Is Medicare better than Advantage plans?

Aug 01, 2019 · To improve options for Medicare coverage, The Centers for Medicare and Medicaid Services (CMS) contracts with private insurance companies to offer Medicare Advantage plans. Medicare Supplement insurance plans are also available from private insurance companies. However, Medicare Advantage and Medicare Supplement insurance …

What are the best Medicare Advantage plans?

Nov 03, 2021 · Both Medicare Supplement Insurance and Medicare Advantage plans are private Medicare options sold through individual insurance companies. The primary difference between these types of insurance: Medicare Supplement Insurance is used along with Original Medicare to help pay certain Medicare out-of-pocket costs.

How do you compare Medicare Advantage plans?

Oct 22, 2021 · October 22, 2021. No Comments. Medigap plans, also known as Medicare Supplements, provide coverage for the Deductibles and Copays that Original Medicare does not cover. Medigap plans do not cover Prescription drugs. Medicare Advantage plans, also known as Medicare Part C, cover Hospitals, Doctors, and Prescription Drugs as well as other benefits. …

What is the difference between Medicare Supplement and Medicare Advantage?

May 05, 2021 · You must be enrolled in Part A and Part B to be eligible for a Medicare Supplement plan, but you’re still getting those benefits directly through the Medicare program (compared with Medicare Advantage, which provides Part A and Part B benefits through a private, Medicare-approved insurance company). Medicare Supplement plans are standardized with …

Is it better to have a Medicare Supplement or an Advantage plan?

Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

What are the disadvantages to a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What are the advantages and disadvantages of Medicare Supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Is Medicare or Medicare Advantage better for seniors?

Your Health A Medicare Advantage plan may be a better choice if it has an out-of-pocket maximum that protects you from huge bills. Regular Medicare plus a Medigap insurance plan generally allows you more choice in where you receive your care.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...Nov 13, 2021

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

Does a Medicare Advantage plan replace Medicare?

Medicare Advantage does not replace original Medicare. Instead, Medicare Advantage is an alternative to original Medicare. These two choices have differences which may make one a better choice for you.

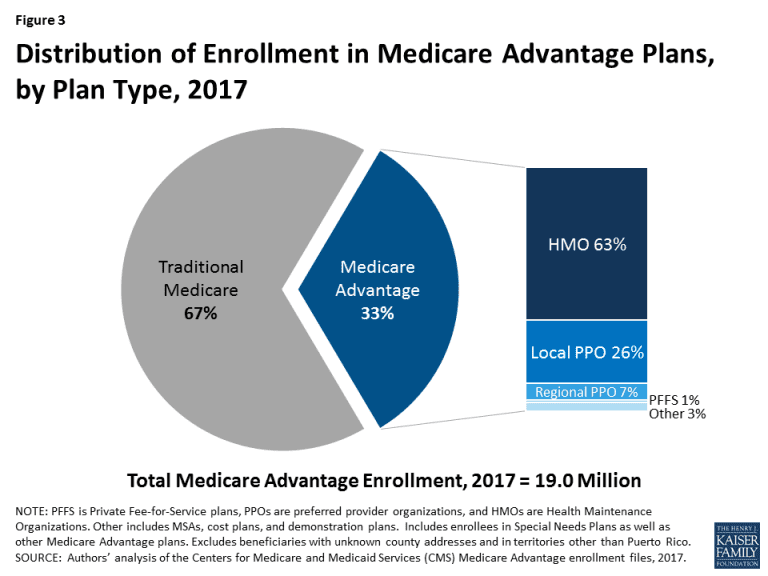

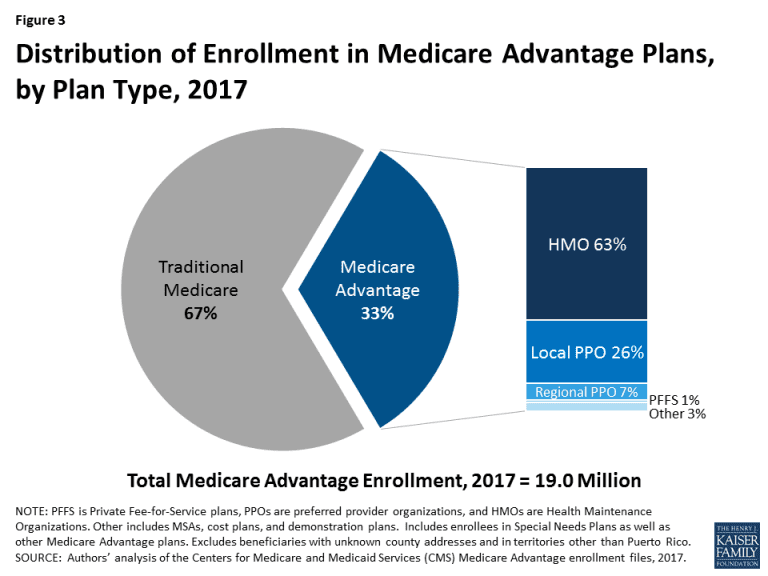

What percent of seniors choose Medicare Advantage?

Recently, 42 percent of Medicare beneficiaries were enrolled in Advantage plans, up from 31 percent in 2016, according to data from the Kaiser Family Foundation.Nov 15, 2021

Can you switch back and forth between Medicare and Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Which Medicare Supplement plan is the most popular?

Plan G will cover almost everything except the Part B deductible. This means that you would be responsible for paying the entire Medicare Part B deductible — $233 for 2022 — before insurance benefits will begin to pay for your health care. Plan G is the most popular Medicare Supplement for new enrollees.Mar 16, 2022

What Is Medicare Advantage?

Also called Medicare Part C, Medicare Advantage plans provide coverage through private insurance companies approved by Medicare. These companies pr...

What Is Medicare Supplement?

Also known as Medigap, Medicare Supplement plans are offered by private insurance companies and can take care of certain health care costs not cove...

What If I Choose Medicare Advantage?

If you decide to enroll in a Medicare Advantage plan after being in Original Medicare (Part A and Part B) for some time, you may want to cancel you...

What is Medicare Advantage?

Medicare Advantage plans are a type of private Medicare insurance that offers all of the same benefits as Original Medicare. Most Medicare Advantage also offer benefits that are not covered by Original Medicare. Benefits and plan availability can vary from plan to plan.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (also called Medigap) and Medicare Advantage plans (Medicare Part C) are two very different private Medicare options that you may consider. This guide highlights the differences between Medicare Supplement Insurance and Medicare Advantage so you can better understand these two private Medicare coverage options.

How does a Medigap plan work?

Here are a few examples of how a Medigap plan can work: You schedule a doctor’s appointment with a doctor for services that are covered by Medicare Part B. The doctor accepts Medicare “assignment” — this means she accepts Medicare’s reimbursement rate for all covered services as payment in full.

What are the benefits of Medicare Part A and B?

Can offer additional benefits, such as dental, vision, hearing and prescription drug coverage, among other benefits.

How much is Medicare Part A deductible in 2021?

The Medicare Part A deductible is $1,484 per benefit period in 2021. The Medicare Part A deductible is not annual — you could potentially need to meet this deductible more than once in a given year. Medicare Part B deductible. The Medicare Part B deductible is $203 per year in 2021.

How many Medicare Supplement plans will be available in 2021?

Medicare Supplement Insurance. Availability. 3,550 different plans available nationwide in 2021 1. 10 standardized plans available in most states, though all 10 may not be available to you in every state. Eligibility. Available to beneficiaries enrolled in Original Medicare who live in the plan’s service area.

What is the average Medicare premium for 2021?

The average monthly premium for a Medicare Advantage plan in 2021 is $33.57. 3. You’ll also still pay your Medicare Part B premium in addition to your Medicare Advantage plan premium. The average monthly premium for a Medicare Supplement Insurance plan in 2019 was $125.93. 4.

What do Medicare Supplement policies not cover?

They won’t cover items that are not Medically necessary and they won’t cover Doctors or Hospitals that do not accept Medicare.

What do Medicare Supplement or Medigap policies cost?

Medicare Supplement plans are standardized and are named Plan A through Plan N – depending on the coverage offered.

What do Medicare Advantage Plans Cover?

Medicare Advantage plans, also known as Medicare Part C, are offered by Medicare-approved private companies (like Florida Blue).

What kind of Medicare Advantage plans are there?

Health Maintenance Organizations (HMO) for low copays in exchange for staying in the Network.

What Do Medicare Advantage plans cost?

With Medicare Advantage plans you still have to pay your $158.80 for Part B.

So what Kind of plan is better For YOU?

Here’s some scenarios to keep in mind when choosing between Medigap and Medicare Advantage;

What is Medicare Advantage?

Unlike Medicare Supplement plans, Medicare Advantage plans give you a way to get your Medicare Part A and Part B benefits through a private insurance company that contracts with Medicare. (Hospice benefits are still covered under Part A.) Medicare Advantage plans often provide coverage beyond that of Original Medicare –most of them include prescription drug benefits, and some include extra benefits such as routine dental services or membership in fitness programs.

How many Medicare Supplement plans are there?

Medicare Supplement plans are standardized with lettered in many states, such as Plan A, Plan B, and so on up to Plan N. There are 10 plans available in most states (Plans E, H, I, and J are no longer sold). Wisconsin, Minnesota, and Massachusetts have their own standardized plans.

When is the best time to buy a Medicare Supplement Plan?

Perhaps the best time to buy a Medicare Supplement plan is during your Medicare Supplement Open Enrollment Period, which starts the month that you’re both 65 or more years old and enrolled in Medicare Part B.

Do you have to be enrolled in Medicare Supplement?

You must be enrolled in Part A and Part B to be eligible for a Medicare Supplement plan, but you’re still getting those benefits directly through the Medicare program (compared with Medicare Advantage, which provides Part A and Part B benefits through a private, Medicare-approved insurance company).

Can you see a doctor who accepts Medicare?

Find Plans. Both types of plans are available from private insurance companies. With most Medicare Supplement plans, you can see any doctor who accepts Medicare assignment. Some Medicare Supplement plans may cover emergency medical care when you’re out of the country. Medicare Advantage plans can include prescription drug coverage, ...

Is Medicare Advantage the same as Medicare Supplement?

Medicare Advantage and Medicare Supplement insurance are not the same. But each type of insurance may have features you might like, as well as some you might not. This table lists the main differences between these types of plans. Yes (different plans may cover different portions of certain out-of-pocket costs).

Does Medicare save you money?

If you’re new to Medicare or will be eligible soon, and you have frequent doctor visits and/or hospitalizations, a Medicare Supplement plan might save you money by helping you with those costs – especially if you make sure to purchase the plan as soon as you’re eligible so your acceptance is guaranteed.

What is Medicare Advantage?

Medicare Advantage plans negotiate contracts with networks doctors, hospitals, and other healthcare providers. The agreements they reach can help to keep their costs lower. This means that you must adhere to their networks or face substantially higher out of pocket costs.

How are Medicare Advantage Plans structured?

How Medicare Advantage Plans Are Structured. Medicare Advantage replaces your Medicare Part A and Part B services. Most of the time it replaces your Part D as well. A Medicare Advantage plan combines them into one coverage with a private insurance company. This is what is known as Part C of Medicare.

How long does it take to get a Medigap plan?

This period starts six months before you enroll in Part B of Medicare and continues the six months after. Medicare Advantage and Part D allow a 3-month open enrollment before and after your date of first coverage under Part B. You will likely have to be underwritten to get a Medigap plan once you are out of your Open Enrollment period.

How long does Medicare lock you in?

If you enroll in a Medicare Advantage plan, Medicare locks you into that plan until December 31st. Medicare Advantage plans and Part D prescription drug plans have only one window of opportunity each year for you to enroll. It happens from October 15 through December 7 each year. During that time, you can change plans or go from MAPD to original Medicare with a Medicare Supplement plan (or vice versa). There are Special Enrollment periods such as if you move out of your network coverage area. You have an Initial Enrollment Period three months before and three months after you first enroll in Part B of Medicare. Other than that, you cannot change plans or move back to original Medicare.

What is a Medigap plan?

Under a Medigap plan, Medicare first pays its portion of the bill and then sends the remainder of the bills to your Medicare supplement company to pay their portion. This is done electronically through what is called the crossover system.

What are the different types of Medicare insurance?

There are two types of private plans that you can purchase that will help fill the gaps of Medicare – Medicare supplements (Medigap) or Medicare Advantage. These two plans are very different and it is imperative that you understand the differences.

How much does Medicare cover in 2021?

If you go with Medicare alone with no additional coverage, you will quickly learn that there are a lot of gaps that Medicare does not cover – a Part A deductible ($1,484 in 2021) that you must pay to the hospital to cover you for up to 60 days of hospital care.

Is it better to have Medicare Advantage or Medicare Supplement (Medigap)?

Whether you choose to apply for a Medicare Advantage plan vs. a Medicare Supplement insurance plan depends on your needs. Here are a few factors to consider when deciding whether Medicare Advantage or Medicare Supplement is better for you:

Can you have a Medicare Advantage plan and a Medicare Supplement plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

Can you change from a Medicare Advantage plan to a Medicare Supplement plan?

During the Annual Enrollment Period, which runs from October 15 to December 7 each year, you are free to reconsider your Medicare coverage. If you decide you want to try a Medicare Supplement plan vs. Medicare Advantage plan, you can make that change during this period. 4

What Is Medicare Advantage?

Medicare Advantage (also known as Part C) plans are provided by private insurers and essentially replace Original Medicare as your primary insurance. They cover all Medicare-covered benefits and may also provide additional benefits like some dental, hearing, vision and fitness coverage.

What Are the Benefits of Medicare Advantage?

Medicare Advantage plans provide all the same benefits provided by Original Medicare, plus coverage for items and services not covered by Original Medicare, including some vision, some dental, hearing and wellness programs like gym memberships.

How Much Does Medicare Advantage Cost?

Many Medicare Advantage plans have a $0 premium, so be sure to explore your options. Baethke explains it like this: “If you enroll in a plan that does charge a premium, you must pay this fee every month in addition to your Medicare Part B premium, which is around $149 [or higher, depending on your income].”

What Is Medicare Supplement?

Medicare Supplement plans (commonly known as Medigap plans) are sold by private insurance companies to help fill the gaps of Original Medicare coverage.

What Are the Benefits of a Medicare Supplement Plan?

A Medicare Supplement plan makes your out-of-pocket costs more predictable and easier to budget.

How Much Does a Medicare Supplement Plan Cost?

The estimated average monthly premium (the amount you pay monthly) for a Medicare Supplement plan can range from $150 to around $200, depending on the state you live in and your insurer.

Sources

NORC at the University of Chicago. Innovative Approaches to Addressing Social Determinants of Health for Medicare Advantage Beneficiaries. Better Medical Alliance. Accessed 9/6/21.

What is a Medigap plan?

Medigap Plans. Doctors and hospitals. You may be required to use doctors and hospitals in the plan network. You can select your own doctors and hospitals that accept Medicare patients. Referrals. You may need referrals and may be required to use network specialists, depending on the plan.

How much does Medicare pay monthly?

Generally, you pay a low or $0 monthly plan premium (in addition to your Part B premium). When you use services, you pay copays, coinsurance, and deductibles up to a set out-of-pocket limit. For Medicare-approved doctor and hospital services, you’ll pay a monthly plan premium in addition to your Part B premium.

Can I switch to a different Medicare Advantage plan?

And you generally can’t be denied coverage or charged more based on your health status . You can apply to buy a plan any time after you turn 65.

Do I have to pay a monthly premium for Medicare?

For Medicare-approved doctor and hospital services, you’ll pay a monthly plan premium in addition to your Part B premium. When you use services, you’ll have. low—or no—copays and coinsurance, depending on the plan selected. Prescription drug coverage is included with most plans.

Is non emergency care covered by Medicare?

Non-emergency care might depend on your plan’s service area. Emergency care is generally covered for travel within the United States and sometimes abroad. Enrollment. Generally, there are specific periods during the year when you can enroll in or switch to a different Medicare Advantage plan.

Does Medicare cover prescription drugs?

Prescription drug coverage is included with most plans. You can select your own doctors and hospitals that accept Medicare patients. You can see specialists without referrals. Coverage goes with you when you travel across the United States and, depending on the plan, may cover emergency care when traveling abroad.

What is the difference between Medicare Supplement and Medicare Advantage?

Medicare supplement insurance fills the gaps in Original Medicare, whereas a Medicare Advantage plan completely replaces your Original Medicare coverage. With Medicare Advantage, you pay the majority of your costs when you use healthcare services through deductibles.

What is Medicare Advantage?

Medicare Advantage (MA), also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare (Medi care Part A and Medicare Part B).... and Medicare supplement insurance.

What is Medicare Advantage Special Needs Plan?

People who qualify for a Medicare Advantage Special Needs Plan. People who are exceptionally healthy and rarely use healthcare services outside of their annual wellness visits.

What are the advantages of Medicare Advantage?

The primary benefit of Medicare Advantage is extra benefits. And, if you are a healthy senior, the additional benefits and cost savings really add up. But, there are some serious disadvantages as well, including network provider limitations, costly inpatient copays, and no coverage traveling away from home.

How are Medicare premiums paid?

Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. ... . Most Medicare Advantage plans require their members to get a referral from their primary care doctor to see a specialist.

What is deductible insurance?

A deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begin s to pay its share.... , coinsurance. Coinsurance is a percentage of the total you are required to pay for a medical service. ... , copayments.

Is Medicare Advantage good for seniors?

If you are a super healthy senior, and you rarely see your doctor for anything more than your annual wellness exam, Medicare Advantage is an excellent medical insurance option.

Why is Medicare Advantage better than Medicare Advantage?

Here are the five top reasons that it’s better to have a Medicare Advantage plan: Up-front costs (monthly premium) are generally lower. You may have more doctor choices in Medicare Advantage. Plans are required to take you regardless of your health condition. If you have both Medicare and Medicaid.

What is the difference between Medicare Part B and Medicare Part B?

And it does it all for one manageable cost ( Medicare Part B. Medicare Part B is medical coverage for people with Original Medicare.

What is Medicare Part B?

Medicare Part B is medical coverage for people with Original Medicare. It covers doctor visits, specialists, lab tests and diagnostics, and durable medical equipment. Part A is for hospital inpatient care.... premium plus the Medigap premium) that is predictable.

What percentage of Medicare is paid?

Medicare pays 80 percent and the patient pays the remaining 20 percent of all covered services. If the beneficiary wants additional coverage, to isolate themselves from the 20 percent gap, they simply buy a Medigap plan (supplemental Medicare coverage).

Why is Kaiser Permanente an HMO?

Garfield Kaiser’s initial premise, the one on which he founded Kaiser Permanente, is that it costs less money to keep people healthy than it does to treat sick people. This is what an HMO is supposed to do. And it is exactly why an HMO plan through Medicare Advantage costs less up-front.

What is open enrollment in Medicare?

In health insurance, open enrollment is a period during which a person may enroll in or change their selection of health plan benefits. Health plan enrollment is ordinarily subject to restrictions.... period.

Is Medicare Supplement insurance a form of health insurance?

give the insurance companies a lot of wiggle room in terms of selling policies. First, unlike Medicare itself, a Medicare supplement insurance policy is not health insurance. It is a form of indemnity insurance. As a result, our modernized health insurance laws, including the Affordable Care Act, do not apply.