Full Answer

What are the threshold annual compensation amounts for the additional Medicare tax?

The threshold annual compensation amounts that trigger the Additional Medicare Tax are: •$250,000 for married taxpayers who file jointly. • $125,000 for married taxpayers who file separately.

What is the wage base limit for Medicare tax?

There's no wage base limit for Medicare tax. All covered wages are subject to Medicare tax.

Does the employer pay half of the Medicare tax?

The employer also pays half of the tax. The Social Security tax rate is assessed on all types of income that an employee earns, including salaries, wages, and bonuses. Medicare wages fund the Medicare tax, which funds the government's Medicare program.

What are Medicare wages and how do they work?

Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax. Similar to the other U.S. payroll tax, Social Security, the Medicare tax is used to fund the government's Medicare program, which provides subsidized healthcare and hospital insurance benefits to people ages 65 and older and the disabled. 1

Is there a cap on Medicare wages?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

What is the Medicare wages threshold amount?

$200,000Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above. Married tax filers filing separately: $125,000 and above.

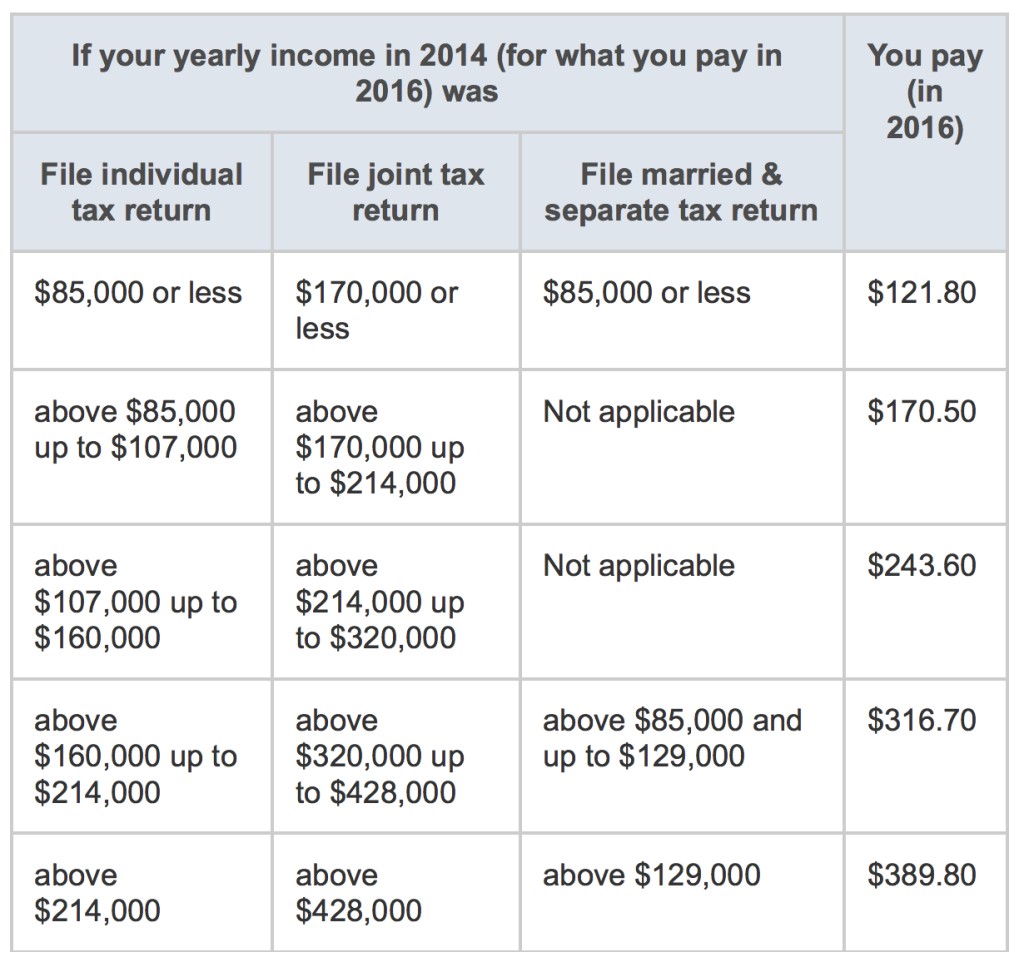

What is the 2016 Medicare Tax Rate This rate is applied to what maximum level of salary and wages?

This added tax raises the wage earner's portion on compensation above the threshold amounts to 2.35 percent; the employer-paid portion of the Medicare tax on these amounts remains at 1.45 percent....2016 Payroll Tax Unchanged; Tax Brackets Nudge Up.FICA Rate (Social Security + Medicare withholding)20152016Employer7.65%7.65%Self-Employed15.30%15.30%2 more rows•Oct 15, 2015

What income is subject to the 3.8 Medicare tax?

The tax applies only to people with relatively high incomes. If you're single, you must pay the tax only if your adjusted gross income (AGI) is over $200,000. Married taxpayers filing jointly must have an AGI over $250,000 to be subject to the tax.

How are Medicare wages calculated?

These wages are taxed at 1.45% and there is no limit on the taxable amount of wages. The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction.

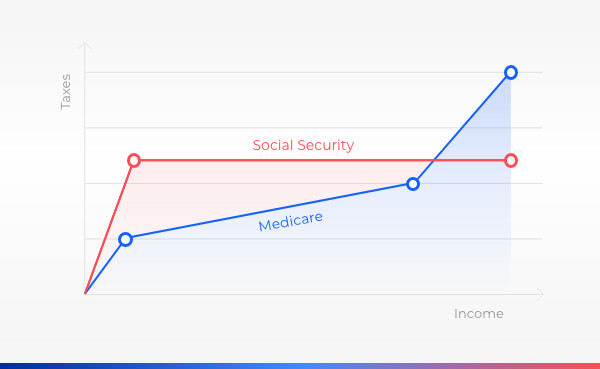

What is the cap on SS tax?

The Social Security tax limit is the maximum amount of earnings subject to Social Security tax. The Social Security taxable maximum is $142,800 in 2021. Workers pay a 6.2% Social Security tax on their earnings until they reach $142,800 in earnings for the year.

What is the maximum amount of earnings that are subject to Social Security tax in 2014?

For 2014, the maximum limit on earnings for withholding of Social Security (Old-Age, Survivors, and Disability Insurance) Tax is $117,000.00. The maximum limit is changed from last year. The Social Security Tax Rate remains at 6.2 percent. The resulting maximum Social Security Tax for 2014 is $7,254.00.

What is the tax cap for income?

In 2020 the top tax rate (37 percent) applies to taxable income over $518,400 for single filers and over $622,050 for married couples filing jointly.

What is Medicare wages?

What Are Medicare Wages? Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax. Similar to the other U.S. payroll tax, Social Security, the Medicare tax is used to fund the government's Medicare program, which provides subsidized healthcare and hospital insurance benefits to people ages 65 ...

How much is Medicare taxed?

Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee's wages. Employers also pay 1.45%. Employees whose wages exceed $200,000 are also subject to a 0.9% Additional Medicare Tax.

What is the Medicare tax rate for self employed?

The Medicare tax for self-employed individuals is 2.9% to cover both the employee's and employer's portions. 2 . The 2020 CARES Act expanded Medicare's ability to cover the treatment and services of those affected by COVID-19. Employees should also consider having money deducted from their wages to fund their retirement through an ...

What is the maximum Social Security tax for self employed in 2021?

5 The maximum Social Security tax for self-employed people in 2021 is $17,707.20. 6 . ...

Can you deduct retirement from paycheck?

In many cases, you can elect to have a portion deducted from your paycheck for this purpose. Many employers offer certain types of retirement plans, depending on the length of time an employee has been with an organization (known as vesting) and the type of organization (company, nonprofit, or government agency).

Do self employed people pay Medicare?

Self-employed individuals must pay double the Medicare and Social Security taxes that traditional employees pay because employers typically pay half of these taxes. But they are allowed to deduct half of their Medicare and Social Security taxes from their income taxes. 6 .

Is there a limit on Medicare tax?

4 . Unlike the Social Security tax, there is no income limit on the Medicare tax.

How many people will pay Social Security taxes in 2015?

Of the estimated 168 million workers who will pay Social Security taxes in 2015, about 10 million will pay higher taxes because of the increase in the taxable maximum, the SSA said. Social Security and Medicare payroll withholding are collected together as the Federal Insurance Contributions Act (FICA) tax.

How much is Medicare tax?

For most Americans, the Medicare portion of the FICA tax remains at 2.9 percent, of which half ( 1.45 percent) is paid by employees and half by employers. Unlike Social Security, there is no limit on the amount of earnings (which includes salary and bonus income) subject to the Medicare portion of the tax. This results, for most American wage ...

What is the tax rate for Medicare and Social Security?

Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable maximum amount. The Medicare portion is 1.45% on all earnings.

What is the FICA tax rate?

This results, for most American wage earners, in a total FICA tax of 15.3 percent (Social Security plus Medicare), half of which is paid by employees and half by employers. Again, self-employed individuals are responsible for the entire FICA tax rate of 15.3 percent (12.4 percent Social Security plus 2.9 percent Medicare).

What is the additional Medicare tax?

The Additional Medicare Tax raises the wage earner’s portion on compensation above the threshold amounts to 2.35 percent ; the employer-paid portion of the Medicare tax on these amounts remains at 1.45 percent. The IRS has posted responses to frequently asked questions regarding the Additional Medicare Tax.

Will Social Security increase in 2016?

On Oct. 15, 2015, the Social Security Administration announced that there will be no increase in monthly Social Security benefit payments in 2016, and that the amount of wages subject to Social Security taxes will also remain unchanged at $118,500 in 2016. See the SHRM Online article Social Security Payroll Tax Threshold Unchanged for 2016.

Is Medicare a payroll tax?

The IRS has posted responses to frequently asked questions regarding the Additional Medicare Tax. Net Investment Income Tax. Although it is not a payroll tax, HR professionals also should be aware of the net investment income tax (NIIT) that high earners must pay when they file their income tax returns.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

Why is the cap on wages subject to the tax controversial?

The cap on wages subject to the tax is the subject of controversy, partly because it means that, while the average worker pays tax on every dollar of their income (the vast majority of workers earn less than the wage base limit), the highest earners pay tax on only part of their income. Critics argue that caps on FICA taxes are not fair for ...

What was the cap on FDR's plan?

As FDR's plan worked its way through Congress, the exemption for high earners was eliminated, and the House Ways and Means Committee replaced it with a $3,000 cap.

How much is payroll tax withheld from a paycheck?

Therefore, if you are a waged or salaried employee, half of the payroll tax—6.2% for Social Security and 1.45% for Medicare—is automatically withheld from each paycheck, and your employer contributes the other half. 1 .

What is the payroll tax for 2020?

It is 12.4% of earned income up to an annual limit that must be paid into Social Security and an additional 2.9% that must be paid into Medicare.

How much is Social Security tax in 2021?

5 . For 2021, the wage base limit for Social Security taxes increased to $142,800, a $5,100 increase from $137,700 in 2020.

Does Medicare tax cap apply to Social Security?

Income tax caps limit do not apply to Medicare taxes, but Social Security taxes have a wage-based limit. The cap limits how much high earners need to pay in Social Security taxes each year. Critics argue that income tax caps unfairly favor high earners compared to low-income earners. Others believe that raising the cap would result in one ...

Is there a wage cap on Medicare?

There is no income cap (or wage base limit) for the Medicare portion of the tax, meaning you continue to owe your half of the 2.9% tax on all wages earned for the year, regardless of the amount of money you make. 4 . The Social Security tax, however, has a wage-based limit, which means there is a maximum wage that is subject to the tax for ...

What is Medicare tax?

Medicare tax by definition goes to fund the federal insurance program for elderly and disabled people. It's deducted from your paychecks along with Social Security tax, which pays for that federal program, as well as ordinary federal and state income tax.

How much is pretax for Medicare?

Also, amounts you receive for educational assistance under your employer’s program earn you a pretax deduction; up to $5,250 annually is exempt from Medicare tax. If a pretax deduction is excluded from Medicare tax, subtract it from your gross wages before subtracting the tax. For example, if you earn $2,000 semi-monthly ...

What is the Social Security tax rate?

The Social Security tax rate is 6.2 percent payable by the employee and 6.2 percent payable by the employer. Self-employed people must pay what is called self-employment tax, which includes the employee and employer portions of Social Security and Medicare taxes, so they pay a 15.3 percent tax rate.

Where is Medicare tax withheld on W-2?

Your employer puts your annual Medicare wages in Box 5 of your W-2 and Medicare tax withheld for the year in Box 6. The amount shown in Box 5 does not include pretax deductions which are exempt from Medicare tax. Your last pay stub for the year may show a different year-to-date amount for Medicare wages than your W-2.

Is Medicare tax exempt from Social Security?

Pretax deductions that are excluded from Medicare tax are typically exempt from Social Security tax as well. Your Medicare wages are usually the same as your Social Security wages except that Social Security tax has an annual wage limit and Medicare tax has none. If you have multiple jobs that collectively put you over the wage limit, you may get a refund for over-withheld Social Security tax

Is pretax income tax exempt from Medicare?

Deductions from your wages used to pay for your employer-sponsored benefits reduce your income and are excluded from taxes. In many cases, pretax deductions are exempt from Medicare tax; however, this isn’t always the case.

Is 2,000 semi monthly taxable?

If the deduction was taxable, your entire gross pay of $2,000 would be subject to taxation.