How to calculate additional Medicare tax properly?

Feb 18, 2022 · Topic No. 560 Additional Medicare Tax. A 0.9% Additional Medicare Tax applies to Medicare wages, self-employment income, and railroad retirement (RRTA) compensation that exceed the following threshold amounts based on filing status: $250,000 for married filing jointly; $125,000 for married filing separately; and. $200,000 for all other taxpayers.

Do employers match additional Medicare tax?

Jul 09, 2021 · Information about Form 8959, Additional Medicare Tax, including recent updates, related forms and instructions on how to file. Use this form to figure the amount of Additional Medicare Tax you owe and the amount of Additional Medicare Tax …

What is the additional Medicare tax?

Nov 18, 2021 · The Affordable Care Act mandates that some taxpayers who earn a higher income make an additional contribution called the Additional Medicare Tax. According to this law, taxpayers who meet certain income levels must pay an additional 0.9% in …

How do you calculate Medicare tax?

Feb 03, 2022 · Barney and Betty will owe the Additional Medicare Tax on the amount by which their combined wages exceed $250,000, the threshold amount for married couples filing jointly. Their excess amount is $275,000 less $250,000, or $25,000. Barney and Betty's Additional Medicare Tax is 0.9% of $25,000, or $225.

How do you calculate the additional Medicare tax?

It is paid in addition to the standard Medicare tax. An employee will pay 1.45% standard Medicare tax, plus the 0.9% additional Medicare tax, for a total of 2.35% of their income....What is the additional Medicare tax?StatusTax thresholdmarried tax filers, filing separately$125,0003 more rows•Sep 24, 2020

Who has to pay the 3.8 Medicare tax?

The tax applies only to people with relatively high incomes. If you're single, you must pay the tax only if your adjusted gross income (AGI) is over $200,000. Married taxpayers filing jointly must have an AGI over $250,000 to be subject to the tax.

What is the additional Medicare tax for 2020?

The FICA tax rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2020 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

What is the 3.8 Medicare surtax?

There is a flat Medicare surtax of 3.8% on net investment income for married couples who earn more than $250,000 of adjusted gross income (AGI). For single filers, the threshold is just $200,000 of AGI.Nov 9, 2021

Who is subject to the additional Medicare tax?

What Is the Additional Medicare Tax? The Additional Medicare Tax has been in effect since 2013. Taxpayers who make over $200,000 as individuals or $250,000 for married couples are subject to an additional 0.9 percent tax on Medicare. The Additional Medicare Tax goes toward funding features of the Affordable Care Act.

What is the additional Medicare tax rate for 2021?

0.9%2021-2022 FICA tax rates and limitsEmployee paysSocial Security tax (aka OASDI)6.2% (only the first $142,800 in 2021; $147,000 in 2022)Medicare tax1.45%.Total7.65%Additional Medicare tax0.9% (on earnings over $200,000 for single filers; $250,000 for joint filers)Jan 13, 2022

What is additional tax?

Additional Tax means an additional federal income tax on certain Non-Qualified Distributions.

What is Federal Additional Medicare?

A 0.9% Additional Medicare Tax applies to Medicare wages, self-employment income, and railroad retirement (RRTA) compensation that exceed the following threshold amounts based on filing status: $250,000 for married filing jointly; $125,000 for married filing separately; and. $200,000 for all other taxpayers.Feb 18, 2022

Who needs to fill out Form 8959?

The tax applies to wages from employment, self-employment income and railroad retirement income, but if you are receiving W-2 income, the tax will most likely be withheld from your wages. Either way, anyone subject to the tax is required to file Form 8959 with their annual income tax filing.Oct 16, 2021

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

What is the Medicare tax rate?

The standard Medicare tax is 1.45 percent, or 2.9 percent if you’re self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

How is Medicare tax calculated?

How is the Additional Medicare Tax calculated? Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

What are the benefits of the Affordable Care Act?

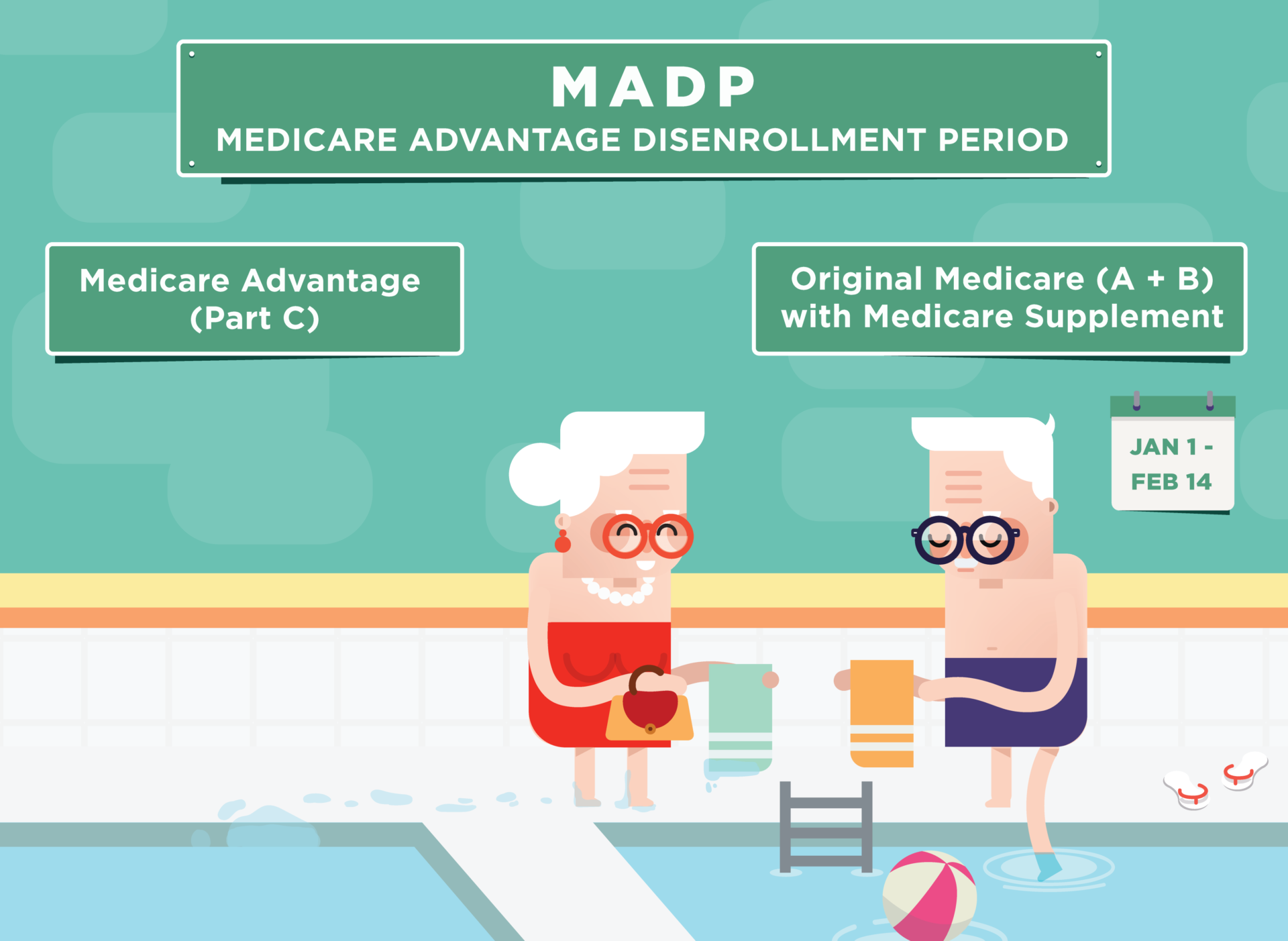

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.

How much Medicare do self employed people pay in 2021?

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2021 tax year, those levels are: Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above.

How much tax do you pay on income above the threshold?

For example, if you’re a single tax filer with an employment income of $250,000, you’d pay the standard 1.45 percent on $200,000 of your income, and then 2.35 percent on the remaining $50,000.

Does RRTA count toward income tax?

Incomes from wages, self-employment, and other compensation, including Railroad Retirement (RRTA) compensation, all count toward the income the IRS measures. If you’re subject to this tax, your employer can withhold it from your paychecks, or you can make estimated payments to the IRS throughout the year.

What is the extra tax on Medicare?

Under the Affordable Care Act, taxpayers who earn above a set income level (depending on filing status) pay 0.9% more into Medicare on top of the regular contribution. This extra tax is called the Additional Medicare Tax.

What is the threshold for Medicare tax?

What is the Income Threshold for Additional Medicare Tax? If you are a high earner, you are subject to the 0.9% additional Medica re tax on earned income in excess of the threshold amount . The threshold amounts are based on your filing status: Single, head of household, or qualifying widow (er) — $200,000.

How much does my spouse pay in Medicare?

Your spouse earns $10,000. Since your joint earned income ($235,000) isn’t more than $250,000, you won’t owe Additional Medicare Tax. However, your employer will still withhold the tax from your paycheck on wages over $200,000.

When does Medicare start withholding?

Your filing status isn’t important for this. Withholding starts when your wages and other compensation are more than $200,000 for the year.

Why don't people pay for Medicare?

Most people don’t pay for Medicare Part A (hospital insurance) because its funded by taxpayer contributions to the Social Security Administration. Employees pay 1.45% of their earnings, employers pay another 1.45%, and self-employed individuals pay the full 2.9% on their own.

Does Medicare tax withheld from paycheck?

Any tax withheld from your paycheck that you’re not liable for will be applied against your taxes on your income tax return. If you earn $200,000 or less, your employer will not withhold any of the additional Medicare tax. This could happen even if you’re liable for the tax.

How much Medicare tax is due in 2013?

Starting with the 2013 tax year, you may be subject to an additional 0.9 percent Medicare tax on wages that exceed a certain threshold. The Additional Medicare Tax is charged separately from, and in addition to, the Medicare taxes you likely pay on most of your earnings.

What is the threshold for married filing jointly for 2020?

On the other hand, if you were married filing separately, you could end up owing more tax, because the threshold is only $125,000.

How to fill out 8959?

Working through Form 8959 1 Fill out Part I if you received W-2 income. 2 Fill out Part II if you received self-employment income. 3 Fill out Part III if you received RRTA

How many parts are on Form 8959?

Form 8959 consists of three parts. Each part includes a short calculation to figure out how much Additional Medicare Tax you owe, if any. You complete only the part of the form that applies to the type of income you received. Fill out Part I if you received W-2 income. Fill out Part II if you received self-employment income.

Does the above article give tax advice?

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Do you have to file 8959 with W-2?

Either way, anyone subject to the tax is required to file Form 8959 with their annual income tax filing.

How Medicare Is Funded

Funding for Medicare comes from several places. Its primary sources are two U.S. Treasury accounts: the Hospital Insurance Trust Fund and the Supplemental Medical Insurance Trust Fund.

How Much Is the Medicare Tax?

Although the 2021 Medicare tax is 2.9%, W-2 employees have to cover only half of it: 1.45%. Employers pay the other half. If, however, you are self-employed, the entire 2.9% falls on you. Although this difference may appear negligible, consider how it works when it comes to your check.

Who Pays the Medicare Tax?

All U.S. employees, employers, and self-employed individuals must contribute to Medicare through taxes, regardless of citizenship or residency. However, there is one categorical exemption: certain nonresident aliens.

What Is the Additional Medicare Tax?

The Affordable Care Act mandates that some taxpayers who earn a higher income make an additional contribution called the Additional Medicare Tax. According to this law, taxpayers who meet certain income levels must pay an additional 0.9% in Medicare tax. That’s a total of 3.8%.

Bottom Line

While the Medicare tax might seem like an unnecessary burden on your paycheck, this money –– combined with that of millions of other Americans –– helps fund the entirety of Medicare.

What is additional Medicare tax?

The requirement is based on the amount of Medicare wages and net self-employment income a taxpayer earns that exceeds a threshold based on filing status.

What is the Medicare tax threshold?

The Additional Medicare Tax applies when a taxpayer's wages from all jobs exceed the threshold amount, and employers are required to withhold Additional Medicare Tax on Medicare wages in excess of $200,000 that they pay to an employee. The same threshold applies to everyone regardless of filing status.

What is Medicare surtax?

The Net Investment Income Tax, also referred to as the "Unearned Income Medicare Contribution Tax," is another surtax that's imposed at 3.8% when investment income, combined with other income, surpasses the same thresholds that apply to the Additional Medicare Tax. 6

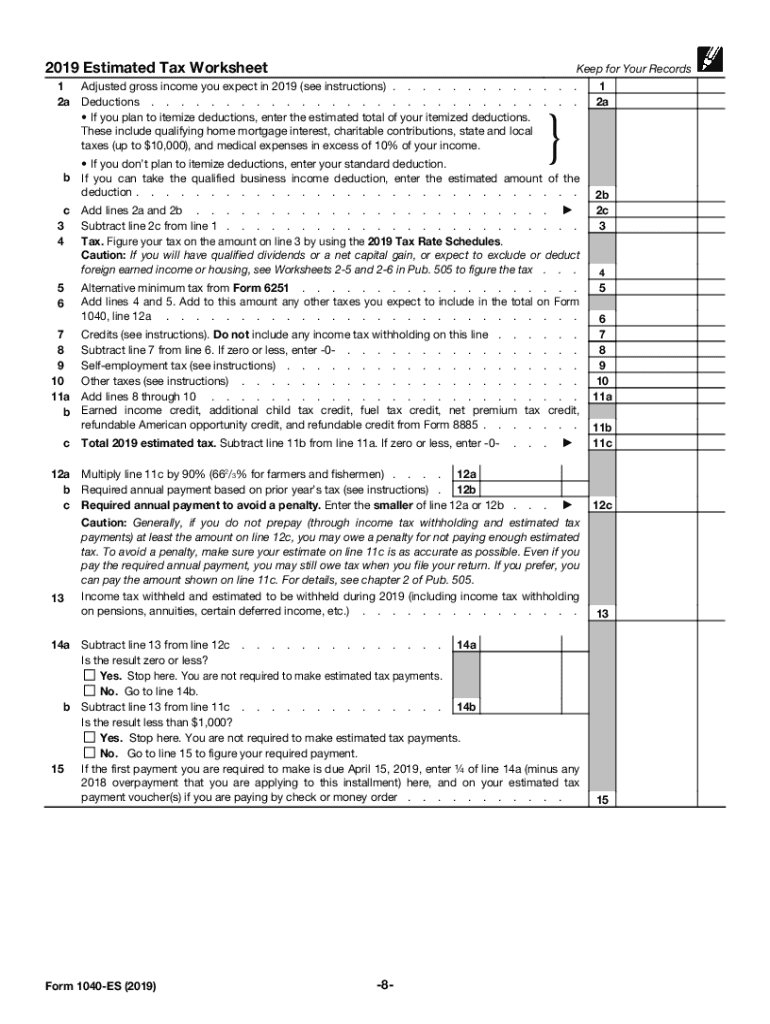

How to calculate Medicare tax?

Step 1: Calculate the Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2: Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

What line is Medicare adjustment on 8959?

An adjustment can be made on Form 8959 beginning at line 10, if you're calculating the AMT on both self-employment income and wages. This adjustment functions to ensure that the Additional Medicare Tax is calculated only once on wages and only once on self-employment income when they're combined and exceed the threshold amount.

How much does Barney and Betty owe in Medicare?

Barney earned $75,000 in Medicare wages, and Betty earned $200,000 in Medicare wages, so their combined total wages are $275,000. Barney and Betty will owe the Additional Medicare Tax on the amount by which their combined wages exceed $250,000, the threshold amount for married couples filing jointly.

How much Medicare does Albert owe?

His excess amount is $25,000, or $225,000 less $200,000. Albert's Additional Medicare Tax is therefore $225, or 0.9% of $25,000.

What is the Medicare tax rate?

The Medicare tax rate is 2.9% of the employee's taxable wages, with 1.45% paid by the employee and 1.45% paid by the employer. The Additional Medicare Tax rate is 0.9% for the employee only. The employer doesn't have to pay this additional tax. 1.

Do you have to exclude wages from Medicare?

You must exclude the wages not subject to Social Security and Medicare taxes when you calculate the wages subject to the Additional Medicare Tax as you work on payroll. IRS Publication 15-B Employer's Tax Guide to Fringe Benefits has a list of wages that are exempt from Social Security and Medicare taxes.

Does Medicare tax self employed?

The new Medicare tax also affects self-employed individuals who earn over a specific amount. If you are both an employee and self-employed, all sources of earned income (as opposed to investment income) are combined to reach the levels where the Additional Medicare Tax is applicable.

When is Medicare tax due for 2019?

February 12, 2019. The additional Medicare Tax calculator is for knowing medicare surcharge you are liable to pay or your employer will withhold.As you know the Medicare is the federal health insurance program as per FICA (Federal Insurance Contributions Act) for people who are 65 or older.

What is Medicare Care Tax?

What is Additional Medicare Care tax? Medicare tax rate is 1.45% for salaried individuals. An equal amount is contributed by the employer. So aggregate deposit on behalf of an employee is 2.9 % of gross wages. In the case of a self-employed person, the Medicare tax rate is 2.9 % of net income.

How much is Medicare tax?

The Medicare Tax is an additional 0.9% in tax an individual or couple must pay on income thresholds above $200,000 for singles and $250,000 for couples. People who owe this tax should file Form 8959, with their tax return.

What happens if you don't pay quarterly estimated taxes?

If an individual has too little withholding or fails to pay enough quarterly estimated taxes to also cover the Net Investment Income Tax, the individual may be subject to an estimated tax penalty. The Net Investment Income Tax is separate from the Additional Medicare Tax, which also went into effect on January 1, 2013.

What is net investment tax?

In addition to the Medicare Tax, there is also the Net Investment Income Tax an individual or couple must pay if their respective incomes are over $200,000 and $250,000. Net Investment Income Tax includes, but is not limited to: interest, dividends, capital gains, rental and royalty income, and non-qualified annuities.