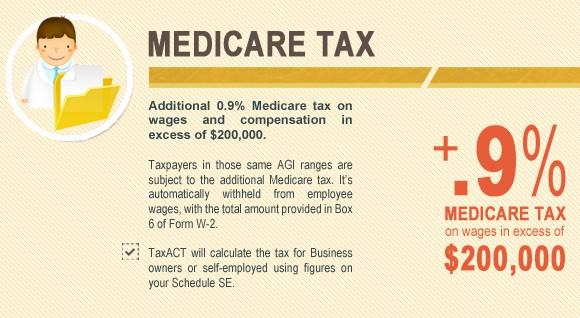

The Net Investment Income Tax is separate from the new Additional Medicare Tax, which also went into effect on January 1, 2013. You may be subject to both taxes, but not on the same type of income. The 0.9 percent Additional Medicare Tax applies to individuals’ wages, compensation, and self-employment income over certain thresholds, but it does not apply to income items included in Net Investment Income.

How to calculate additional Medicare tax properly?

Feb 18, 2022 · Topic No. 560 Additional Medicare Tax. A 0.9% Additional Medicare Tax applies to Medicare wages, self-employment income, and railroad retirement (RRTA) compensation that …

When do you pay additional Medicare tax?

The Net Investment Income Tax is separate from the Additional Medicare Tax, which also went into effect on January 1, 2013. You may be subject to both taxes, but not on the same type of …

What is Medicare tax on investment income?

Feb 03, 2022 · The Net Investment Income Tax, also referred to as the "Unearned Income Medicare Contribution Tax," is another surtax that's imposed at 3.8% when investment income, …

What wages are subject to Medicare tax?

The Affordable Care Act of 2010 included a provision for a 3.8% "net investment income tax," also known as the Medicare surtax, to fund Medicare expansion. It applies to taxpayers above a …

What is the additional Medicare tax?

What is investment tax?

The Net Investment Income Tax is imposed by section 1411 of the Internal Revenue Code. The NIIT applies at a rate of 3.8% to certain net investment income of individuals, estates and trusts that have income above the statutory threshold amounts.

Why am I being charged additional Medicare tax?

What is the additional Medicare tax for 2021?

2.35% Medicare tax (regular 1.45% Medicare tax + 0.9% additional Medicare tax) on all wages in excess of $200,000 ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return). (Code Sec. 3101(b)(2))Oct 15, 2020

What is the 3.8 investment tax?

What income is subject to the 3.8% Medicare tax?

There is a flat Medicare surtax of 3.8% on net investment income for married couples who earn more than $250,000 of adjusted gross income (AGI). For single filers, the threshold is just $200,000 of AGI.Nov 9, 2021

Who needs to fill out Form 8959?

What is additional tax?

Additional Tax means the same as that term is defined in Section 529A of the Code, which applies a 10% additional tax to the portion of the earnings included in any Non-Qualified Distribution. The Additional Tax also may apply to a state income tax calculation.

How is additional Medicare tax calculated?

...

What is the additional Medicare tax?

Who pays additional Medicare tax 2021?

How much of my Social Security is taxable in 2021?

What is Medicare tax?

The standard Medicare tax applies to all earned income, with no minimum income limit.

How much is Medicare tax?

The standard Medicare tax is 1.45% if someone is an employee or 2.9% if a person is self-employed. Single tax filers earning above $200,000, or $250,000 for married couples, pay the 0.9% additional Medicare tax.

What are the benefits of Medicare Part B?

The Affordable Care Act also expanded Medicare Part B preventive services to include: 1 abdominal aortic aneurysm and cardiovascular disease screenings 2 alcohol misuse screenings and counseling 3 cervical and vaginal and some colorectal cancer screenings 4 sexually transmitted infections and HIV screenings and counseling 5 type 2 diabetes screenings 6 obesity screenings and nutrition counseling 7 certain vaccines, such as the flu, pneumococcal, and hepatitis B shot 8 one-time ‘Welcome to Medicare’ preventive visit and annual wellness visits

Do you have to pay taxes on Medicare?

Some people in the U.S. must pay tax on their Medicare payments. As part of the Federal Insurance Contributions Act (FICA), the Social Security Administration (SSA) collects payments from taxpayers that go towards funding Medicare. The standard Medicare tax applies to all earned income, with no minimum income limit.

Does Medicare tax self employed?

Everyone who works as an employee in the U.S. must pay Medicare tax on their earnings. People who are self-employed must also pay the standard Medicare tax.

How much Medicare tax do self employed people pay?

A person who is self-employed will pay 2.9% standard Medicare tax, and an additional Medicare tax of 0.9%, for a total of 3.8%. Employers do not have to contribute any amounts through the additional Medicare tax. A person is liable for the additional Medicare tax after their total income goes above the threshold for their filing status.

What is the donut hole in Medicare?

With the Affordable Care Act, a person enrolled in Medicare no longer had to worry about the Medicare Part D coverage gap, also known as the donut hole. The Affordable Care Act also expanded Medicare Part B preventive services to include: abdominal aortic aneurysm and cardiovascular disease screenings.

What is Medicare tax?

What is the Additional Medicare Tax? Medicare is a federal health insurance program consisting of three parts (A, B, and D). Most people don’t pay for Medicare Part A (hospital insurance) because its funded by taxpayer contributions to the Social Security Administration.

Why don't people pay for Medicare?

Most people don’t pay for Medicare Part A (hospital insurance) because its funded by taxpayer contributions to the Social Security Administration. Employees pay 1.45% of their earnings, employers pay another 1.45%, and self-employed individuals pay the full 2.9% on their own.

How to calculate Medicare taxes?

If you receive both Medicare wages and self-employment income, calculate the Additional Medicare Tax by: 1 Calculating the Additional Medicare Tax on any Medicare wages in excess of the applicable threshold for the taxpayer's filing status, without regard to whether any tax was withheld; 2 Reducing the applicable threshold for the filing status by the total amount of Medicare wages received (but not below zero); and 3 Calculating the Additional Medicare Tax on any self-employment income in excess of the reduced threshold.

Can non-resident aliens file Medicare?

There are no special rules for nonresident aliens or U.S. citizens and resident aliens living abroad for purposes of this provision. Medicare wages, railroad retirement (RRTA) compensation, and self-employment income earned by such individuals will also be subject to Additional Medicare Tax, if in excess of the applicable threshold for their filing status.

What is additional Medicare tax?

The requirement is based on the amount of Medicare wages and net self-employment income a taxpayer earns that exceeds a threshold based on filing status.

Is Medicare tax indexed for inflation?

Medicare wages are reported on Form W-2 in box 5. As of tax year 2020, the threshold amounts aren't indexed for inflation. 2 They are: Filing Status.

How to calculate Medicare tax?

Step 1: Calculate the Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2: Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

Who is William Perez?

William Perez is a tax expert with 20 years of experience who has written hundreds of articles covering topics including filing taxes, solving tax issues, tax credits and deductions, tax planning, and taxable income. He previously worked for the IRS and holds an enrolled agent certification.

What is net self employment income?

Net self-employment income is the total of all self-employment income after deductions for business expenses are taken on Schedule C, Schedule F, or Schedule E, which reports self-employment income from partnerships. The total self-employment income is then reduced by multiplying it by 92.35%.

What line is Medicare adjustment on 8959?

An adjustment can be made on Form 8959 beginning at line 10, if you're calculating the AMT on both self-employment income and wages. This adjustment functions to ensure that the Additional Medicare Tax is calculated only once on wages and only once on self-employment income when they're combined and exceed the threshold amount.

How much does Barney earn?

Barney earned $75,000 in wages, which is below the $125,000 threshold for a married person filing separately, so he doesn't have wages in excess of the threshold amount. He doesn't have to pay any Additional Medicare Tax. But Betty's wages are $200,000.

What is Medicare tax?

The Additional Medicare Tax is one of the U.S. government's payroll withholding taxes that is paid solely by employees and the self-employed. In other words, the employer does not match the Additional Medicare Tax. The Additional Medicare Tax is 0.9% (0.009) of an employee's gross pay (wages, salaries, bonuses, etc.) that are in excess of $200,000 during a calendar year.

Who is Harold Averkamp?

Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. Read more about the author.

What is the Medicare tax rate?

The Medicare tax rate is 2.9% of the employee's taxable wages, with 1.45% paid by the employee and 1.45% paid by the employer. The Additional Medicare Tax rate is 0.9% for the employee only. The employer doesn't have to pay this additional tax. 1.

Does Medicare tax self employed?

The new Medicare tax also affects self-employed individuals who earn over a specific amount. If you are both an employee and self-employed, all sources of earned income (as opposed to investment income) are combined to reach the levels where the Additional Medicare Tax is applicable.

Is fringe benefit taxable?

Some wages and fringe benefits are taxable to the employee for income tax purposes , but some wages may not be taxable to the employee for Social Security and Medicare taxes, including the Additional Medicare Tax. You must exclude the wages not subject to Social Security and Medicare taxes when you calculate the wages subject to ...

Who is Jean Murray?

Jean Murray, MBA, Ph.D., is an experienced business writer and teacher. She has written for The Balance on U.S. business law and taxes since 2008. The Additional Medicare Tax is owed by higher-income employees, and employers are responsible for withholding this tax and paying it to the Internal Revenue Service (IRS).

Does the above article give tax advice?

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

How to fill out 8959?

Working through Form 8959 1 Fill out Part I if you received W-2 income. 2 Fill out Part II if you received self-employment income. 3 Fill out Part III if you received RRTA