What is IRS Form 8959?

Jul 09, 2021 · About Form 8959, Additional Medicare Tax About Form 8959, Additional Medicare Tax Use this form to figure: the amount of Additional Medicare Tax you owe and the amount of Additional Medicare Tax withheld by your employer, if any. Current Revision Form 8959 PDF Instructions for Form 8959 ( Print Version PDF) Recent Developments None at this time.

How to calculate additional Medicare tax properly?

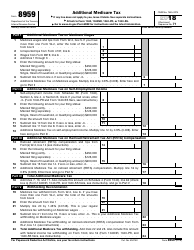

Form 8959 Department of the Treasury Internal Revenue Service Additional Medicare Tax If any line does not apply to you, leave it blank. See separate instructions.

When do you pay additional Medicare tax?

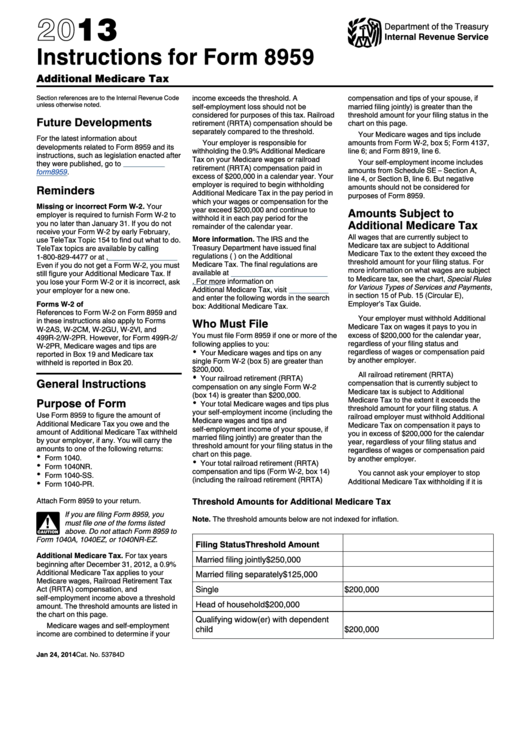

This tax became effective in 2013 and is reported on Form 8959, Additional Medicare Tax. The 0.9 percent Additional Medicare Tax applies to an individual’s wages, Railroad Retirement Tax Act compensation, and self-employment income that exceed a threshold amount based on the individual’s filing status. An employer is responsible for withholding the Additional Medicare …

Do Medicare deductions reduce the taxable amount of my income?

Dec 29, 2021 · Form 8959, Additional Medicare Tax, is used to figure the additional 0.9% percent Medicare tax on the portion of wages, self-employment, and railroad retirement income that exceeds a certain threshold. That threshold is $250,000 for jointly filing couples, $125,000 for married couples filing separately, and $200,000 for everybody else.

Should I file Form 8959?

The tax applies to wages from employment, self-employment income and railroad retirement income, but if you are receiving W-2 income, the tax will most likely be withheld from your wages. Either way, anyone subject to the tax is required to file Form 8959 with their annual income tax filing.Oct 16, 2021

Why do I owe additional Medicare tax?

An individual will owe Additional Medicare Tax on wages, compensation and self-employment income (and that of the individual's spouse if married filing jointly) that exceed the applicable threshold for the individual's filing status.Jan 18, 2022

What is the additional Medicare tax for 2020?

The FICA tax rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2020 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

What is the additional Medicare tax for 2021?

2021 updates. For 2021, an employee will pay: 6.2% Social Security tax on the first $142,800 of wages (maximum tax is $8,853.60 [6.2% of $142,800]), plus. 1.45% Medicare tax on the first $200,000 of wages ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return), plus.Oct 15, 2020

What is the Form 8959?

Use Form 8959 to figure the amount of Additional Medicare Tax you owe and the amount of Additional Medicare Tax withheld by your employer, if any. You will carry the amounts to one of the following returns.Dec 6, 2021

What is additional tax?

Additional Tax means an additional federal income tax on certain Non-Qualified Distributions.

Who pays additional Medicare tax 2021?

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2021 tax year, those levels are: Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above.

What is the additional Medicare tax rate for 2022?

0.9%2022 updates 2.35% Medicare tax (regular 1.45% Medicare tax plus 0.9% additional Medicare tax) on all wages in excess of $200,000 ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return).Jan 12, 2022

Do I have Medicare if I pay Medicare tax?

According to the Internal Revenue Service (IRS), taxes withheld from your pay help pay for Medicare and Social Security benefits. If you're self-employed, you generally still need to pay Medicare and Social Security taxes. Payroll taxes cover most of the Medicare program's costs, according to Social Security.

How to fill out 8959?

Working through Form 8959 1 Fill out Part I if you received W-2 income. 2 Fill out Part II if you received self-employment income. 3 Fill out Part III if you received RRTA

How many parts are on Form 8959?

Form 8959 consists of three parts. Each part includes a short calculation to figure out how much Additional Medicare Tax you owe, if any. You complete only the part of the form that applies to the type of income you received. Fill out Part I if you received W-2 income. Fill out Part II if you received self-employment income.

How much Medicare tax is due in 2013?

Starting with the 2013 tax year, you may be subject to an additional 0.9 percent Medicare tax on wages that exceed a certain threshold. The Additional Medicare Tax is charged separately from, and in addition to, the Medicare taxes you likely pay on most of your earnings.

Do you have to file 8959 with W-2?

Either way, anyone subject to the tax is required to file Form 8959 with their annual income tax filing.

What is Medicare tax?

The Additional Medicare Tax is an additional (0.9%) tax to wages, compensation, and self-employment income, if an individual's income exceeds the threshold amount for their individual filing status. This is a new tax added by the creation of the Affordable Care Act (ACA). For more information please use the following IRS link. Questions and Answers for the Additional Medicare Tax.

Does 8959 Medicare tax net?

The calculation of the additional tax can be a bit confusing because IRS Form 8959 Additional Medicare Tax does not actually "net" the difference between what your employer withheld and what the tax is in your situation, but transfers both amounts to the Federal Form 1040.