All Medicare Supplement plans typically cover:

- Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted

- Some or all of your Medicare Part B coinsurance

- Some or all of your Part A hospice coinsurance

- Some or all of your first three pints of blood

Full Answer

What are the best Medicare supplement plans?

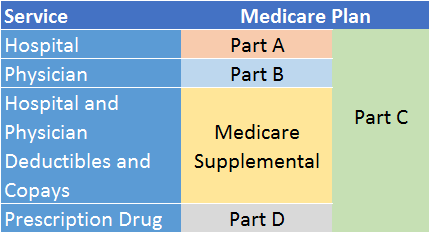

- Medicare Supplement Insurance helps you manage out-of-pocket costs for covered services

- Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share

- Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020

How much does a Medicare supplement insurance plan cost?

Medicare Supplement Insurance Cost Factors

- Plan Coverage. One big factor in the cost of a Medicare Supplement Insurance plan is the level of coverage provided.

- Carrier. Medicare Supplement Insurance is sold by private insurance companies that set their own plan prices.

- Location. ...

- Enrollment Time. ...

- Pricing Structure. ...

- Discounts. ...

- Gender. ...

What is the best medical supplement for Medicare?

- You must have Medicare Part A and Part B.

- A Medigap policy is different from a Medicare Advantage Plan. ...

- You pay the private insurance company a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. ...

- A Medigap policy only covers one person. ...

Do I really need a Medicare supplement?

You need a Medicare supplement to provide you peace of mind, knowing that if the unexpected happens, you won’t have your credit ruined because of unpaid medical bills. Medicare supplements take care of things like co-payments, deductibles, and coinsurance that you are responsible for, and some plans even cover you if you travel outside of the United States.

What is the difference between a supplement plan and a Medicare Advantage Plan?

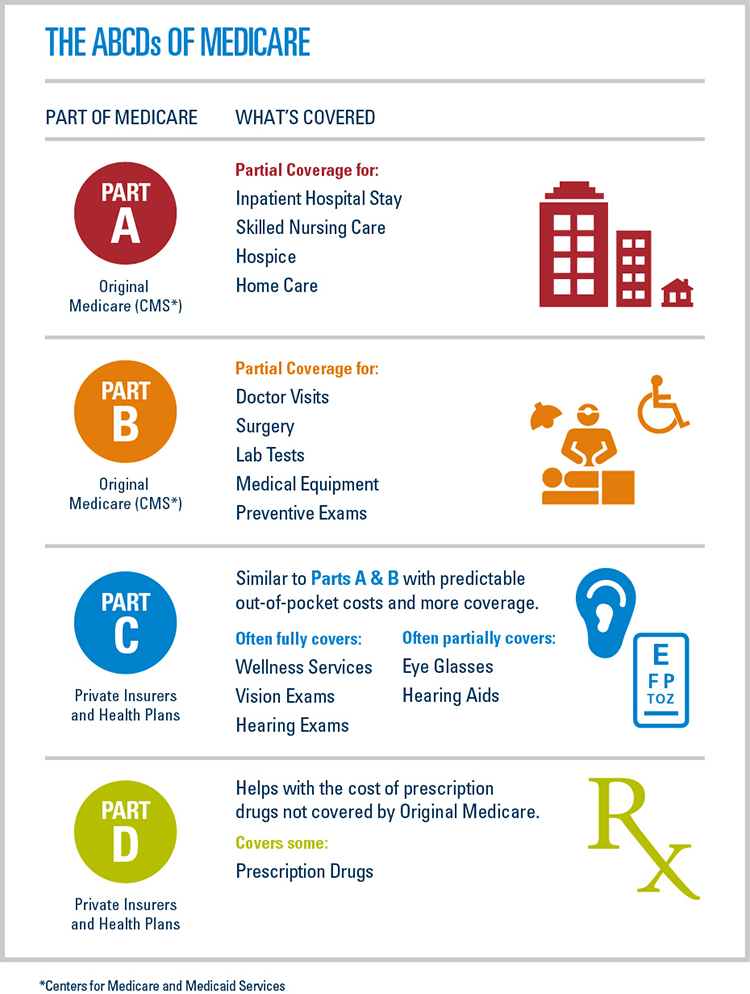

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

What do Medicare Supplement plans offer?

Medicare Supplement or Medigap policies are designed to pay your costs related to Original Medicare. Depending on the plan you choose, they could pay the Part A hospital deductible, the Part B deductible, and the 20% coinsurance that you are responsible for, as well as other out-of-pocket costs.

What is a standard Medicare Supplement plan?

Medicare Supplement insurance Plan A covers 100% of four things: Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days after Medicare benefits are used up. Medicare Part B copayment or coinsurance expenses. The first 3 pints of blood used in a medical procedure.

What is the difference between Medicare secondary and supplemental insurance?

Secondary health insurance provides the coverage of a full health care policy while supplemental insurance is intended only to augment an existing primary care plan. Choosing one of these health care routes may come down to finances and the coverage extended through your primary health insurance.

Is there a Medicare Supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What is the difference between plan G and plan N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

Do Medicare Supplement plans cover deductible?

Most Medicare Supplement insurance plans cover the Part A deductible at least 50%. All Medicare Supplement plans also cover your Part A coinsurance and hospital costs 100% for an additional 365 days after your Medicare benefits are used up.

What is the most comprehensive Medicare Supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Does Medicare cover copay as secondary?

Medicare will normally act as a primary payer and cover most of your costs once you're enrolled in benefits. Your other health insurance plan will then act as a secondary payer and cover any remaining costs, such as coinsurance or copayments.

Is Medigap same as supplement?

Summary: Medicare Supplement and Medigap are different names for the same type of health insurance plan – you can use either name.

What is Medicare Supplement Insurance Plan?

What Is a Medicare Supplement Insurance Plan? A Medicare Supplement Insurance plan (also called Medigap) can help cover some of the out-of-pocket costs that Original Medicare doesn't, such as copays and deductibles. Each type of plan offers a different combination of basic health insurance benefits. Use the following guide to compare Medicare ...

Which is the most popular Medicare Supplement?

Medigap Plan F Is the Most Popular. Medicare Supplement Insurance Plan F is the most popular Medigap plan, largely because it offers the most comprehensive range of basic benefits. Plan F is the only Medigap plan that covers all nine of the basic Medigap benefits, including the Medicare Part B deductible and Part B excess charges.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

When is the best time to buy Medicare Supplement?

The best time to buy a Medicare Supplement Insurance plan is during your Medigap open enrollment period. During your open enrollment period, insurance companies cannot consider any pre-existing conditions when deciding whether or not to offer you a policy. They also cannot charge you more for a Medigap plan based on pre-existing conditions.

Does Medicare Supplement Insurance require coinsurance?

Medicare Supplement Insurance Plans. Medicare Part A and Part B both require deductibles and coinsurance or copays. Medigap plans help beneficiaries fill in these cost "gaps" that can add up to potentially large dollar amounts. The chart below lists the basic benefits offered by each type of Medigap plan. Click here to view enlarged chart.

What is Medicare Supplement?

Medicare Supplement insurance plans are private insurance plans that are offered to help bridge the gap between the coverage you need and what is offered through Medicare. While Medicare pays for a large percentage of the healthcare services and supplies you may need, it does not offer complete coverage, so Medicare Supplement insurance plans can ...

How does Medicare Supplement insurance work?

A Medicare Supplement insurance plan will have a monthly premium cost that you pay to the private insurance company that you purchased the plan through. You’ll pay your monthly Medigap policy premium separately of any Medicare premiums. Costs can vary widely for Medicare Supplement plans because they are offered through private insurance companies, ...

What happens when you buy a Medicare Supplement?

When you purchase a Medicare Supplement insurance plan, your Medigap policy will serve as a secondary source of insurance. That means that Medicare will be used first to pay for any Medicare-approved costs for any healthcare supplies and services. After Medicare has been applied, then your Medigap policy will be charged.

Why is Medicare Supplement Insurance called Medigap?

Medicare Supplement insurance plans are often referred to as Medigap policies, because they can help fill the gap between Medicare and healthcare needs. Many people use Medigap policies to help cover the costs of associated healthcare expenses, such as coinsurance payments, copays and deductibles.

How much does Medigap pay for emergency care?

Additionally, the Medigap policy will only pay 80% of the billed charges for eligible medically-necessary emergency care providing you pay your $250 year ly deductible. Additionally, the $250 deductible for foreign travel coverage is a separate deductible from any regular deductible that your plan stipulates.

How long after Medicare benefits are used up can you get a coinsurance?

Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up. Part B coinsurance or copayment. The first three pints of blood. Part A hospice care coinsurance or copayment. Skilled nursing facility care coinsurance. Part A deductible.

Does Medicare Supplement cover travel?

Unlike Original Medicare, Medicare Supplement insurance plans offer the advantage of additional coverage for emergency health care when you are outside of the U.S. For instance, Medigap Plans C, D, F, G, M, and N offer foreign travel emergency health care coverage if you are traveling outside of the U.S. There are also additional Medigap policies that are no longer for sale, but if you are already enrolled in them, they cover you for emergency care while traveling as well.

What Is Medigap?

Medigap, or Medicare Supplement, is a private insurance policy purchased to help pay for what isn’t covered by Original Medicare (which includes Part A and Part B). These secondary coverage plans only apply with Original Medicare—not other private insurance policies, standalone Medicare plans or Medicare Advantage plans.

How to Choose the Right Medicare Supplement Plan for You

What are my health care needs now and possibly in the future? Consider your current health status as well as your family history.

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best.

How to Sign Up for Medigap Plans

Signing up for a Medigap plan is easy. “Medicare supplements may be bought through an agent or from the carrier directly,” says Corujo. Since there’s no annual open enrollment period, you may join at any time.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

Which Medicare supplement is best for seniors?

Best overall Medicare supplement for new enrollees: Plan G. Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible.

How much is Medicare Part B deductible in 2021?

This means that you would be responsible for paying the entire Medicare Part B deductible — $203 a year for 2021 — before insurance benefits will begin to pay out. However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473.

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

What is the best alternative to Plan G?

Best alternative to Plan G Medicare supplement: Plan N. Plan N is a good option for individuals who do not want to purchase Plan G but still want comprehensive Medicare insurance coverage at a cheaper price.

Is Medicare Supplement Plan G the same as Aetna?

This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna. However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans.

Is Plan F a good plan?

Plan F is a good option if you want a comprehensive policy that will give you peace of mind about day-to-day expenses, such as paying a copay for a doctor. The monthly premium for Plan F will be $221. Unfortunately, Plan F will not be available to new Medicare enrollees who become eligible after Jan. 1, 2020.

How long does a Supplement 1 plan cover?

The Supplement 1 plan covers 120 days of mental health hospitalization and the state-mandated benefits, plus the deductibles for Medicare Part A and Part B, co-insurances for services at a skilled nursing facility under Part A, and emergency medical costs when traveling outside of the U.S.

Who regulates Medicare Supplement Insurance?

Medicare Supplement Insurance plans are tightly regulated by the Centers for Medicare and Medicaid Services (CMS), a government agency. CMS determines what each letter plan will cover, and it requires each insurance company to offer the plan as is, without modifications.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What is covered by Plan A?

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

How much does Medicare pay for a doctor's visit?

Here’s an example with numbers: if the doctor’s visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

What is Medicare Supplement Insurance?

Each plan has different , yet standardized, benefits and coverage that must follow federal and state laws, and must be clearly identified as “Medicare Supplement Insurance.”. This means that no matter which insurer you buy from, the basic benefits of each plan type of the same letter will be the same. In Massachusetts, Minnesota, and Wisconsin, ...

How to apply for Medicare Supplement?

You can apply for a Medicare Supplement plan insurance policy if you are: 1 A resident of a state where the policy is offered. 2 Enrolled in Medicare Parts A and B. 3 Age 65 or over, or in some states, under age 65 with a disability and/or end stage renal disease (plan offerings and eligibility vary by state).

What does Medigap cover?

What Medigap Plans Can and Cannot Cover. A Medicare Supplement Insurance (Medigap) policy, sold by private companies, may help pay some of the health care costs that Original Medicare doesn’t cover: Your Medicare deductibles. Your coinsurance. Hospital costs after you run out of Medicare-covered days. Skilled nursing facility costs ...

What is the age limit for Medicare?

A resident of a state where the policy is offered. Enrolled in Medicare Parts A and B. Age 65 or over, or in some states, under age 65 with a disability and/or end stage renal disease (plan offerings and eligibility vary by state). Note: Medigap Plans are different from Medicare Advantage Plans. In fact, Medigap policies can’t work ...

When to enroll in Medigap?

How to Enroll in Medigap Plans. It is highly recommended that you buy a Medigap policy during your six-month Medigap open enrollment period which starts the month you turn 65 and are enrolled in Medicare Part B (Medical Insurance).

Can you get a Medigap policy with Medicare Advantage?

Note: Medigap Plans are different from Medicare Advantage Plans. In fact, Medigap policies can’t work with Medicare Advantage Plans. You must have Original Medicare Parts A and B to get a Medigap policy.

Does Medigap cover out of pocket expenses?

Medigap can help pay out-of-pocket expenses that Original Medicare doesn’t cover. An Original Medicare plan paired with a Medigap policy can offer comprehensive coverage, which will likely result in lower out-of-pocket expenses.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.