Medicare Part A is free for most Americans age 65 or older, though people who haven't worked or paid Medicare taxes for at least 10 years will pay a large monthly Part A premium. Most people don't get Part B for free whether they've reached their 65th birthday or not, but the cost is much lower and depends on your income.

Full Answer

What are the best Medicare plans?

... Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers. Sign up today for a FREE virtual event and let Silver Supplements Solutions help you understand your best option for your own peace of mind!

How much is the late enrollment penalty for Part B?

Your late enrollment penalty would be 20% of the Part B premium, or 2 x 10%. This is because you waited 30 months to sign up, and that time period included 2 full 12-month periods. In most cases, you have to pay the penalty every month for as long as you have Part B. If you’re under 65 and disabled, any Part B penalty ends once you turn 65 because you’ll have another Initial Enrollment Period based on your age.

What is the best and cheapest Medicare supplement insurance?

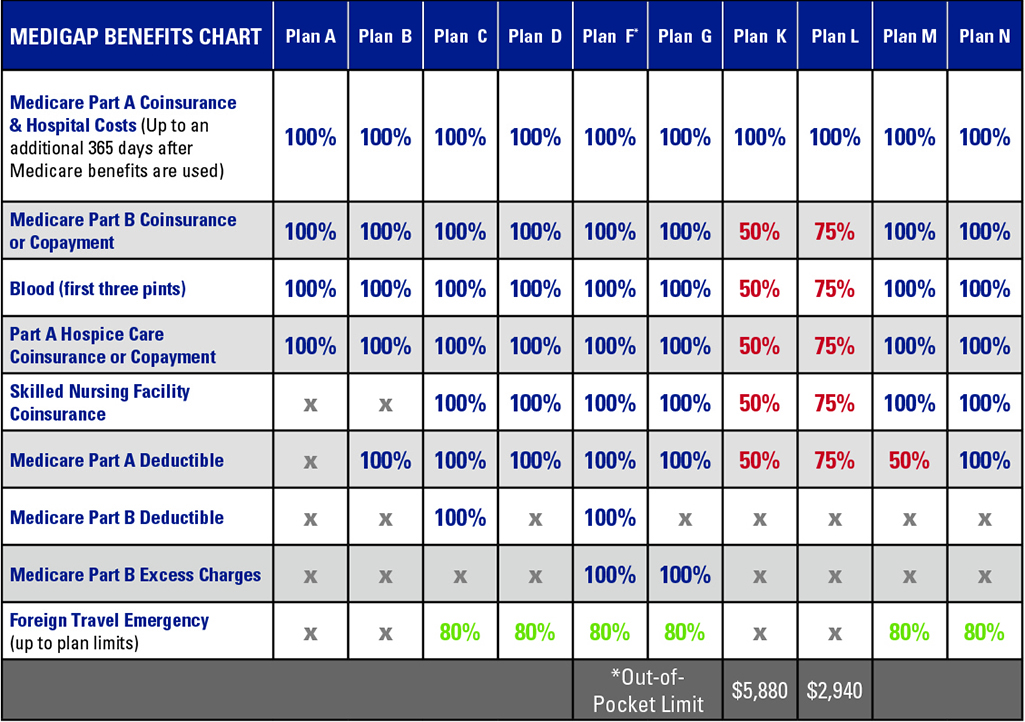

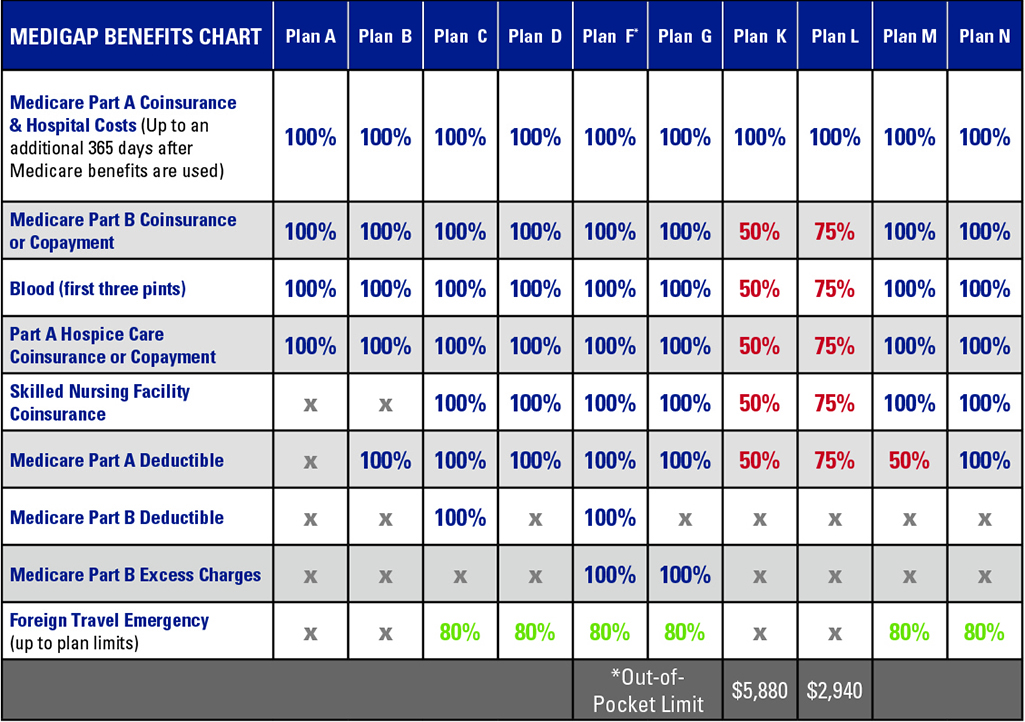

The Medicare Supplement Plan N is best for the following people:

- People looking for complete coverage at a modest monthly rate

- Those who don’t mind paying a minor fee at the time of service

- People who are not subject to Part B excess charges

What is the least expensive Medicare supplement?

Ranking the best medicare supplement plans of 2021

- Humana. Humana is one of the largest providers of healthcare and healthcare insurance in the country. ...

- Mutual of Omaha Medicare Supplement. Mutual of Omaha offers eight Medicare supplement plans that cover most out of pocket expenses most people will incur.

- United Medicare Advisors. ...

- Aetna Medicare Supplement. ...

- Cigna. ...

Is Part B Medicare expensive?

Costs for Part B (Medical Insurance) $170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services.

How much is Medicare Part B monthly?

2022If your yearly income in 2020 (for what you pay in 2022) wasYou pay each month (in 2022)File individual tax returnFile joint tax return$91,000 or less$182,000 or less$170.10above $91,000 up to $114,000above $182,000 up to $228,000$238.10above $114,000 up to $142,000above $228,000 up to $284,000$340.203 more rows

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What is the difference between Medicare Part A and B?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

What is the cost of Medicare Part B in 2021?

$148.50The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Do I pay for Medicare Part A?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Is Medicare Part B automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Is Medicare Part B necessary?

Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem. Cost: If you have Part B, you pay a Part B premium each month.

What is not covered by Medicare Part A?

A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care. A television or telephone in your room, and personal items like razors or slipper socks, unless the hospital or skilled nursing facility provides these to all patients at no additional charge.

Does Medicare Part B pay for prescriptions?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. covers a limited number of outpatient prescription drugs under certain conditions. A part of a hospital where you get outpatient services, like an emergency department, observation unit, surgery center, or pain clinic.

Does Medicare Part A cover emergency room visits?

Medicare Part A is sometimes called “hospital insurance,” but it only covers the costs of an emergency room (ER) visit if you're admitted to the hospital to treat the illness or injury that brought you to the ER.

Who is eligible for Medicare Part A and Part B?

In order to be eligible for Medicare Part A and/or Part B, you must meet each of the following eligibility requirements:

How much is Medicare Part A deductible?

Medicare Part A also includes a deductible of $1,484 per benefit period (in 2021), which is not annual. This means that you could potentially be required to pay the Part A deductible more than once in a year.

How long does Medicare Part A last?

This 7-month period begins three months before you turn 65, includes the month of your birthday and continues on for three more months. You may apply for Medicare Part A and B during this time. You may also be able to sign up during a Special Enrollment Period if you qualify based on certain specific circumstances .

How long does Medicare pay for premium free?

Anyone who paid Medicare taxes for more than 40 quarters (the equivalent of 10 years) receives premium-free Part A.

What does Medicare Part A cover?

Some of the items and services that Medicare Part A covers while you’re admitted as an inpatient can include: Meals. Nursing care. A semi-private room. Drugs that are used as part of your inpatient treatment. Part A covers skilled nursing care you receive in a skilled nursing facility (SNF).

How often do Medicare premiums increase?

The premiums for Part A and Part B can potentially increase every year.

What are the two parts of Medicare?

Medicare Part A and Part B are the two parts that make up “ Original Medicare .”

How Are Medicare Part A and Part B Different?

The main difference between Part A vs Part B is the services covered under each plan. Medicare Part A is a form of hospital insurance. It covers inpatient hospital stays, hospice care, skilled nursing care and limited home health services. Medicare Part A may also cover temporary nursing home care.

What is Medicare Part A?

Medicare Part A covers costs for inpatient hospital care, while Part B covers most outpatient and preventive care. Learn more about the costs for Parts A and B, also known as Original Medicare.

How much does Medicare pay for coinsurance?

Enrollees pay no coinsurance for the first 60 days of an inpatient stay. For days 61 to 90, the coinsurance amount is $352 ...

What is deductible in Medicare?

A deductible is the amount of money a beneficiary must pay before his or her Medicare benefits kick in. So what is the difference between Medicare Part A and Part B when it comes to deductibles?

How many credits do you need to get Medicare?

Because the funds for Medicare come from payroll taxes, a beneficiary typically needs to earn at least 40 credits to receive Part A coverage without having to pay a premium. 40 credits is equivalent to working and paying Medicare taxes for 10 years. For individuals with 30-39 work credits, the Part A premium is $252 for 2020.

When does the benefit period end for Medicare?

With Medicare Part A, a benefit period starts on the first day of admission for inpatient care and ends when the enrollee hasn't received inpatient hospital care or inpatient care at a skilled nursing facility for 60 consecutive days.

How much is the 2020 Part B deductible?

The Part B deductible is $198 for the year in 2020. Once a beneficiary meets this deductible, their Part B coverage kicks in and they are typically responsible for a 20% coinsurance/copayment for their Part B-covered services for the rest of the year.

How much is Medicare Part B?

Medicare Part B, on the other hand, requires a monthly premium. The standard premium is $144.60 in 2020 (up from $135.50 in 2019) and increases with income. 3 You can choose to have this premium deducted automatically from your Social Security benefits, which can make things easier. The annual deductible for Part B is $198 in 2020 (up ...

Why is Medicare Part B called medical insurance?

Medicare Part B is known as “medical insurance” because it covers doctor visits and medical care outside the hospital. Like with Medicare Part A, treatment must be determined as medically necessary or preventative to be covered by Medicare Part B.

What is Medicare Part A?

Medicare Part A is sometimes referred to as “hospital insurance.” As the name implies, this is the Medicare plan that covers hospital stays and inpatient treatment. For treatment to be covered by Medicare Part A, it must be deemed medically necessary. This means a doctor has agreed that the treatment is required to prevent or treat a condition or illness.

How much is the 2020 Medicare premium?

For 2020, the monthly premium is $458 (up from $437 in 2019). 1 Additional costs with Part A include coinsurance in specific situations and a deductible of $1,408 in 2020 (up from $1,364 in 2019) to cover hospital inpatient care. 2.

How much does Medicare pay for covered services?

Medicare Part B pays 80% of costs for covered services, leaving beneficiaries to pay the remaining 20% of Part B expenses out of pocket.

Is Medicare Part B mandatory?

While Part A is required for some people on disability or those receiving other forms of government aid, Medicare Part B is not mandatory for these people. However, you may incur late enrollment penalties if you don't sign up when you're first.

Is eligibility.com a DBA?

Content on this site has not been reviewed or endorsed by the Centers for Medicare & Medicaid Services, the United States Government, any state Medicare agency, or any private insurance agency (collectively "Medicare System Providers"). Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.

How much does Medicare cost?

For this, you pay a monthly premium for Part B, which is typically $135.50 per month. Deductibles and coinsurance are covered by you unless you receive supplemental coverage through Medigap. However, this typically costs less. You also must purchase a Part D drug plan separately.

What is Medicare Part C?

Medicare Part C (private health insurance) Medicare Part C is also called Medicare Advantage (MA). These plans may also be called Medicare Health plans by private health insurance carriers. Before enrolling in a Medicare Advantage plan, you need to enroll in Original Medicare. If you decide that you want Medicare Advantage, ...

How many different Medicare plans are there?

Medicare essentially breaks down into four different plans. But there are also some other supplemental plans associated with Medicare, as well such as Medigap. If you are thinking of getting Medicare, understanding the different plans is essential.

What is Medicare for disabled?

First of all, Medicare is a health insurance program that covers: Those who are aged 65 or older. Those who are disabled. Those who have amyotrophic lateral sclerosis (ALS, or Lou Gehrig’s disease) Those whose parents or spouse are covered by Medicare. Essentially, eligibility for Medicare depends largely on income and age.

Does Medicare Advantage cover prescription drugs?

However, these plans are also offered through private health insurance companies. You sign up for Part D plans directly with private insurance companies. If you enroll in this program, you pay a monthly premium and also a deductible, in some cases. You also cover copays for any drugs that you need.

Does Medicare Advantage cover PPO?

But you may pay more. Medicare Advantage plans offer HMO and PPO plans, which offer more or less flexibility. You are guaranteed to be able to pick your doctor with Original Medicare. But you will inevitably pay more and have to sign up for Medigap to cover other costs.

Does MA cover dental?

This means that your MA plan could cover more health facilities, doctors, dental, vision, hearing and wellness services. You still pay a premium for Medicare Part B. And, you are still enrolled in Medicare and receive its protection. These plans also typically include prescription drug coverage.

Does Medicare cover eye exams?

Original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices, and other health care facilities. Original Medicare doesn’t cover some benefits like eye exams, most dental care, and routine exams.

Do you pay for Part B?

You pay the monthly Part B premium and may also have to pay the plan’s premium. Plans may have a $0 premium and may help pay all or part of your Part B premium. Most plans include Medicare drug coverage (Part D).

Which is better, private or Medicare?

Typically, private insurance is a better option for people with dependents. While Medicare plans offer coverage only to individuals, private insurers usually allow people to extend health coverage to dependents, including children and spouses.

How much is the deductible for Medicare Part A?

Medicare Part A: $1,484. Medicare Part B: $203. As this shows, the deductible for Medicare Part A is lower than the average deductible for private insurance plans.

What is Medicare approved private insurance?

The health insurance that Medicare-approved private companies provide varies among plan providers, but it may include coverage for the following: assistance with Medicare costs, such as deductible, copays, and coinsurance. prescription drug coverage through Medicare Part D plans.

What is Medicare Advantage?

Medicare Advantage plans, which replace original Medicare , may offer coverage that more closely resembles that of a private insurance plan. Many Medicare Advantage plans offer dental, vision, and hearing care and prescription drug coverage.

Why does Medicare cost more?

However, Medicare plans may cost more because they do not have an out-of-pocket limit, which is a requirement of all Medicare Advantage plans.

How many employees does Medicare have?

For example, Medicare is the primary payer when a person has private insurance through an employer with fewer than 20 employees. To determine their primary payer, a person should call their private insurer directly.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

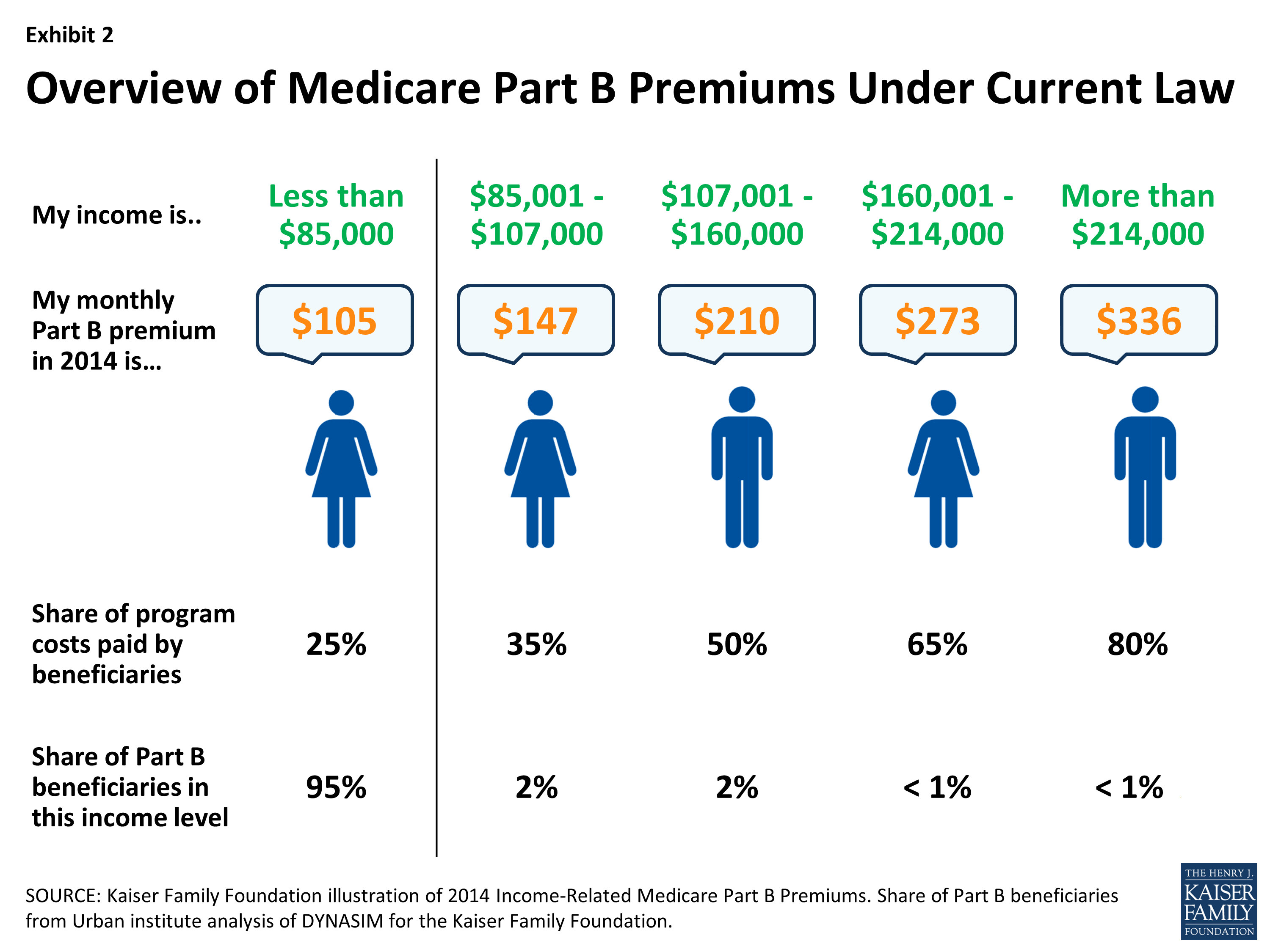

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

When will Medicare Part B and Part D be based on income?

If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

How much is the 2021 Medicare Part B deductible?

The 2021 Part B deductible is $203 per year. After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

Does Medicare have a 0 premium?

Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations. Find out if a $0 premium plan is available where you live by calling to speak with a licensed insurance agent.

Does Medicare Advantage cover Part A?

Did you know that a Medicare Advantage plan covers the same benefits that are covered by Medicare Part A and Part B (Original Medicare)? Did you know that some Medicare Advantage plans also offer benefits not covered by Original Medicare?

Who sells Medicare Part C?

Medicare Part C plans (also called Medicare Advantage) and Medicare Supplement Insurance plans (also called Medigap) are sold by private insurance companies. The cost of plans can vary from one provider to the next.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

What is Medicare Advantage?

Under Medicare Advantage, you will essentially be joining a private insurance plan like you probably had through your employer. The most common ones are health maintenance organizations (HMOs) and preferred provider organizations (PPOs). Medicare Advantage employs managed care plans and, in most cases, you would have a primary care physician who would direct your care, meaning you would need a referral to a specialist. HMOs tend to have more restrictive choices of medical providers than PPOs.

What percentage of doctors accept Medicare?

According to the Kaiser Family Foundation, 93 percent of primary physicians participate in Medicare. That means chances are pretty good that any doctor you are currently seeing will accept Medicare and you won't have to change providers.

What is Medicare buffet?

If you elect to go with original Medicare, your buffet will include Part A (hospital care), Part B (doctor visits, lab tests and other outpatient services) and Part D (prescription drugs). If you decide to go with Part C, a Medicare Advantage plan, it will be more like a set menu, since a private insurer has already bundled together parts A and B and almost always D into one comprehensive plan.

How to find out what out of pocket costs are?

To help you get an idea of what your out-of-pocket costs would be, you can consult the Centers for Medicare & Medicaid Services’ out-of-pocket cost calculator, which can help you compare your estimated out-of-pocket expenses .

Does Medicare have an annual cap?

Many beneficiaries who elect original Medicare also purchase a supplemental – or Medigap – policy to help defray many out-of-pocket costs, which Medicare officials estimate could run in the thousands of dollars each year. There is no annual cap on out-of-pocket costs.

Does Medicare cover dental?

While Medicare will cover most of your medical needs, there are some things the program typically doesn't pay for -— like cosmetic surgery or routine dental, vision and hearing care. But there are also differences between what services you get help paying for.

Does MA have a copay for doctor visits?

But instead of paying the 20 percent coinsurance amount for doctor visits and other Part B services, most MA plans have set copay amounts for a physician visit , and typically that means lower out-of-pocket costs than original Medicare. MA plans also have an annual cap on out-of-pocket expenses.