In 2017: The standard deductible is $400. The standard initial coverage limit is $3,700. The standard catastrophic coverage limit (out-of-pocket threshold) is $4,950.

Full Answer

How much will your Medicare premiums be in 2017?

Because of a rule linking Medicare premiums with Social Security cost-of-living adjustments, premiums for this group have grown more slowly over the past couple of years. This group of beneficiaries will pay just $109 per month on average in 2017.

What does Medicare Part B cover in 2017?

Medicare Part B is also known as "medical insurance," and it covers most medical services and supplies other than hospital stays. Here's a more detailed explanation of what Medicare Part B covers and what it will cost in 2017. Image source: Getty Images. Before we dive into a specific part of Medicare, let's go over the four parts of the program:

What is the Medicare Part a hospital deductible for 2017?

The Medicare Part A inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,316 per benefit period in 2017, an increase of $28 from $1,288 in 2016. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What do Medicare health plans cover?

What Medicare health plans cover Medicare health plans include Medicare Advantage, Medical Savings Account (MSA), Medicare Cost plans, PACE, MTM Preventive & screening services Part B covers many preventive services.

What were Medicare premiums in 2017?

Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What is the most basic Medicare coverage?

At age 65, most people in America qualify for Medicare Part A and B (Original Medicare), which is basic Medicare coverage. Basic Medicare coverage provides hospital and medical insurance but leaves out coverage for many things, including most prescription drugs you take at home.

What is the difference between basic Medicare and Medicare Advantage?

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you'll pay more for care you get outside your network.

What is the Medicare Part B deductible for 2017?

$183 in 2017CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2017 (compared to $166 in 2016).

Does Medicare Part B cover 100 percent?

Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What is the standard Medicare Part B premium for 2016?

If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What was the Medicare Part B premium for 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

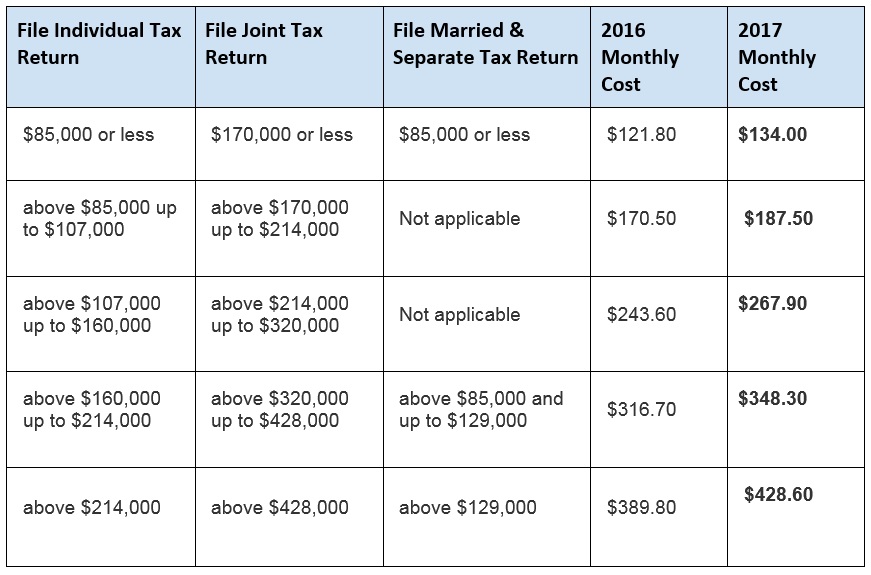

Are Medicare premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What Medicare Part B Covers

In a nutshell, Medicare Part B, or "medical insurance," is the part of Medicare that covers most medical services and supplies other than hospital...

What Medicare Part B Costs in 2017

The short answer is that the standard Medicare Part B premium is $134 per month. However, that's not what most beneficiaries actually pay. There ar...

Is Medicare in Financial Trouble?

You may have seen headlines about Medicare's financial troubles, so let's set the record straight. First of all, those headlines are referring to t...

What are the preventative services covered by Medicare Part B?

Preventative services covered by Medicare Part B include services like lab tests; screenings for conditions such as diabetes, heart disease, and cancer; and services intended to prevent diseases (such as your annual flu shot).

How much does Medicare Part B cost?

The short answer is that the standard Medicare Part B premium is $134 per month. However, that's not what most beneficiaries actually pay. There are essentially three categories of beneficiaries, each with different premiums. About 70% of Medicare beneficiaries pay their premiums directly through their Social Security benefits.

What is Medicare Part B?

Medicare Part B is also known as "medical insurance," and it covers most medical services and supplies other than hospital stays. Here's a more detailed explanation of what Medicare Part B covers and what it will cost in 2017. Image source: Getty Images.

When will Medicare be privatized?

This change may come in the form of a tax increase, benefit reductions, or privatization. If Republican leaders get their way, Medicare will be privatized by 2024 (which would definitely affect Part B).

When will the hospital insurance fund run out?

After that, however, deficits are projected, and the Hospital Insurance trust fund is expected to run out in 2028. So it's fair to assume that something will need to change in the coming years.

Does Medicare cover ambulances?

Medicare Part B also covers ambulance services, but only if other transportation could endanger your health. For instance, if you're having a heart attack , Medicare Part B would cover ambulance transportation. Preventative services covered by Medicare Part B include services like lab tests; screenings for conditions such as diabetes, heart disease, ...

Is Medicare Part A funded by premiums?

First of all, those headlines are referring to the part of Medicare that's funded by tax revenue -- Part A, or hospital insurance -- not Part B, which is funded mostly by premiums. Also, Medicare Part A is in decent financial shape -- for now.

When To Expect Your Mailed Copy of "Medicare and You"

Medicare will send you a printed copy of "Medicare and You" in late September of each year. You can also choose to get your handbook electronically. If you choose to get it electronically, you won’t receive a printed copy in the mail.

What To Do With the Handbook

Keep the Medicare and You 2017 Handbook as a reference guide. Whenever you have questions about basic Medicare benefits and if you ever want to find more information about how to get help paying for Medicare costs, you can use the handbook to find the answers.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

Why did Medicare premiums go up in 2016?

The Centers for Medicare & Medicaid Services (CMS) cited several reasons for the price hike, including paying off mounting debt from past years and ensuring funding for future coverage. But another important factor was that 2016 saw no cost-of-living adjustment (COLA) for Social Security benefits. For 70 percent of Medicare beneficiaries, this meant that premium rates would stay the same in 2016. The remaining 30 percent — about 15.6 million enrollees — faced higher monthly premiums. And everyone who signs up for Medicare in 2016, regardless of enrollment status or income, will pay a higher annual deductible.

How much does Medicare Part B cost?

Most recipients pay an average of $109 a month for coverage, but certain beneficiaries pay the standard premium of $134 a month. If you meet one of the following conditions, then you’ll pay the standard amount ($134) or more:

What is Part D insurance?

Part D covers prescription drug costs, and it was introduced in 2003 to help seniors afford medication. It’s a popular provision. How much you pay for Part D varies based on the type of coverage you choose, but there are standards in place to limit your out-of-pocket spending. Once again, higher-income enrollees will pay an income-based surcharge on top of their monthly premiums:

What is Medicare Advantage?

Medicare Advantage offers a bevy of benefits to seniors who are looking for more comprehensive coverage. These plans must include at least the same benefits offered through Parts A and B, and many (but not all) plans cover prescription drugs. Because these plans are sold through private insurers instead of directly through the federal government, Medicare Advantage has different costs that vary by plan. As with any insurance plan, costs rise each year. If you want to learn more about this type of coverage, then check out our guide to Medicare Advantage.

Is Medigap the same as Medicare?

In all but three states, Medigap plans are the same. They are organized into plans A through N. These plans are offered by private insurance companies and are not part of Medicare. They offer the same things Medicare does and then some.

Medicare Part A Coverage

Medicare.gov explains that Medicare Part A is often referred to as Hospital Insurance. Rightfully so, as this is the part of Medicare that covers expenses related to hospital, nursing facility care, hospice, and home health care.

Medical Coverage Outside The United States

Original Medicare generally does not cover treatment outside the United States, except under very limited circumstances, such as on a cruise ship within six hours of a U.S. port.

Medicare Part A And Part B Leave Some Pretty Significant Gaps In Your Health

Medicare Part A and Part B, also known as Original Medicare or Traditional Medicare, cover a large portion of your medical expenses after you turn age 65. Part A helps pay for inpatient hospital stays, stays in skilled nursing facilities, surgery, hospice care and even some home health care.

Enhanced Plans Can Offer Coverage In Donut

Enhanced plans can offer coverage in the donut-hole, but basic drug plans cannot do so. While gap coverage may be your deciding factor in choosing an enhanced plan you must remember that most donut-hole gap coverage is limited to a small group of generic drugs and an enhanced plan that offers this type of coverage will charge a much higher premium.

What Exactly Is Basic Health Insurance

The Affordable Care Act guarantees basic health insurance by making sure plans provide minimum essential coverage, sometimes called qualifying health coverage. This is any insurance plan that meets the Affordable Care Act requirement for health coverage.

Medicare Part B Dental Benefits

On the other hand, if the physician conducts the examination needed prior to kidney transplant or heart valve replacement, the CMS states that Part B benefits will apply.

Original Medicare Vs Medicare Advantage

You have two options when you sign up for Medicare. You can opt for Original Medicare or Medicare Advantage. Original Medicare is Parts A and B, and it’s managed by the federal government. You can see any doctor or go to any hospital in the U.S. that accepts Medicare when you have this coverage.

Parts of Medicare

Learn the parts of Medicare and what they cover. Get familiar with other terms and the difference between Medicare and Medicaid.

General costs

Discover what cost words mean and what you’ll pay for each part of Medicare.

How Medicare works

Follow 2 steps to set up your Medicare coverage. Find out how Original Medicare and Medicare Advantage work.

Working past 65

Find out what to do if you’re still working & how to get Medicare when you retire.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Get started with Medicare

Get basics on how Medicare works, sign up, and review your options for more coverage. Learn about it at your own pace.

Medicare costs

Learn about Medicare costs, how to pay premiums, and cost-saving programs.

Identity theft & fraud: Protect yourself

Find out how to protect your personal information, including your Medicare Number, and how to spot and stop scams and fraud.