How does a spell of illness affect my Medicare benefits?

Where a spell of illness continues for a long period of time, as over a several year period, the program pays less than 90 days of care per year, because it does not pay in the second or third year if there has not been a break in the spell of illness. Additionally, under Medicare, the deductible is tied to each spell of illness.

What is a “spell of illness”?

Intregral to determination of a benefit period is the term “spell of illness.” 42 U.S. Code § 1395x (a) defines a spell of illness as follows: The term “spell of illness” with respect to any individual means a period of consecutive days—

What happens if my health insurance is exhausted during a spell?

Once coverage is exhausted during a spell of illness, there is no additional coverage until a new spell of illness (and benefit period) begins. 42 U.S. Code § 1395d (b) expressly provides that payment under this part for services furnished an individual during a spell of illness may not (subject to subsection (c)) be made for—

What is a benefit period (spell of illness)?

Understanding the Part A Benefit Period (Spell of Illness) A benefit period (also known as a spell of illness) is a period of consecutive days during which medical benefits for covered services, with certain specified maximum limitations, are available to the beneficiary.

What is the 60-day rule for Medicare?

The 60-day rule requires anyone who has received an overpayment from Medicare or Medicaid to report and return the overpayment within the latter of (1) 60 days after the date on which the overpayment was identified and (2) the due date of a corresponding cost report (if any).

What happens when Medicare benefits are exhausted?

When a patient receives services after exhaustion of 90 days of coverage, benefits will be paid for available reserve days on the basis of the patient's request for payment, unless the patient has indicated in writing that he or she elects not to have the program pay for such services.

What would prevent a resident from being covered under the presumption of coverage?

If the beneficiary is discharged from the hospital to a setting other than the SNF, the presumption of coverage does not apply, even if the beneficiary's SNF admission occurs within 30 days of discharge from the qualifying hospital stay.

How many days will Medicare pay for a hospital stay?

90 daysMedicare covers a hospital stay of up to 90 days, though a person may still need to pay coinsurance during this time. While Medicare does help fund longer stays, it may take the extra time from an individual's reserve days. Medicare provides 60 lifetime reserve days.

Can you run out of Medicare coverage?

In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

What is the 3 day rule for Medicare?

The 3-day rule requires the patient have a medically necessary 3-consecutive-day inpatient hospital stay. The 3-consecutive-day count doesn't include the discharge day or pre-admission time spent in the Emergency Room (ER) or outpatient observation.

What is presumption of care?

In general, CMS presumes that beneficiaries admitted to an SNF immediately after a hospital stay requires a skilled level of care. Therefore, CMS has developed the presumption of coverage policy.

What is an interrupted stay for Medicare?

A stay is considered interrupted when A resident leaves the facility and returns to that same SNF no later than the third calendar day after they left. The resident remains in the facility but is no longer under Medicare A coverage, and their Medicare A coverage needs to resume within three days.

What is the interrupted stay policy?

An “interrupted” stay is one in which a patient is discharged from Part A SNF care and subsequently readmitted under the following TWO conditions: The patient returns to Part A care in the same SNF (not a different SNF); AND: The patient returns within three days or less (the “interruption window”)

Does Medicare pay 100 percent of hospital bills?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

Can Medicare kick you out of hospital?

Medicare covers 90 days of hospitalization per illness (plus a 60-day "lifetime reserve"). However, if you are admitted to a hospital as a Medicare patient, the hospital may try to discharge you before you are ready. While the hospital can't force you to leave, it can begin charging you for services.

What is the Medicare two midnight rule?

The Two-Midnight rule, adopted in October 2013 by the Centers for Medicare and Medicaid Services, states that more highly reimbursed inpatient payment is appropriate if care is expected to last at least two midnights; otherwise, observation stays should be used.

What will happen to Medicare in 2026?

According to a new report from Medicare's board of trustees, Medicare's insurance trust fund that pays hospitals is expected to run out of money in 2026 (the same projection as last year). The report states that in 2020, Medicare covered 62.6 million people, 54.1 million aged 65 and older, and 8.5 million disabled.

Can you lose Medicare Part B coverage?

If you're enrolled in a Medicare Advantage or Medicare Supplement plan, your coverage is typically contingent on being enrolled in Part A and Part B. If you lose Part A or Part B coverage because you didn't pay the premiums, you may be disenrolled from your other plan. You move outside your plan's coverage area.

Why would Medicare be suspended?

Improper Medicare Payments and Payment Suspensions CMS imposes suspensions under any of three circumstances: (1) fraud or willful misrepresentation, (2) when an overpayment exists but the amount has not been determined, and (3) when payments made or to be made may be incorrect.

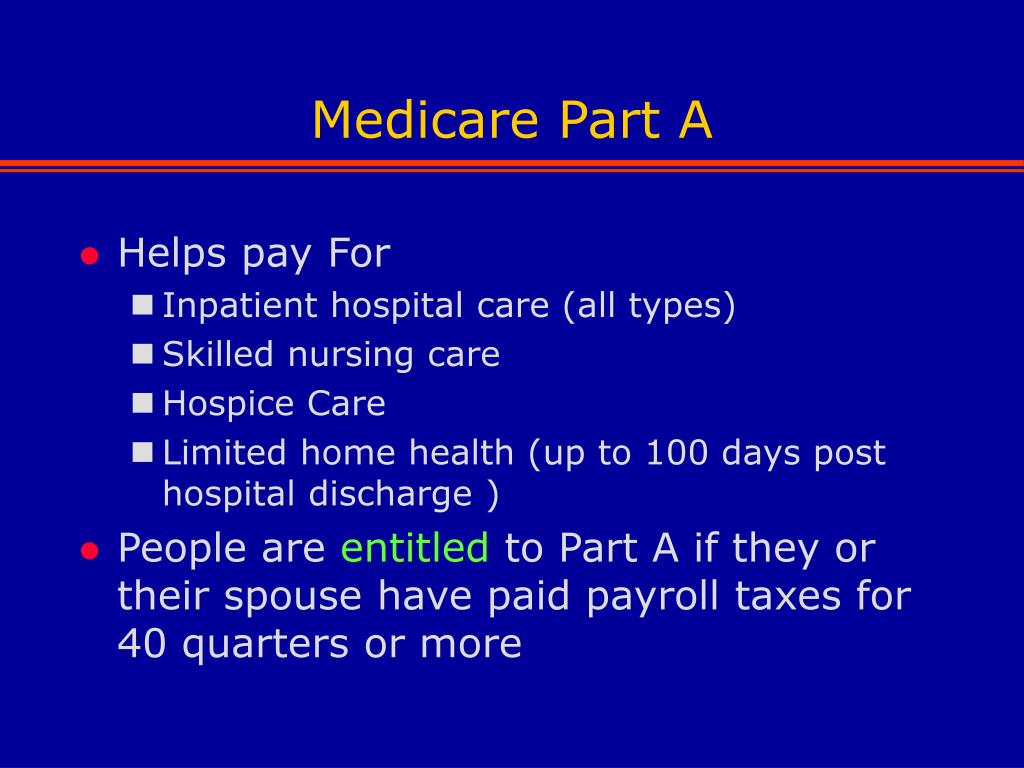

What makes you not eligible for Medicare?

Did not work in employment covered by Social Security/Medicare. Do not have 40 quarters in Social Security/Medicare-covered employment. Do not qualify through the work history of a current, former, or deceased spouse.

What is a spell of illness?

Understanding the Part A Benefit Period (Spell of Illness) A benefit period (also known as a spell of illness) is a period of consecutive days during which medical benefits for covered services, with certain specified maximum limitations, are available to the beneficiary. The benefit period begins the day a beneficiary is admitted as an inpatient ...

How many days does Medicare have in February?

Assumption: Medicare beneficiary admitted to an ACH on January 1, starting a full benefit period (not using LTR days) with stays at 2 ACHs and 2 SNFs. February has 28 days.

When does a day start for Medicare?

The number of days of care charged to a beneficiary for inpatient hospital or SNF care services is always in units of full days. A day begins at midnight and ends 24 hours later. The midnight-to-midnight method is to be used in counting days of care for Medicare reporting purposes even if the hospital or SNF uses a different definition of day for statistical or other purposes.

How long does a hospital beneficiary have to pay for inpatient care?

A beneficiary having hospital insurance coverage is entitled, subject to the inpatient deductible and coinsurance requirements, to have payment made on his/her behalf for up to 90 days of covered inpatient hospital services in each benefit period (also, the beneficiary has a lifetime reserve (LTR) of 60 additional days upon exhausting 90 regular benefit days):