What is a CO 253 claim?

The code will appear as a CO 253 on the RA "Sequestration – reduction in federal payment" as the reason. For the Medicare Fee-for-Service (FFS) program, claims with dates-of-service or dates-of-discharge on or after April 1, 2013, will continue to incur a 2 percent reduction in the Medicare payment until further notice.

What is the CARC 253 form used for?

Answer: Claim adjustment reason code (CARC) 253 is used to report the sequestration reduction on the ERA and SPR. Question: What is the verbiage for CARC 253?

Is the EOB the same as a Medicare summary notice?

No, but you’ll receive a Medicare Summary Notice (MSN), the Medicare explanation of benefits. Like the EOB, the MSN is not a bill — it’s a monthly snapshot of the services you’ve needed and what Medicare has agreed to pay for them.

What is a Medicare Part D EOB?

Medicare Part D is prescription drug coverage for people enrolled in Medicare. Part D is optional and is offered by private insurance companies. EOBs offer detailed breakdowns of the costs, including the full price of services, amounts covered by your policy, and what you owe

What is Medicare sequestration adjustment?

Medicare FFS claims: 2% payment adjustment (sequestration) changes. The Protecting Medicare and American Farmers from Sequester Cuts Act impacts payments for all Medicare fee-for-service claims: No payment adjustment through March 31, 2022.

What does sequestration reduction amount mean?

Sequestration is the automatic reduction (i.e., cancellation) of certain federal spending, generally by a uniform percentage.

Who pays the 2 Medicare sequestration?

As this applies to Medicare, the reduction in federal spending means providers receive less payment for services, specifically by two percent. Important to note is that beneficiaries do not pay this extra two percent Medicare sequester. Rather, the healthcare providers themselves bear the added financial burden.

What is Medicare 2% sequestration?

Medicare FFS Claims: 2% Payment Adjustment (Sequestration) Changes. The Protecting Medicare and American Farmers from Sequester Cuts Act impacts payments for all Medicare Fee-for-Service (FFS) claims: No payment adjustment through March 31, 2022.

How does Medicare calculate sequestration?

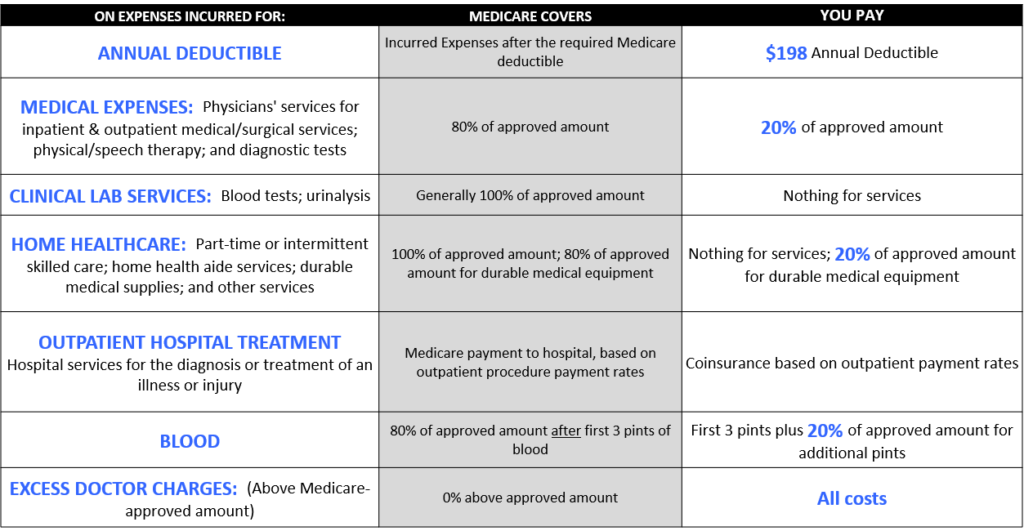

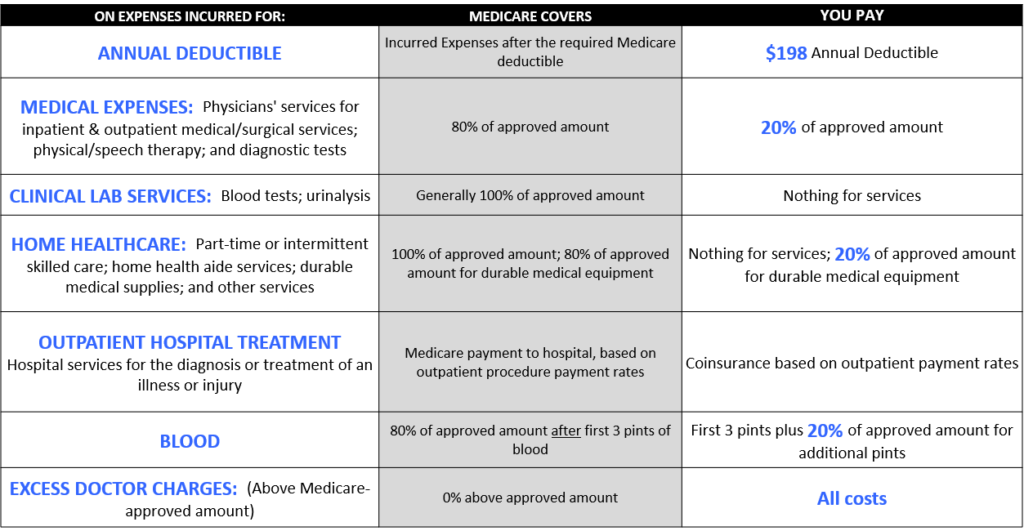

Medicare normally would reimburse the beneficiary for 80% of the approved amount after the deductible is met, which is $36 ($45 x 80% = $36). However, due to the sequestration reduction, 2% of the $36 calculated payment amount is not paid to the beneficiary, resulting in a payment of $35.28 instead of $36 ($36 x .

Does the 2 sequestration apply to Medicare Advantage?

The payment reduction, referred to as sequestration, is applied to the Net Capitation Payment (NCP) made to the plans, including MAOs. Therefore, Medicare rates and fee schedules remain unaffected by sequestration.

Is sequestration still in effect in 2021?

Jun. 3, 2021 Update: Congress has passed legislation that continued the moratorium on sequestration. As a result, CMS has extended the moratorium on sequestration until December 31, 2021.

How is sequestration calculated?

We normally would pay 80% of the approved amount after the deductible is met, which is $40.00 ($50.00 x 80% = $40.00). The patient is responsible for the remaining 20% coinsurance amount of $10.00 ($50.00 – $40.00 = $10.00).

What does sequestration mean in insurance?

"Sequestration" is a process of automatic, largely across-the-board spending reductions under which budgetary resources are permanently canceled to enforce certain budget policy goals.

When did Obama issue the sequestration order?

As required by law, President Obama issued a sequestration order on March 1, 2013. The Administration continues to urge Congress to take prompt action to address the current budget uncertainty and the economic hardships imposed by sequestration. Medicare Fee-for-Service (FFS) claims with dates-of-service or dates-of-discharge on/after April 1, ...

Can a physician collect more than the limiting charge?

If the Limiting Charge applies to the service rendered , physicians/practitioners cannot collect more than the Limiting Charge amount from the beneficiary. Example: A non-participating provider bills an unassigned claim for a service with a Limiting Charge of $109.25.

Is Medicare deductible a 2 percent reduction?

Though beneficiary payments for deductibles and coinsurance are not subject to the 2 percent payment reduction, Medicare's payment to beneficiaries for unassigned claims is subject to the 2 percent reduction.

Is Medicare 2% reduction?

Answer: Though beneficiary payments toward deductibles and coinsurance are not subject to the 2% payment reduction, Medicare's payment to beneficiaries for unassigned claims is subject to the 2% reduction.

What is a reason code used on an EOB?

Reason codes appear on an explanation of benefits (EOB) to communicate why a claim has been adjusted. If there is no adjustment to a claim/line, then there is no adjustment reason code.

Here is a comprehensive reason codes list

Do you have reason code with you? Want to know what is the exact reason?

Credentialing Services

Simplifying Every Step of Credentialing Process, Most trusted and assured Credentialing services for all you need, like Physician Credentialing Services, Group Credentialing Services, Re-Credentialing Services, Additionally We do provide:

Why is CO 56 denied?

CO 56 Claim/service denied because procedure/treatment has not been deemed `proven to be effective' by the payer. CO 58 Payment adjusted because treatment was deemed by the payer to have been rendered in an inappropriate or invalid place of service.

Can Medicare beneficiaries be billed for group code PR?

Medicare beneficiaries may be billed only when Group Code PR is used with an adjustment. For CO denial code, We could not bill the patient but we could resubmit the claim with necessary correction according to Denial. SOME IMPORTANT CO DENIAL CODES.

What is EOB in Medicare?

Explanation of Benefits (EOB) go to enrollees in Medicare Advantage. Medicare Advantage ( Medicare Part C) is health insurance for Americans aged 65 and older that blends Medicare benefits with private health insurance. This typically includes a bundle of Original Medicare (Parts A and B) and Medicare Prescription Drug Plan (Part D).

What is an EOB bill?

For example: If your deductible is $1,000, your insurance company will not cover any costs until you pay the first $1,000 yourself. An EOB is NOT a bill.

What does EOB mean in July?

The EOB you receive in July will reflect the claims and charges from those visits. Your EOB will show what your insurance company has agreed to pay for the services you received. With your EOB, you can check that you’re being charged correctly by your doctors and specialists when you get your bills.

What is coinsurance for medical bills?

Coinsurance is the percentage of your medical costs that you pay after you meet your deductible. Your insurance company pays the remaining amount. For example: If you have a $1,000 medical bill and your coinsurance is 20%, you'll pay $200. Your insurance company will cover the final $800.

Do you get an explanation of Medicare benefits each month?

If you have a Medicare Advantage or Medicare Prescription Drug Plan (Part D), you probably receive an explanation of benefits each month. Unfortunately, many people don’t understand how to use this info. With the right knowledge, however, your Explanation of Benefits can be a handy tool.

Does Medicare Advantage have an EOB?

Each plan has its own EOB form; private insurance companies provide Medicare Advantage and Part D, and your EOB will come directly from them. If your MA plan and Part D plan are from different companies, you’ll receive an EOB for each.

Why did Medicare fail to meet the deadline?

Some believe Medicare failed to meet the deadline because economists and financial analysts predicted Congress would step in and squash the Budget Control Act of 2011. When Congress didn’t step in, it gave little time for entities such as Medicare to outline a plan before the deadline.

What was the Medicare cut in 2013?

Under these budget cuts, any claim received by Medicare after April 1, 2013 was subject to a 2 percent payment cut. Any drugs that were administered as part of the claim were also reimbursed with a 2 percent cut implemented.

What is Medicare sequestration?

Medicare sequestration is a penalty created during The Budget Control Act of 2011. Medicare sequestration was made to create savings and prevent further debt, but it had some negative repercussions on hospitals, physicians, and health care. Beneficiaries are not responsible for the price difference caused by the sequestration.

What was the budget control act?

The Budget Control Act required half of the budget savings must be acquired through defense spending cuts. Providers were limited to a 2 percent reduction in reimbursement. This meant that most money needed to meet budget needs had to be obtained through domestic discretionary programs.

Is chemo covered by Medicare?

Chemo is administered in a clinical setting by a physician, so it is a covered charge under Medicare Part B. Part B drugs are subject to a 2 percent reduction, which made it impossible for some expensive chemotherapy sessions to be canceled or moved to facilities that could absorb the loss in payment.

Is Medicare 2 percent cut?

The 2 percent cut to Medicare payments is also not cumulative. This means is payments will not continually be reduced by 2 percent year after year. Instead, they will only be subject to the initial 2-percent reduction until 2022. The only way this reduction could be removed or changed is if Congress voted to change it.

Example

- Providers seeing a 2 percent payment decrease on their Remittance Advice (RA) is due to a mandatory sequestration payment reduction. Claim adjustment reason code (CARC) 253 is used to report the sequestration reduction. The code will appear as a CO 253 on the RA \"Sequestration reduction in federal payment\" as the reason. Answer: The reduction is...

Background

- The Budget Control Act of 2011 requires, among other things, mandatory across-the-board reductions in Federal spending, also known as sequestration. The American Taxpayer Relief Act of 2012 postponed sequestration for 2 months. As required by law, President Obama issued a sequestration order on March 1, 2013. The Administration continues to urge Congress to take pr…

Scope

- The claims payment adjustment are applied to all claims after determining coinsurance, any applicable deductible, and any applicable Medicare Secondary Payment adjustments.

Effects

- Though beneficiary payments for deductibles and coinsurance are not subject to the 2 percent payment reduction, Medicare's payment to beneficiaries for unassigned claims is subject to the 2 percent reduction. CMS encourages Medicare physicians, practitioners, and suppliers who bill claims on an unassigned basis to discuss with beneficiaries the impact of sequestration on Med…

Issue

- Question: How long is the 2% reduction to Medicare fee-for-service claim payments in effect? Answer: The sequestration order covers all payments for services with dates of service or dates of discharge (or a start date for rental equipment or multi-day supplies) on or after April 1, 2013, until further notice. Question: How is the 2% payment reduction under sequestration identified o…

Mission

- We encourage physicians, practitioners, and suppliers who bill unassigned claims to discuss with their Medicare patients the impact of the sequestration reductions to Medicare payments.

Benefits

- Answer: In general, Medicare FFS claims with dates-of-service or dates-of-discharge on or after April 1, 2013, will incur a 2 percent reduction in Medicare payment. Claims for durable medical equipment (DME), prosthetics, orthotics, and supplies, including claims under the DME Competitive Bidding Program, will be reduced by 2 percent based upon whether the date-of-servi…