What are Medicare supplement plans does Aetna offer?

What is an Aetna Medicare Supplement Plan? An Aetna Medicare Supplement plan may help you pay for certain out-of-pocket costs associated with Original Medicare, including copayments, coinsurance, and deductibles. This coverage could give you some peace of mind, considering that Original Medicare has no out of pocket maximum.

Which is the best Medicare plan, Aetna or Humana?

The 11 Best Medicare Supplement Plans

- United Medicare Advisors

- Go Medigap

- Aetna

- SelectQuote Senior

- Blue Cross Blue Shield

- GoHealth

- Humana

- Medicare Plans

- Cigna

- Health IQ

Does Aetna have a Medicare Advantage plan?

Depending on where you live, you may be able to enroll in one of the following types of Aetna Medicare Advantage plans: Aetna Medicare Advantage HMO (Health Maintenance Organization) plans may have lower costs than other types of Medicare Advantage plans because they use a contracted provider network to keep health-care expenses low.

What Medicare plans does Aetna cover?

All plans acquired through Aetna that cover parts A and B of Original Medicare are called Medicare Advantage plans because they are acquired through a private Medicare-approved provider. These plans are considered Part C of Medicare.

What is the highest rated Medicare Supplement company?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

What is the rating for Aetna insurance?

Aetna is rated A (excellent) by AM Best, and has high ratings from several other financial ratings services. AM Best is a credit rating firm that assesses the creditworthiness of and/or reports on over 16,000 insurance companies worldwide.

Is Aetna good for Medicare?

Aetna has a longstanding reputation in the insurance industry. Its Medicare plans typically receive favorable reviews, and the company has an overall quality rating of 4 stars from the Centers for Medicare & Medicaid Services.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

Who owns Aetna Medicare?

CVS HealthAetnaTypeSubsidiaryParentCVS Health (2018–present)SubsidiariesCoventry Health Care Healthagen Active Health Management Aetna International First Health PPO Network Unite Health Care MinistriesWebsitewww.aetna.comFootnotes / references10 more rows

How many stars does Aetna have?

For 2022, Aetna Medicare Advantage Prescription Drug (MAPD) plans earned an overall weighted average rating of 4.29 out of 5 stars. The majority of Aetna Medicare plan members are in a plan rated 4.5 stars or higher out of 5 stars....Aetna Medicare Star Ratings.Star Ratings★★★Average★★Below average★Poor2 more rows

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How much does Aetna charge for plan G?

Aetna plan options and costsPlanMonthly costPlan B$112Plan F$147Plan F (High)$45Plan G$1172 more rows•Feb 11, 2022

How long has Aetna been in the Medicare Supplement business?

Aetna has been around for over 160 years, so if you like stability, this insurance company will deliver it. They paid their first Medicare claim way back in 1966. Currently, they are based in Brentwood, Tennessee. Depending on which plan you choose, Aetna Medicare Supplements have much to offer.

What is the most comprehensive Medicare Supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

What is the Best Medicare Plan D for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

How do I choose a Medicare Supplement plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.

What is the eligibility for an Aetna Medigap Plan?

You are eligible to apply for a Medigap Plan if you are in a state that offers the policy, have Medicare Parts A and B, and are age 65 or older, or...

What happens to my policy if I move states?

You can keep your policy even if you move states as long as you still have Original Medicare. However, Medigap policies may vary from state to stat...

Do Medigap policies work with Medicare Advantage Plans?

No, Medigap plans do not work with Medicare Advantage Plans. Medigap policies do not pay deductibles, copayments, coinsurance, or premiums under Me...

Can I lose my Medigap coverage?

Generally no, because the Medigap policy is guaranteed to be renewable. Reasons your insurance company can drop you include: premium payments aren’...

Medicare Supplement Insurance has you covered

Your coverage can’t be changed or canceled when you move anywhere within the United States, as long as you pay your premiums on time.

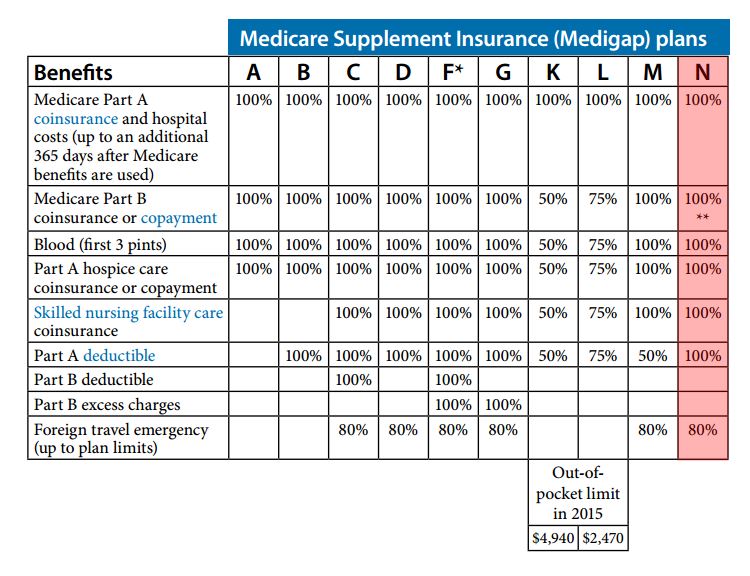

A variety of plans to choose

There are many different Medicare Supplement Insurance plans, so it’s important to understand what each plan covers and how federal law affects your eligibility.

See an outline of coverage

Select your state to view a PDF summary of Medicare Supplement coverage.

What is the star rating for Aetna?

The weighted overall star rating for Aetna Medicare Advantage plans is 4.3 out of 5 stars. Also, the majority of beneficiaries in an Aetna Advantage plan have a 4.5 star or higher policy.

How much does Aetna rate increase?

Aetna rate increases, like most companies, fall between 3% and 10% depending on various factors.

What to do if Medicare Supplement isn't available?

And, choose a reliable, stable company to handle your claims.

How much does a Plan G cost?

Plan G can cost around $120 with some areas costing much less, and other regions are more expensive. But, if you don’t mind trading out of pocket costs for a lower premium, you can consider a Plan N or High Deductible Plan G.

Does Aetna Medicare include a silver sneaker?

For the most part, it’s Aetna Medicare Advantage that would include a Silver Sneaker benefit. But, even some of the Advantage plans charge an extra fee for the gym benefit. In some cases, a $10 Youfit membership is just as cost-effective.

Is Aetna Medicare Supplement Plan G good?

Aetna Medicare Supplement Plan G. Plan G reviews are excellent no matter which company you choose. Plan G is perfect for those that are money savvy; you pay the Part B deductible yourself and save quite a bit of money in premium costs.

Does Aetna have a low premium?

A low premium doesn’t always equate to an excellent policy. Sometimes, paying more in premiums can save you money. Our expert opinion of Aetna is that when it comes to their Medicare Advantage plans, they have a broad range of doctors in-network and some of the most affordable policies.

Where is Aetna based?

About Aetna. Aetna, which began as a life insurance company based in Hartford, Connecticut in 1850, has a 170-year history of providing insurance support and addressing Americans' healthcare disparities. Aetna is now a subsidiary company of CVS Health Corporation that services over 39 million people in the United States and worldwide.

Which Medicare deductible plan is best for seniors?

Pro Tip: For seniors enrolled in the Medicare Part A deductible plan, Aetna plans B, D, G, N, C, and F will provide the most benefits and coverage, while plans C and F are best for those enrolled in the Medicare Part B deductible plan.

How to buy Medigap insurance?

Here is a step-by-step guide to purchasing an Aetna Medigap policy: 1 Decide on the benefits you want and need to find an acceptable Aetna Medigap policy. 2 Research which Aetna plans are available in your state using the “View available plans” tool on their website's home page. Also research other insurance companies that sell Medigap policies where you live. That way, you can compare the competitors alongside Aetna to see if the company is the right fit.#N#Searching by state on Aetna’s home page 3 You can compare the options available to you on the Aetna website by clicking “Get a no-obligation quote” on the page that appears after you enter your state. You'll be asked to input some information like your birthdate, gender, and zip code. A list of Aetna's policies will appear with monthly rates and plan benefits. Remember, monthly rates will vary by location and from person to person.#N#Comparing Aetna Medigap plans and prices 4 We also recommend calling and comparing the costs of Medigap policies from different insurance companies. Below this list, we've included a helpful worksheet from Aetna's website2 that provides important questions to ask during your search. 5 After comparing the policies and prices, choose your policy and company, submit an application, and purchase the policy. The insurance company will inform you of acceptable payment options. The most common are checks, money orders, or bank withdrawal.

How long is the open enrollment period for Medicare?

During this time, you'll have access to all of the insurance company's plans, as well as access to the best prices and variety of policies. There is a six-month Medigap open enrollment period that starts on the first day of the month during which you are 65 or older and enrolled in Medicare Part B.

How much does Plan N cost?

For seniors who don't need to visit the doctor as often, Plan N is one of the least expensive options; however, you'll be charged a $20 copay for every office visit and a $50 copay for emergency room visits.

What to do after comparing insurance policies?

After comparing the policies and prices, choose your policy and company, submit an application, and purchase the policy. The insurance company will inform you of acceptable payment options. The most common are checks, money orders, or bank withdrawal.

Does Aetna cover Medicare?

For seniors who are finding themselves paying out of pocket for medical expenses that Medicare doesn't cover, Aetna's Medicare Supplement insurance plans may provide some relief. Benefits of Aetna's Medigap Plans include:

Who is Caremark for Aetna?

Aetna has selected Caremark as the prescription management and mail delivery service for our members. If you do not intend to leave our site, close this message.

What is Medicare Supplement?

With a Medicare Supplement plan, you’ll enjoy a variety of benefits, including: No restrictive provider networks. The freedom to visit any physician, specialist or hospital that accepts Medicare patients.

Does Aetna use InstaMed?

Aetna handles premium payments through InstaMed, a trusted payment service. Your InstaMed log-in may be different from your Caremark.com secure member site log-in.

Does Medicare cover out of pocket expenses?

A reliable way to limit your out-of-pocket costs. Medicare provides you with coverage for health-related expenses, but it doesn’t cover everything. There may be some gaps in Medicare coverage. A Medicare Supplement Insurance plan can help you with out-of-pocket expenses.

Does Aetna use Payer Express?

Aetna handles premium payments through Payer Express, a trusted payment service. Your Payer Express log-in may be different from your Aetna secure member site log-in.

How many supplemental Medicare plans does Aetna have?

Aetna currently provides five different supplemental Medicare plans, outlined in the chart below. While other Medigap insurance providers offer more plans (there are now 11), choosing among them can be confusing.

How much does Medicare Supplement cost?

Your age, location and health status affect the cost as well. The median annual cost for Plan G is $1,547 with a high rate of $5,487 and a low of $858. The price of Medicare Plan A is as low as $479 in some states, ramps up to nearly $14,500 in others, with a middle ground of $1,412.

Is Aetna Medicare worth it?

If you are one of the millions of retirees who work with a doctor to manage a chronic medical condition or are worried about unexpected medical bills wiping out your retirement savings, Aetna Medicare supplement insurance is worth considering. While Aetna offers only a few plans, you will likely find the right balance of coverage and affordability. With Aetna’s partnership with CVS, the company is financially strong, so you know your claims will be paid into the future.

Is Aetna a strong insurance company?

AM Best, Moody’s and other credit rating agencies give Aetna very strong financial strength rating. Aetna Insurance Company received many awards over the years, including the Innovation in Reducing Health Care Disparities Award three times from the nonprofit National Business Group on Health.

Can Medicare be cancelled with CVS?

Pros. Medicare supplement policies can never be canceled, regardless of your medical conditions.

Does Aetna have Medicare?

Although it’s the standard insurance for seniors, Medicare has limitations. Aetna Medicare Supplement insurance pays deductibles and other costs not covered by Medicare. Aetna currently carries five Medicare Supplement plans, also called Medigap insurance, to cover hospital costs, skilled nursing care and other medical expenses.

Does CVS Health own Aetna?

In November 2018, leading healthcare company CVS Health acquired Aetna. The insurance company will continue to operate on its own while working with CVS to take a community approach ...

What is Aetna Medicare Supplement Insurance Plan F?

Aetna Medicare Supplement Insurance Plan F is frequently called “first-dollar coverage” because it pays your cost-share amount starting with the first dollar you owe. Here is an overview of the benefits that Aetna Medigap Plan F covers 100%:

What is the maximum deductible for Aetna?

Beneficiaries willing to assume more cost-sharing for medical expenses can choose the Aetna high deductible Medicare Supplement Plan F as their Medigap plan. Benefits are the same as Plan F, but under the high-deductible plan, the beneficiary pays copayments, deductibles, and coinsurance up to a maximum out-of-pocket deductible. In 2019, the deductible is $2,300.

How long does Medicare Part A coinsurance last?

Medicare Part A coinsurance and hospital costs for up to one year after your Medicare benefits are used

Is Aetna a Medicare Supplement?

Aetna has provided health care benefits to beneficiaries for more than 160 years and is one of the best-rated Medicare Supplement policy carriers. In comparison to other top-rated carriers, Aetna has one of the largest enrollee populations covered by Medicare Supplement plans. The long-term stability and large beneficiary base offer several benefits for seniors considering Aetna Medigap Plan F or any Medigap plans:

When will the high deductible plan F be available?

Like regular Plan F, the high-deductible Plan F will not be available to beneficiaries eligible after Jan. 1, 2020.

Does Medigap increase premiums?

Issue-age: Your age when you take out the Medigap policy determines your premium. Premiums can increase because of inflation but never because of your age.

Does Aetna have one rating method?

It is important to understand that Aetna, or any other insurance company, may choose one rating method in one state and another method in another state. Also, annual increases in rates differ between states based on geographic considerations.

Which is the best Aetna supplement?

In terms of coverage for new beneficiaries, Plan G is the best of all the Aetna Medicare Supplement plans available.

When did CVS acquire Aetna?

Aetna health insurance was acquired by CVS Health in 2018. According to Moody’s, “Aetna’s performance has been solid since the acquisition, and Aetna has managed well through the coronavirus pandemic.”.

What is the best Medigap plan?

Before 2020, Plan F was considered the best Medigap plan. Regular Plan F and the High Deductible Plan F were the most popular Aetna Medigap plans because they fill all the gaps in Original Medicare.

What is Medicare Supplement Plan G?

When you receive outpatient services, Medicare Supplement Plan G covers the Part B copayments and 20% coinsurance for Medicare-approved charges. You are responsible for the Medicare Part B deductible.

What is a Part B copayment?

Part A hospice care copays or coinsurance. Part A deductible. Part B coinsurance or copayment, which includes office visits. Part B excess charges for when you are billed over the Medicare-approved amount. First three pints of blood you may need in the emergency room or during a procedure.

What is a PPO plan?

PPO is a type of Medicare Advantage plan. It stands for Preferred Provider Organization, which is a network of health care providers. Medicare Supplement insurance plans do not use a network.

Does Medicare Supplement Plan G cover prescription drugs?

Medicare Supplement plan G does not cover over-the-counter or prescription drugs. However, there are other Aetna health plans available. Prescription drug coverage is one of the insurance products that Aetna offers. Our insurance agents can guide you through enrollment and plan options.