Medicare Plan G is Better than Plan F for a variety of reasons, mostly due to Plan G’s value. The only difference between the two plans is who pays the annual Part B deductible. With Plan F, you pay much higher premiums than the deductible amount to have it paid for you.

Full Answer

Which is better Medicare Plan F or G?

When it comes to coverage, Plan F will give you the most coverage since it’s a first-dollar coverage plan and leaves you with zero out of pocket costs. However, when it comes to the monthly premium, if you think lower is better, then Plan G may be better for you.

Is Medicare Plan G better than Plan F?

Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible. Is Medicare Plan F being discontinued? Yes, but only for new enrollees on or after January 1, 2020.

What is plan F and G in Medicare?

Plan G offers excellent value for Medicare beneficiaries who are willing to get a small annual deductible. After that, Plan G will provide complete coverage for all the gaps in Medicare. It will be covering 20 percent of what Medicare Part B fails to cover. It will take care of the Medicare Part A hospital deductible, coinsurance, and copays.

What are the benefits of Medicare Plan F?

- Acupuncture, acupressure and other homeopathic treatments

- Routine vision care and eyeglasses

- Routine dental care and dentures

- Foot care that is not related to medical conditions

- Hearing aids and routine hearing tests

- Cosmetic surgery

- Custodial care (help with bathing, dressing, eating, etc.)

Is plan G better than plan F?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible, whereas Medigap Plan F covers that deductible.

What is the difference between Medicare Plan G and plan F?

Medicare Supplement Plan G is almost identical to Plan F, except for the Part B deductible. If you select Plan G, you'll need to pay your Part B deductible ($233 for 2022), yourself. After you pay your deductible, you have no other out-of-pocket costs, just like the Plan F.

Should I switch from F to G?

When it comes to coverage, Medicare Supplement Plan F will give you the most coverage since it's a first-dollar coverage plan and leaves you with zero out-of-pocket costs. However, when it comes to the monthly premium, if you think lower is better, then Medicare Supplement Plan G may be better for you.

What is F and G on Medicare?

Plans F and G are known as Medicare (or Medigap) Supplement plans. They cover the excess charges that Original Medicare does not, such as out-of-pocket costs for hospital and doctor's office care. It's important to note that as of December 31, 2019, Plan F is no longer available for new Medicare enrollees.

Are Medicare G plans good?

Plan G offers great value for beneficiaries willing to pay a small annual deductible. After that, Plan G provides full coverage for all of the gaps in Medicare. It pays for your Medicare Part A hospital deductible, copays, and coinsurance. It also covers the 20% that Medicare Part B doesn't cover.

Why is plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

What does plan F cover that plan G does not?

The only benefit Plan F offers that Plan G doesn't is coverage for the Medicare Part B deductible. Even though Plan G doesn't cover the Part B deductible, some Plan F options could have high enough premiums that the cost difference between Plan F vs. Plan G would be higher than the Part B deductible itself.

What does plan F Medicare cover?

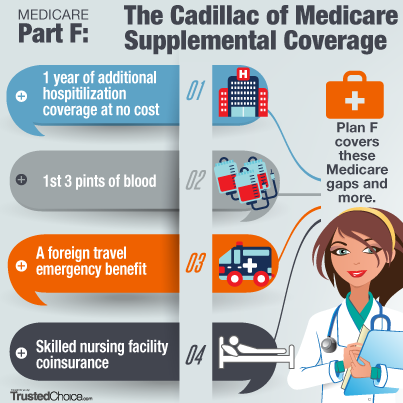

Medicare Supplement Plan F offers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services.

Can I switch from plan F to plan G without underwriting?

Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch. There are a few companies in a few states that are allowing their members to switch from F to G without review, but most still require you to apply to switch.

Does plan F have copays?

Remember that the monthly premium for Medicare Supplement Plan F is the only cost you will be paying for your Medigap coverage. You will not be required to pay any copays, coinsurance, or deductible for your service. So, paying a higher premium may save you money in the long run.

Does Medicare Plan G have a maximum out-of-pocket?

Similarly, Plan G has no out-of-pocket limit to protect you from spending too much on covered health care in a year. If you are interested in an out-of-pocket limit, consider Plan K or Plan L. Plan G is most similar in coverage to Plan F.

What is the monthly premium for Plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

Does Medicare Part G have a deductible?

What does Medicare Part G cover? Medicare Part G fully pays these healthcare costs: Medicare Part A deductible. Part A coinsurance and hospital costs up to an additional 365 days after your standard Medicare benefits end.

What is Medigap Plan F?

Medigap Plan F provides a person with coverage for some parts of healthcare that original Medicare does not cover. However, there are some restrictions on enrollment: A person newly enrolled in Medicare can no longer get Plan F.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How many Medigap policies are there?

There are 10 Medigap policies: A, B, C, D, F, G, K, L, M, and N. The plans offer standardized benefits to Medicare recipients and help pay coinsurance, deductibles, and copays that original Medicare may not cover. Medigap plans may also cover emergency healthcare if a person needs treatment while they are away from the United States.

How much is the deductible for Medicare 2021?

In addition to the basic Plan F, there is a high deductible version of Plan F available. In 2021, this has a deductible of $2,370. A person must reach the deductible before the plan starts to cover costs.

What is the maximum amount of medical expenses for a foreign traveler?

A $250 annual deductible may be applied by Plan F and Plan G to cover foreign travel emergency services, with a lifetime limit generally set at $50,000. The healthcare must begin during the first 60 days of a person’s trip, and no other Medicare benefit may cover it.

Can you have a Medigap plan if you are enrolled in Medicare Advantage?

In addition, if a person is enrolled in a Medicare Advantage plan, they cannot also have a Medigap plan.

Does Medigap work with original Medicare?

Comparing the plans. Costs. Summary. Medicare supplemental health insurance plans, also called Medigap, work with original Medicare. Medigap Plan F provides many of the same benefits as Plan G, with some differences. Medigap plans help a person pay their out-of-pocket Medicare expenses. A person can get a Medigap plan, ...

Is Plan F better than Plan G?

However, if the premium for Plan F is minimal compared to Plan G , it may be the better option . Another thing to consider is that in 2020, Plan F will be going away, however, those who already have Plan F can be grandfathered in to keep it. If you’re looking for another similar option, consider High-Deductible Plan F.

Do you have to pay a deductible on a Plan G or F?

Therefore, even though you will have to pay a deductible, you can save money overall if Plan G has a lower premium than Plan F. However, because pricing varies among plans, states, and individuals, this isn’t always true – sometimes there will be minimal difference in the premium cost.

What is the difference between Medicare Plan F and Plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments . Plan G does not.

How much is the deductible for Medicare 2021?

If you’re currently enrolled in the Plan F high-deductible option for 2021, you are required to pay for Medicare-covered costs up to the deductible amount of $2,370 before your Medigap plan begins to cover any expenses.

When is the last day to enroll in Medicare?

The last possible day for new enrollment was December 31, 2019. If you currently have Medicare Plan F, you can continue with the plan, if you so decide. This distinction is worth noting when reviewing the differences involved with Medicare Plan F vs. Plan G.

Is Medicare Plan F still available?

It really depends on your needs and budget. However, as of December 31, 2019, Plan F is no longer available for new enrollment. Here are two things to consider as you evaluate keeping your Medicare Plan F. If coverage for the Part B deductible is important to you, you may want to stick with Medicare Plan F.

Does Plan G cover Part B?

Although Plan G does not cover the Part B deductible ($198 in 2020), the premium savings could offset the cost of the yearly deductible. For example, the average 2020 premium ranges from $160 to $210 for Plan G and $185 to $250 for Plan F for a 65-year-old Florida woman who does not use tobacco.

Does HealthMarkets have Medicare Supplement plans?

HealthMarkets can help you get the right Medicare Supplement plan for your needs. Best of all, this service comes at no cost to you. We can help you quote and compare various Medicare Supplement plans to figure out which one is the right fit for your needs.

What is Medicare Plan F and G?

Medicare Plan F and Plan G are two of the 10 different types of standardized Medicare supplemental health insurance plans available in most states. You pay a premium for both types of plans, but both plans help pay for out-of-pocket expenses that Original Medicare doesn’t cover. The following chart provides a side-by-side look at all 10 ...

What is the difference between Medicare Plan F and Plan G?

Another big difference between Medicare Plan F and Plan G is who is eligible to enroll. Both plans require you to first have Original Medicare, but the enrollment guidelines for Plan F changed at the beginning of 2020. If you first became eligible for Medicare on or after January 1, 2020, you cannot enroll in Medicare Plan F.

Why switch to Medicare Plan G?

Switching to a Medicare Plan G might be a good idea because you’ll pay lower premiums, and you might also never pay the $203 Medicare Part B deductible.

How much does Medicare cover if you have a plan F?

If you have Medicare Plan F and you haven’t yet met your Medicare Part B deductible, it would cover the $203 deductible plus the 20% of the Medicare-approved coinsurance amount. If you have Medicare Plan G, you’ll need to pay the $203 Medicare Part B deductible first. Then your Medicare Supplement plan would cover the 20% coinsurance.

What is the deductible for Medicare 2021?

If you became eligible for Medicare. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

When will Medicare change to Plan F?

Both plans require you to first have Original Medicare, but the enrollment guidelines for Plan F changed at the beginning of 2020. If you first became eligible for Medicare on or after January 1, 2020, you cannot enroll in Medicare Plan F.

Is everyone eligible for Medicare Plan F and Plan G?

Medicare Plan F and Plan G can help you save money on your Medicare costs. However, as of January 1, 2020, not everyone is eligible for both plans, and you need to understand the new requirements.

What is the difference between Medicare Supplements Plan F and Plan G?

The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise they function just the same. There is one important feature that Medicare Supplements Plan F and G have over all the other Medigap plans.

What is a Medigap Plan F?

Medigap Plan F is a heavy favorite with individuals who want comprehensive benefits and first-dollar coverage on their health care costs. First-dollar coverage means that both your Part A and Part B deductibles are covered by the plan, so you pay nothing before your Medicare benefits kick in.

What happens if you don't have Medicare?

When you see a provider that doesn’t participate with Medicare, he can charge up to 15% more than the standard Medicare rate for your services. You will pay this money out of pocket unless you have Medigap Plan F or Plan G. It’s definitely something to consider if provider choice is important to you.

How many Medigap plans are there?

There are currently 10 different Medigap plans that are standard across most states. (Massachusetts, Minnesota, and Wisconsin have their own plan standards.) What this means for consumers, however, is that Plan A offered by Company X in Anaheim is exactly the same as Plan A offered by Company Y in Boise.

Which is the most comprehensive Medicare plan?

The most comprehensive plan currently available is Medigap Plan F. It covers all of the gaps in Medicare. The next most comprehensive plan is Plan G, which covers nearly as much, with the Part B deductible being the only difference. Finally, Plan N is probably the third most popular plan because it operates similar to Plan G except ...

How much does a 66 year old spend on Medicare?

The average 66-year-old couple spends about 57% of their Social Security benefits on health care, according to a 2016 study. Learn Medicare for Free: Enroll in 6-Day Medicare Mini Course.

Is Medigap Plan G the same as Plan F?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deduct ible, which is $203 in 2021. Medigap Plan G is now the most popular plan among beneficiaries new to Medicare.

Which is better, Plan G or Plan F?

Plan G is not too far behind. Is Plan F the best Medicare Supplement plan? Plan F is the plan that will give you the most comprehensive coverage. So, in regards to coverage, yes, Plan F is the best Medicare Supplement plan since it gives you the most coverage.

What is the difference between a plan F and a plan G?

With Plan F, you’ll have zero out of pocket costs outside your monthly premium. This is because it’s a first-dollar coverage plan. This means the first dollar is covered by Medicare. You have no deductible, no coinsurance, and no copays. All you have to pay is your monthly premium. With a Plan G, the only cost you have to pay out ...

Does Medigap have standardized benefits?

However, these charges are not common. Some states don’t even allow them. With Medigap plans, the benefits are standardized by the federal government. Meaning, it doesn’t matter which carrier you choose to enroll with, the benefits across each letter plan are exactly the same.

Can I switch to a Medicare Advantage plan?

Can I change from a Medicare Advantage plan to Plan G, Plan N, or Plan F? Yes, you can change from a Medicare Advantage plan to a Medigap with Guarantee Issue Rights during the first 12 months of enrolling in a Medicare Advantage plan. After that, you may need to wait until the Annual Enrollment Period to switch.

Is Plan N a good plan?

Then there’s Plan N. Plan N is great for those that are okay paying a small copay when they visit the doctors or hospital. These small copays keep the monthly premium low. If you find yourself going to the doctor’s office often, you may want to consider Plan G.

Can you change your Medicare plan without underwriting?

But, you may need to answer health questions first. There are times when you’re eligible for Guarantee Issue Rights, in which case you could change plans without underwriting. The plans you’re eligible to enroll in, depend on when you became Medicare eligible.

Do you have to pay out of pocket for a Plan G?

All you have to pay is your monthly premium. With a Plan G, the only cost you have to pay out of pocket is the Part B deductible. After you’ve met the deductible, Plan G will cover the rest, just like Plan F. Then there’s Plan N. Plan N is great for those that are okay paying a small copay when they visit the doctors or hospital.