Full Answer

What is the difference between Medicare Advantage HMO and PPO?

Medicare Advantage PPO plans are also provided by private insurance companies. The key difference between PPO and HMO plans is that PPO plans offer more flexibility. Like HMO plans, Medicare PPO plans have a network of healthcare providers that offer discounted services. However, policyholders aren’t limited to this network.

Is a PPO more expensive than a HMO?

Patient cost-sharing has been increasing for years, and that makes it important to consider co-pays, coinsurance levels, and drug costs when comparing plans. In terms of plan premiums, PPOs are typically more expensive than HMOs.

Is Medigap better than Medicare Advantage?

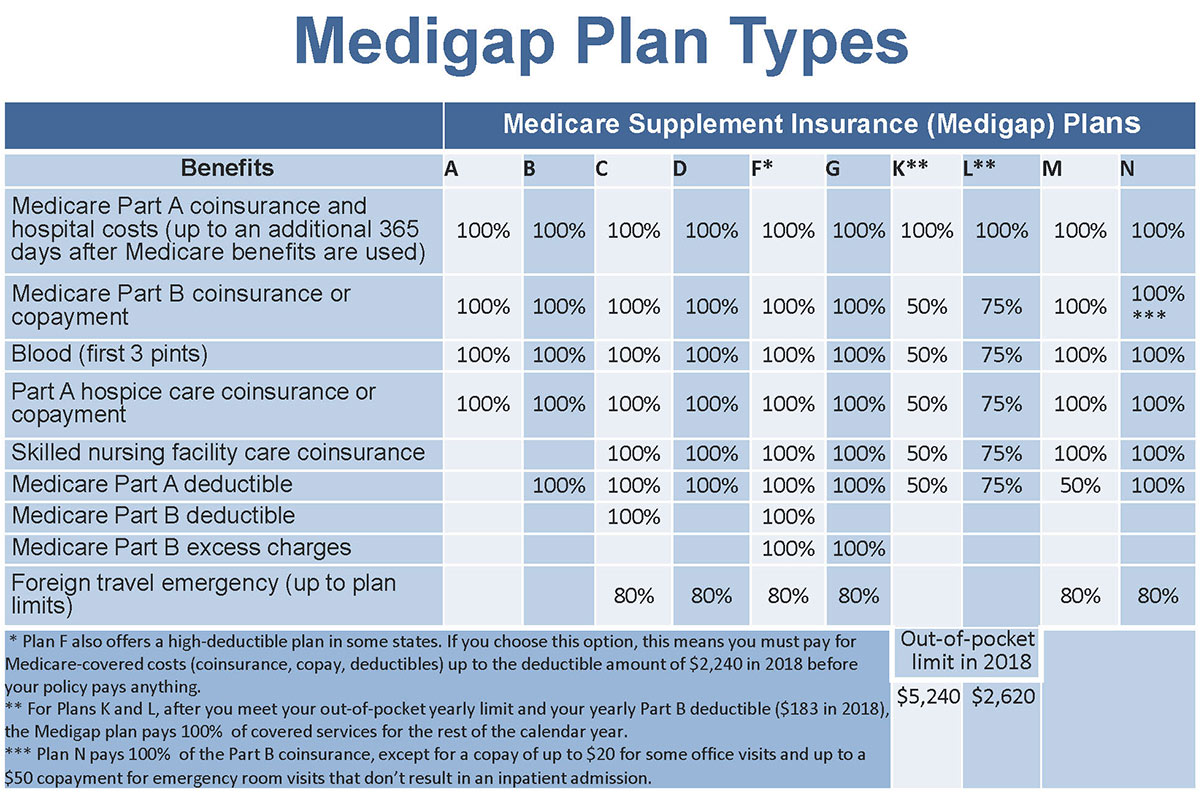

While Medigap premiums are generally higher than Medicare Advantage, Medigap will likely charge you lower out-of-pocket expenses. You’ll need to calculate how much you expect to pay for health care over a year and compare that to your annual premium cost.

What is preferred blue PPO?

- Medical Plans

- BlueCard PPO

- Personal Choice

- Keystone HMO

- Find a Doctor

- Forms

- Wellness

- ibxpress.com

Is Medicare Advantage the same as Blue Advantage?

Blue Cross Blue Shield offers Medicare Advantage Prescription Drug plans, or MAPDs, as well as stand-alone prescription drug plans and Medicare Advantage plans without drug coverage. A health maintenance organization, or HMO, generally requires that you use a specific network of doctors and hospitals.

What is the difference between Medicare Advantage and Medicare Advantage PPO?

A Preferred Provider Organization (PPO) plan is a Medicare Advantage Plan that has a network of doctors, specialists, hospitals, and other health care providers you can use, but you can also use out-of-network providers for covered services, usually for a higher cost.

What is the difference between an Advantage plan and a PPO plan?

There are differences between Medicare Advantage plans. The specific structure of the plan you choose dictates how much you pay for care and where you can seek treatment. HMO plans limit you to a specific network of providers, while PPO plans offer lower rates to beneficiaries who seek care from a preferred provider.

What is a Medicare PPO Advantage plan?

Medicare Advantage PPOs are types of Medicare Advantage plans that offer provider flexibility for beneficiaries who need it. With Medicare PPOs, you'll receive coverage for any provider you'd like, but you'll pay less if you use in-network providers and more if you use out-of-network providers.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Do doctors prefer HMO or PPO?

PPOs Usually Win on Choice and Flexibility If flexibility and choice are important to you, a PPO plan could be the better choice. Unlike most HMO health plans, you won't likely need to select a primary care physician, and you won't usually need a referral from that physician to see a specialist.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is the maximum out-of-pocket for Medicare Advantage plans?

The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year. In 2019, this amount is $6,700, which is a common MOOP limit. However, you should note that some insurance companies use lower MOOP limits, while some plans may have higher limits.

What are the two types of PPOs?

There are two types of PPO plans.A local PPO has a small service area, such as a county or part of a county, with approximately 2,000-5,000 providers in its network.A regional PPO has a contracted network that serves an entire region or regions and can include 16,000-17,000 providers in the network.

What is the highest rated Medicare Advantage plan?

Best Medicare Advantage Plans: Aetna Aetna Medicare Advantage plans are number one on our list. Aetna is one of the largest health insurance carriers in the world. They have an AM Best A-rating. There are multiple plan types, like Health Maintenance Organizations (HMOs) or Preferred Provider Organizations (PPOs).

Can you switch back from Medicare Advantage to regular Medicare?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Can you have Medicare and Medicare Advantage at the same time?

People with Medicare can get their health coverage through either Original Medicare or a Medicare Advantage Plan (also known as a Medicare private health plan or Part C).

What is a blue Medicare PPO?

Blue Medicare PPO – a popular Medicare Advantage plan in Florida. Some Counties in Florida have a couple dozen Medicare plans to choose from. Competition is fierce for some plans with name recognition to attract new members. Name recognition is one problem Blue Cross does not have. The Blue Medicare PPO plan attracts a lot ...

Is Blue Cross Blue Shield a PPO?

Blue Cross Blue Medicare PPO offers some flexibility. At some point in your life you may have had insurance with Blue Cross Blue Shield. Whether you had an individual or employer group plan, you probably formed some opinion about the company. If your experience was good and you are Medicare eligible, you may want to check out ...

Is a PPO a HMO?

A Medicare PPO allows you the benefit of saving money by utilizing in-network providers, but also gives you the flexibility to go out of network if you choose. This type of Medicare Advantage plan can offer more flexibility in that regard than a Medicare HMO.

Is Part D included in Blue Cross?

Part D is included in then plan. If you are considering a Blue Cross Medicare plan you should have no problem locating an agent who can help you enroll. But before you do, you should take the time to do a thorough comparison of all your options.

Does Blue Medicare PPO plan renew?

The Blue Medicare PPO plan attracts a lot of new members and many members stay with the plan year after year. If you choose to enroll in a Medicare Advantage plan, you should be aware that plans can change benefits, premiums, providers or just not renew for the following year.

About Blue Medicare Advantage

Blue Medicare Advantage offers Group Medicare Advantage plans with a national network of doctors and a care management team that supports retirees on their health care journey.

Welcome Blue Medicare Advantage Members

Welcome to Blue Medicare Advantage, your plan sponsor's Medicare Advantage plan. Our Blue Medicare Advantage plans include:

What is a copayment in Medicare?

Copays. A copayment may apply to specific services, such as doctor office visits. Coinsurance. Cost sharing amounts may apply to specific services. Out-of-Pocket Expenses. All Medicare Advantage plans have an annual limit on your out-of-pocket expenses, which is a feature not available through Original Medicare.

How to change Medicare plan?

The Medicare Open Enrollment Period provides an annual opportunity to review, and if necessary, change your Medicare coverage options. Coverage becomes effective on January 1. During Open Enrollment, some examples of changes that you can make include: 1 Join a Medicare Advantage (Part C) plan. 2 Discontinue your Medicare Advantage plan and return to Original Medicare (Part A and Part B). 3 Change from one Medicare Advantage plan to another. 4 Add or Change your Prescription Drug Coverage (Part D) plan if you are in Original Medicare.

What is the initial enrollment period for Medicare?

The Initial Enrollment Period is a limited window of time when you can enroll in Original Medicare (Part A and/or Part B) when you are first eligible. After you are enrolled in Medicare Part A and Part B, you can select other coverage options like a Medicare Advantage plan from approved private insurers.

Does Medicare Advantage have copayments?

Medicare Advantage plans may have copayments or cost sharing amounts on Medicare covered services that differ from the cost sharing amounts in Original Medicare. Medicare Advantage plans may change their monthly premiums and benefits each year. This also occurs in Original Medicare, as Part B premiums, standard deductibles ...

Does Medicare Advantage have geographic service areas?

Limits. Medicare Advantage plans have defined geographic service areas and most have networks of physicians and hospitals where you can receive care. Ask your physicians if they participate in your health insurance plan’s Medicare Advantage network.

Do you have to enroll in Medicare before joining a Medicare Advantage plan?

You must first enroll in Medicare Part A and Part B before joining a Medicare Advantage plan. Contact your local Blue Cross Blue Shield company for help choosing a Medicare Advantage plan and getting enrolled.

How much does Blue Advantage pay for prescriptions?

Blue Advantage pays the rest. Once YOUR out-of-pocket spending on prescriptions reaches $6,550 you pay the greater of $3.70 for generic drugs and $9.20 for brand-name drugs OR 5% coinsurance per prescription for the rest of the year. Blue Advantage pays the rest.

What is Blue Advantage?

Blue Advantage makes it easy to stay healthy and save money. Choice of plans, including $0 premium option. Built-in prescription drug coverage. Statewide provider network with 100% of Alabama hospitals and over 90% of doctors. No referral required for network specialists, doctors or hospitals.

What is a blue card PPO?

BlueCard PPO members are Blue Cross and Blue Shield members whose PPO benefits are delivered through the BlueCard Program. It is important to remember that not all PPO members are BlueCard PPO members, only those whose membership cards carry this logo. BlueCard PPO members traveling or living outside of their Blue Plan’s area receive the PPO level of benefits when they obtain services from designated BlueCard PPO providers.

What does the third character on a blue card mean?

This may indicate that the claims are handled outside the BlueCard Program. Please look for instructions or a telephone number on the back of the member’s ID card for how to file these claims.

Why is my Blue Cross claim returned?

A claim is returned to you from The Local Blue Cross and Blue Shield because no alpha prefix was included on the original claim that was submitted. In some cases, The Local Blue Cross and Blue Shield will request that you file the claim directly with the member’s Blue Plan.

Does Blue Cross and Blue Shield send paper claims?

That means you will no longer need to send paper claims directly to the member’s Blue Plan. Instead, you will submit these claims to The Local Blue Cross and Blue Shield. However, you will continue to submit Medicare supplemental (Medigap) and other COB claims under your current process (see below).

Does Keystone HMO have blue card?

You can tell if you have this on your plan if your card has the PPO Traveling Briefcase logo: It’s important to note that members who have a Keystone HMO, Amerihealth or Horizon HMO or local EPO do NOT have Blue Card PPO.

Do all PPOs have a blue card?

It is important to remember that not all PPO members are BlueCard PPO members, only those whose membership cards carry this logo. BlueCard PPO members traveling or living outside of their Blue Plan’s area receive the PPO level of benefits when they obtain services from designated BlueCard PPO providers.

Can I file a PPO card with Blue Cross?

If you are a non-PPO (traditional) provider and are presented with an identification card with the “PPO in a suitcase” logo on it, you should still accept the card and file with your local Blue Cross and Blue Shield Plan. You will still be given the appropriate traditional pricing.

Choosing the Right Medicare Advantage Plan for Your Needs

You have options when it comes to Medicare Part C plans. Our Medicare Advantage (MA) plans can give you prescription drug coverage and extra benefits, like transportation services to doctor appointments and discount and reward programs. Many plans even have a $0 monthly plan premium.

Florida Blue Medicare PPO Plans

Do you want the savings of a provider network and the flexibility to see doctors and specialists outside the network? If you do not like to wait for a primary care doctor referral to go to a specialist, one of our Medicare Advantage PPO plans may be a better fit for your needs.

What Does a Medicare Advantage Plan Cost?

Like Original Medicare, Medicare Advantage (Part C) plans share the cost of care through deductibles, co-payments (copays) and co-insurance. These costs vary by plan. Our HMO plans offer $0 premiums, low out-of-pocket costs, and low prescription drug costs.

Your Original Medicare (Parts A and B) costs may include

Deductible - The amount you pay before Florida Blue Medicare begins to pay its share of the cost. Some MA plans have a separate drug deductible before they start to pay for your prescriptions.

We're always happy to help you navigate Medicare

Call us for help or for any questions you have about your Medicare insurance plan needs.