449 and 99451-99452 eligible for reimbursement according to the CMS Physician Fee Schedule (PFS).

What are political sanctions?

Diplomatic sanctions are political measures taken to express disapproval or displeasure at a certain action through diplomatic and political means, rather than affecting economic or military relations.

What is the definition of a critical section a violation Medicare?

What is the definition of a critical Section A violation? Typically a willful action reported to Humana by the Medicare beneficiary. Penalties and sanctions for HIPAA privacy violations potentially include: Fines and possible imprisonment.

What does denial Code N174 mean?

N174 This is not a covered service/procedure/ equipment/bed, however patient liability is limited to amounts shown in the adjustments under group "PR".

What does Medicare Part D cover?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary.

What is a drug plan's list of covered drugs called?

A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary. Many plans place drugs into different levels, called “tiers,” on their formularies. Drugs in each tier have a different cost. For example, a drug in a lower tier will generally cost you less than a drug in a higher tier.

What is formulary exception?

A formulary exception is a drug plan's decision to cover a drug that's not on its drug list or to waive a coverage rule. A tiering exception is a drug plan's decision to charge a lower amount for a drug that's on its non-preferred drug tier.

What happens if you don't use a drug on Medicare?

If you use a drug that isn’t on your plan’s drug list, you’ll have to pay full price instead of a copayment or coinsurance, unless you qualify for a formulary exception. All Medicare drug plans have negotiated to get lower prices for the drugs on their drug lists, so using those drugs will generally save you money.

How many prescription drugs are covered by Medicare?

Plans include both brand-name prescription drugs and generic drug coverage. The formulary includes at least 2 drugs in the most commonly prescribed categories and classes. This helps make sure that people with different medical conditions can get the prescription drugs they need. All Medicare drug plans generally must cover at least 2 drugs per ...

How many drugs does Medicare cover?

All Medicare drug plans generally must cover at least 2 drugs per drug category, but plans can choose which drugs covered by Part D they will offer. The formulary might not include your specific drug. However, in most cases, a similar drug should be available.

What is a tier in prescription drug coverage?

Tiers. To lower costs, many plans offering prescription drug coverage place drugs into different “. tiers. Groups of drugs that have a different cost for each group. Generally, a drug in a lower tier will cost you less than a drug in a higher tier. ” on their formularies. Each plan can divide its tiers in different ways.

What is Medicare Part D?

Prescription Coverage is often referred to as Medicare Part D. Medicare coverage of prescription drugs is an optional benefit offered to everyone who has Medicare Part A or Part B, or both. Medicare Part D plans can help lower than the full market price of medicine. Automatic refill services through the mail may be a convenient option ...

What are the out-of-pocket costs of Medicare Part D?

Enrollees can authorize an automatic deduction from Social Security for Part D premiums. Out-of-pocket costs include deductibles, copays, and coinsurance. These vary by the plan chosen and the prescription needs a person has.

What does CMS mean for prescription drugs?

The Centers for Medicare and Medicaid Services (CMS) approves the drug formulary for each plan. As a rule, plans must include at least 2 drugs in the most commonly prescribed categories or classes of drugs. This effectively helps people with different medical conditions to get the prescription drugs they need.

How much will the catastrophic coverage limit be in 2021?

Upon reaching the catastrophic out-of-pocket spending threshold for that year, drug savings resume. In 2021, that limit is $6,550 spent on formulary prescription drugs.

How long does it take to enroll in Medicare?

Ideally, the window to enroll in Medicare Prescription Drug coverage is the 7-month Initial Enrollment Period surrounding one’s 65th birthday. People younger than age 65 with eligibility for Medicare due to disability get a 7-month Initial Enrollment Period. This IEP runs from the 22nd month of receiving disability benefits, ...

How long do you have to give a plan to add a low cost generic?

Moreover, plans must give a 30-day notice when a formulary adds a low cost generic in place of a high tier drug. Following suit, plans must provide at least a one-month supply of dropped drugs under the same plan coverage as before the formulary changed. Medicare Part D Costs.

How long can you go without prescription coverage?

Generally, the penalty applies to applicants who go without prescription medical coverage for more than 63 consecutive days. After the Initial Enrollment Period’s final date, the clock starts ticking.

What is a Part D plan?

The best Medicare Part D plans not only help you manage the cost of prescription drugs, they also play a role in ensuring medicines stay affordable and they can protect against future price hikes. Roughly 70% of Americans signed up for Medicare supplement with a Part D plan, ...

How long does Medicare Part D last?

There are three different enrollment periods for Medicare Part D, as follows: Initial enrollment period: This covers a total of seven months - three months before you turn 65, your birthday month itself, and then the three months directly after your 65th birthday. So seven months in total.

What is the Medicare Part D deductible for 2020?

In 2020, the allowable Medicare Part D deductible is $435. Depending on the provider you choose, plans may either charge the full deductible, a partial, or waive the deductible (zero deductible). You pay the network discounted price for prescription drugs until your plan equals the deductible.

What is the best Medicare Part D provider?

The best Medicare Part D providers include AARP, Humana Medicare Rx, WellCare, and Cigna-HealthSpring. If you’re eligible for Part D coverage, the three main considerations you’re likely to make are your current health, budget, and any medicine you take.

What are the deductibles for Medicare?

Deductibles apply to services covered under Part A and B. Medicare Part C (Medicare Advantage Plans) and Medicare Part D are optional and have their own premiums. If you live in a low income household, you may qualify for a subsidy to reduce the overall cost of Medicare.

Is AARP a good Medicare plan?

AARP Medicare Rx, with services provided by United Healthcare, is an excellent all-round provider of Medicare Part D plans and is the only range of plans backed by AARP. This is the best Medicare Part D plan option for seniors as it mixes low co-pays with competitive premiums and has a network of preferred providers.

Does Medicare Part D have monthly premiums?

Similar to other commercial health insurance plans, Medicare Part D Prescription Drug Plans vary with the monthly premiums, depending on the company and the coverage and the prescriptions you need covered. Expert Advice.

What is a Part D plan?

Part D is a standalone prescription drug coverage plan offered by the government that beneficiaries can purchase in addition to original Medicare (Parts A and B). A Part D plan includes a deductible, which varies by plan but does have a cap put in place by the government. In 2017, the maximum Part D deductible is $400. It increases to $405 next year. Once you meet the deductible, you’ll pay 25 percent for the cost of your prescriptions while the plan pays for the remainder until you meet your plan’s coverage limit.#N#The initial coverage limit is $3,700 in 2017 and will increase to $3,750 in 2018. Once you hit the coverage limit, you’ll be stuck in a situation known as the “donut hole,” or coverage gap, a scenario that the Affordable Care Act has been working on addressing by giving seniors additional discounts while they’re in the gap.

Why do people choose Medicare Advantage over Part D?

There’s a reason that more people are choosing Medicare Advantage plans over Part D coverage, and that’s primarily because MA plans include more comprehensive coverage. Some plans, for instance, even cover vision and dental, which traditional Medicare does not. But MA plans aren’t necessary for everyone, and you may be fine with original Medicare ...

Why are Advantage plans better than Original Plans?

Advantage plans come with their own separate premium costs, but benefits can be better for a lot of people because Advantage plans are more comprehensive than original plans. Many MA plans provide prescription drug coverage, usually requiring beneficiaries to pay a set copay.

How to contact Medicare Advantage?

Medicare Part D vs. Medicare Advantage Plans. For more information on Medicare, please call the number below to speak with a healthcare specialist. 1-800-810-1437. Choosing which Medicare plan works best for you can be overwhelming. If you are one of many seniors who also takes prescription drugs, there are added considerations.

Can you get a donut hole with Medicare Part D?

With low prescription costs, you may never reach the donut hole. Choosing between Medicare Part D and a Medicare Advantage plan with drug coverage comes down to cost and long-term benefit. Evaluate your medication needs, talk to your doctor and make a list of questions to ask a qualified Medicare specialist.

Why did Cigna get sanctioned?

U.S. regulators recently imposed sanctions on health insurer Cigna-HealthSpring because of issues with certain Medicare offerings.

When is open enrollment for Medicare?

Open enrollment, which runs from Oct. 15 to Dec. 7 each year, is when Medicare beneficiaries are allowed to shop for Medicare Advantage and prescription drug plans for the following year.

Does Cigna HealthSpring have Medicare Advantage?

The sanctions only involve Cigna-HealthSpring’s plans for Medicare Advantage (also called Medicare Part C, which is private insurance that replaces Original Medicare) and Medicare Part D (which is prescription drug coverage.) If you have a Cigna-HealthSpring Medicare Advantage health insurance plan or a Cigna-HealthSpring Medicare Part D ...

Does Cigna HealthSpring have a suspension?

Cigna-HealthSpring, which reported the sanctions in a regulatory public filing, stated that the suspension, effective immediately, does not affect members currently enrolled in the plans, as reported by Reuters.

Is Cigna HealthSpring banned from Medicare?

For now, the sanctions mostly affect consumers who are aging into Medicare — meaning they are turning 65 and becoming eligible for Medicare — because Cigna-HealthSpring is banned from marketing and offering new Medicare Advantage and Prescription Drug plans.

How many providers are on the preclusion list?

Approximately 1,300 providers and prescribers appeared on the initial Preclusion List. CMS suggests that payment denials and claim rejections begin on April 1, 2019 for the December 31, 2018 Preclusion List.

When will the preclusion list start?

Claim Rejection and Denials for Providers on the Preclusion List to begin on April 1, 2019.

Do Part D plans have to reject a claim?

Part D plans will be required to reject a pharmacy claim (or deny a beneficiary request for reimbursement) for a Part D drug that is prescribed by an individual on the Preclusion List. These efforts are essential to protect patients and people with Medicare benefits who may not be aware their provider is precluded from billing Medicare for services.