UnitedHealth Group

UnitedHealth Group Incorporated is an American for-profit managed health care company based in Minnetonka, Minnesota. It offers health care products and insurance services. It is the largest healthcare company in the world by revenue, with 2018 revenue of $226.2 billion and 115 million cu…

Full Answer

Does AARP offer the best Medicare supplemental insurance?

AARP® Medicare Rx Plans from UnitedHealthcare. AARP is a nonprofit, nonpartisan organization that empowers people to choose how they live as they age. About AARP.

What is the best AARP Medicare supplement plan?

AARP Medicare Rx Plan The American Association of Retired Persons (AARP) is an organization that provides prescription drugs to the beneficiaries of Medicare at low costs.

Does AARP offer Medicare Advantage plans?

AARP Medicare Rx Plan. The American Association of Retired Persons, now known exclusively as AARP, offers Medicare Part D prescription drug plans for its members. Those who have Medicare Parts A and B – also known as Original Medicare – can purchase a Medicare Part D prescription drug plan from AARP. Medicare Part D is a government program that is designed to assist you …

How to register for AARP Medicare plan?

Apr 12, 2022 · A stand-alone Medicare prescription drug (Part D) plan can help pay for your medication. You can also get prescription drug coverage as part of a Medicare Advantage plan. You must live in the service area of the Part D plan to enroll, and some plans will have a network of pharmacies they work with. With prescription drug coverage, in addition ...

What is AARP Medicare Rx?

AARP MedicareRx plans, offered through UnitedHealthcare, can help you save money on your prescription drugs and give you peace of mind—even if your health changes. Plans include commonly used generic and brand name prescription drugs, but each plan has slightly different coverage and drug lists.

Is Medicare Rx the same as Medicare Part D?

Medicare offers prescription drug coverage for everyone with Medicare. This coverage is called “Part D.” There are 2 ways to get Medicare prescription drug coverage: 1.

What is the deductible for AARP Part D?

In 2022, the annual deductible limit for Part D is $480. Copays are generally required each time you fill a prescription for a covered drug. Amounts can vary based on the plan's formulary tiers as well as what pharmacy you use if the plan has network pharmacies.

What is AARP MedicareRx Walgreens PDP?

AARP® MedicareRx Walgreens (PDP) is a Medicare Prescription Drug Plan plan with a Medicare contract.Jan 1, 2022

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is AARP Medicare Rx Saver Plus PDP?

AARP® MedicareRx Saver Plus (PDP) is a Medicare Prescription Drug Plan plan with a Medicare contract.Jan 1, 2022

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

Do you automatically get Part D Medicare?

You'll be automatically enrolled in a Medicare drug plan unless you decline coverage or join a plan yourself.

Does AARP plan F cover prescriptions?

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.Dec 15, 2020

Does Walgreens accept AARP insurance?

AARP members can enroll in the program for an annual fee of $19.95. in return, they receive a prescription discount card they can use at more than 50,000 participating retail network pharmacies, including Walgreens, CVS, Longs Drugs, Target and Wal-Mart.Oct 17, 2008

What is SilverScript SmartRx?

The SilverScript SmartRx plan is intended for active, generally healthy adults who take generic maintenance drugs or no regular medications. Its formulary offers a substantial list of tier 1 drugs at a $0 copay at preferred pharmacies during the initial coverage phase.

What do Medicare prescription drug plans cover?

Medicare prescription drug (Part D) plans cover the types of drugs most often prescribed for people enrolled in Medicare. This is decided by the fe...

What should I know about a plan’s drug list?

A drug list (also called a formulary) tells you what drugs covered by a plan.A drug list can change from year to year.Part D plans can add or remov...

What does it mean if my prescription drug has a requirement or limitation?

Plans have rules that limit how and when they cover certain drugs. These rules are called requirements or limitations. You need to follow the rules...

How can I get the best value from my Medicare prescription drug plan?

Know the drug list.Make sure your medication is on a plan’s drug list. If it’s not, check with your provider to see if there’s one on the drug list...

What is AARP in Medicare?

The American Association of Retired Persons (AARP) is an organization that provides prescription drugs to the beneficiaries of Medicare at low costs.

When is open enrollment for AARP?

You can also make any plan changes during the open enrollment period. This is between November 15 and December 31 of each year.

Which Medicare plan has the lowest monthly premiums?

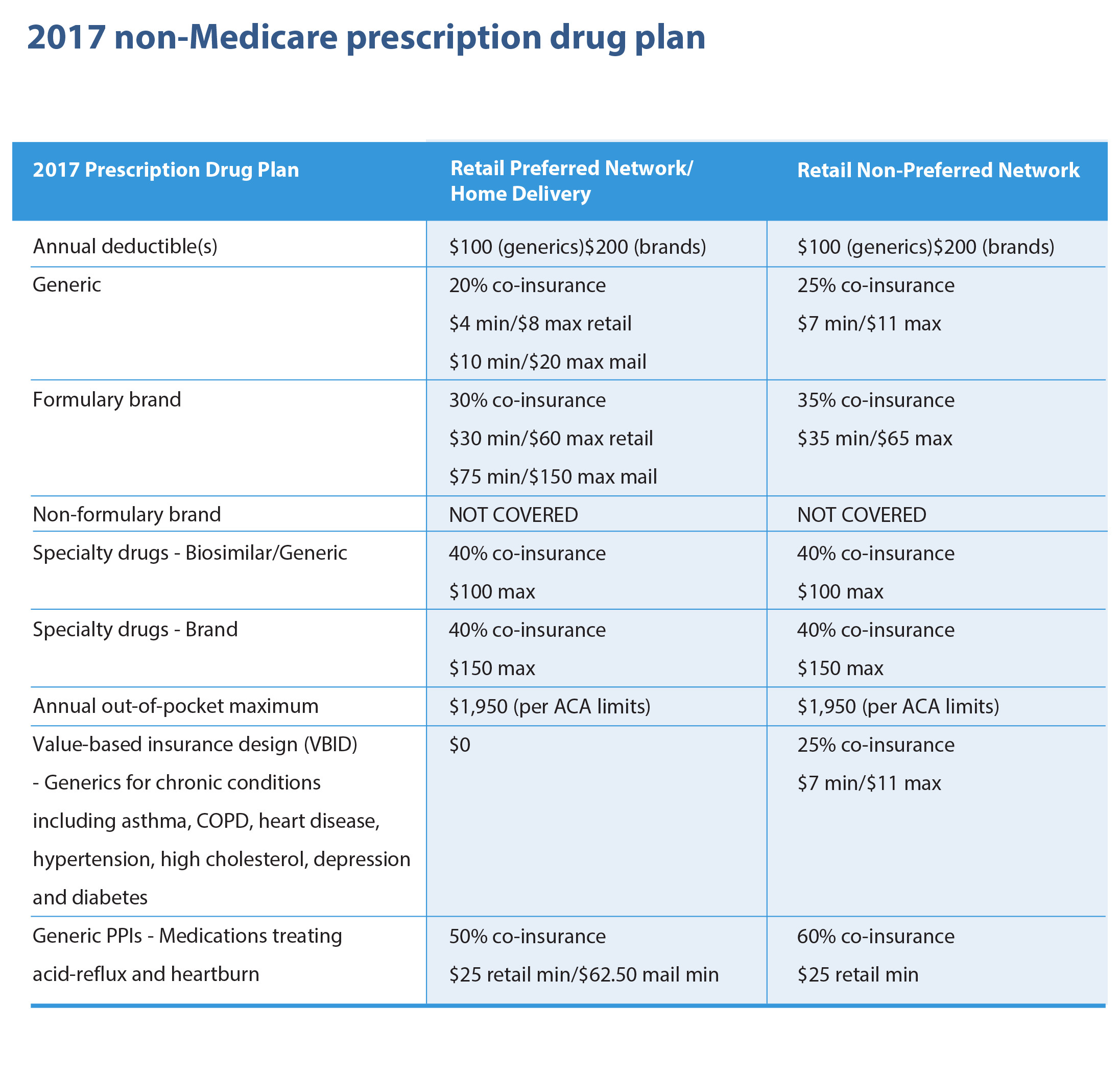

The only plan that has annual deductible is AARP Medicare Rx Plan – Saver. However, this plan includes the lower monthly premiums and co-pays. Other benefits of the AARP plans include discount mail order prescription services, additional assistance for low income beneficiaries, discounts on prescriptions approved by FDA, etc.

Which tier of Medicare has the lowest co-pay?

Tier 1 includes generic drugs and has the lowest co-pay; Tier 2 has preferred brand name prescription drugs with medium co-pay; the higher co-pay Tier 3 includes non-preferred drugs; and the highest co-pay comes in the Specialty Tier.

How long does it take to enroll in AARP?

Usually, the enrollment period starts three months prior to the individuals’ 65 th birthday month and lasts until three months after the birthday month; this is called the seven-month enrollment window.

Does AARP have a deductible?

AARP Medicare Rx Plan – Enhanced has an additional bonus drug list that includes drugs not covered by Medicare Part D. This plan offers Tier 1 generic drug coverage with flat and simple co-pays and no deductibles. The only plan that has annual deductible is AARP Medicare Rx Plan – Saver. However, this plan includes the lower monthly premiums ...

What is the drug list in Medicare Advantage?

Medicare Part D and Medicare Advantage plans have a drug list (also called a formulary) that tells you what drugs are covered by a plan. Medicare sets standards for the types of drugs Part D plans must cover, but each plan chooses the specific brand name and generic drugs to include on its formulary.

What are the drugs not listed on a plan's formulary?

Drugs not listed on a plan's formulary. Drugs prescribed for anorexia, weight loss or weight gain. Drugs prescribed for fertility, erectile dysfunction, cosmetic purposes or hair growth. Prescription vitamins and minerals.

What is the deductible for Part D 2021?

In 2021, the annual deductible limit for Part D is $445. Copays are generally required each time you fill a prescription for a covered drug. Amounts can vary based on the plan’s formulary tiers as well as what pharmacy you use if the plan has network pharmacies.

How to save on prescription drug costs?

Order 90-day supplies. You may be able to save on prescription drug costs by ordering 90-day supplies. Use a preferred network pharmacy. Many plans offer cost savings if you fill your prescriptions at a pharmacy that's part of the plan's preferred network.

What is the D coverage gap?

A note about the Part D coverage gap (donut hole) The Part D coverage gap—also known as the "donut hole"—opens when you and your plan have paid up to a certain limit for your drugs in the one year. When you're in this stage, you pay a bigger share of the costs for your prescriptions than before.

Do you have to pay a monthly premium for Medicare Part D?

Costs you could pay with Medicare Part D. With stand-alone Part D plans, you will pay a monthly premium and may also pay an annual deductible, copays and coinsurance. Some plans charge deductibles, some do not, but Medicare sets a maximum deductible amount each year.

Does Medicare Part D cover generic drugs?

Specific brand name drugs and generic drugs included in the plan's formulary (list of covered drugs) It is important to note that while Medicare Part D plans are required to cover certain common types of drugs, the specific generic and brand-name drugs they include on their formulary varies by plan.

What is the Medicare Part D coverage gap?

Includes many generic and brand name drugs covered by Medicare Part D. Includes most generic and commonly used brand name drugs covered by Medicare Part D. Includes many generic drugs and some commonly used brand name drugs covered by Medicare Part D. Coverage Gap. You pay no more than 25% of the total cost for generic drugs or 25% ...

What is Medicare Part D?

Since Original Medicare Parts A and B don't include prescription drug coverage, a Medicare Prescription Drug (Part D ) plan helps cover the costs of medication. If you only need prescription drug coverage to complete your Original Medicare plan, a UnitedHealthcare Part D plan may be your best option. UnitedHealthcare Part D plans help you save money and give you peace of mind. Each plan includes commonly used generic and brand name prescription drugs, and has slightly different coverage and drug lists.

What are the benefits of Medicare Advantage?

Medicare Advantage plans may include: 1 Low-cost premiums, some as low as $0 2 Prescription drug coverage for thousands of brand name and generic drugs 3 Drug copays as low as $0 with home delivery from OptumRx® 5 4 Set copays and yearly limits to out-of-pocket spending 5 Routine hearing and vision coverage 6 Fitness plans and wellness programs 7 Urgent care and worldwide emergency coverage

Is Medicare Advantage Part C or D?

Medicare Advantage (Part C) plans may provide better prescription drug coverage than a stand-alone Part D plan, and offer more benefits than Original Medicare. A Medicare Advantage plan combines your doctor, hospital and prescription drug coverage with low monthly premiums—some as low as $0.

Does Medicare cover prescription drugs?

By design, Original Medicare doesn't provide prescription drug coverage. If you need prescription drugs, you can purchase a Medicare Part D prescription drug plan. There are a number of prescription drug plans to choose from depending on where you live. Each plan has a different level of coverage with premiums, ...

What is the number to call for OptumRx?

This information is not a complete description of benefits. Call 1-877-699-5710 (TTY: 711), 8 a.m. – 8 p.m., 7 days a week, for more information. OptumRx is an affiliate of UnitedHealthcare Insurance Company.

How to contact OptumRx?

Contact OptumRx anytime at 1-888-658-0539, TTY 711. $0 copay may be restricted to particular tiers, preferred medications, or home delivery prescriptions during the initial coverage phase and may not apply during the coverage gap or catastrophic stage.

Can you move OptumRX to home delivery?

OptumRx makes it easy to move to home delivery. Get started with only a few quick steps. We can even contact your doctor to move your prescription. Begin using home delivery today.

Do you have to use OptumRx for 90 day delivery?

You are not required to use OptumRx home delivery for a 90-/100-day supply of your maintenance medication If you have not used OptumRx home delivery, you must approve the first prescription order sent directly from your doctor to OptumRx before it can be filled.

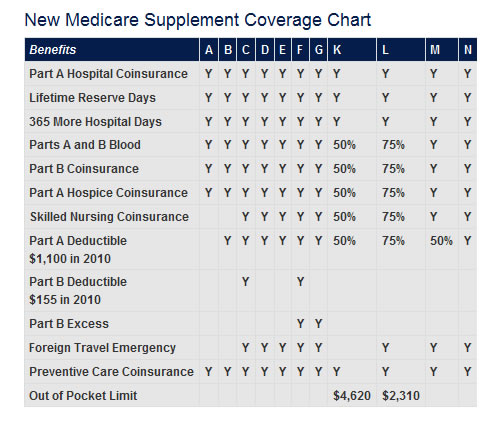

What is Plan K for Medicare?

Plan K. Plan K is similar to Plan C, but it pays only 50% rather than 100% of certain costs. Hospital Services for Medicare Part A: Plan K pays only 50%—or $742—of the $1,484 Part A deductible. Regarding care at a skilled nursing facility, it pays up to $92.75, instead of $185.50, per day for days 21 to 100.

How much does Medicare pay for days 61 to 90?

For days 61 to 90, the plan pays the $371 per day that Medicare does not cover. Days 91 and beyond are covered at $742 per day while using your 60 lifetime reserve days. Once the lifetime reserve days are used, Plan A continues to pay for all Medicare-eligible expenses that would not otherwise be covered by Medicare for an additional 365 days.

What is covered by Plan B after day 100?

After day 100, you are responsible for all skilled nursing care costs. Plan B also covers the first three pints of blood and, for hospice care, any co-payment and co-insurance Medicare may require for outpatient drugs and inpatient respite care. 3 .

How much does Medicare pay for hospitalization?

Hospital Services for Medicare Part A: Plan B pays the $1,484 deductible for Part A for the first 60 days of hospitalization. It then acts like Plan A. For days 61 to 90, Plan B pays the $371 per day that Medicare doesn't cover. For days 91 and beyond, Plan B pays $742 per day while using the 60 lifetime reserve days.

How much is Medicare Part A deductible?

Plan A. Hospital Services for Medicare Part A: With Plan A, you are responsible for the Part A deductible of $1,484 for the first 60 days of hospitalization. This plan includes semiprivate room and board and general nursing costs. For days 61 to 90, the plan pays the $371 per day that Medicare does not cover.

How much does Plan B pay?

For days 91 and beyond, Plan B pays $742 per day while using the 60 lifetime reserve days. After the lifetime reserve days are used, Plan B continues to pay 100% of Medicare-eligible expenses for an additional 365 days. After that period, you are responsible for all costs. If you have been in the hospital for at least three days ...

Does AARP provide Medicare Supplement?

AARP Medicare Supplement Plans are provided through UnitedHealthcare Insurance Company. For seniors who are concerned that their Medicare plan may not provide all the health insurance coverage they need, these plans are available to supplement their Medicare coverage.

How much does Medicare pay for generic drugs?

For generic drugs: You’ll pay 25% of the price. Medicare pays 75% of the price. Only the amount you pay will count towards getting you out of the “donut hole.”. NOTE: Some plans may have coverage in the gap, so if this is true for you, you will get a discount after the plan’s coverage has been applied to the drug’s price. ...

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is a donut hole in Medicare?

What Is the Medicare Part D “Donut Hole”? Most Medicare Part D prescription drug plans have a coverage gap. More commonly, this has been known as the “donut hole.”. The “donut hole” essentially refers to where a drug plan may reach its limit on what it will cover for drugs. Once you and your Medicare Part D plan have spent a certain amount on ...

Does a catastrophic plan pay for out of pocket drugs?

You may pay a small copay or coinsurance, and you will remain in this stage for the rest of the year. Your out-of-pocket drug costs, including copays, coinsurance amounts and your deductible, if any, count toward the dollar limits.

Deductible and Premium for AARP MedicareRx Preferred (PDP)

The AARP MedicareRx Preferred (PDP) plan has a monthly drug premium of $104.20 and a $0.00 drug deductible. This UnitedHealthcare plan offers a $77.40 Part D Basic Premium that is not below the regional benchmark.

UnitedHealthcare Premium Assistance

Depending on your income level you may be eligible for full 75%, 50%, 25% premium assistance. The AARP MedicareRx Preferred (PDP) medicare insurance plan offers a $71.80 premium obligation if you receive a full low-income subsidy (LIS) assistance. And the payment is $79.90 for 75% low income subsidy $88.00 for 50% and $96.10 for 25%.

S5820-009 Gap Coverage

In 2022 once you and your plan provider have spent $4130 on covered drugs. (combined amount plus your deductible) You will be in the coverage gap. (AKA "donut hole") You will still receive a 75% discount on covered brand-name drugs and a discount on generic drugs.

AARP MedicareRx Preferred (PDP) Drug Plan Customer Service Ratings

Source: CMS. Plans as of September 1, 2021. Notes: Data are subject to change. All contracts for 2020 have been not finalized. For 2020, enhanced alternative plans may offer additional cost sharing reductions in the gap on a sub-set of the formulary drugs, beyond the standard Part Includes 2020 approved contracts/plans.