Blue Cross Blue Shield Medicare Supplement

Medigap

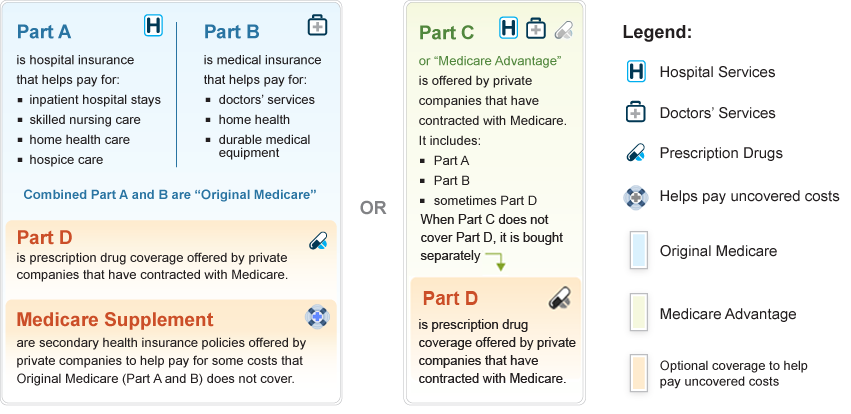

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

Who administers Blue Cross Medicare supplement plans?

Blue Cross Blue Shield of Michigan administers Blue Cross Medicare Supplement plans. Where you live, your age, gender and whether you use tobacco may affect what you pay for your plan. Your health status may also affect what you pay. This is a solicitation of insurance.

What does BCBS Medicare supplement insurance cover?

Medicare Supplement Insurance plans can help cover of the out-of-pocket expenses that Original Medicare (Part A and B) doesn’t cover. These costs can include deductibles, coinsurance, copayments and more. BCBS was founded in 1929 and strives to help provide high-quality and affordable health care to all Americans. 1

What are the costs of Blue Cross Blue Shield Medigap plans?

The costs of Medigap plans offered by Blue Cross Blue Shield can depend on things like your location, age, and the type of plan you choose. Medicare supplement insurance plans help pay for some of your Medicare costs that typically come out of pocket, such as deductibles, copays, and coinsurance.

Is Blue Cross Blue Shield the same as Medicare?

However, BCBS is a Medicare contractor for the federal government. Where are Blue Cross Blue Shield Medigap policies accepted? In most cases, Medigap coverage through BCBS is accepted anywhere that accepts Medicare. Does Blue Cross Blue Shield cover hearing aids?

What is the difference between Medicare and a supplemental plan?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance.

What is considered a Medicare Supplement plan?

Medicare Supplement plans, also known as Medigap policies, are health insurance policies that limit the amount you'll pay for medical services once you are on Medicare. As you may know, both Medicare Part A and Part B have deductibles and other costs that you pay and don't have an out-of-pocket maximum.

Is BCBS the same as Medicare?

BCBS companies have been part of the Medicare program since it began in 1966 and now offers multiple Medicare insurance options. Though quality and costs vary by company and by specific plan within those companies, most BCBS plans offer decent value and benefits across a range of health plan options.

What is the most basic Medicare Supplement plan?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What does a Medicare Supplement plan cost?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Jun 22, 2022

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

Is plan F better than plan G?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.

What is the difference between plan G and plan N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

When is the best time to buy a Medicare Supplement?

The best time to buy a Medigap policy is the six-month period that starts the first day of the month that you turn 65 or older and enrolled in Part B.

What is a Medigap plan?

Medigap (Medicare Supplement) If you are enrolled in Medicare Part A and B (Original Medicare), Medigap plans can help fill the coverage gaps in Medicare Part A and Part B. Medigap plans are sold by private insurance companies and are designed to assist you with out-of-pocket costs (e.g., deductibles, copays and coinsurance) not covered by Parts A ...

How long does Medicare Part A last?

When you are first eligible, your Initial Enrollment Period for Medicare Part A and Part B lasts seven months and starts when you qualify for Medicare, either based on your age or an eligible disability. Your Initial Enrollment Period is based on the month in which you turn 65.

When is open enrollment for Medicare?

The open enrollment period for Medicare runs from October 15 through December 7 on an annual basis, however, this is not the case for individuals interested in Medigap (Medicare Supplement) coverage. The open enrollment period for a Medigap policy is the six-month period that starts the first day of the month that you turn 65 or older ...

Is Medigap standardized?

These plans are available in all 50 states and can vary in premiums and enrollment eligibility. Medigap plans are standardized; however, all of the standardized plans may not be available in your area.

Do you have to pay Part B premium for Medigap?

All Medigap plans require that you continue to pay your Part B premium and a separate premium for Medigap coverage. Deductible. Some plans have deductibles. Copays. A copayment may apply to specific services. Coinsurance. The percentage of coinsurance varies depending on plan.

Do you have to enroll in Medicare before joining a Medigap plan?

You must first enroll in Medicare Part A and Part B before joining a Medigap (Medicare Supplement) plan. Contact your local Blue Cross Blue Shield company for help choosing a Medigap (Medicare Supplement) plan and getting enrolled.

What is a BCBS Medicare Supplement Plan?

BCBS Medicare Supplement Plan A. Plan A is the most basic type of Medigap plan. It focuses on covering some of the copays and coinsurance associated with Medicare Part A and Part B. BCBS Medicare Supplement Plan B. Plan B includes the same coverage as Plan A, along with coverage of the Medicare Part A deductible.

What is a BCBS plan?

One of these companies is Blue Cross Blue Shield (BCBS). BCBS offers a wide variety of Medicare plans, including Medicare Advantage and Medigap options. Keep reading to learn more about the different types of Medigap plans that BCBS offers in 2021, how much they cost, and what each plan covers.

What is the best plan for Medicare 2020?

If you’re new to Medicare in 2020 and would like a very inclusive Medigap plan, Plan G might be a good option. BCBS Medicare Supplement Plan K. Plan K covers copays and coinsurance for Medicare parts A and B as well as the Medicare Part A deductible.

What does BCBS cover?

It covers everything that Plan C covers and also covers excess charges associated with Medicare Part B. You must also have been eligible for Medicare prior to 2020 to buy this plan. BCBS Medicare Supplement Plan G. Plan G covers everything that Plan F covers except the Medicare Part B deductible.

What is Medicare supplement insurance?

Medicare supplement insurance plans help pay for some of your Medicare costs that typically come out of pocket, such as deductibles, copays, and coinsurance. You may also see this type of insurance referred to as Medigap. Many private insurance companies sell Medigap plans. One of these companies is Blue Cross Blue Shield (BCBS).

How many Medigap plans are there?

There are 10 different Medigap plans. However, these plans are standardized. This means that each plan must offer the same basic level of coverage, regardless of which company is offering it. Medigap plans are specific to your location, so it’s possible that some plans may not be offered in your state or county.

What are the benefits of Blue Cross Blue Shield?

On top of the standard coverage that comes with all Medigap plans, some of Blue Cross’s plans offers additional benefits, which may include: coverage for preventive and restorative dental care. coverage for routine eye exams and an allowance for glasses or contact lenses.

What are the letters in Medicare Supplement?

Plans are identified by the letters A, B, C, D, F, G, K, L, M and N . Each plan covers a different set of costs. Some plans only cover basic benefits. Other plans cover a wider range of health care costs. Medicare Supplement Insurance Plans do not cover hearing, dental or vision care, or prescription drugs. However, any plan can be paired ...

What does "standardized" mean in Medicare?

They may protect you against medical costs that are not covered or are unexpected. Medicare Supplement insurance plans are "standardized" by the government and are named by the letters A through N. Standardized means that all the companies' plans are the same.

How much does Medicare pay?

And finally, Original Medicare may only pay 80 percent for certain coverages. You will have to pay for the other 20 percent. Look carefully at the costs of the plans to decide whether a Medicare Supplement insurance plan will help you.

Does Medicare Supplement cover prescriptions?

The plan gives you the freedom to choose your own doctors, specialists and hospitals. Medicare Supplement insurance plans do not include prescription drug coverage. You can't have a Medicare Supplement Insurance Plan and a Medicare Advantage Plan at the same time, ...

Does Medicare cover dental insurance?

Medicare Supplement Insurance Plans do not cover hearing, dental or vision care, or prescription drugs. However, any plan can be paired with a prescription drug plan. Some Medicare Supplement Insurance Plans cover foreign travel care. Plan G from one company has the same coverage as Plan G from another company.

Does Medicare Supplement Insurance cover all costs?

While Medicare Parts A and B cover a lot of health care cost, they don’t cover all cost. A Medicare Supplement Insurance Plan offered by a private health insurance company like Blue Cross and Blue Shield of Texas, a Division of Health Care Service Corporation, covers the cost that Original Medicare doesn’t, like:

Does Blue Cross Blue Shield offer Medigap?

If you're in the market for a Medigap plan, Blue Cross Blue Shield (BCBS) might be exactly what you're looking for. They offer all 10 available Medigap plans and support millions of seniors across the country. Depending on where you live, you may even have access to add-ons like hearing aid coverage or dental insurance.

Is BCBS a single company?

Unlike other insurance companies, such as Aetna, BCBS isn't a single company. It's actually an umbrella term for an association of 36 locally operated BCBS companies. Here's where it can get confusing: Many of these companies go by a different name. Some of these names include: Highmark Blue Shield. Capital BlueCross.

Does BCBS offer all Medicare plans?

BCBS, as a whole, provides all 10 Medicare plans. Not every individual BCBS company offers every plan, though. You'll need to check with your local provider to see which plans are available to you. FYI: Plan C and Plan F are no longer available to new enrollees.

When is the best time to enroll in a supplement plan?

The best time to enroll in a supplement plan is when you are first eligible for Medicare. During this time you can buy any supplement or Medigap policy sold in your state, even if you have health problems. The company must also sell you a supplement plan at the same price as those with good health.

Can you add a supplement to Medicare Advantage?

If you've decided on Original Medicare instead of a Medicare Advantage plan, you may come across extra costs. But there's a way to lower what you'll pay with Original Medicare. You can add a supplement plan. Supplement insurance, also called Medigap, provides coverage for services that Original Medicare doesn't cover.

How to find out how much Medicare Supplement is in Michigan?

It may be different depending on where you live in Michigan. There are a few ways you can find out how much a Blue Cross Blue Shield of Michigan Medicare Supplement plan costs: online, by phone or using our rate tables. The prices you'll see are estimates and won't include taxes. They'll give you a good idea of what your monthly bill will be ...

When can I enroll in Medicare Advantage Plan A?

You're automatically eligible for Plan A if you’re 65 or older. If you’re under age 65, you are eligible for Plan A if you’ve lost coverage under a group policy after becoming eligible for Medicare. You can also enroll if you had Plan A, then enrolled in a Medicare Advantage plan, and now would like to return to Plan A.

Does Blue Cross Blue Shield of Michigan cover Medicare Supplement?

Blue Cross Blue Shield of Michigan administers Blue Cross Medicare Supplement plans. Where you live, your age, gender and whether you use tobacco may affect what you pay for your plan. Your health status may also affect what you pay. This is a solicitation of insurance. We may contact you about buying insurance.

Can I enroll in Plan C if I lost my Medicare?

You may enroll in Plan C if you’ve lost coverage under a group policy after becoming eligible for Medicare . You're also eligible if you had Plan C, then enrolled in a Medicare Advantage plan, and now would like to return to Plan C.

Does Medicare stay the same?

The government decides how Medicare supplement, also known as Medigap, plans are structured. So they pretty much stay the same from company to company. However, health insurance companies that sell these types of plans decide what to charge. So, prices vary.

Is Blue Cross Medicare endorsed by the government?

This is a solicitation of insurance. We may contact you about buying insurance. Blue Cross Medicare Supplement plans aren't connected with or endorsed by the U.S. government or the federal Medicare program. If you're currently enrolled in Plan A or Plan C, you can stay with your plan as long as you pay your premium.

How much does Medicare reimburse for a B plan?

Each member of a Basic Option plan who has Medicare Part A and Part B can get reimbursed up to $800 per year for paying their Medicare Part B premiums.

How does Medicare work with service benefit plan?

Combine your coverage to get more. Together, the Service Benefit Plan and Medicare can protect you from the high cost of medical care . Medicare works best with our coverage when Medicare Part A and Part B are your primary coverage. That means Medicare pays for your service first, and then we pay our portion.

What is Medicare for seniors?

What's Medicare? Medicare is a federal health insurance program for people age 65 or older, people under 65 who have certain disabilities and people of any age who have End-Stage Renal Disease. It has four parts that cover different healthcare services.