What is the difference between Blue Cross medicarerx value and PDP?

Blue Cross MedicareRx Value SM and Blue Cross MedicareRx Plus SM plans have a larger formulary. All PDP plans have a large nationwide pharmacy network. You can get your prescriptions in your neighborhood or across the country.

What is the difference between Blue Shield RX enhanced and PDP?

* Blue Shield Rx Enhanced (PDP) has a more robust formulary than the Blue Shield Rx Plus (PDP) Prescription Drug Plan 101 Medicare Part D helps pay for generic and brand-name drugs not covered by Original Medicare. These plans are provided by private insurance companies or health plans, like Blue Shield of California.

Why Blue Shield for Medicare Prescription Drug Plans?

Why Blue Shield for Medicare Prescription Drug Plans? Our stand-alone Medicare Prescription Drug Plans (PDP) provide a wide range of cost-share and coverage options for your prescription drug costs. Our plans pair well with Medicare Supplement coverage and are easy to understand. Get an extended day supply of your prescription

What are the different Blue Cross Blue Shield Part D plans?

As an association of so many companies, it’s hard to pin down umbrella statements about Blue Cross Blue Shield (BCBS) Part D plans. In general, you’ll see plan names like Basic, Plus, Value, Standard, Enhanced, Premier, or Value Plus for BCBS’s prescription coverage.

What does Medicare PDP stand for?

Medicare Prescription Drug PlanJoin a Medicare Prescription Drug Plan (PDP). These plans add coverage to Original Medicare, and can be added to one of these: • A Medicare Savings Account (MSA) Plan.

What is a PDP plan?

A prescription drug plan (PDP) is a stand-alone plan that offers Medicare prescription drug coverage (Part D) through a private insurance company. PDPs work with Original Medicare, Medical Savings Account (MSA) plans, Cost Plans, and Private Fee-For-Service (PFFS) plans without drug coverage.

Is Medicare Part D the same as a PDP?

Medicare Part D prescription drug plans are also known as PDPs. These are standalone plans that can be purchased through private insurance companies. PDPs provide coverage for prescription drugs and medications and may also cover some vaccines too. Original Medicare (Parts A & B)

What is the difference between basic and enhanced Part D plans?

Enhanced plans charge higher monthly premiums than basic plans but typically offer a wider range of benefits. For instance, these plans may not have a deductible, may provide extra coverage during the donut hole, and may have a broader formulary. Some of these plans may also cover excluded drugs.

What are the benefits of a PDP?

The benefits of a PDP are:It provides you with clear goals.It helps you to identify your strengths and weaknesses.It improves your employability.It improves your performance.It increases your motivation.It helps track your progress.It improves your sense of purpose.More items...•

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What are the two types of Medicare Part D plan?

The plan can be a “stand-alone” Part D drug plan — one that offers only drug coverage and is the type that can be used by people enrolled in the original Medicare program. Or it can be a Medicare Advantage plan (such as an HMO or PPO) that offers Part D drug coverage as well as medical coverage in its benefits package.

What is the deductible of a PDP plan?

Summary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2022, the Medicare Part D deductible can't be greater than $480 a year.

Do I need Medicare Part D if I don't take any drugs?

No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D.

What drugs does Medicare Part D not cover?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

What is the problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

What is the cost for Medicare Part D for 2021?

The maximum annual deductible in 2021 for Medicare Part D plans is $445, up from $435 in 2020.

What is a coinsurance plan?

Coinsurance. Some Part D plans require that you pay a percentage (coinsurance) of a medication’s cost every time you fill a prescription. Coverage Gap. Although plan designs can vary, most Medicare Part D plans have a cost sharing component commonly known as a coverage gap or “donut hole.”. The coverage gap is a temporary limit where you are ...

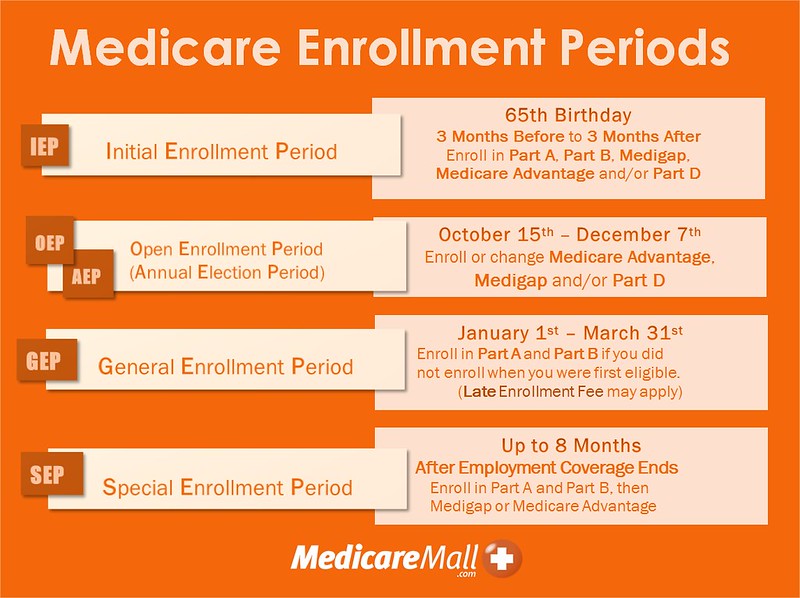

What is the initial enrollment period for Medicare?

The Initial Enrollment Period is a limited window of time when you can enroll in Original Medicare (Part A and/or Part B) when you are first eligible. After you are enrolled in Medicare Parts A or B, you can select other coverage options like a Prescription Drug Coverage (Part D) plan from approved private insurers.

How long does Medicare Part A last?

Title. When to Enroll. Description. When you are first eligible, your Initial Enrollment Period for Medicare Part A and Part B lasts seven months and starts when you qualify for Medicare, either based on your age or an eligible disability.

When is open enrollment for Medicare?

Open Enrollment runs from October 15 through December 7 and it provides an annual opportunity for Medicare-eligible consumers to review and make changes to their Medicare coverage. This includes the opportunity to select or make changes to Prescription Drug Coverage (Part D).

Does Medicare cover prescription drugs?

Medicare Prescription Drug plans are offered by private health insurance companies and cover your prescription drug costs for covered medications. You can choose to receive this coverage in addition to: Original Medicare (Part A and Part B) Original Medicare (Part A and Part B) with a Medigap Plan. Part D coverage is generally included in most ...

How many states have Blue Cross Blue Shield Part D?

You can find a Blue Cross Blue Shield Part D (PDP) plan in 41 states. If you live in the following states, however, you’ll need to find a different Part D provider:

What is the number for Blue Cross Blue Shield?

833-271-5571. Sources: 1. Blue Cross Blue Shield, “ BCBS Companies and Licenses ”. Content on this site has not been reviewed or endorsed by the Centers for Medicare & Medicaid Services, the United States Government, any state Medicare agency, or any private insurance agency (collectively "Medicare System Providers").

Does Blue Cross Blue Shield offer Medicare Advantage?

Blue Cross Blue Shield (BCBS) offers far more than Part D coverage; they also sell Medigap plans to supplement your Original Medicare. Or, to bundle all your Medicare coverage into one plan, consider Medicare Advantage (Part C).

Is Blue Cross Blue Shield a single entity?

December 11, 2019. Among private health insurance providers, Blue Cross Blue Shield (BCBS) isn’t like the rest. This is evident primarily through the organization of the company—it is not a single entity, but an association of 36 independent companies operating under the BCBS license. 1 As such, you’ll likely find regional differences and lots ...