AARP MedicareComplete is a Medicare Advantage health insurance plan that gives you both Medicare Part A and Part B along with additional benefits for drug coverage, hearing exams and wellness programs. Basic Coverage

Full Answer

What Medicare plans does UnitedHealthcare offer?

With over 12 million Medicare members and a partnership with AARP, UnitedHealthcare provides Medicare beneficiaries with other types of Medicare coverage. UnitedHealthcare’s coverage includes Medicare Advantage plans, stand-alone Medicare Prescription Drug Plans (Part D), and Medicare Supplement (Medigap) plans.

Is UnitedHealthcare the same as AARP?

UnitedHealthcare has a long standing relationship with AARP. UnitedHealthcare and AARP are both aligned in caring about individuals over the age of 50 and their access to affordable, quality healthcare. What does it mean to carry the AARP name?

Which providers accept United Healthcare Medicare plans?

Your UnitedHealthcare Medicare plans provider network might include primary care providers, medical and surgical specialists, pharmacists, hospitals, outpatient facilities, labs, and/or imaging centers. Depending on the plan you choose, you may even have dental, vision, and hearing care providers in your plan network.

Does AARP offer the best Medicare supplemental insurance?

We chose AARP as best for its set pricing for Medicare Supplement coverage because it doesn’t charge more as you grow older. This is especially helpful if you are still covered under your...

Is AARP Medicare Advantage the same as UnitedHealthcare?

AARP Medicare Supplement plans are insured by UnitedHealthcare Insurance Company and endorsed by AARP.

What is AARP MCR complete?

AARP MedicareComplete is a Medicare Advantage health insurance plan that gives you both Medicare Part A and Part B along with additional benefits for drug coverage, hearing exams and wellness programs.

What Does AARP have to do with UnitedHealthcare?

AARP is a nonprofit, membership organization. It offers medical supplement insurance plans through the United Healthcare insurance company. The plans, also known as Medigap, help people pay for out-of-pocket medical expenses that original Medicare does not cover.

What is the difference between AARP Medicare Complete and AARP Medicare Advantage?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

Is AARP UnitedHealthcare good?

Yes, AARP/UnitedHealthcare Medicare Advantage plans provide good coverage and have an average overall rating of 4.2 stars. The company stands out for cheap PPO plans that cost $15 per month on average. The downside is overall customer satisfaction trails behind other companies such as Humana and Anthem.

What is the monthly premium for AARP Medicare Supplement?

2. AARP Medigap costs in states where age affects pricing. In states with this pricing structure, the average monthly cost for the AARP Medigap Plan G is $124 per month for someone who is 65 years old. At age 75, the average monthly premium is $199, and it's $209 for those aged 85.

What are the pros and cons of UnitedHealthcare?

Pros and Cons of AARP UnitedHealthcare Medicare AdvantageProsConsThe $0 premium and $0 deductible plans are available in most areas.PPO plan premiums are slightly higher than average in some areas.Most plans include Part D plus generous extra benefits, including dental, vision, nurse hotline, and fitness membership.2 more rows•Oct 21, 2020

Does AARP Medicare Complete require referrals?

AARP HMO plans If you have to see a specialist, you'll usually need a referral from your primary care doctor. Most AARP Medicare Advantage plans have a few exceptions to this rule. If you need flu shots, vaccines, or preventive women's healthcare services, you may receive them from a specialist without a referral.

What UnitedHealthcare products are endorsed by AARP?

* *AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare Insurance Company. UnitedHealthcare Insurance Company pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP.

Is UnitedHealthcare Medicare a good plan?

According to the National Committee for Quality Assurance, overall satisfaction ratings for Medicare plans issued by UnitedHealthcare ranged from 3.5 to 4 stars. Highest scores were for prevention. Consumer Affairs gave UnitedHealthcare a rating of 3.8 stars in 2021 based on 1,891 consumer ratings and reviews.

What is AARP insurance?

AARP is a nonprofit, membership organization. It offers medical supplement insurance plans through the United Healthcare insurance company. The plans, also known as Medigap, help people pay for out-of-pocket medical expenses that original Medicare does not cover. This article looks at the various AARP medical supplement insurance plans.

How many AARP plans are there?

The eight AARP Medigap plans offered by AARP cover some of the gaps left in original Medicare coverage, including out-of-pocket costs such as copays, coinsurance, and deductibles. The plans vary in coverage and cost. Each state has at least one AARP Medigap plan available, although people may not find all eight plans in their location.

How many Medigap plans does United Healthcare offer?

AARP members can choose from 8 standardized Medigap plans offered through United Healthcare. These plans are A, B, C, F, G, K, L, and N. Although all 50 states have at least one of these plans, people may not find all 8 plans offered in their state. A person can use this online tool to find a plan in their state.

What is the process of underwriting for Medigap?

Insurance companies use a process called medical underwriting to decide if they will accept an application for Medigap and to determine the cost. During open enrollment, a person with health issues can enroll in any Medigap policy in their state for the same price as someone in good health.

What is the Medicare Part B copayment?

For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

Does Medicare cover Medigap?

Medicare standardizes the coverage for each Medigap plan. The table below shows some of the benefits covered through the AARP Medigap plans. A person can check the complete coverage details for all AARP plans online. Benefit. Coverage 100%.

What is Medicare Advantage?

Medicare Advantage plans are offered through private companies, which develop agreements with Medicare to provide some Medicare benefits to those who sign up with them. The AARP MedicareComplete plans are available through the insurance provider UnitedHealthcare. Some medical care services continue to be covered through Medicare instead ...

What are the different types of Medicare?

UnitedHealthcare offers four types of MedicareComplete plans. One type is HMO plans, which are health maintenance organizations that require participants to pursue care within a network of providers. Another type is point-of-service plans, which maintains a network of providers but allows participants to seek coverage for certain services outside of the network for a higher price. The third type is the preferred provider organization, which allows participants to seek a provider for any covered service outside of the network; this comes with higher costs for participants. The fourth type is private fee-for-service, which provides the most flexibility in choosing your desired doctor who takes Medicare and accepts the plan's payment terms.

Do you have to pay deductible for a health insurance plan?

Plan participants pay no deductible for eligible health care costs, and an annual maximum is set for out-of-pocket costs, limiting the medical expenses participants pay in a year. They receive routine eye exams, access to a nurse by phone around the clock and coverage for emergency care anywhere in the world.

Does AARP MedicareComplete have a deductible?

Plan participants pay no deductible for eligible health care costs, and an annual maximum is set for out-of-pocket costs, ...

What is Medicare Supplement Insurance Plan?

Medicare Supplement Insurance Plan. Also called Medigap, these plans help cover some out-of-pocket costs not paid by Original Medicare. Medicare Prescription Drug Plans (Part D) This plan helps pay for prescription drugs and can be used with Original Medicare or Medicare Supplement plans. Get to know Medicare.

What is Medicare insurance?

Medicaid. Medicare insurance plans. Medicare insurance plans are for people 65 or older — or for those who may qualify because of a disability or special condition.

How old do you have to be to qualify for Medicare?

You’re under age 65 and qualify on the basis of disability or other special situation. You’re at least 65 years old and receive extra help or assistance from your state. These plans offer benefits and features beyond Original Medicare, which might also include transportation assistance and prescription drug coverage.

Is UnitedHealthcare an insurance company?

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract. Enrollment in the plan depends on the plan’s contract renewal with Medicare. Contact us. Careers.

Already a Member?

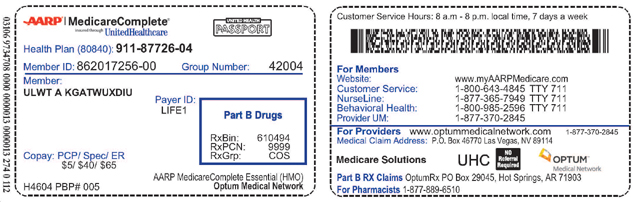

Connect with UnitedHealthcare by calling the number on your member ID card, 8 a.m.–8 p.m., 7 days a week. Or sign into your member account to get information about your plan (s).

Contact UnitedHealthcare by Mail

Use the following address to send UnitedHealthcare correspondence or enrollment forms through the mail if you have a Medicare Advantage, Medicare prescription drug or Medicare Special Needs plan.

PROVIDERS ONLY

If you are a Provider and require assistance, you may contact UnitedHealthcare plans by calling the toll-free General Provider line. Please do not call the Customer Service number listed throughout this website. Providers are routed by their Tax ID.

Website Technical Support

UnitedHealthcare Customer Service advocates are available to assist you with password resets, enhancement requests and technical issues with the website.

How much does Medicare pay for skilled nursing?

If you qualify for short-term coverage in a skilled nursing facility, Medicare pays 100 percent of the cost — meals, nursing care, room, etc. — for the first 20 days. For days 21 through 100, you bear the cost of a daily copay, which was $170.50 in 2019.

What is the 3 day rule for Medicare?

Two more things to note about the three-day rule: Medicare Advantage plans, which match the coverage of original Medicare and often provide additional benefits, often don’t have those same restrictions for enrollees. Check with your plan provider on terms for skilled nursing care.

How long does Medicare pay for a stroke?

If you’re enrolled in original Medicare, it can pay a portion of the cost for up to 100 days in a skilled nursing facility.

Does Medicare cover nursing homes?

Under specific, limited circumstances, Medicare Part A, which is the component of original Medicare that includes hospital insurance, does provide coverage for short-term stays in skilled nursing facilities, most often in nursing homes.

Does Medicare cover long term care?

Of course, Medicare covers medical services in these settings. But it does not pay for a stay in any long-term care facilities or the cost of any custodial care (that is, help with activities of daily life, such as bathing, dressing, eating and going to the bathroom), except for very limited circumstances when a person receives home health services ...

Does long term care insurance pay for veterans?

Long-term care insurance: Some people have long-term care insurance that might pay, depending on the terms of their policies. The VA: Military veterans may have access to long-term care benefits from the U.S. Department of Veterans Affairs.

Does Medicare cover skilled nursing facilities?

Skilled nursing facilities are the only places that have to abide by the rule. If you’re discharged from the hospital to another kind of facility for ongoing care, such as a rehabilitation hospital, Medicare provides coverage under different rules.

Stay fit. Stay focused. Stay you

Meet Renew Active®. The gold standard in Medicare fitness programs for body and mind. It includes:

Find a Fitness Location

Stay active by choosing a local gym or fitness location from Renew Active's network of over 20,000 locations nationwide—including many premium gyms and fitness locations not offered by other Medicare fitness programs.

Fitness at Home

You have options. If you prefer to exercise at home, you can view thousands of on-demand workout videos and live streaming fitness classes.

Exercise Your Mind

Stay focused on brain health with an online brain health program from AARP® Staying Sharp®, including: a brain health assessment and exclusive content such as brain health challenges, videos and fun games for Renew Active® members.

Classes and Events Near You

Stay active and explore your interests with local classes and events. Enjoy classes in strength training, dancing, hiking, bowling, arts and crafts, technology, reading, caregiving, nutrition and more, at no additional cost.

Already Have Renew Active?

Sign in to the Member website or call the Customer Service number on your Member ID card.

Meet with Us

1The Renew Active® program varies by plan/area. Access to gym and fitness location may vary by location and plan.

What is a federal health insurance program?

A federal health insurance program for people who are: 65 or older. Under 65 with certain disabilities. Of any age and have End Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS, also called Lou Gehrig's Disease)

Does each state have its own medicaid program?

Each state creates its own Medicaid program, but has to follow federal guidelines, like the required and optional benefits they include. Some of the benefits Medicaid programs have to include are:

Can you be dual eligible for Medicare?

If you qualify for both Medicare and Medicaid, you are considered "dual eligible.". Sometimes the two programs can work together to cover most of your health care costs. Individuals who are dual eligible can often qualify for special kinds of Medicare plans. One such example is a Dual Special Needs Plan (D-SNP).

Can a provider leave a health plan?

Your provider can leave the plan whenever they want, leaving you with a plan that your primary care physicians no longer accept and you cannot change plans until the next Open Enrollment Period. It's very possible the provider recently left the plan and that's why they are no longer on the carrier provider list.

Does AARP pay royalty fees?

AARP commercial member benefits are provided by third parties, not by AARP or its affiliates. Providers pay a royalty fee to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. Some provider offers are subject to change and may have restrictions.