Can an RRE send information on every claim without Medicare status?

It is not acceptable for an RRE to send information on every claim record without regard to the injured party’s Medicare status.

How does the RRE determine Medicare entitlement status?

Under MMSEA, all insurers, including self-insured entities, must determine the Medicare entitlement of all claimants and report specific information about the claims to CMS. To determine the Medicare entitlement status of a claimant, the RRE may ask the claimant directly whether he/she is eligible.

What is a Medicare reference number (IRN)?

A Medicare Reference Number is a number that represents the position of a person on a Medicare card. For example, a person who is listed second on a Medicare Card has an IRN of 2. The IRN appears to the left of the patient’s name on their Medicare card.

How do I register an rre with CMS?

An RRE must register electronically with CMS, and can register through this link: www.section111.cms.hhs.gov. This website allows you to: In complying with MMSEA, it is important for the RRE not to assume that all claimants aged 65 and older are Medicare beneficiaries, or that those aged 65 and under are not.

What is a Medicare RRE?

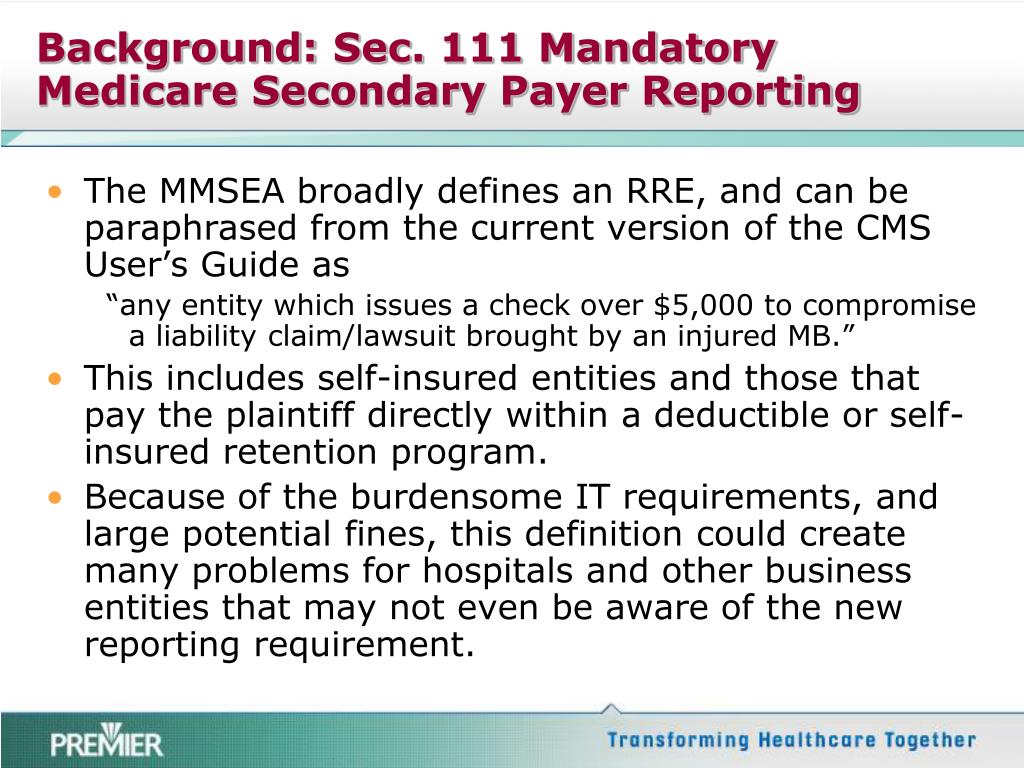

Responsible Reporting Entity (RRE) — the party that is responsible for funding a claim payment to an individual eligible for Medicare benefits is considered the Responsible Reporting Entity (RRE) under the provisions of the Medicare, Medicaid, and SCHIP Extension Act (MMSEA) of 2007.

What does GHP stand for in insurance?

A “Group Health Plan” (GHP) is health insurance offered by an employer, union or association to its members while they are still working. GHP coverage is based on current employment.

What is an Mmsea form?

Section 111 of the Medicare, Medicaid and SCHIP Extension Act of 2007 (MMSEA), a new federal law that became effective January 1, 2009, requires that liability insurers (including self-insurers), no-fault insurers, and workers' compensation plans report specific information about Medicare beneficiaries who have other ...

What does NGHP mean?

NGHPAcronymDefinitionNGHPNext Generation Home Products

What is a GHP account?

A GHP is a health plan that: Gives health coverage to employees, former employees, and their families, and Is from an employer or employee organization.

Who may be covered under a GHP?

First, the beneficiary must be age 65 or older and on Medicare because of age. Second, the insured person under the GHP must be either the beneficiary or the spouse of the beneficiary. Third, the GHP coverage must be based upon the current employment status of the insured person.

What is the purpose of section 111 reporting?

The purpose of Section 111 reporting is to enable Medicare to correctly pay for the health insurance benefits of Medicare beneficiaries by determining primary versus secondary payer responsibility. Section 111 authorizes CMS and GHP RREs to electronically exchange health insurance benefit entitlement information.

What are CMS reports?

The cost report contains provider information such as facility characteristics, utilization data, cost and charges by cost center (in total and for Medicare), Medicare settlement data, and financial statement data. CMS maintains the cost report data in the Healthcare Provider Cost Reporting Information System (HCRIS).

What is the reporting process of CMS?

Reporting is accomplished by either the submission of an electronic file of liability, no-fault, and workers' compensation claim information, where the injured party is a Medicare beneficiary, or by entry of this claim information directly into a secure Web portal, depending on the volume of data to be submitted.

ACCOUNT MANAGERS AND ACCOUNT DESIGNEES

ACCOUNT MANAGERS AND ACCOUNT DESIGNEES: It is important to note that Authorized Representatives, Account Managers and Account Designees all have differing duties and limitations under the MMSEA Section 111 reporting program. The RRE must also separately name or assign a single Account Manager for each RRE ID that is issued.

PENALTIES FOR NONCOMPLIANCE

PENALTIES FOR NONCOMPLIANCE: MMSEA Section 111 includes a civil penalty of $1,000 per day for each and every Medicare beneficiary for which an RRE fails to comply with the new reporting rules and regulations enacted by the statute. The Implementation Deadline, under MMSEA Section 111, is July 1, 2009.

CENTERS FOR MEDICARE & MEDICAID SERVICES WEBSITE

CENTERS FOR MEDICARE & MEDICAID SERVICES WEBSITE: A more detailed and descriptive analysis of the COBSW Section 111 registration and account set up requirements, and reporting procedures, can be accessed and printed through the CMS website (currently published at "www.section111.cms.hhs.gov/MRA/help/how_to/GetStarted.htm"). An MMSEA Section 111 USER GUIDE (Version 1.0) was issued by the CMS on March 16, 2009, and is also available for downloading and printing from the CMS website.

What is a Medicare reference number?

A Medicare Reference Number is a number that represents the position of a person on a Medicare card. For example, a person who is listed second on a Medicare Card has an IRN of 2.

Where is the Medicare card number?

While your Individual Reference Number is the number to the left of your name on your card, your Medicare Card Number is the 10 digit number that appears above your name, across the top section of the card.

How long does a RRE have to report a Medicare claim?

If the RRE is the party responsible for the payout they have 60 days to reimburse Medicare and failure to do so may result in CMS charging interest on the total outstanding amount. If CMS is required to take legal action to secure recovery, CMS is entitled to recover “double damages” – twice the amount of the payments made.

How long does it take for Medicare to determine if a RRE is a beneficiary?

Following submission of the query, Medicare will determine the beneficiary’s status within 14 days. RRE’s will be required to retain their records regarding MSP related information for ten years, and CMS has the authority to audit an RRE at any point.

What is a RRE in MMSEA?

Under MMSEA, Responsible Reporting Entities (RRE), including workers’ compensation plans, no fault insurance plans and self-insureds, will be required to directly report potentially eligible claimants to the CMS. An RRE must register electronically with CMS, and can register through this link: www.section111.cms.hhs.gov.

How much is Medicare fined?

Under the new Medicare legislation, insurance carriers and self-insured entities will be fined $1,000 day, per claim for failure to comply. Medicare hopes to increase its ability to identify individuals who received Medicare payments and to recoup an estimated $1.7 billion of inappropriately paid benefits per year.

How many categories of information are required for a RRE?

Following entry of an award or an order approving settlement, the RRE must complete CMS’s extensive report. More than 100 categories of information may be sought by CMS, depending on the action pursued by the claimant.

When did Medicare liens become a secondary payer?

Introduction. In the 1980’s, Congress amended the Social Security Act to include the Medicare Secondary Payer Act (MSP), which effectively enacted Medicare liens. In 2003, the Government clarified its position that self-insured entities were also included in the MSP in passing the Medicare Act of 2003. Prior to the Act, Medicare did not have an ...

Does Medicare pay work comp?

One of the more significant issues is how this program is going to impact future costs on claims. Medicare knows that medical payments for work comp claims have been transferred to Medicare when the injured worker qualifies for Medicare. When they find them, Medicare will send a bill to the carrier or self insured employer. Starting in 2011, Medicare started asking for reimbursement on these claims.