5 Medicare Changes for 2019 You Should Know About

- Medicare Part B premiums are going up Though Medicare Part A, which covers hospital visits, is usually free for...

- Medicare deductibles are also going up When you utilize healthcare services under Medicare, you're subject to an...

- Medicare Advantage is getting a new open enrollment period Seniors who want...

How will Medicare change?

Medicare's benefits will remain largely the same in 2022. As the new year begins, Congress is still debating several proposals that would change the face of Medicare, including adding a hearing benefit and several proposals to lower the price of prescription drugs, including capping out-of-pocket costs in Part D plans. But even if Congress adopts these changes, they wouldn't take effect this year.

How much does Medicare cost at age 65?

In 2021, the premium is either $259 or $471 each month ($274 or $499 each month in 2022), depending on how long you or your spouse worked and paid Medicare taxes. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

Is there a monthly premium for Medicare?

What does Medicare cost? Generally, you pay a monthly premium for Medicare coverage and part of the costs each time you get a covered service. There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medicare Supplement Insurance (

How much is the standard Medicare premium?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

What are the changes for 2021 Medicare?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.

What big changes are coming to Medicare?

The biggest change Medicare's nearly 64 million beneficiaries will see in the new year is higher premiums and deductibles for the medical care they'll receive under the federal government's health care insurance program for individuals age 65 and older and people with disabilities.

What changes are coming to Medicare in 2020?

What Are the Medicare Changes 2020?Part A premium will be $458 (many qualify for premium-free coverage)Part B premium will increase to $144.60.Part B deductible will rise to $198.Supplement Plan F and Plan C will no longer be available to those who became eligible on or after January 1, 2020.More items...

What are the 3 changes for Medicare 2022?

Part A premiums, deductible, and coinsurance are also higher for 2022. The income brackets for high-income premium adjustments for Medicare Part B and D start at $91,000 for a single person, and the high-income surcharges for Part D and Part B increased for 2022.

What will Medicare cost in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Is Medicare changing their cards for 2022?

15 through Dec. 7, the more than 63 million Medicare beneficiaries can pick a new Medicare Part D drug plan, a new Medicare Advantage plan, or switch from Original Medicare into a Medicare Advantage plan or vice versa. Any coverage changes made during this period will go into effect Jan. 1, 2022.

Is Medicare going up 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the Medicare Part B premium for 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

What are the new benefits for Medicare?

Medicare gives patients the ability to receive more services at ambulatory surgical centers – giving Medicare beneficiaries more choice and convenience when accessing their health care. And 4 out of 5 people will pay a premium of less than $50 per month in 2019 for a Medicare Advantage Plan.

How much will Social Security take out for Medicare in 2022?

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

What will Medicare Part D cost 2022?

Highlights for 2022 The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2022, based on current enrollment, while average monthly premiums for the 16 national PDPs are projected to range from $7 to $99 in 2022.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

What is changing in Medicare enrollment in 2019?

What is Changing in Medicare Enrollment Periods in 2019? Medicare recipients consider making changes to their coverage each year for a number of reasons, but you can only switch, drop, or enroll in new plans during specific enrollment periods during the year. Let’s review the enrollment periods for 2019.

When is the Medicare election period?

Medicare’s Annual Election Period, from October 15 to December 7 , is the period each year when Medicare recipients can make changes to their coverage. During AEP, you can: Drop Original Medicare and enroll in a Medicare Advantage plan.

What is loss of coverage?

Loss of coverage The loss of Medicaid eligibility, employer or union coverage (including COBRA), or creditable Medicare drug coverage. Plan changes its contract with Medicare Medicare may terminate the plan’s contract, take an official action against the plan that affects you, or choose not to renew the plan’s contract.

When does the open enrollment period end?

Open Enrollment Period (OEP) Medicare is introducing a new Open Enrollment Period (OEP) in 2019. The OEP will begin January 1 and end on March 31. During the Open Enrollment Period, Medicare recipients enrolled in a Medicare Advantage (MA) plan, including newly MA-eligible individuals, can make a one-time election to switch to another Medicare ...

When is the 5 star period for Medicare?

Medicare recipients are granted a Five-Star Special Enrollment Period from December 8 through November 30 . During this Special Enrollment Period, you may switch plans once to a 5-Star Medicare Advantage, 5-Star Medicare Cost Plan, or 5-Star Medicare Prescription Drug Plan available in your area.

Can you drop MA plan during OEP?

During OEP, Medicare recipients can also drop their MA plan and return to Original Medicare. Individuals using the OEP to make a change may make a coordinating change to add or drop Part D coverage. This will eliminate the existing Medicare Advantage Disenrollment Period (MADP).

When can I switch to Medicare Advantage?

If you have a Medicare Advantage Plan in 2019, you’ll have the opportunity to change your coverage using the Medicare Advantage Open Enrollment Period , which occurs from January 1 to March 31. During this time, you can switch from your Medicare Advantage Plan to another one or to Original Medicare, with or without a stand-alone Part D prescription drug plan.

How often can I switch Medicare Part D plans?

Previously, people with Extra Help had a Special Enrollment Period to enroll in a Part D plan or switch between plans once every month. Starting in 2019, this Special Enrollment Period will be available once per calendar quarter for the first three quarters of the year. To qualify for Extra Help, your monthly income currently must be less than $1,538 ($2,078 for married couples) and your assets must be below specified limits.

Does Medicare change each year?

Medicare costs change each year, so if you’re 65 or older, it’s important to understand and review your benefits for the upcoming year. Some new rules affect the cost of prescription drugs covered under Part D (Medicare’s prescription drug benefit) and change the times when you can revise your Medicare health and drug coverage.

Does Medicare Advantage have flexibility?

Beginning in 2019, Medicare Advantage plans have increased flexibility in their plan offerings. This means that plans may be able to reduce cost-sharing for certain benefits, offer extra benefits or charge different deductibles for some enrollees who meet specific medical criteria.

How much is the Medicare deductible for 2019?

When you utilize healthcare services under Medicare, you're subject to an out-of-pocket deductible that must be met before your coverage kicks in. The annual deductible for Medicare Part B will be $185 in 2019, which represents a $2 increase from 2018. Meanwhile, the Medicare Part A inpatient deductible for hospital admittance will be $1,364 in 2019. That's a $24 increase from the current year.

Why do seniors delay medical care?

To address this, Medicare has been offering a telehealth program that allows patients and doctors to connect via videoconference. Beginning in 2019, telehealth services will be available to patients who have end-stage renal disease or are in the midst of stroke treatment.

What is Medicare Advantage?

Advantage is an alternative to traditional Medicare that allows enrollees to bundle their healthcare needs (including prescriptions) into a single plan. And since most Advantage plans offer coverage for services like dental, hearing, and vision -- items not covered under regular Medicare -- many seniors ultimately find it far more cost-effective.

How much is Medicare Part B?

In 2018, the standard monthly premium is $134, but that figure is climbing by $1.50 a month next year to a total of $135.50. That said, if you're a higher earner, you could end up paying significantly more for Medicare Part B.

How much does Medicare cover for speech therapy?

Currently, coverage for physical, speech, or occupational therapy (often after suffering a fall or a stroke or while managing a chronic illness) is capped at around $2,000 for enrollees in original Medicare. As part of the 2018 budget deal, Congress eliminated the coverage caps on those therapies starting next year.

Is there a Medicare Advantage plan for daycare?

Under new government rules announced earlier this year, Medicare Advantage plans will be able to provide even more benefits beyond what original Medicare covers starting in 2019. The new services could include adult daycare, home-based palliative care, home health aides to provide personal care, counseling and respite support for caregivers, non-opioid pain management, memory fitness services, home and bathroom safety devices, transportation to and from the doctor, and some over-the-counter health items.

When will Medicare Part B be available?

Currently, there are two policies ( Plans C and F) that cover the Part B deductible. These plans will no longer be offered after January 1, 2020.

What are the benefits of Medicare Supplement?

The CMS (Centers for Medicare & Medicaid Services) now allows plans to offer supplemental benefits in addition to medical services. These include services such as: 1 Nutritional services (such as home meal delivery) 2 Ride-shares to medical facilities 3 Adult day care 4 Home safety devices 5 Telehealth services

How much is Medicare Part D deductible?

For 2019, the prescription drug deductible has been capped at $415 (an increase of $10), although some insurers may charge less. The maximum coverage limit is $3,820, which is $70 higher than it was in 2018.

What is the first change to look out for every year?

The first change to look out for every year is to see whether your premiums and deductibles have gone up. As health care costs rise, it’s only natural that Medicare would make changes that reflect the current costs of services.

Do you need to check your Medicare plan every year?

Since these plans are offered by private insurers and are not standardized, you’ll need to check each year to see whether your insurer has made any changes to your plan. Fortunately, updates to Medicare policies mean that your insurer may be able to offer you more benefits.

Does Medicare roll out new plans?

Each year, the government makes some changes to Medicare that may affect your premiums, deductibles, coinsurance, and other out-of-pocket costs. Medicare may also roll out new plans, such as new Medicare Supplement Insurance policies, or phase out old ones.

Will Medicare change in 2019?

Understanding the changes coming to Medicare in 2019 can be a tricky process for anyone to do on their own. Fortunately, we know the system inside and out and can help you prepare for these changes in advance — before they have an impact on your coverage or your budget.

When did Medicare update Part D?

On April 2, 2018 , the Centers for Medicare & Medicaid Services (CMS) issued a final rule that updates Medicare Advantage (MA) and the prescription drug benefit program (Part D) by promoting innovation and empowering MA and Part D sponsors with new tools to improve quality of care and provide more plan choices for MA and Part D enrollees.

What is an OEP in Medicare?

The new OEP allows individuals enrolled in an MA plan, including newly MA-eligible individuals, to make a one-time election to go to another MA plan or Original Medicare. Individuals using the OEP to make a change may make a coordinating change to add or drop Part D coverage.

When is the new version of NCPDP?

CMS is adopting the NCPDP SCRIPT Standard, Version 2017071 beginning on January 1, 2020.

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

How many people will have Medicare Advantage in 2020?

People who enroll in Medicare Advantage pay their Part B premium and whatever the premium is for their Medicare Advantage plan, and the private insurer wraps all of the coverage into one plan.) About 24 million people had Medicare Advantage plans in 2020, and CMS projects that it will grow to 26 million in 2021.

What is the maximum out of pocket limit for Medicare Advantage?

The maximum out-of-pocket limit for Medicare Advantage plans is increasing to $7,550 for 2021. Part D donut hole no longer exists, but a standard plan’s maximum deductible is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending decreases significantly) is increasing to $6,550.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

How much is the Medicare coinsurance for 2021?

For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020). The coinsurance for lifetime reserve days is $742 per day in 2021, up from $704 per day in 2020.

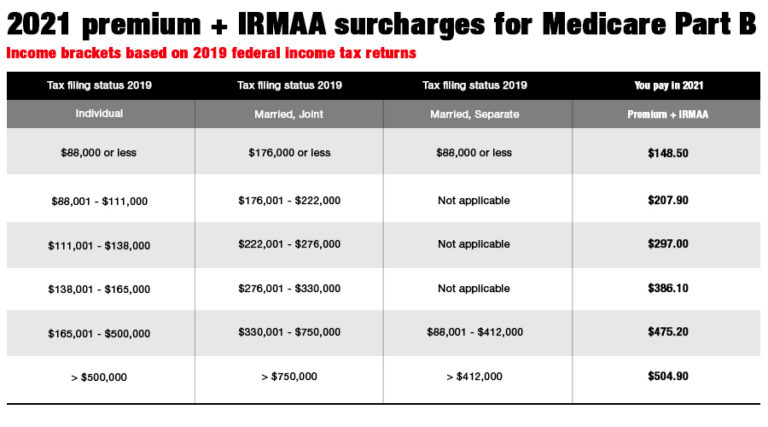

What is the income bracket for Medicare Part B and D?

The income brackets for high-income premium adjustments for Medicare Part B and D will start at $88,000 for a single person, and the high-income surcharges for Part D and Part B will increase in 2021. Medicare Advantage enrollment is expected to continue to increase to a projected 26 million. Medicare Advantage plans are available ...

How long is a skilled nursing deductible?

See more Medicare Survey results. For care received in skilled nursing facilities, the first 20 days are covered with the Part A deductible that was paid for the inpatient hospital stay that preceded the stay in the skilled nursing facility.